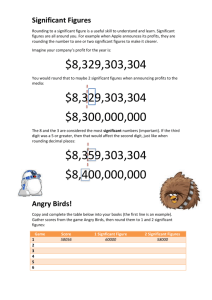

INSURANCE PREMIUM DOUBLE ROUNDING LITIGATION:1

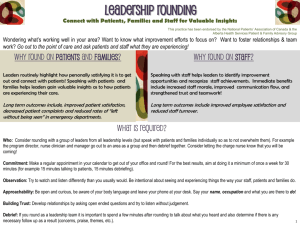

advertisement