Hang Seng Indexes Licenses HKEX to Use Hang Seng Sector Index

advertisement

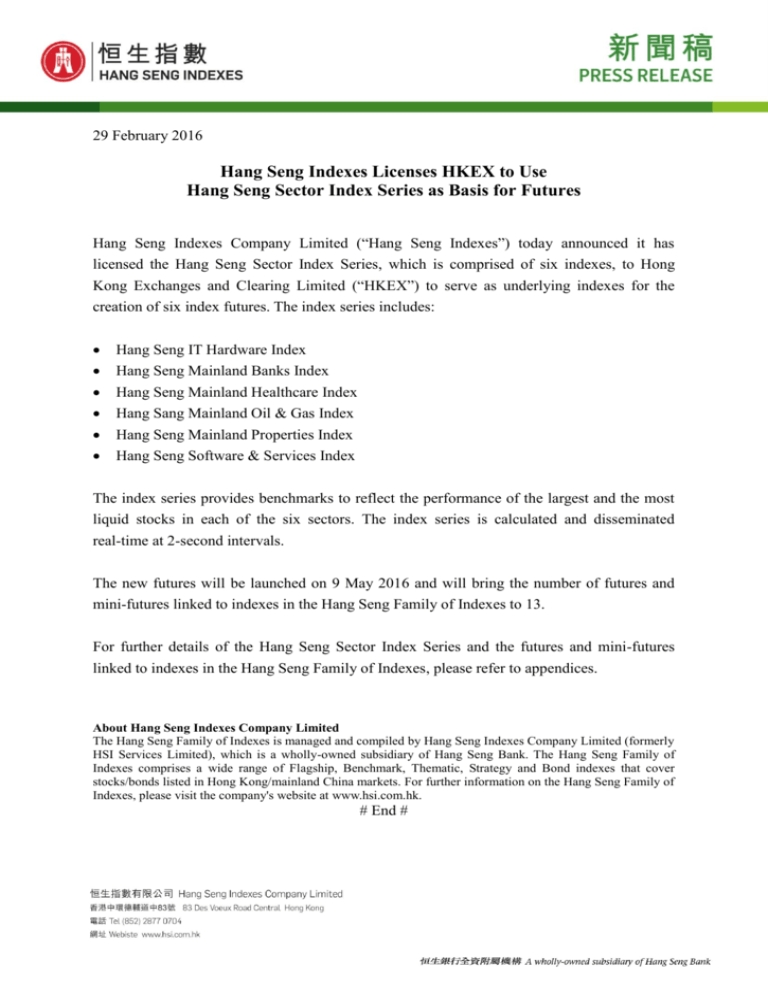

29 February 2016 Hang Seng Indexes Licenses HKEX to Use Hang Seng Sector Index Series as Basis for Futures Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced it has licensed the Hang Seng Sector Index Series, which is comprised of six indexes, to Hong Kong Exchanges and Clearing Limited (“HKEX”) to serve as underlying indexes for the creation of six index futures. The index series includes: Hang Seng IT Hardware Index Hang Seng Mainland Banks Index Hang Seng Mainland Healthcare Index Hang Sang Mainland Oil & Gas Index Hang Seng Mainland Properties Index Hang Seng Software & Services Index The index series provides benchmarks to reflect the performance of the largest and the most liquid stocks in each of the six sectors. The index series is calculated and disseminated real-time at 2-second intervals. The new futures will be launched on 9 May 2016 and will bring the number of futures and mini-futures linked to indexes in the Hang Seng Family of Indexes to 13. For further details of the Hang Seng Sector Index Series and the futures and mini-futures linked to indexes in the Hang Seng Family of Indexes, please refer to appendices. About Hang Seng Indexes Company Limited The Hang Seng Family of Indexes is managed and compiled by Hang Seng Indexes Company Limited (formerly HSI Services Limited), which is a wholly-owned subsidiary of Hang Seng Bank. The Hang Seng Family of Indexes comprises a wide range of Flagship, Benchmark, Thematic, Strategy and Bond indexes that cover stocks/bonds listed in Hong Kong/mainland China markets. For further information on the Hang Seng Family of Indexes, please visit the company's website at www.hsi.com.hk. # End # Appendix 1 Hang Seng Sector Index Series Index Overview Indexes HSITHI HSMBI HSMHI HSMOGI Launch Date 13 July 2015 Base Date 4 March 2011 Base Value 3,000 Number of Constituents Weighting Methodology HSMPI HSSSI Maximum at 10 Constituents are freefloat-adjusted for investability representation. A 15% cap will be applied on individual stocks for index(es). A 25% cap will be applied on individual stocks for index(es) with number of constituents that is less than 8. Equal weight will be applied on individual stocks for index(es) with number of constituents that is less than 5. Hong Kong Dollar Currency Real-time at 2-second intervals Dissemination Vendor Codes Thomson Reuters HSITHI : HSMBI : HSMHI : HSMOGI : HSMPI : HSSSI : .HSITHI .HSMBI .HSMHI .HSMOGI .HSMPI .HSSSI Hang Seng IT Hardware Index Hang Seng Mainland Banks Index Hang Seng Mainland Healthcare Index Hang Sang Mainland Oil & Gas Index Hang Seng Mainland Properties Index Hang Seng Software & Services Index For further information on the Hang Seng Sector Index Series, please visit http://www.hsi.com.hk/HSI-Net/static/revamp/contents/en/dl_centre/methodologies/IM_HSSISe.pdf Hang Seng Sector Index Series Constituents and weightings (as at 26 February 2016) Stock Code Company Name Weighting (%) * Hang Seng IT Hardware Index 303 VTech Hldgs 2018 AAC Tech 992 Lenovo Group 2038 FIH 763 ZTE 552 China Comservice 2369 Coolpad Group 285 BYD Electronic 732 Truly Int'l 2618 TCL Comm Total 17.20 16.11 13.36 12.45 12.44 10.58 5.26 4.67 4.10 3.82 100.00 Total 15.24 15.04 14.62 13.28 12.61 8.61 8.21 8.15 2.29 1.95 100.00 Total 15.83 14.77 14.61 12.06 9.31 8.47 8.16 6.50 6.49 3.81 100.00 Total 15.88 15.67 15.55 13.92 12.96 12.89 5.75 4.31 1.58 1.49 100.00 Hang Seng Mainland Banks Index 939 CCB 3988 Bank of China 1398 ICBC 1288 ABC 3968 CM Bank 1988 Minsheng Banking 3328 Bankcomm 998 CITIC Bank 6818 CEB Bank 3618 CQRC Bank Hang Seng Mainland Healthcare Index 1099 Sinopharm 1093 CSPC Pharma 1177 Sino Biopharm 867 CMS 2186 Luye Pharma 1066 Weigao Group 2607 Shanghai Pharma 2196 Fosun Pharma 570 Trad Chi Med 1515 PhoenixHealth Hang Sang Mainland Oil & Gas Index 883 CNOOC 857 PetroChina 386 Sinopec Corp 135 Kunlun Energy 2883 China Oilfield 2386 Sinopec SEG 934 Sinopec Kantons 3899 CIMC Enric 2236 Wison Engrg 3337 Anton Oilfield * Figures may not add up to totals due to rounding. Hang Seng Sector Index Series Constituents and weightings (as at 26 February 2016) Stock Code Company Name Weighting (%) * Hang Seng Mainland Properties Index 688 China Overseas 1109 China Res Land 2007 Country Garden 3333 Evergrande 3699 Wanda Comm 960 Longfor PPT 813 Shimao Property 683 Kerry Prop 3377 Sino-Ocean Land 283 Goldin PPT Total 15.62 15.60 14.61 12.40 10.60 7.78 6.92 6.74 6.55 3.18 100.00 Total 17.03 15.79 14.11 12.89 9.99 9.32 6.36 5.81 5.59 3.09 100.00 Hang Seng Software & Services Index 700 Tencent 327 PAX Global 3888 Kingsoft 268 Kingdee Int'l 400 Cogobuy 777 NetDragon 1236 National Agri 2280 HC Intl 1980 TianGe 434 BOYAA * Figures may not add up to totals due to rounding. Appendix 2 Summary of Futures Linked to the Hang Seng Family of Indexes Index As at 29 February 2016 No. of Trading Index-linked Location Futures Hang Seng Index 1 Futures 1 Mini-Futures Hang Seng China Enterprises Index 1 Futures 1 Mini-Futures Hang Seng Dividend Point Index Series HSI Dividend Point Index HSCEI Dividend Point Index 2 Futures HSI Volatility Index 1 Futures Hang Seng Sector Index Series Hang Seng IT Hardware Index Hang Seng Mainland Banks Index Hang Seng Mainland Healthcare Index Hang Sang Mainland Oil & Gas Index Hang Seng Mainland Properties Index Hang Seng Software & Services Index 6 Futures* *To be launched on 9 May 2016. Hong Kong