Innovation - The Greater Cleveland Partnership

advertisement

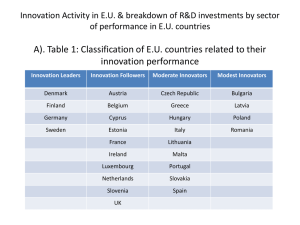

Innovators 550 Innovation in the Midwest A CONVERSATION WITH 2012 Innovation Survey Conducted by the accountants and consultants of Plante Moran and the business educators of NewNorth Center Thank you Special thanks to: David Curtis President Residential Home Health Pedro Guillen Managing Partner Kinetik Partners Jim Marcuccilli President and CEO Star Bank Angela Nahikian Director of Global Environmental Sustainability Steelcase Inc. Molly Riley Executive Director Cystic Fibrosis Foundation, Greater Illinois Chapter Rick Rothwell Vice President Eureka! Ranch International Mark Schroeder CEO/Chairman of the Board German American Bancorp 2 Plante Moran There was a brief period after the financial crisis and the housing market meltdown when disbelief and uncertainty seemed to paralyze business leaders, but the results of our 2012 Innovation Quotient Survey prove it didn’t take long for them to grasp the impact of the situation and begin working toward answers that would sustain their operations and prove the value of their organizations to customers. Our data points out that leaders have always considered innovation essential to the sustainability of their organizations, but the impact of the Great Recession reawakened their innovative spirits. Through our process of discovery, it became clear that many of our respondents have been implementing changes in strategy and organizational structure as well as developing new marketing concepts. At the same time they were introducing new products, services, and processes. Foreword A self-improvement guide for innovators An intense interest in innovation was clear. A participant from the healthcare industry put it best when he said — “With or without legislation, we should continue to look for innovations and efficiencies in health care because it is the right thing to do.” Another respondent from the manufacturing sector said he is always looking and listening for new ideas. There is a determination among top innovators to increase the quality of their products and services and add value whenever possible. Gordon Krater Plante Moran Managing Partner This year, Plante Moran Partner Jeff Mengel led the team that analyzed the Innovation Quotient Survey data. He has a well-established, national reputation for benchmarking and his energy propelled his team to uncover the secrets of innovation and help all of us use it more effectively. As you read through the report you will see that our team uncovered four categories of innovators: • Accidental innovators — those that jump from one good idea to the next • Disciplined innovators — those that have a repeatable approach • Top innovators — those that weave innovation into the fabric of their organization • Superstars — those that develop an ecosystem of support allowing them to go for breakthroughs Our data shows that moving through these categories toward superstardom can mean increased revenue. A superstar can double the return on his innovation efforts. Thank you to all of you who took the time to share your information and thoughts on innovation. We hope that you will profit from the insights in this report. Regards, Gordon E. Krater 2012 Innovation Quotient Survey results 3 About our participants Defining our 550 innovators More than 550 leaders in the private and public sectors participated in the 2012 Innovation Quotient Survey. The survey was distributed by 24 organizations throughout Illinois, Indiana, Michigan, and Ohio. It is an annual project by the accountants and consultants of Plante Moran and the business educators of NewNorth Center to stimulate a conversation on innovation and to share best practices. Industries represented Roles of participants Financial institutions Chairman, CEO, owner 18% Manufacturing Health care 19% Business/ professional services 10% Notforprofit 2% 4% Technology and software companies 19% 27% 15% Other Construction Director 4% Government 6% 12% Vice president Other 13% 15% CFO 11% 3% 3% 4% 5% Leader of an innovation team CIO COO Member of an innovation team 10% Education Revenue of organizations Location Michigan < $10M 49% 39% $11$25M 13% > $500M 15% $26-$50M $101$51$500M $100M 10% 10% 12% Other Ohio 12% 3% Illinois 21% 15% Indiana For the purpose of this survey, innovation is defined as new or significantly improved processes, products, or services as well as changes that the organization has introduced at a strategic level. 4 Plante Moran Participants and collaborators We would like to thank those who took their time to share their insights and those organizations that helped us distribute the survey. They include: Chicagoland Chamber of Commerce Columbus Chamber of Commerce Community Bankers Association of Illinois Cornerstone Chamber of Commerce Detroit Regional Chamber European-American Chamber of Commerce Grand Rapids Area Chamber of Commerce Greater Elkhart Chamber of Commerce Holland Area Chamber of Commerce Illinois Health Care Association Illinois Manufacturers’ Association Indiana Bankers Association Kalamazoo Regional Chamber of Commerce Lakeshore Advantage Michigan Community College Association Michigan Bankers Association Michigan Council of Women in Technology Midwest Technology Leaders Conference Ohio Association of College and University Business Officials Ohio Bankers League Ohio Health Care Association Ohio Manufacturers’ Association PolymerOhio The Right Place 2012 Innovation Quotient Survey results 5 Contents Health care Business/ professional services Not-for-profit Takeaways: Follow the best practices to a eureka moment p. 8 Innovation superstars see 100% better results p. 9 INSIGHT: Healthcare providers link innovation and survival p. 12 Conversation: Affordable capital is available p. 14 INSIGHT: Innovation is top of mind at organizations, and the business/ professional service sector is ready to help p. 15 Conversation: Create an innovation ecosystem p. 17 Commitment translates into breakthroughs p. 18 INSIGHT: Governments, K-12, higher education, and not-for-profits turn to innovation in their transformation efforts p. 20 Conversation: Venture philanthropy: A foundation’s pioneering approach to finding a cure p. 22 Building a culture that nurtures innovation p. 23 Fail fast/fail cheap: A proven process to speed innovation & decrease risks p. 25 INSIGHT: Banking Community banks know they must innovate, but . . . p. 26 Conversation: Customers are the source of our ideas p. 28 Conversation: Community banks need to share best practices to survive this era of change p. 29 Manufacturing INSIGHT: Manufacturing is responding to the slow-growth economy with a two-pronged approach to innovation p. 30 Conversation: Celebrating 100 years of innovation by planning for 100 more p. 32 6 Plante Moran Follow the best practices to a eureka moment Innovation superstars see 100% better results 8 9 Commitment translates into breakthroughs Building a culture that nurtures innovation 18 23 A proven process to speed innovation & decrease risks Celebrating 100 years of innovation by planning for 100 more 25 32 2012 Innovation Quotient Survey results 7 Takeaways Follow best practices to a eureka moment Successful innovators are deliberate. That was the message we heard last year. And it was the resounding takeaway from our analysis of data collected in the Innovation Quotient Survey this year. Organize In general, this year’s survey participants expect innovation to help them meet their revenue and cost cutting goals in 2013 and 2014, and their past history predicts they will be successful. As a group they generated 16.1 percent of their revenue from new products introduced in the last three years. • Create a commercialization process. Some great ideas get lost because there is limited training, dollars, or patience to bring the idea to market. However, by using correlation and frequency charts our analysts were able to determine that there is more potential if organizations follow the best practices uncovered in the survey. In fact if they were able to replicate the techniques of the innovation superstars we found, they could improve their results by more than 100 percent. These are best practices for incremental innovation, but if you are looking for a breakthrough, learn from the innovation superstars and develop an ecosystem of research organizations. We want to thank the 550 survey participants for sharing their thoughts. After carefully aggregating the responses and testing them, we offer you the following recommendations to get more value from your innovation efforts. Develop a plan for innovation Celebrate • The innovation team should at a minimum be recognized and monetary rewards should be considered. Include universities and government and private research facilities in your innovation efforts and you are more apt to have a eureka moment. Depth of innovation 80% 70% 60% 50% • Establish clear and measurable expectations 40% • Monitor progress toward those expectations 20% • Make alterations to the plan when necessary • Abandon a project if it is not generating the expected results Budget • Fund your innovation objectives • Expect a return on your innovation investment • Identify a process for getting resources and support to innovation efforts 8 • Establish cross-functional teams with the goal of developing proponents for innovation throughout your organization Plante Moran 30% 10% 0% Variations on a single theme New but within its traditional markets Breakthrough in all ways Accidental innovators Top innovators Disciplined innovators Superstars Innovation superstars see 100% better results There is good news in the Midwest. Economic activity continues to expand at a moderate pace and according to this year’s Innovation Quotient (IQ) Survey, both the private sector and the public sector are expecting new products and improved ways of doing things to generate increased revenue and cost savings through 2014. Their bet on innovation is well founded. IQ survey respondents reported an average of 16.1 percent of revenue from new products introduced in the last three years. This is in keeping with recent studies by Georgia Tech and The National Center for the Middle Market at The Ohio State University that document the importance of innovation in sustaining organizations and growing their top lines. In fact successful innovation is one of the distinguishing characteristics of the National Center’s “growth champions.” The question Using a scale of 1 to 10, please rank the importance of revenue generating or cost savings innovations to your organization in the next two years 1 2 3 4 5 6 7 8 9 10 2012 Innovation Quotient Survey results 9 Successful innovators engage in change every year impact of the resulting Dodd-Frank Act. Looking for solutions in tough times Tough times are often the mother of innovation, and the IQ survey results indicate that is clearly the case. Although the field of respondents changed from 2011 to 2012, the strength of response numbers from sectors seemed to reflect reactions to economic factors. Last year manufacturing represented 36 percent of respondents and financial institutions came in second with 11 percent. This year manufacturing went down to 19 percent and financial institutions went up to 18 percent. This could be because manufacturers were forced to face a difficult economy before other sectors and are well on their way to ramping up innovation. On the other hand financial institutions are just beginning to cope with the financial crisis and the Surfacing in creditable numbers for the first time were not-for-profits including governments and education. As expected, the effects of the financial crisis and the housing market meltdown took longer to affect them, but now they, too, are turning to innovation to help sustain their operations. Innovation, finding new ways of doing things and inventing new products, processes, and services, is an obvious response. But it is clear from the survey results that organizations cannot turn into effective innovators overnight. Successful innovators engage in change every year. Our analysts found there are different levels of innovation and decided advantages to move from one tier to the next. We will look at their findings and share the “best practices” in hopes of bringing up the level of innovation across the board and maintaining the nation’s reputation for being home to the world’s best innovators. It is important to realize that almost one out of three of the survey respondents received no revenue from new products/ services during the last three years. We encourage their interest, but studied only those respondents who reported some revenue from new products and services. • Accidental innovators — 30.1 percent of respondents are categorized as accidental innovators. Accidental Defining the categories by revenue from new products/services 10 All respondents Accidental innovators Disciplined innovators Top innovators Superstars % of total 100.0% 30.1% 19.4% 20.8% 12.3% New product introduction % of revenue 16.1% 11.1% 15.4% 21.0% 23.3% Plante Moran innovators reported 11.1 percent of revenue from new products/services over the last three years. • Disciplined innovators — 19.4 percent of respondents are categorized as disciplined innovators. Disciplined innovators reported 15.4 percent of revenue from new products/services over the last three years. • Top innovators — 20.8 percent of the respondents are categorized as top innovators. Top innovators reported 21 percent of revenue from new products/services over the last three years. • Superstars — 12.3 percent of the respondents are categorized as superstars. They reported 23.3 percent of revenue from new products/services over the last three years. Is your organization an accidental innovator? A accidental innovator is a classic entrepreneur that seizes opportunity — a unique idea hits and a champion surfaces to drag the idea through the steps to completion and, when appropriate, commercialization. The accidental innovator initiates new products, services, or processes in response to comments from customers/constituents or a need to improve quality. Our survey data indicates that 30 percent of organizations follow this approach and generated 11.1 percent of their revenue from products or services that they introduced in the last three years. Learning from the disciplined innovator The disciplined innovators identified in the survey were able to improve revenue from innovation by 38.6 percent over the accidental innovators. They showed 15.4 percent of revenue from new products in the last three years, up from the 11.1 percent for the accidental innovators. What did they do differently? The disciplined innovators established systems such as cross-functional work teams, budgets, work plans, and included innovation in their strategic plans. In comparison to the accidental innovators, their innovation ideas are more likely to be driven by strategy, entering new markets, and increasing operational flexibility and capacity. Going for the gold: characteristics of top tier innovators The top tier innovators weave innovation into the fabric of their organizations starting with the corporate strategy. Leadership is engaged, innovators are rewarded both financially and non-financially, and special teams may be created to lead the innovation process. These organizations have a strong affinity for improving valueadded product/services. Top tier organizations have more registered innovation (trademarks, copyrights, and patents) and types of innovation (product, process, and systems), as well as many times the potential for a major breakthrough in innovation. This top tier group generated 21 percent of its revenue from products or services that were introduced in the last three years, an 88.1 percent improvement over the accidental innovator. Within this group, there are superstars that generated 23.3 percent of revenue from products or services that were introduced in the last three years — an 109 percent improvement over the accidental innovator. To keep that success going, however, they can learn from the even more successful innovators that take an intentional approach to innovation. 2012 Innovation Quotient Survey results 11 INSIGHT Matt Weekley Practice leader Health Care Healthcare providers link innovation and survival Respondents to this year’s Innovation Quotient Survey who are in the healthcare industry understand without question that innovation is a key ingredient to their sustainability. As one respondent commented, “We are in one of the most dynamic times for health care of any in U.S. history. Value-based purchasing and bundled payments are just two examples of the kinds of changes that are happening and will be expanded. To survive, we must learn to adapt to the changing environment or we will go the way of the dinosaur. Innovation is critical to our survival.” However, understanding this inevitability and acting are two very different things. Although 76 percent of healthcare respondents said that legislative efforts to strike down the Affordable Care Act would have no impact on their innovation efforts, another 24 percent said they would anticipate a reduction in innovation if the mandates did not exist. This second response would seem to be tied to the ability to pay for innovation efforts rather than the desire to implement them. Respondents said improving quality, increasing value, and customer demands are the top drivers of innovation in their organizations. But the deterrents are numerous. The cost of financing and of direct innovation efforts received the highest overall responses by the healthcare survey respondents when asked about the most significant constraints on their ability to innovate. Data also indicates that healthcare respondents lag the survey group in budgeting for innovation. As our analysts looked at the numbers and compared the innovation budgets of the top innovators and the superstars among them to the other respondents, it became clear that the amount an organization budgets is not as important as the fact that it budgets. Budgets bring accountability. Unfortunately, we also found that more than half of the healthcare respondents are not aware of the Center for Medicaid and Medicare Services (CMS) Innovation Center and its Innovation Challenge grants, funding for pilot programs, and cooperative agreements. Of those who are aware of them, just under half had applied to participate in the program. One area of healthcare innovation that requires nearly all providers to participate is electronic medical records (EMR). When asked what percentage of implementation their organizations had completed relative to EMR, only 26 percent indicated they were 100 percent complete while 35 percent said their organizations were less than 50 percent complete. Collaboration and integration across the healthcare continuum are also something we see increasing exponentially as reimbursement models move to bundled 12 Plante Moran Innovation constraints Organizational culture Organizational leadership Direct innovation costs too high Cost of financing Availability of financing Lack of qualified personnel Lack of information on technology Lack of market information 0 2 4 6 Accidental innovators 8 Scale of 1-10 Top innovators Disciplined innovators Superstars Healthcare payments, value-based purchasing, and shared savings programs. Fifty-five percent of our survey respondents said their organization is considering a merger or an acquisition. While the ability to fund innovation is a real issue for healthcare providers, perhaps another is just as significant — leadership. When asked what internal factors drive innovation in their organizations, healthcare respondents said leadership is even more important than organizational strategy or dedicated teams focused on innovation. Our survey also found that the most superstars reward their innovators with promotions (32.4%) or in non-financial (63.2%) and financial (55.9%) ways. Although healthcare providers come close to the benchmark for non-financial rewards (57%), more than a third of the healthcare respondents reported having no rewards system. If there is agreement that innovation in healthcare delivery must include solutions that improve quality of care as well as the efficiency of delivering it, then the good news from our survey is that the majority of respondents (59 percent) said their organizations have already implemented process re-engineering initiatives and nearly half (48 percent) are using cost accounting to track profitability of service lines. Unfortunately, reductions in staffing (44 percent) and service lines (17 percent) are also realities. Perhaps this survey participant summed it up best, “In the best interest of the organization and those we care for, it’s necessary to continue, if not even increase, innovation efforts to be competitive and meet the ever rising bar of expectations of those we serve.” 2012 Innovation Quotient Survey results 13 Affordable capital is available The following is a conversation with David Curtis, president of Residential Home Health, which provides services in Michigan and Illinois. Would you say having an aggressive innovation program is critical to a healthcare provider’s success today? If so, why? Curtis: Of course it is, because the traditional ways of doing things are too David Curtis expensive, inefficient, and are not meeting the changing needs of patients and providers. For example, our organization is wired from end to end electronically. We’ve had EMRs for more than seven years because patient status can change quickly and the doctors, case managers, and nursing homes that our professionals interface with want to know what is happening with their patients. Any time something hits our database as a clinical event, they get notified via e-mail. They have info at their fingertips on a tablet and know in real time what’s going on with a patient. We have continuity of care across providers. What has your organization done to generate innovations that will improve your business? Curtis: We actively seek out the opinions and input of others. We’ve invited customers to come in and review how we deliver care. We bring our technology vendors in to make sure we’re using the applications to their fullest extent. Last year, I took a team of eight or nine people to visit a company that does what we do in Texas. We spent two days with them to learn best practices. We are not committed to making sure all of the best ideas are invented only within the metaphorical walls of our company. The assumption is that others are doing something better that we should know about. This year’s Innovation Quotient Survey indicates that the respondents feel one of the biggest inhibitors to innovation for healthcare providers is access to capital. Would you agree? Curtis: No. We just refinanced our debt and received the best terms in the last several years. And I know that if we needed mezzanine capital or equity capital, while it may be more expensive, it’s also available. It may be that some providers are still perceiving a barrier that isn’t necessarily there anymore. If you have a good business plan you can find capital at a reasonable cost. 14 Plante Moran When asked what internal factors drive innovation in their organizations, healthcare respondents said leadership is even more important than organizational strategy or dedicated staff teams focused on innovation. What do you think? Curtis: Leadership is important for business, period. It’s important to state that the status quo is unacceptable and needs to be constantly re-evaluated. In my case, we’re dealing with reimbursement issues, and so necessity is the mother of invention. I share info with my team and tell them we will need to come up with creative ways to do things better in order to grow. I’m transparent with our team about results. That way they understand the choices and tend to reach the same conclusions as I do – we‘ve got to change. If I say to them, “We’re in a service business with a declining reimbursement environment and at an operating cost that is 65 to 70 percent payroll, the worst way to deal with it is to give everyone a pay cut. What else can we do?” That gets them thinking. How important is collaborating with other providers in the healthcare continuum for successful innovation efforts? What has your own experience been? Curtis: We’ve had great partnership experiences. We’re an independent provider so we’re not tied into an integrated delivery network. We have to work with the outside world and be flexible and responsive. The answer is always “Yes. Now, what’s your question?” We have to have that mindset. Analysis of the data indicates that 97 percent of the respondents from the sector had undertaken some kind of work to increase their knowledge for developing new products, processes, or services. Manufacturing, usually a leader in research and development, was at 92. The sector was also most focused on innovation of any of the sectors. On a scale of 1 to 10 with 10 indicating the strongest, the business/professional services sector ranked focus on innovation at 7.52, while health care came in second at 7.2, and not-for-profit came in third at 6.9. Innovation is top of mind at Chris Jones organizations, Practice leader Service Industry and the business/ professional service sector is ready to help INSIGHT The number of respondents from the business/professional services sector quadrupled this year. Consulting accounted for more than a third of the respondents in this sector with advertising, marketing, and communications coming in a distant second. Focus on innovation 7.6 7.4 7.2 Business/professional services 7.0 Health care 6.8 Not-for-profit 6.6 6.4 Rewards innovation Scale of 1-10 70% 60% 50% This seems to imply that the business/professional services sector is responding to clients who are placing more emphasis on innovation for help sustaining and growing their organizations. Certainly this sector ranks well above the lower tier innovators when it comes to listening to clients. The business/professional services sector comes in at 8.25 compared to 6.7 for the accidental innovator and 7.6 for the disciplined innovator. However, it does not reach the 8.7 and 8.8 ranking of the top innovators and the superstars respectively. The business services sector also finds itself better than the lower tier innovators but not as generous as the top innovators and superstars when it comes to rewarding innovation. Forty-nine percent of the respondents in the sector reported rewarding innovators in a non-financial way. Forty-one percent rewarded innovators in financial ways. 40% 30% 20% 10% 0% Non-financial Financial Promotions There are ways ways no rewards Business/professional services Accidental innovators Disciplined innovators Top innovators Superstars 2012 Innovation Quotient Survey results 15 Further findings indicate that the business/professional services sector is less worried about finding qualified personnel than even the top innovators and superstars. In fact, the respondents in this sector rivaled the top innovators and superstars in several areas. They were at least as satisfied with the information they have on technology and markets. They, however, were more concerned about the economic risks connected to innovation and they were more apt to see availability of financing as a constraint. Innovation constraints Organizational culture Organizational leadership Direct innovation costs too high Cost of financing Availability of financing Lack of qualified personnel Lack of information on technology Lack of market information 0 2 4 Accidental innovators Disciplined innovators Top innovators Superstars Business/professional services 16 Plante Moran 6 8 Scale of 1-10 Create an innovation ecosystem As an example of how a business services group can help with innovation, we had this conversation with Pedro Guillen, managing partner at Kinetik Partners, a boutique innovation consulting firm with offices in Detroit, Mich., and Barcelona, Spain. When you talk about a new frontier in innovation, what do you mean? Guillen: I’m talking about middle-market companies Pedro Guillen developing and nurturing an innovation ecosystem. Because industries are becoming more and more complex to serve, it is becoming evident that no one company can completely innovate internally and provide long-term results. The degree of know-how, expertise, and investment required to develop new products is not often found within individual companies. Do you mean joint ventures or new approaches to technology licensing? How do you create an ecosystem? Guillen: I’m talking about innovation hubs where research institutions, start-ups, and commercial entities are codeveloping new products, generating know-how, and designing transformational business models. For instance, some competitors are working to understand the basic and applied science behind new products or services. Taking it even further some suppliers are codeveloping to reduce time-to-market as well as mitigate the risk and investment required. Codevelopment is the norm in the European CORDIS Program and it’s also surfacing in the defense industry in both the United States and Europe. the revolution taking place in the automotive advanced materials industry. They are starting to link aerospace technologies, materials development, and advanced manufacturing to develop new lightweight, high-efficiency vehicles. What kind of business models do these ecosystems have? Guillen: They are self-regulating and they are adaptable. It is important for each member of the ecosystem to have a strong business model because once the power of innovation is unleashed they will need to harness it for strong returns and increased value. What’s one thing you’d add about ecosystems for innovation that we have failed to cover? Guillen: They can be self-perpetuating. As industries grow more complex the need for innovation expands; an ecosystem can adjust and expand to include the members it needs, always generating new solutions. Is this just a factor for the middle market, don’t big companies continue to have big R&D operations? Guillen: Actually this approach to external or open innovation filtered down from the big corporations like Siemens, Dow, and Procter & Gamble. More than 10 years ago, P&G decided on an open innovation model and now it requires its team to identify or source 50 percent of its products from the outside. Can you give us an example of how to create an ecosystem and how it works? Guillen: It takes mapping, looking at the current needs, and projecting future needs. When you find gaps, then you look for solutions. A perfect example is 2012 Innovation Quotient Survey results 17 Commitment translates into breakthroughs Across the board, our data indicates that top innovators and the superstars among them are more driven to improve and invent by all of the factors usually considered as innovation drivers. Their commitment is superior to innovators in other categories and may reflect their comprehensive attitude toward innovation or as one participant explained — ”We’re always looking/always listening.” Examining the data indicates that top innovators and the superstars among them put a top priority on: “We’re always looking/always listening.” • Customer demands • Corporate strategy • Improving quality • Increasing value add Emphasizing these areas translates into: • A greater frequency of innovation • More breakthroughs • Stronger return on innovation investment 18 Plante Moran Ranking of factors contributing to innovation Customer demands Corporate strategy Employees with ideas Reducing cost per unit provided or produced Improving quality Replacing outdated products, services, or processes Increasing range of products and services Entering new markets Increasing market share Increasing value added Increasing flexibility for producing products or services Increasing capacity for producing products or services 4 5 6 7 8 9 10 Scale of 1-10 Accidental innovators Top innovators Disciplined innovators Superstars 2012 Innovation Quotient Survey results 19 INSIGHT John Bebes Practice leader Not-for-profit Beth Bialy Practice leader Government Government, K-12, higher education, and not-forprofits, turn to innovation in their transformation efforts Laura Claeys Practice leader K-12 Uncertain economic times are driving innovation among not-for-profit organizations and the public sector, much more so than in the private sector. In fact, not-for-profits and the public sector including governments, K-12, and higher education ranked the economy and finances as the primary factors driving their innovation efforts. Those two factors ranked near the bottom for the rest of the survey group. Up until recent years, governments in particular did not focus on innovation because there was little incentive to consider it. Revenue streams and resultant budgets were extremely stable, leading to “business as usual.” Now that the economy is requiring innovative solutions, many governments are finding themselves ill equipped. Our analysts found that not-for-profits and the public sector rely heavily on leadership to instigate the innovation process. That adds another competing priority to an already stressful situation and puts a heavy burden on boards and councils. Following best practices and spreading the responsibility for innovation by integrating it into the organization’s fabric, however, could mitigate this situation. It is a given that the profit motive differentiates for-profit organizations from not-for-profits and the public sector but there are best practices that can be shared. Perhaps the most relevant is that many successful companies are driven to innovate because it supports their mission. (See Venture philanthropy, page 22, and Steelcase celebrating 100 year of innovation, page 32.) Vicki VanDenBerg Practice leader Higher education Data indicates that not-for-profits and the public sector are compensating for shrinking budgets by actively looking for opportunities to deliver programs and services in better, faster, cheaper ways. More than 91 percent said Innovation drivers 10 9 8 7 6 5 All respondents Education Government Not-for-profit 4 3 2 1 0 The economy 20 Plante Moran Finances Scale of 1-10 Innovation constraints Lack of market information Lack of information on technology Lack of qualified personnel Availability of financing All respondents Education Cost of financing Government Not-for-profit Direct innovation costs too high Economic risks No process for new initiatives Organizational leadership Organizational culture 0 2 4 6 8 10 Scale of 1-10 they have re-evaluated the necessity of the services they offer, and more than 88 percent re-evaluated the demand for the services they offer. To save on costs and maintain or improve service, not-for-profits and the public sector are also looking for opportunities to share. Eighty-six percent of them are sharing services; 68 percent are sharing facilities; and 56 percent are sharing technology with other organizations. Technology is important to these groups. Half of them are using technology to improve efficiencies now and almost half of them said they were looking to leverage technology even more to improve efficiencies. They also seemed somewhat interested in leveraging technology for service delivery and to engage their stakeholders. Not-for-profits and the public sector depend on technology to support their efforts to contain costs, and at the same time they find a lack of information on technology a major constraint on their innovation efforts. Perhaps a technology assessment could help squeeze out more value from existing systems and could serve as a basis to develop a systematic approach to upgrades that would ensure a stronger return on their technology investments. Budgeting for innovation is a best practice that notfor-profits and the public sector might consider. Despite tight budgets, there are real benefits from funding a line item for innovation. Survey results indicate that the amount is not as important as the fact that a budget actually exists for innovation. Budgeting makes the process of innovation more accountable and integrates it into the organization’s strategy, which is a building block for an innovation culture. 2012 Innovation Quotient Survey results 21 Venture philanthropy: A foundation’s pioneering approach to finding a cure The following is a conversation with Molly Riley, executive director, Greater Illinois Chapter, Cystic Fibrosis Foundation. The Cystic Fibrosis Foundation (CFF) pioneered venture philanthropy. Can you explain what that means? Molly Riley Riley: The Cystic Fibrosis (CF) Foundation is proud to be a pioneer in the concept of venture philanthropy and it evolved from our mission to find new drugs to fight cystic fibrosis. The foundation had been funding academic and medical research for decades, but there were still no drugs to control CF. So in the late 1990s, our President Robert Beall decided to try a new approach. CFF would fund drug development at for-profit pharmaceutical companies. It was a tough sell at first because the companies knew there would be a limited market. There are only 30,000 individuals in this country with CF, 70,000 globally. But the time was right. Because of growing economic and regulatory hurdles, biotech companies began reprioritizing their programs with smaller targets. CFF was one of the first to invest in for-profit drug development, but now several rare-disease, non-profit healthcare organizations like the Michael J. Fox Foundation and the Christopher Reeve Foundation are following suit. Has this been a successful approach? Riley: Absolutely. You can go to our website and see our pipeline of drugs at various stages in development. The pipeline is our report card to our donors and they can see at any time where the money we raise is being used. Just this year, the FDA approved Kalydeco for people with a certain kind of CF gene mutation. It is the first drug to address the underlying cause of CF and opens more opportunities that may lead to a control for all patients. 22 Plante Moran This is very innovative at the national level. Have you done anything at the chapter level that you would consider innovative? Riley: We’ve opened opportunities for more people to get involved. For instance, we’ve started an annual fund program for people who give between $1 and $9,999. This is an intermediate step in giving for people who don’t attend events and aren’t able to be part of our major gifts program. We’ve gotten a lot of new donors and reconnected with lapsed donors with this program. It raised $125,000 in the first year. Along the same lines we are now looking at adding a second more moderately priced golf outing as our current golf outing at Conway Farms begins at $4,000 for a foursome. Golf outings have been around for a while, but it seems as if you have a creative approach to fundraising. Riley: We try to keep up with trends. In 1996 we launched one of the first chef galas. We believe we were ahead of the times with that concept, and proud to report that it is one of the longest running chef events in Chicago. We were also an early adopter of the stair climb as a fundraiser, and right now there is a national trend toward extreme hikes. We plan on hosting our first one in 2013. Have you made any recent changes in the way your office works? Riley: Ninety cents of every dollar we raise goes to research, so we’re always looking at better and more efficient ways of raising money. Recently we’ve reorganized our staff by fundraising programs, allowing our directors to focus on their area of expertise. Building a culture that nurtures innovation Having a line item for innovation doesn’t remedy all of the constraints that organizations face when developing a culture that stimulates change and improvement, but it goes a long way. Data from organizations that budget for innovation proved that they introduced more new products in the last three years, integrated innovation into their strategy, and rewarded innovators — most often in non-financial ways. Actually the importance of rewards became clear last year when 35 percent of all respondents reported rewarding their innovators. This year that is up to 40 percent for the private sector, but came in at only 12 percent for not-for-profits and the public sector. The C-suite needs to become better listeners There is some indication that there is a disconnect between the C-suite and offices down the hall when it comes to innovation. In general, the role an individual plays did not alter the responses, but data uncovered communication gaps that are causing discontent. For instance, the non-C-suite group reported more abandoned innovation projects than the C-suite respondents, leading our analysts to conjecture that perhaps the projects were never reported to the C-suite. The two groups also had different concerns. The C-suite is concerned about attracting key employees, training, and strategy, but in general see fewer constraints. However, data indicates that in many cases, members of the C-suite failed to assure their colleagues that innovation is integral to the organization. Respondents outside of the C-suite group see leadership and culture as major constraints on innovation. “In general, the role an individual plays did not alter the responses.” You don’t need charismatic leaders to be innovation superstars Our data this year allowed us to look more closely at the role of leadership in innovation. Last year’s data indicated strong leadership support for innovation was essential and that continues to be true when you consider that leadership is responsible for developing strategy, budgeting, and nurturing culture. But our current data allows us to take a closer look at the process of innovation, and it is clear that a charismatic leader can set the stage, but innovation bubbles up from the lower ranks. This may be one reason why the savvy C-suite is so concerned about attracting talent. If our data is correct, they could use innovation as a tool for attracting employees. In fact companies that develop new products/services are more able to attract talent. On the other hand companies, usually larger ones, with 2012 Innovation Quotient Survey results 23 longer running products, are concerned more about attracting people with new ideas. teams in the ecosystem. Data indicates that organizations, especially the larger ones, are anxious to put together diverse teams and when they do they see positive results — an increased number of innovations that can be registered. Where do innovators turn for inspiration? It is clear that organizations with all levels of innovation turn to their suppliers, their customers, and even their competitors as resources for ideas. What sets the top innovators and the superstars among them apart is that they reach out to consultants, universities, and public research groups. It could be said that an organization’s culture that honors innovation also has high expectations for innovation and wants to see results. That could be why the top innovators and the superstars among them see many more patents, industrial designs, trademarks, and copyrights. This is their way of setting up an ecosystem that supports innovation and they are often rewarded with breakthroughs. Diversity on your team will facilitate collaboration Data indicates the positive power of an innovation ecosystem, but to maximize that power an organization needs a team that has diversity of age, gender, ethnicity, and skills. That kind of team will be agile enough to work with the many different Resources for innovation Government or public research institutes Universities or other higher education institutions Consultants, commercial labs, or private R&D institutes Competitors or other organizations like yours Clients or customers Suppliers of equipment, materials, services, or software 0 20% 40% 60% Accidental innovators Disciplined innovators Top innovators Superstars 24 Plante Moran 80% 100% Rick Rothwell Rick Rothwell is vice president of business development at Eureka! Ranch, an innovation systems company that provides innovation training funded and supported by the U.S. Department of Commerce and delivered through Manufacturing Extension Program (MEP) locations across the country. For a list of MEP locations, see http://www.nist.gov/mep/innovation.cfm. Many organizations are betting on innovation to help them increase revenue. Is that realistic? Rothwell: Absolutely. We like to say that our innovation engineering management system (IEMS) is the way to wealth. The system that is offered through MEP was designed by Doug Hall, noted for his innovation success at Procter & Gamble where he was able to bring nine new products to market in 12 months. The IEMS and its tools used to be available only to big companies like Nike, Hewlett Packard, Walt Disney, and Ford Motor Company, but thanks to the U.S. Department of Commerce’s NIST/MEP network it’s now available to all companies. Doesn’t innovation call for a budget and a dedicated staff for research? Rothwell: The IEM system helps you find meaningful, unique, patentable ideas that you can sell on value not price and you can do it with the talent you have. Also the fail fast/fail cheap approach that is part of the system increases the speed of innovation by six times and decreases the risk by 30 to 80 percent. Can you explain how to assemble a team? Rothwell: There are three key positions. You need the buy-in of someone in a leadership position. You need an innovation coach, someone who has gone through extensive training. Coaches are available through the MEP offices. For instance, there are four people at PolymerOhio who are in the final stages of training. When they complete the training they will become Innovation Engineering Black Belts and certified coaches. After you decide on a project, you will also need a project manager or champion, a person within the company who is passionate about the idea. So I have the team, but how do we come up with those unique ideas? Rothwell: Your employees have the ideas you need. Assemble a small, diverse group from finance, engineering, marketing, production, etc. Have them write down their ideas. We also teach them how to use stimulus mining to search the world for stimulus that may spark ideas for the company. In the process of defining ideas, you can separate the winners from the costly losers. This is the time when you want to make sure that you are solving a problem for your customers and that you can follow through on your promises and deliver. Fail fast/fail cheap A proven process to speed innovation & decrease risk The key is to continue to grow the number of people in your company who are innovating, so that every person is coming up with innovative ideas every day. This will give you the sustainable culture of innovation. So let’s say we fully defined an idea, what is next? Rothwell: You put the idea through rapid fire testing. Your team voices concerns. Innovation Engineering Black Belts then help you take your ideas through day cycles of learning to determine if the idea can get past the objections. This is the fail fast/fail cheap process and an inexpensive way to mitigate the risk and minimize the time spent. When the team feels confident an idea is worth commercializing, there is still the question – will it make money? To answer that question we do the math game with IEMS proprietary software. Our data indicates that innovation superstars abandon projects more often than other less successful innovators. Can we assume that it is because they have a system of discovery like you describe? Rothwell: I say that is a well-founded assumption. But it is important to remember that the goal is to develop a culture of innovation, so abandoning a project doesn’t mean innovation stops. The focus just turns to another project. Sometimes killing a project early on (a smart kill) can be the ‘big win.’ 2012 Innovation Quotient Survey results 25 INSIGHT Brian Pollice Practice leader Financial Institutions Community banks know they must innovate, but ... “Even though all sectors rated innovation as an important factor in generating revenue and containing costs, the sectors ranked their focus on innovation very differently. By and large financial institutions did not value innovation highly compared to other sectors.” This is quoted from the notes of the statistical analysts who reviewed the results of the 2012 Innovation Quotient Survey. The survey results indicate that financial institutions, in particular community banks, know they will have to depend on innovation to sustain their operations in the years to come, but they are unaccustomed to innovation and are just beginning to lay the foundation for a culture that is always looking for improvements and new ideas, a process that can take time. However, they need to be ever vigilant and deliberate in their innovation efforts. With the growth of debit cards among retailers like Kroger and Wal-Mart as well as government departments like state welfare offices, banks are in danger of being squeezed out of the payment processing business and a major part of their revenue. How can they fight back? According to an independent consultant who has worked for banks since the early ‘90s, the response needs to begin with change at the top. The results from the IQ survey indicate that a leader who champions innovation is essential. It is the leader who sets the tone, integrating innovation into the organization’s strategy, budgeting for it, and creating a culture that values new ideas and improved ways of doing things. Focus on innovation Not-for-profit Business services and technology Manufacturing & distribution Health care Financial institutions All data 4 5 6 7 8 Scale of 1-10 26 Plante Moran Interestingly, the analysts found that innovation doesn’t depend on a charismatic leader because innovation most often bubbles up from the lower ranks, but it is the leader who has to develop a culture where the employees feel empowered to bring new ideas to the table. It seems as if bank leaders are facing an uphill battle when it comes to creating an innovation culture because they and their colleagues see so many constraints. For instance, all respondents showed concerns about the cost of innovation, but on a scale of one to 10, financial institutions were a full point above the rest. Perhaps that is because over the last three years, they’ve seen dramatic increases in the cost of regulatory compliance. More than half of the respondents saw a 25 to 50 percent increase in compliance costs and looking ahead 48 percent estimated another 25 to 50 percent increase in the next three years. To cope with increased regulations, more than 61 percent of the respondents are using software for compliance and 29 percent said they planned to begin soon. This is a good first step, but technology experts indicate that the banks often don’t take time to maximize the value of the software they select. Sharing the services of a skilled industry professional such as a compliance officer is another way of dealing with the increased costs of regulatory compliance. Ten percent of respondents are already doing that, and 44 percent said they would consider sharing. Service/product offerings The question of how often to re-evaluate current product/service offerings was also part of the bankers’ conversation on innovation. Forty-eight percent of respondents said they re-evaluated annually; 23 percent quarterly; and 8 percent monthly. Do they re-evaluate or do they just look at pricing, an independent consultant challenged. The survey results indicate that financial institutions are least likely to listen to customer demands. The innovative ones, however, never miss a chance to connect with their customers. Some have begun Saturday workshops in branch offices to teach customers about mobile banking. Others train their employees to end every conversation with a question — “Is there anything more we could help with?” The conversation on innovation in the banking community continues with Jim Marcuccilli President and CEO of Star Bank see page 28 Mark Schroeder CEO and chairman of the board, German American Bancorp see page 29 This can be a catch-22, however, because as branches close, there are fewer and fewer people to reach out. There seems to be many hurdles for the banking industry, but there are also opportunities. We asked two bank presidents to share their views. See their reaction on pages 24 and 25. 2012 Innovation Quotient Survey results 27 Customers are the source of our ideas The following is a conversation with Jim Marcuccilli, president and CEO of Star Bank, which serves northern Indiana. Our survey data indicates that banks don’t value innovation as much as other sectors. Do you think that is true? And if so, why? Marcuccilli: I wouldn’t say that banks value innovation any less than other sectors, but I do believe we face many challenges that hinder our ability to innovate at the pace we would like. It is important to realize that banks have to be precise. They balance their books every day, and this kind of accuracy makes it harder to implement new ideas. At Star, we foster innovation through an emphasis on our backroom operations – and that has been the case for many years. In the 1960s my father and his partners, who were the principal owners, centralized the backroom operation by creating a data service center so when customers came in we could bring up all of their information on a desktop computer. That was more than 50 years ago, but we still focus on ensuring accuracy and access today. It’s a different sense of innovation garnered through efficiency and service, with the customer as a focal point. Do you depend on your employees for innovative ideas? Marcuccilli: We rely heavily on our customers and employees for innovative ideas — their insights on 28 Plante Moran consumer trends, purchasing behaviors, and competitive technologies. We certainly encourage the Star team to implement changes and to introduce innovative ideas, but as I mentioned, accuracy is essential and we can’t forego quality service. Your website indicates Star Bank has a very close connection to its customers. How do you do that? Marcuccilli: It starts with our community focus. We’re still owned by two families and we’ve been in this for three and four generations. We have strong roots and a very local approach. We have a system to reach out to our customers each year in a very personal way. At the beginning of the year, the regional president, the senior commercial lender, and the senior retail officer in our locations map out “touches” with their customers. It can be lunch, taking them to an event. They listen and then they ask: “How can we help you with that?” How do you keep up with all of the changes in technology and customers’ demands for new electronic services? Marcuccilli: Our number one concern is the security of our customers’ information. We aim to provide progressive technologies through mobile, online banking, and other channels, and as I mentioned, we’re eager to obtain feedback from our customer base on new ways to enhance our products and services. Additionally, we stay current on upcoming and existing trends through webinars, seminars, and thirdparty relationships. However, at the end of the day, the safety and soundness of our customers and of the bank are top of mind. Technology has allowed us to become more efficient and competitive, but fraud has picked up and we need more resources to monitor and keep our customers’ information safe. We also do an annual review of our software and systems to make sure we have the controls we need for information security and the resources we need to offer the services our customers expect. We can’t end our conversation without talking about regulatory compliance. Marcuccilli: It is a neverending source of pressure in the banking industry. For example, the Dodd-Frank Act has 200-plus new regulations, and people are just now sitting down to write them. It is complex and burdensome to banks, consumers, and the economy. I’m afraid that we’re going to see a lot of banks that say this is just too hard and discontinue products or services. Inevitably, the consequence will result in fewer banks and less competition — so we’ll have fewer home mortgages, for example, and higher rates. Without question, the cost of doing business is rising. One of the biggest costs is training our 600 employees on the new rules and regulations and how to implement them. Thanks for your time. May we share your comments? Marcuccilli: Absolutely. I am the first vice chairman of the Indiana Bankers Association. Star Bank really believes that strengthening the whole banking industry is important. We can do that by sharing information. Community banks need to share best practices to survive this era of change The following is a conversation with Mark Schroeder, CEO and chairman of the board, German American Bancorp. Our survey data indicates that banks don’t value innovation as much as other sectors. Do you think that is true? And if so, why? Schroeder: Those figures don’t surprise me. As an industry, banking has seen innovators pay the price whether they were on the cutting edge of expansion or lending. As they say you can always tell the pioneers by the arrows in their backs. I’d say German American is opportunistic. We’re early adopters as opposed to innovators especially when it comes to technology. The speed of adoption, however, has changed. It used to be that the trends would gradually filter in from the coasts and we had time to adjust, but now it is like a tidal wave and we have to be able to move quickly. Customers hear of options and they want them; we have to be able to keep up with them. How do you keep up with them? Schroeder: Because of our size, we can have an individual whose sole job is to manage the electronic process. He can help us keep our finger on the pulse. We know where we want to be and he can address what is coming at us and get us where we need to be. This is a cost conscience approach. Too often when you spend the money to be on the leading edge, by the time the smoke has cleared, your customers are on to something else. Are you concerned about the trends in the payment card process? Schroeder: We’re concerned about the whole payment system, the whole electronic system. On the deposit side, adoption of mobile banking is accelerating. The million dollar question is what should we invest in. We aren’t like the big banks; we can’t develop our own core systems. We have to buy off the shelf and our vendors aren’t offering the products we need. Vendors aren’t investing money back into their operations and coming up with new solutions. We’re forced to buy a variety of products and then we have interface problems. Our data indicates that financial institutions are the least likely to listen to their clients. Do you think that is true? Do you have any solutions? Schroeder: We are a relationship business and it is true that because of electronic banking we have fewer touch points, so we need to work harder. We have a senior vice president heading up a strategic customer service plan. We ask customers to evaluate our onboard process after they’ve opened an account or a loan. We’re planning to do a customer survey. Right now every issue that arises is entered into the database. If we see trends we know we have to address the problem. Because regulatory compliance has become such an issue, we have to ask you, how you are responding? Schroeder: There has been an enormous change. We’re on a three-year exam cycle and during that time compliance expectations went from what I’d call loose to zero tolerance. We’ve responded with a new three-stage process. We have specialists check the documents when a loan request is opened and after it is closed. We have compliance officers monitoring the internal process, and we have outside auditors review our checks and balances. We’ve more than tripled the staff devoted to compliance. We really appreciate your candor. Can we confirm that we have your permission to share this conversation? Schroeder: Absolutely. The more we can share, the better chance we have to see a healthy future for community banks. “We’re early adopters as opposed to innovators especially when it comes to technology.” 2012 Innovation Quotient Survey results 29 INSIGHT Jeff Mengel Leader in the manufacturing group Manufacturing is responding to the slow-growth economy with a twopronged approach to innovation Manufacturers responded to the financial crisis of 2008 by going into a cost-cutting mode. Focused on the bottom line, their innovative energies went toward new processes that would allow them to cut their way to profitability. However, our data indicates a major change. While continuing to pursue cost savings, manufacturers also are beginning to seek top line growth through innovation. More than 70 percent of the manufacturers reported innovation within their traditional markets. As a group this puts them right up there with the top innovators and superstars analysts found in their benchmarking. The same is true of innovation that was a variation on a single theme. They did lag, however, the top innovators in breakthrough innovation even though 50 percent of the manufacturers reported registering for a patent or trademark. Although the size of an organization did not correlate with innovation success, data did indicate that larger organizations tend to have older products and are milking them for revenue rather than developing new products. In other words they are less hungry for change. Depth of innovation 80% 60% 70% 50% 60% 40% 50% 40% 30% 30% 20% 20% 10% 10% 0% Variations on a single theme New but within Breakthrough in its traditional all ways markets Manufacturing Accidental innovators Disciplined innovators Top innovators Superstars 30 Registration of innovation Plante Moran 0% Applied for Registered Registered a Produced a patent an industrial trademark materials design eligible for copyright Manufacturing Accidental innovators Disciplined innovators Top innovators Superstars Manufacturers need to add services to their innovation mix That said, it is surprising to see such a penchant for change among manufactures because more than a quarter of them were among the biggest companies in our survey group. Yet they compare favorably with our top innovators when it comes to new products. Their innovation efforts do drop off when it comes to services. Perhaps they need to be reminded of the “Power by the Hour” from GE Aviation. The manufacturer of jet engines offers customers the option of paying for the engine per operating flight hour rather than paying tens of millions of dollars upfront. The company realizes that the lifetime profit of the engine does not arise at the time of initial purchase, but instead comes from the spare parts, maintenance, and servicing. When customers opt into the Power by the Hour program, GE is ensured of all after-sale service work on the engines. The big question More fundamentally however, manufacturing needs to investigate how to use rewards for innovation as an effective stimulus. Most manufacturers already embrace and budget for continuous improvement which is a component of innovation success, but in general manufacturers fail to reward innovation. According to our data, rewarding innovation is one of the major differentiators of the top innovators that enjoy more than five times more breakthrough innovations than accidental innovators. How does a manufacturer, in an environment where continuous improvement is considered a job requirement, promote breakthrough innovation and define the levels of progress and success that warrant a reward? Types of innovation 120% 100% 80% 60% 40% 20% 0% Introduced new or improved products Introduced new or improved services Introduced new or improved processes Manufacturing Accidental innovators Disciplined innovators Top innovators Superstars 2012 Innovation Quotient Survey results 31 Mission: Sustainability Celebrating 100 years of innovation by planning for 100 more When you’ve been true to your vision for so long, and you’ve seen so much success, what do you do when you’re about to turn 100? Steelcase, the world’s largest office furniture maker, has embarked on a journey of self-discovery. Angela Nahikian The company, based in Grand Rapids, Mich., prides itself on being lean and green. In fact sustainability seems to be a significant part of its corporate DNA. Driven by the vision of the company’s founders, Steelcase focuses on: •Designing products and processes that minimize their impact on the environment •Empowering a worldwide supply base to join the cause of sustainability But what should the company do moving into its second century? With customary earnestness the company is looking inside and out to better understand where it’s been and where it’s going. The process began three years ago and the findings will guide the manufacturer as it develops a strategy for its second century. Initial results indicate that the company’s culture of innovation is at the root of its longevity and its survival. “But we realize we need to reexamine and perfect,” says Angela Nahikian, 32 Plante Moran To celebrate the process of re-evaluating its strategy, Steelcase commissioned a video “100 Dreams, 100 Minds, 100 Years” for its website. The video follows children from their kitchen tables, to their playgrounds, and to their schools in countries around the world. The Indian boy who contributed this drawing dreamed of “buildings that grow legs and fly high if a tsunami comes – so everyone can live.” director of Global Environmental Sustainability. “So we’ve engaged three groups of consultants. One will focus on our corporate sustainability report. The second will help us with stakeholder research, and the third will help us address end of use/ end of life issues.” For the corporate sustainability report, a consulting firm is helping Steelcase determine its strengths, where it needs work, and market expectations on issues such as pollution prevention, employee health and well-being, and fair labor practices. “Through a series of interviews, we’ve been able to identify areas for opportunity that will help us orient ourselves more toward a socially- and environmentallyminded system,” says Nahikian. “The added benefit is that we will be able to accurately report on this in our upcoming corporate sustainability report.” Working closely with another consulting group, Steelcase has been surveying its sales staff and customers to find out what they think about sustainability in both a personal and professional sense. “By reaching out to them, we’ve been able to gather valuable information on their perceptions of sustainability. We are using this information to develop messaging and sales tools to correspond better with the desires and expectations of our stakeholders,” Nahikian continues. To round out Steelcase’s comprehensive self-examination, the company is consulting with some outside groups to explore end-of-use possibilities. Soon the company will be pulling all this information together, synthesizing it, and developing a plan to leverage all of the company’s assets to advance its social and economic goals. That will be good for Steelcase and good for its competitors. “We celebrate each and every action that promotes sustainability, including those of our competitors,” Nahikian says with conviction. 2012 Innovation Quotient Survey results 33 Webinars Add your voice to the conversation Our conversation on innovation continues year round. You can take the survey at innovationquotient.plantemoran.com and you will receive a customized report ranking your responses against the categories — The webinar schedule is: Become an innovation superstar: double the return on your investment Friday, Sept. 21, 2-3 p.m. EDT This webinar is designed to help leaders unravel the mystique of innovation and understand how to develop a philosophy or ecosystem that nurtures invention. We will share the best practices of top innovators. •Accidental innovators •Disciplined innovators Know you need to innovate, but don’t know where to begin? •Top innovators Wednesday, Oct. 24, 2-3 p.m. EDT •Superstars If you know you need to innovate, but don’t know where to begin, you are like most of the financial institutions who responded to our 2012 Innovation Quotient Survey. This webinar will help you understand what the best in class innovators are doing to sustain their organizations and keep their customers happy. If you’ve already participated in the survey this year, we invite you to take it next year. Each year we collect data between May 15 and June 15 for our report. You also may be interested in our webinars on innovation that are scheduled this fall. If you are double booked and can’t attend the presentation, they will be available three days after the presentation at plantemoran.com. Innovate or die: A wake up call for healthcare providers Thursday, Nov. 1, 2-3 p.m. EDT This year the Innovation Quotient Survey asked specific questions about the status of innovative practices among healthcare providers. We will use the survey findings as a jumping off point for discussion about the urgent need for entrepreneurial mindsets in the industry and how providers can create a culture of innovation, nurture it, and ultimately benefit from it through reduced costs, improved quality outcomes, and better consumer experiences. Using optimism and structure to drive innovation in a service organization Wednesday, Nov. 7, 10-11 a.m. EST Services dominate the world’s established economies and are becoming increasingly important in developing economies. Leaders understand embracing innovation is critical to capturing the increasing opportunities. Yet they grapple with what to do to maintain a competitive edge. Register: webinars.plantemoran.com All webinars are archived at plantemoran.com three days after the presentation. 34 Plante Moran My team and I came away from this project realizing how important it is to keep talking. In this era of electronic communication, it is easy to dash off an e-mail or an instant message and feel like you are communicating. But we learned that it’s best to pick up the phone or better yet, when possible, walk down the hall. The give and take of a conversation can produce new ideas to pursue and make every project richer. The research tools we used gave us correlations and frequencies. But it was the write-in comments that helped us put our data into context. And it was the people who went on to share their stories that further inspired confidence in the health of innovation in the Midwest. For the Future We should talk more It used to seem that innovation was a lonely race conducted by scientists in guarded buildings. It was mysterious. But now we understand that continuous improvement and even breakthrough innovation depend on collaboration. The mystery has been solved and innovation is open to all. We hope to talk next year. Jeff Mengel Plante Moran Partner Jeff Mengel The Innovation Quotient Survey report team included Diane Baumann, Amanda Dine, Kim Greenspan, Alexandra Haller, Becky Killarney, Kari Laderach, Karen Pope, and Donna Smith. 2012 Innovation Quotient Survey results 35