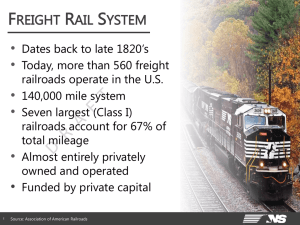

Analysis of Freight Movement Mode Choice Factors

advertisement