Growing Your Credit Union - Cornerstone Credit Union League

advertisement

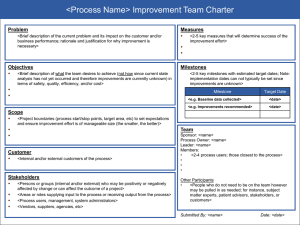

“GROWING YOUR CREDIT UNION” Ideas to Increase Your Membership in Today’s Economy What We’ll Cover Your Current Field of Membership How Do You Determine Members’ Needs? Your Marketing Plan & Marketing Strategies Field of Membership Expansion Opportunities Who are You Chartered to Serve? Do you know who qualifies for your field of membership? Has your sponsor company been acquired? Obtain Section 5 of your credit union’s charter Has your sponsor company changed its name? 1. Contact your NCUA Examiner 2. Contact your Region’s Division of Insurance 3. Contact State Supervisory Authority (SSA), if state chartered Things to Consider Current Members ~ Family Members Potential Members 4 Don’t Forget Family Members… Definition Immediate Family Member Means Siblings, Stepsiblings Parents, Stepparents, Grand parents Children, Stepchildren, Adoptive Children, Grandchildren Spouse Study Member Growth Trends Has your credit union experienced positive or negative growth trends? Understand your target markets. What target markets are growing? (Why) What target markets are contracting? (Why) Review Internal Membership Data • Generate reports to identify demographic data. Membership Data • Determine if software vendor can provide demographic data (there may be a fee). Methods to Identify Eligible Members Internet/Maps Sponsor Company or Associations Census Bureau and Labor Dept Publications Community Organizations Trade Groups How Do You Determine Need? Develop a membership survey and ask the following questions: Are you using the credit union? Why? 1. What products and services are you using? 2. Do your immediate family members belong? 3. Is our location and our hours convenient? Why not? 4. What products and services would you like to use that are not currently offered? 5. Is our staff professional and knowledgeable? 6. Do you consider this your primary financial institution? What is Marketing? Marketing is…… Establishing, maintaining and enhancing longterm relationships with members so both the credit union’s and members’ objectives are met. Credit union’s Objectives Members’ Objectives 10 Reasons to Market Your Field Membership WhenCurrent you need to of develop your credit union. WhenDoyou to reinforce a positive image. How Youneed Determine Members’ Needs? WhenMarketing you needPlan to grow your membership base. Your & Marketing Strategies When there has been a change in your field of Field of Membership Expansion Opportunities membership. Develop a Marketing Plan to Reach Existing and/or Eligible Members Step 1. Step 2. Select Your Target Markets Set Marketing Goals Step 3. Step 4. Formulate Marketing Strategies Measure Results 12 1. Select Your Target Market Step 1. • Determine what demographic (s) your marketing effort will focus. 2. Set Marketing Goals Step 2. • Determine what goals credit union management wants to achieve such as increasing members, loans and/or shares. Step 2. • Make the goals realistic, achievable and measurable. Great Member Service Good Products and Services Convenience On to Winning Strategies… 3. Formulate Marketing Strategies Step 3. Step 3. Step 3. • Run newspaper or radio ads • Promote excellent member service • Develop a website • Distribute brochures in lobbies at Select Employee Groups (SEG)s • Develop a Financial Literacy Program 3. Formulate Marketing Strategies • Distribute new members’ kits Step 3. • Develop a newsletter Step 3. • Use bulletin boards • Email marketing promotional to SEGs Step 3. • Participate in sponsor activities 3. Formulate Marketing Strategies • Consider marketing efforts with an emphasis to the youth and young adults by using Twitter, Step 3. Face Book, Email or other popular media Step 3. • Recruit new businesses • Promote credit union membership as a Step 3. benefit that can be added with little or no cost to the business 3. Marketing Strategy Examples Step 3. Step 3. Step 3. • Promote Family Membership – Provide gift cards for each new family member joining the credit union • Attract Youth Accounts – Coloring contests for kids or matching $10 deposits for youth savings are some ideas • Financial Literacy – Conduct a workshop or develop an informational pamphlet on how to improve your credit score, obtaining a mortgage loan, or balancing a checkbook for all ages • Attend Sponsor Activities – Have a booth at a sponsor event and give incentives to join the credit union such as $25 to open a new account, $100 if approved for an auto loan, or $150 if you bring an existing loan from another institution, etc. 4. Measure Performance Step 4. Step 4. Step 4. • How do your marketing efforts compare to industry average? • Do you know for certain your marketing efforts are effective? • Are your members satisfied? Keep A Record Repeat the Good Stuff! Field of Membership(FOM) Expansion Why FOM Expansion? • Expansion provides a viable option for credit unions seeking growth opportunities Field of Membership Expansion Benefits • Diversifies your membership and risks FOM Expansion • Provides new markets and opportunities Benefits • May mean survival of your credit union Field of Membership Expansion Risks FOM Expansion Risks • Lack of familiarity with new members • Can damage relationship with sponsor • May create additional compliance risk Common Bond Expansions Your Field of Membership SingleCurrent Common Bond Expansions Conversion Single to MultipleNeeds? Common Bond How Do Youfrom Determine Members’ Multiple CommonPlan Bond ExpansionsStrategies Your Marketing & Marketing Field of Membership Internet Field of Membership Expansion Opportunities Application (FOMIA) Single Common Bond (SCB) Expansions Occupational or Associational Common Bond • Add contract employees of an occupational common bond • Add churches of the same denomination SCB Expansion Requirements • Cover letter to Regional Director SCB Expansion • Complete NCUA Form 4015 EZ Multiple Common Bond (MCB) Conversion Requirements SCB to MCB Conversion • Letter to Regional Director requesting conversion to MCB • Complete NCUA Form 4015 or 4015EZ as applicable • Submit letter from the group and bylaws if association for MCB Multiple Common Bond (MCB) Expansion Requirements MCB Expansion • Complete manual or Internet application. • Complete NCUA Form 4015 or 4015EZ as applicable. • Submit letter from the group and bylaws if association for MCB. • Log onto http://www.ncua.gov/data/FO MIA/NCUAgovLink.htm for the Internet application. FOM Internet Application Criteria for Approval Group must have less than 3,000 potential members. CU must have less than a CAMEL 3. CU must have Net Worth of 6 percent or greater. Distance must be 25 miles or less. Community Charter Conversion/Expansion Chapter 2, Section V, of the Chartering Manual Convert to or expand current community Cannot have SEGs & Community Charter Cannot add Underserved Areas to Community Charter 1. Community Conversion/Expansion Background Information • Federal Credit Union History Step 1. • Membership Penetration • Reason for Conversion Step 1. • Area Requested • Population Step 1. • Groups & Number of Members Outside Proposed Community 2. Identify Community Boundaries Step 2. Step 2. • Well-Defined Local Community (WDLC) is met if: • within a single political jurisdiction • WDLC may be met if: • Multiple contiguous if population < 500,000 or • Metro Statistical Area (MSA) population < 1 million 3. Determine Proposed FOM Wording Example Step 3. • Persons who live, work, worship or attend school in, and businesses and other legal entities located in geographic area 4. Community Charter Conversion/Expansion Step 4. • Include at least two MAPS of the community with at least one statewide map highlighting the requested area Map - Example 1 (Census) 36 Map - Example 2 37 Map – Example 3 38 Map – Example 4 39 5. Community Charter Package Includes Step 5. • General Background • Narrative Proving Local Community (if applicable) • Proposed Field of Membership Wording Step 5. • Maps (Local and Statewide) • Marketing Plan addressing how the community will be served Step 5. • Business Plan addressing how conversion fits CUs objectives and how management can support the plan. • Pro forma Financial Statements for two years after conversion with assumptions • Anticipated financial impact on the credit union Understand your members and their financial needs. Offer the best products that meet your members’ needs. Make it easy for members to access your services. Consider FOM expansion for growth opportunities. 41 References Your Currentand Field of Membership Chartering Field of Membership Manual FOMDo Internet Application – User Instructions How You Determine Members’ Needs? FOM Internet Application – Frequently Asked Your Marketing Plan & Marketing Strategies Questions LetteroftoMembership FCUs 03-FCU-05 Field Expansion Opportunities Questions ?