The Triple DiviDenD of resilience

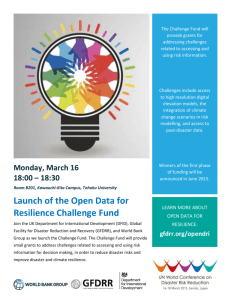

advertisement