Ask the Expert - The Sleeter Group

advertisement

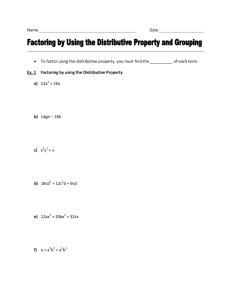

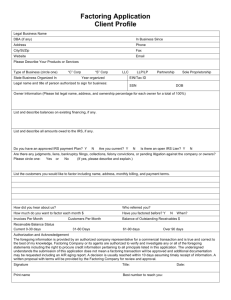

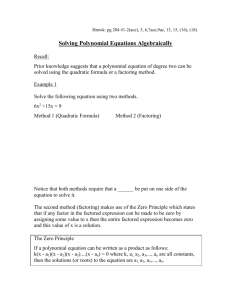

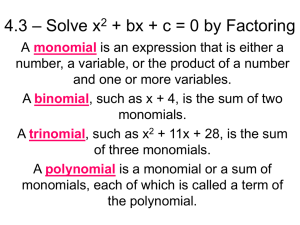

Ask the Expert Factoring Invoices QUESTION: Have you developed or come across a procedure within QuickBooks to account for A/R factoring which is simple enough for a non-accountant client to process? INTERPRETATION: How to track and record factoring of invoices in QuickBooks®. SCENARIO: We sell our invoices to a factoring company. Typically the factoring company will advance only a portion of the invoice being factored, say 70%. The balance (less a factoring fee) is remitted to us when the factoring company collects the full invoice amount. We would Receive Payment and use the discount screen at that time to clear out the remaining balance on the receivable and record the factoring expense. Complications arise when after a period of time we have to "buy back" the receivable from the factoring company as they have not been able to collect from the customer. The buy back may be through a check issued to the factoring company for the receivable that has been factored plus a factoring fee. Alternatively, the factoring company may take the buy back cost out of the reserves (amount of other invoices not paid initially, in this example-30%) that are held by the factoring company. Thus keeping a clean A/R file down to the invoice level is tricky. ANSWER: To make this process as simple as possible, create a Bank account called ‘Factoring Holding Account’. Only use this account to record factoring transactions. Its balance should always be zero once all transactions are done. Create normal invoices for the entire sale amount; let’s say $10,000. Then, Receive Payment on the date that the invoice is ‘sold’ to the factoring company for the amount advanced ($7,000 in our example). Handle the deposit as illustrated later. When the customer pays the $10,000 invoice, the factoring company will send you a check for $3,000 less the factoring fee, say 5%. Then, Receive Payment for $2,500 on the customer’s account. Notice that QuickBooks® still shows a balance of $3,000 on the customer’s account. Record the $500 factoring fee by selecting ‘Discount Info’ on the Receive Payment screen. Enter the factoring fee and the expense account as illustrated below. This will reduce the customer’s invoice balance as illustrated below. Enter the amount received from the factoring company as a payment to reduce the customer’s balance to zero. Instead of selecting ‘Group with other undeposited funds’, select ‘Deposit To’ and choose the Factoring Holding Account as illustrated above. The above method is the simplest method because using the “discount” button on the receive payments screen is relatively quick. As an alternative, you could enter a credit memo for the factoring discount for each invoice and then “apply existing credits” in the receive payments screen. Note: There are tradeoffs to using Credit Memos instead of Discounts: If there are a lot of invoices to be factored, entering credit memos will require many more transactions. This will be more time consuming and will increase the data file size. The main advantage of using credit memos is that the credit memos will be listed as separate transactions on statements, customer registers and QuickReports. Also, using credit memos allows you to use Class tracking and memos on the factoring expense transactions. When all of the individual Receive Payments have been entered, the balance of the Factoring Holding Account will be the amount received from the factoring company. Finally, make a deposit into the Checking account from the Factoring Holding Account. This will clear the Factoring Holding Account to zero and will record the deposit in the Checking account. What if you have to buy back a receivable? Let’s assume, for example, that you have to buy back a $5,000 receivable and must pay back the factoring company the initial advance of $3,500 plus a 5% factoring fee. The simplest procedure is to write a check to the factoring company for the $3,750 ($3,500 advance plus 5% of $5,000). Enter Accounts Receivable as the account and the customer’s name in the name column for $3,500 and record the $250 fee as illustrated below. Notice that the customer’s balance is back to the original balance of $5,000. To complicate matters further, let’s assume that instead of you writing a check to the factoring company, they withhold the $3,750 you owe them from reserves on other accounts. The purpose of the Factoring Holding Account is to enable you to keep correct balances at the invoice level when this happens. If the factoring company withholds a buy back from your reserves, record a check to the factoring company as illustrated previously using the Factoring Holding Account as the bank account instead of the Checking account. This will reduce the ending balance in the Factoring Holding Account to the actual amount received from the factoring company. Finally, make a deposit into the checking account from the Factoring Holding Account to record the actual amount deposited. Notice that the balance is the Factoring Holding Account is now zero. If you decide that the invoice is uncollectable, write it off with a credit memo using an item that hits Bad Debt Expense. Go to Receive Payments and click on ‘Apply Existing Credits?’ and select the invoice. This will apply the credit memo to the invoice. It may be best to use this method all the time, even when nothing was withheld from reserves, so the same method is used consistently. This method should make it possible to keep an accurate record of Accounts Receivable open balances even when you are factoring invoices.