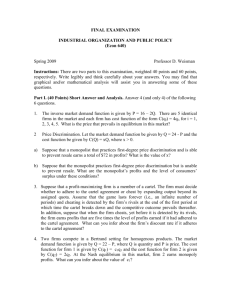

Industrial Combination

advertisement