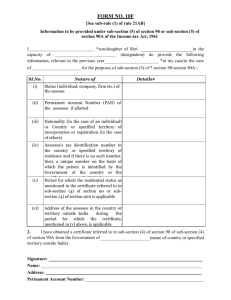

the finance bill, 2016

advertisement