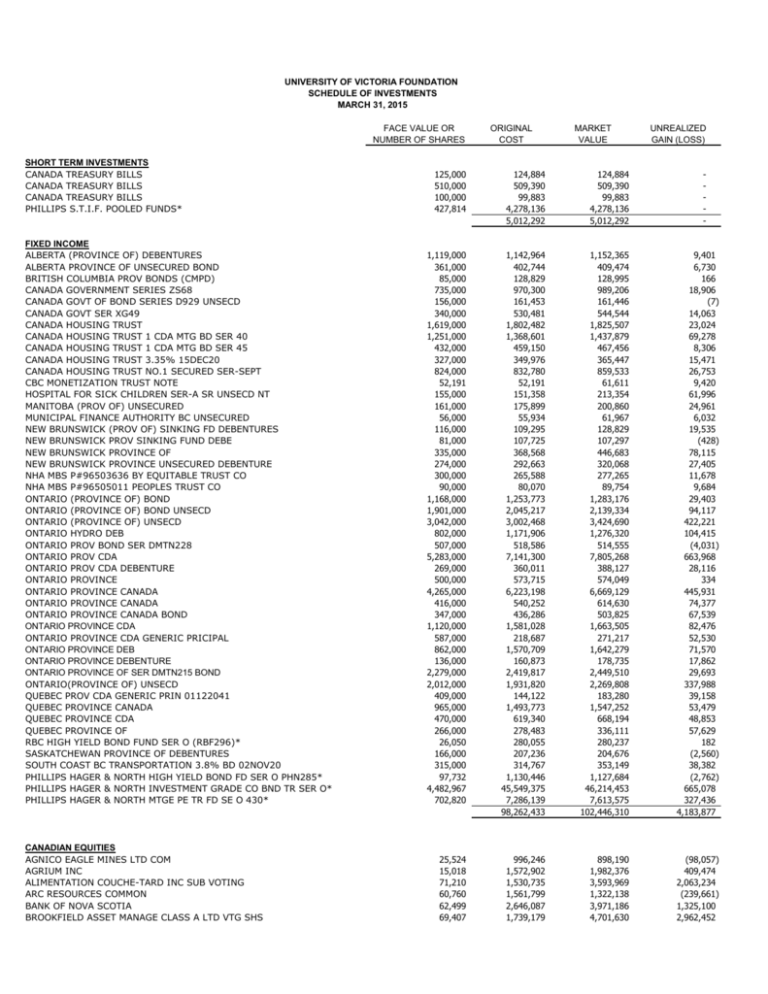

FACE VALUE OR ORIGINAL MARKET UNREALIZED NUMBER OF

advertisement

UNIVERSITY OF VICTORIA FOUNDATION SCHEDULE OF INVESTMENTS MARCH 31, 2015 FACE VALUE OR NUMBER OF SHARES SHORT TERM INVESTMENTS CANADA TREASURY BILLS CANADA TREASURY BILLS CANADA TREASURY BILLS PHILLIPS S.T.I.F. POOLED FUNDS* FIXED INCOME ALBERTA (PROVINCE OF) DEBENTURES ALBERTA PROVINCE OF UNSECURED BOND BRITISH COLUMBIA PROV BONDS (CMPD) CANADA GOVERNMENT SERIES ZS68 CANADA GOVT OF BOND SERIES D929 UNSECD CANADA GOVT SER XG49 CANADA HOUSING TRUST CANADA HOUSING TRUST 1 CDA MTG BD SER 40 CANADA HOUSING TRUST 1 CDA MTG BD SER 45 CANADA HOUSING TRUST 3.35% 15DEC20 CANADA HOUSING TRUST NO.1 SECURED SER-SEPT CBC MONETIZATION TRUST NOTE HOSPITAL FOR SICK CHILDREN SER-A SR UNSECD NT MANITOBA (PROV OF) UNSECURED MUNICIPAL FINANCE AUTHORITY BC UNSECURED NEW BRUNSWICK (PROV OF) SINKING FD DEBENTURES NEW BRUNSWICK PROV SINKING FUND DEBE NEW BRUNSWICK PROVINCE OF NEW BRUNSWICK PROVINCE UNSECURED DEBENTURE NHA MBS P#96503636 BY EQUITABLE TRUST CO NHA MBS P#96505011 PEOPLES TRUST CO ONTARIO (PROVINCE OF) BOND ONTARIO (PROVINCE OF) BOND UNSECD ONTARIO (PROVINCE OF) UNSECD ONTARIO HYDRO DEB ONTARIO PROV BOND SER DMTN228 ONTARIO PROV CDA ONTARIO PROV CDA DEBENTURE ONTARIO PROVINCE ONTARIO PROVINCE CANADA ONTARIO PROVINCE CANADA ONTARIO PROVINCE CANADA BOND ONTARIO PROVINCE CDA ONTARIO PROVINCE CDA GENERIC PRICIPAL ONTARIO PROVINCE DEB ONTARIO PROVINCE DEBENTURE ONTARIO PROVINCE OF SER DMTN215 BOND ONTARIO(PROVINCE OF) UNSECD QUEBEC PROV CDA GENERIC PRIN 01122041 QUEBEC PROVINCE CANADA QUEBEC PROVINCE CDA QUEBEC PROVINCE OF RBC HIGH YIELD BOND FUND SER O (RBF296)* SASKATCHEWAN PROVINCE OF DEBENTURES SOUTH COAST BC TRANSPORTATION 3.8% BD 02NOV20 PHILLIPS HAGER & NORTH HIGH YIELD BOND FD SER O PHN285* PHILLIPS HAGER & NORTH INVESTMENT GRADE CO BND TR SER O* PHILLIPS HAGER & NORTH MTGE PE TR FD SE O 430* CANADIAN EQUITIES AGNICO EAGLE MINES LTD COM AGRIUM INC ALIMENTATION COUCHE-TARD INC SUB VOTING ARC RESOURCES COMMON BANK OF NOVA SCOTIA BROOKFIELD ASSET MANAGE CLASS A LTD VTG SHS ORIGINAL COST MARKET VALUE UNREALIZED GAIN (LOSS) 125,000 510,000 100,000 427,814 124,884 509,390 99,883 4,278,136 5,012,292 124,884 509,390 99,883 4,278,136 5,012,292 - 1,119,000 361,000 85,000 735,000 156,000 340,000 1,619,000 1,251,000 432,000 327,000 824,000 52,191 155,000 161,000 56,000 116,000 81,000 335,000 274,000 300,000 90,000 1,168,000 1,901,000 3,042,000 802,000 507,000 5,283,000 269,000 500,000 4,265,000 416,000 347,000 1,120,000 587,000 862,000 136,000 2,279,000 2,012,000 409,000 965,000 470,000 266,000 26,050 166,000 315,000 97,732 4,482,967 702,820 1,142,964 402,744 128,829 970,300 161,453 530,481 1,802,482 1,368,601 459,150 349,976 832,780 52,191 151,358 175,899 55,934 109,295 107,725 368,568 292,663 265,588 80,070 1,253,773 2,045,217 3,002,468 1,171,906 518,586 7,141,300 360,011 573,715 6,223,198 540,252 436,286 1,581,028 218,687 1,570,709 160,873 2,419,817 1,931,820 144,122 1,493,773 619,340 278,483 280,055 207,236 314,767 1,130,446 45,549,375 7,286,139 98,262,433 1,152,365 409,474 128,995 989,206 161,446 544,544 1,825,507 1,437,879 467,456 365,447 859,533 61,611 213,354 200,860 61,967 128,829 107,297 446,683 320,068 277,265 89,754 1,283,176 2,139,334 3,424,690 1,276,320 514,555 7,805,268 388,127 574,049 6,669,129 614,630 503,825 1,663,505 271,217 1,642,279 178,735 2,449,510 2,269,808 183,280 1,547,252 668,194 336,111 280,237 204,676 353,149 1,127,684 46,214,453 7,613,575 102,446,310 9,401 6,730 166 18,906 (7) 14,063 23,024 69,278 8,306 15,471 26,753 9,420 61,996 24,961 6,032 19,535 (428) 78,115 27,405 11,678 9,684 29,403 94,117 422,221 104,415 (4,031) 663,968 28,116 334 445,931 74,377 67,539 82,476 52,530 71,570 17,862 29,693 337,988 39,158 53,479 48,853 57,629 182 (2,560) 38,382 (2,762) 665,078 327,436 4,183,877 25,524 15,018 71,210 60,760 62,499 69,407 996,246 1,572,902 1,530,735 1,561,799 2,646,087 1,739,179 898,190 1,982,376 3,593,969 1,322,138 3,971,186 4,701,630 (98,057) 409,474 2,063,234 (239,661) 1,325,100 2,962,452 UNIVERSITY OF VICTORIA FOUNDATION SCHEDULE OF INVESTMENTS MARCH 31, 2015 BROOKFIELD INFRASTRUCTURE PARTNERS LP BROOKFIELD PROPERTY PARTNERS LP UNIT CANADIAN ENERGY SERVICES & TECHNOLOGY CRP COM CANADIAN NATIONAL RAILWAY COMPANY COMMON CANADIAN PACIFIC RAILWAY LIMITED COMMON CATAMARAN CORPORATION COMMON CDN NATURAL RES LTD CGI GROUP INC CL A SUB VTG CINEPLEX INC COMMON DOLLARAMA INC COMMON ELEMENT FINANCIAL CORP COMMON FAIRFAX FINANCIAL HOLDING LTD SUB VTG FIERA CAPITAL PL INVESTMENT FD SML CAP FUND* FIRSTSERVICE CORPORATION SUB-VTG FRANCO NEVADA CORP COMMON GILDAN ACTIVEWEAR INC COMMON INTER PIPELINE FD CL A LP UNITS KEYERA CORP COMMON LUNDIN MINING CORP COMMON MAGNA INTERNATIONAL INC COMMON MANULIFE FINANCIAL CORPORATION COMMON METHANEX CORP OIL VENTURES NO.1 WELL NET ROYALTY CERTIFICATE ONEX CORP SUB VTG OPEN TEXT CORP COM PARAMOUNT RES LIMITED CL A COMMON ROYAL BANK OF CANADA SUNCOR ENERGY INC. TELUS CORPORATION COM TORONTO DOMINION BANK TOURMALINE OIL CORP COMMON TRANSFORCE INC COMMON NEW VERMILION ENERGY INC COMMON WEST FRASER TIMBER CO LTD GLOBAL EQUITIES ADOBE SYSTEMS INC COM USD0.0001 AIA GROUP LTD COM AMPHENOL CORP CL'A'COM USD0.001 AUTO DATA PROCESS BARD (CR) INC BG GROUP CHINA MOBILE HKD0.10 CHINA SHENHUA ENER 'H'CNY1 CISCO SYSTEMS COM CLP HOLDINGS HKD5 CNOOC LTD HKD0.02 COGNIZANT TECHNOLOGY SOLUTIONS CORP CL ACOMMON COLGATE-PALMOLIVE COM USD1 CSL NPV DBS GROUP HOLDINGS DENSO CORP EOG RESOURCES INC ESSILOR INTL. EUR0.35 FANUC LTD FASTENAL COM USD0.01 GILEAD SCIENCES SOM USD0.001 GOOGLE INC COM USD0.001 CLASS 'A' GOOGLE INC COM USD0.001 CLASS 'C' HENNES & MAURITZ HONDA MOTOR CO HONG KONG & CHINA GAS HKD0.25 INDITEX EUR0.15 INTUITIVE SURGICAL INC COM JOHNSON & JOHNSON KEYENCE CORP FACE VALUE OR NUMBER OF SHARES 26,494 66,130 175,271 47,349 8,841 28,762 78,681 45,347 31,530 29,019 155,408 1,234 53,977 4,681 39,777 47,945 52,453 13,232 129,407 31,366 210,457 19,668 1 21,502 29,140 41,828 88,169 76,566 58,942 122,244 40,552 71,395 30,199 42,170 ORIGINAL COST 1,083,041 1,658,588 1,505,620 1,163,484 2,078,072 1,434,919 3,490,238 1,676,529 1,149,504 821,128 1,922,638 808,149 4,794,864 314,846 2,047,344 2,847,830 1,293,385 652,300 689,450 935,065 3,699,614 1,368,845 1 920,309 1,855,829 2,505,318 3,971,965 2,494,986 2,260,932 4,033,611 1,288,546 1,951,004 1,457,792 1,794,015 72,016,706 MARKET VALUE 1,530,251 2,040,772 941,205 4,016,142 2,050,228 2,168,655 3,054,396 2,436,041 1,572,667 2,054,545 2,660,585 876,140 12,271,934 383,702 2,441,512 3,580,533 1,712,066 1,114,796 661,270 2,123,792 4,526,930 1,333,687 1 1,581,472 1,948,300 1,305,034 6,722,005 2,833,708 2,479,690 6,626,847 1,554,358 2,141,850 1,608,097 2,732,616 103,555,314 UNREALIZED GAIN (LOSS) 447,209 382,183 (564,415) 2,852,659 (27,844) 733,736 (435,841) 759,512 423,162 1,233,417 737,947 67,991 7,477,070 68,855 394,168 732,703 418,680 462,496 (28,180) 1,188,727 827,316 (35,157) 661,163 92,472 (1,200,285) 2,750,040 338,721 218,758 2,593,236 265,812 190,846 150,305 938,601 31,538,608 13,500 173,800 17,900 13,400 6,300 78,200 57,500 206,000 37,000 63,500 732,000 17,000 16,720 16,400 80,404 17,600 13,200 7,500 5,200 22,100 11,000 860 1,260 26,300 26,100 308,565 37,500 1,500 10,500 2,116 436,483 785,748 362,962 584,995 562,029 1,405,618 569,886 850,545 881,546 457,490 1,010,970 1,337,441 700,915 555,044 926,319 568,034 560,736 404,725 498,215 427,510 1,406,618 471,302 1 669,543 939,349 412,051 389,284 578,230 672,235 488,438 1,264,229 1,385,511 1,335,986 1,453,429 1,335,299 1,218,860 950,580 666,305 1,289,857 702,787 1,310,575 1,343,310 1,468,360 1,461,786 1,511,493 1,019,145 1,532,881 1,089,567 1,441,577 1,159,770 1,367,260 604,184 874,507 1,349,906 1,075,831 904,294 1,524,170 959,447 1,337,826 1,465,968 827,746 599,764 973,024 868,434 773,270 (186,758) 380,695 (184,241) 408,311 245,297 299,606 5,869 767,445 906,741 585,175 451,111 972,144 684,842 943,361 732,260 (39,358) 132,882 874,506 680,363 136,482 492,243 1,134,886 381,217 665,592 977,531 UNIVERSITY OF VICTORIA FOUNDATION SCHEDULE OF INVESTMENTS MARCH 31, 2015 KOMATSU Y50 L'OREAL EUR0.20 LVMH MOET HENNESSY EUR0.30 MASTERCARD INC COM USD0.0001 CLASS A MICROSOFT CORP COM USD0.0000125 NESTLE NIKE INC CLASS'B'COM NPV NOVO-NORDISK ORACLE CORP COM USD0.01 PRAXAIR INC COM USD0.01 PRECISION CASTPART COM NPV QUALCOMM INC COM USD0.0001 RECKITT BENCHKISER SCHLUMBERGER SGS SA CHF1(REGD) SHIN-ETSU CHEMICAL STANDARD CHARTERED ORD USD0.50 STRYKER CORP SUNCOR ENERGY INC. SWATCH GROUP CHF2.25 SYNGENTA CHF0.10(REGD) TJX COS INC COM USD1 W. W. GRAINGER INC WAL-MART STORES COM HEXAVEST WORLD EQUITY FUNDS* ALTERNATIVES PRIME CANADIAN PROPERTY FUND MACQUARIE EUROPEAN INFRASTRUCTURE FUNDS IV MACQUARIE INFRASTRUCTURE PARTNERS III * Indicates an investment in a pooled fund. For further information on pooled funds please contact the University Secretary's Office at usec2@uvic.ca or 250-721-8102. FACE VALUE OR NUMBER OF SHARES 36,300 5,750 3,100 12,300 27,300 15,400 10,800 24,600 25,600 8,300 5,000 16,000 12,200 12,900 455 15,800 59,429 11,900 25,000 1,000 3,400 15,200 2,400 13,200 61,113 ORIGINAL COST 871,142 521,923 668,377 331,823 725,423 572,325 332,187 315,637 576,079 899,683 568,449 916,277 577,525 870,789 629,711 923,704 1,506,952 1,090,193 931,586 588,512 1,206,681 469,009 645,734 691,493 72,911,486 110,256,960 MARKET VALUE 905,698 1,340,212 692,188 1,345,801 1,405,688 1,473,971 1,372,357 1,666,214 1,399,050 1,269,234 1,329,847 1,405,129 1,330,394 1,363,253 1,103,562 1,309,881 1,221,827 1,390,355 925,250 537,372 1,466,174 1,348,541 716,780 1,375,062 72,033,381 138,131,920 UNREALIZED GAIN (LOSS) 34,556 818,289 23,811 1,013,979 680,265 901,646 1,040,170 1,350,577 822,971 369,551 761,398 488,852 752,869 492,464 473,850 386,177 (285,125) 300,162 (6,336) (51,140) 259,492 879,532 71,046 683,569 (878,105) 27,874,960 4,580,309 6,504,004 3,910,972 31,003,393 8,837,963 4,884,804 44,726,161 35,493,776 7,437,328 4,884,804 47,815,909 4,490,383 (1,400,635) 3,089,748 330,274,551 396,961,744 66,687,193 330,274,551 396,961,744 - (0)