FORECASTING VOLATILTY OF ISTANBUL STOCK EXCHANGE

advertisement

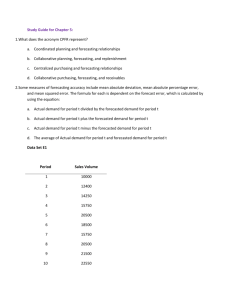

FORECASTING VOLATILTY OF ISTANBUL STOCK EXCHANGE Ahmet ASARKAYA Istanbul Bilgi University Istanbul, Turkey ahmet.asarkaya@student.bilgi.edu.tr Abstract This paper uses eight different models; random walk, historical mean, exponential smoothing, ARCH(1), GARCH(1,1), EGARCH(1,1), APARCH(1,1) and GJR-GARCH(1,1) to forecast weekly volatility of Istanbul Stock Exchange 100 Index between 2002 and 2008. Within-week standard deviation of countinously compounded daily return is used as the volatility measurement. Both symmetric and asymmetric loss functions are employed to measure the forecasting accuracy of the models. According to symmetric statistics error, exponential smoothing produces the best forecast. However, when under predictions are penalized more heavily ARCH-type models outperform any other models. On the other hand, non-ARCH models provide the best result when over predictions are penalized more heavily. Key Words: Stock market volatility, GARCH, forecasting JEL Classification: C22, C53, G15, G17 3. INTRODUCTION Forecasting stock market return volatility has great importance for both investors, traders as well as researchers, because predicting volatility might enable one to take risk-free decisions including portfolio selection and option pricing. Recent financial turbulance once again proved the importance of reasonable measurement of uncertainity in financial markets. This uncertainity is usually known as volatility which has crucial significance to financial decision makers as well as policy makers. Forecasting volatility has attracted the interest of many academicians, hence various models ranging from simplest models such as random walk to the more complex conditional heteroskedastic models of the GARCH family have been used to forecast volatility. GARCH was used to forecast volatility for the first time by Akgiray (1989). Over the years different variations of the GARCH model has been used to forecast volatility. These models include E-GARCH, GJR-GARCH, VSGARCH, QGARCH etc. Purpose of this paper is to evaluate out of sample forecasting accuracy of various models applied to Istanbul Stock Exchange, and to answer the question; Do GARCH-type models have superiority in forecasting volatility? Akgiray (1989) is the first one who uses GARCH model to forecast volatility and he shows that GARCH produces better forecast than most of the other forecasting methods such as Random Walk (RW), Historical Mean (HM), Moving Average (MA) and Exponential Smoothing (ES) when applied to monthly US stock market data. In addition, Cao and Tsay (1992) found that Threshold GARCH outperforms ARCH, GARCH, and Exponential GARCH on monthly US stock market data. On the other hand, Dimson and Marsh (1990) evaluate the forecasting accuracy of simple models such as Random Walk, Moving Average, Exponential Smoothing and Regression Models on UK stock market data and they conclude that Exponential Smoothing and Regression Models provide the best forecast. It is important to note that Dimson and Marsh (1990) did not include ARCH type models in their research. In the literature, other papers reach different conclusions from one another. For example, Tse (1991) shows the superiority of Exponentially Weighted Moving Average (EWMA) over ARCH-type models by using weekly Japanese data. In addition, Tse and Tung (1992) found the same result with the Singaporean data. Brailsford and Faff (1996) prefers GJR-GARCH(1,1) as the best model to forecast Australian stock market. Franses and Van Dijk (1996) use Random Walk, GARCH(1,1) and other non-linear GARCH models to forecast the volatility of thestock markets of Spain, Germany, Italy and Sweden and conlude that Quadratic GARCH (QGARCH) produces the best forecast. Balaban, Bayar and Faff (2002) investigate the forecasting performance of both ARCH-type models and non-ARCH models applied to 14 different countries. They include not only symmetric loss funtions but also asymmetric loss funtions to measure the out-of-sample accuracy of these various models. By using symmetric loss functions, they find that Exponential Smoothing is the best model to forecast weekly volatility and MA models provide the second best forecast. In addition, they observe that non-ARCH models usually produce better forecast than ARCH type models. Finally, Exponential GARCH is the best among ARCH-type models. On the other hand, when asymmetric loss functions are introduced which penalize over prediction or under predictions more heavily, results differ. When under-predictions are penalized more heavily, ARCH-type models produce the best forecast while Random Walk is the worst. However, Exponential Smoothing provides the best forecast when over predictions are penalized more heavily. Pan and Zhang (2006) use Moving Average, Historical Mean, Random Walk, GARCH, GJR-GARCH, EGARCH and APARCH to forecast volatility of two Chinese Stock Market indices; Shanghai and Shenzhen. They reach a number of several results. First, Moving Average model is preferred to forecast daily volatility for Shenzhen stock market. However, they could not reach a conclusion for Shangai stock market since different models are found to be the best under different evaluation criteria. Among GARCH models, GJR-GARCH and EGARCH outperforms other ARCH models for Shenzhen stock market. Magnus and Fosu (2007) employed Random Walk, GARCH(1,1), TGARCH(1,1) and EGARCH(1,1) to forecast Ghana Stock Exhange. GARCH(1,1) provides the best forecast according to three different criterias out of four. On the other hand, EGARCH and Random Walk produces the worst forecast. 4. DATA AND SAMPLE DESCRIPTION The data sample used in this research is the daily closing prices of Istanbul Stok Exchange 100 Index (ISE100) for the period between January 2002 and December 2008. The analysis presented on this exercise involves weekly volatility forecast. Daily return is calculated as follows: Ri log( index i / index i 1 ) where indexi is the closing price on ith day and Ri is the continously compounded return on ith day. Within-week standard deviation of weekly return is used as weekly realized volatility: n a ,t (R t 1 t t ) 2 n 1 Where µt is the mean return and n is the number of trading days excluding national holidays. There are 365 weekly volatility observations in our data sample. First 183 observations are used for estimation whereas the second 182 are used for forecasting. Descriptive statistics for within-week standard deviations of continuously compounded weekly returns in the full period, estimation period and forecasting period are shown in Table 1. Table 1: Summary Statistics: Within-Week Standard Devations Mean Median Maximum Minimum Standard Deviation Skewness Kurtosis Jarque-Bera Statistics Probability Observations Full Period Estimation Period Forecasting Period 0.0185 0.0159 0.0823 0.0028 0.0107 1.98 9.48 877.8 0.0000 365 0.0196 0.0173 0.0823 0.0028 0.0111 2.09 10.25 533.8 0.0000 183 0.0173 0.0149 0.0712 0.0031 0.0100 1.82 7.92 284.3 0.0000 182 There is evidence of positive skewness which means that the distribution has a long right tail in all periods, so deviations are non-symmetric. Since kurtosis is greater than 3 in all sub-samples, standard deviations of weekly returns are leptokurtic relative to the normal. According to Jarque-Bera statistic, we reject the null hypothesis of a normal distribution; hence we can say that the series is non-normal. Generally volatility has large differences between its maximum and minimum values. Standard deviation is also high which indicates that high volatility exists in Istanbul Stock Exchange. 1. FORECASTING TECHNIQUES 1.1 Random Walk Model Supporters of efficient market hypothesis say that stock market indices are random and any attempt to forecast these indices is fruitless. Under Random Walk Model, the best forecast of this week’s volatility is the last week’s realized volatility. f ,t a ,t 1 1.2 Historical Mean Model According to this model, the best forecast of volatility at time t is the average of all past realized volatilities. f ,t 1 t 1 a ,i t 1 i 1 1.3 Exponential Smoothing Model An exponential smoothing model gives some weight to the last week’s observed volatility and takes last week’s forecast into consideration when forecasting this week’s volatility. f ,t (1 ) a ,t 1 f ,t 1 The smoothing parameter, λ, should lie between 0 and 1. λ is calculated and it is equal to 0.17. 1.4 ARCH(1) Model Before the ARCH model introduced by Engle (1982), the most common way to forecast volatility was to determine volatility using a number of past observations under the assumption of homoscedasticity. However, variance is not constant. Hence, it was inefficient to give same weight to every observation considering that the recent observations are more important. ARCH model, on the other hand, assumes that variance is not constant and it estimates the weight parameters and it becomes easier to forecast variance by using the most suitable weights. Mean function of ARCH(1) is a simple first order auto regression: Rt c Rt 1 t and the conditional variance equation is as follows: t2 t21 1.5 GARCH(1,1) Model The GARCH model was developed by Bollerslev (1986) and Taylor (1986) independently. In GARCH(1,1) model, conditional variance depends on previous own lag. Mean equation of GARCH(1,1): Rt c Rt 1 t and the variance equation is: t2 t21 t21 Where ω is constant, is the ARCH term and is the GARCH term. As we can see, today’s volatility is a function of yesterday’s volatility and yesterday’s squared error. 1.6 The Exponential GARCH Model - EGARCH(1,1) Nelson’s (1991) EGARCH(1,1) model’s variance equation is as follows: log( t2 ) ( t 1 2 2 ) ( t 1 ) log( t 1 ) t 1 t 1 1.7 The Asymmetric Power ARCH Model – APARCH(1,1) Taylor (1986) and Schwert (1989) introduced the standard deviation GARCH model, where the standard deviation is modeled rather than the variance. It is a very changable ARCH model and the model is specified as follows: t ( t 1 t 1 ) t1 1.8 The GJR-GARCH Model – GJR-GARCH(1,1) This model is proposed by Glosten, Jagannathan and Runkle (1993). Conditional variance is given by; t2 t21 t21 t21I t 1 Where I t 1 1 t 1 0 if and I t 1 0 otherwise. 4. FORECASTING EVALUATION 4.1 Symmetric Loss Functions Root mean squared error (RMSE), mean absolute error (MAE), mean absolute percentage error (MAPE) and Theil inequality coefficient (TIC) are emloyed to measure the accuracy of the forecasting models. 365 RMSE ( t 184 f ,t ) 2 182 365 MAE a ,t t 184 a ,t f ,t 182 365 MAPE 100 184 a ,t f , t a ,t 182 365 ( a ,t f ,t ) 2 184 TIC 181 365 365 2 a ,t 184 182 2 f ,t 184 182 Where σa,t is the actual volatility and σf,t is the forecasted volatility. Table 2 gives the actual forecast error statistics for each model. Ranking of the models is also provided in the table (1 being the best forecast and 8 being the worst forecast). In the case of RMSE, Exponential GARCH provides the best volatility forecast where Historical Mean model produces the worst forecast by far. It is interesting to note that all error statistics except Historical Mean are so close to each other that no models has clear superiority over other models. If we look at MAE and MAPE, Exponential Smoothing Model clearly produces the best forecast, and it is followed by EGARCH. Historical Mean Model, once again, is the worst forecasting model. According to these two criterias, ARCH-type models provide better forecasting than non-ARCH models. The Theil Inequality Coefficient (TIC) is a scale invariant measure that always lies between zero and one, where zero indicates a perfect fit. Looking at this coefficient we can say that Random Walk is the best forecasting model. It is interesting to note that Exponential Smoothing is no longer the best model, on the contrary, it produces the worst forecasting according to TIC. It is not easy to make a judgement if ARCH models are better than non-ARCH models; however, if we calculate the mean of the ranks of ARCH models, we can see that this mean is smaller than non-ARCH models’ mean which indicates that ARCH models gives better forecasting results. 4.2 Asymmetric Loss Functions Commonly used loss functions such as MAPE, ME and RMSE are symmetric which means that they give the same weight to over and under predictions of volatility. However, for traders, investors and decision makers, it is sometimes important to know the direction of volatility. For example, under prediction of volatility is not good for a seller, whereas over prediction is not good for a buyer. In order to penalize under and over predictions the following Mean Mixed Error (MME) statistics are introduced: U 1 O MME (U ) a , t f , t a , t f , t 182 t 1 t 1 U 1 O MME (O) a , t f , t a , t f , t 182 t 1 t 1 Where U is the number of under predictions and O is the number of over predictions. MME(U) penalize the under predictions more heavily where MME(O) penalize the over predictions more heavily. In Table 3, forecast error statistics of each model and their rank are presented. Since we know that ARCH-type models are likely to overpredict, these models’ forecasting performance are better than non-ARCH models when their performance is assessed by MME(U). On the other hand, conventional methods outperform ARCH models according to MME(O). Exponential GARCH produces the best result among ARCH models regardless of MME(U) and MME(O). According to MME(U), there is not much difference between ARCH models; however, EGARCH is slightly better than the other models, and it is followed by GJR-GARCH. On the other hand, in the case of MME(O), EGARCH is the best model by far among ARCH family models. Asymmetric Power ARCH is the second best. 5. CONCLUSION Forecasting Volatility has attracted the interest of investors and researchers. Various models has been employed for volatility forecasting ranging from simplest models such as Random Walk and Historical Mean to more complex ARCH family models. Some argue that simpler models produces the best forecast, because it is not possible to construct a model to fully cover the dynamics of financial markets. On the other hands, some others stress the importance of ARCH-type models in forecasting. Researchs in the literature has several different findings. Some shows the superiority of ARCH models whereas others show that simple models are the best. In this study, we employed eight different models to forecast volatility; Random Walk model, Historical Mean model, Exponential Smoothing, ARCH(1), GARCH(1,1), EGARCH(1,1), APARCH(1,1) and GJR-GARCH(1,1). We used within-week standart deviation to measure the volatility. In order to measure the outof-sample forecasting accuracy of the models, we used both symmetric and asymmetric loss functions. Findings of this research can be summerized as follows; first, when we employ standard symmetric loss funtions to measure the accuracy of the models, we observe that Exponential Smoothing model provides the best forecast and Historical Mean model is the worst model in forecasting volatility. Among ARCH-type models, Exponential GARCH produces the best forecasting results. Overall, ARCH family models are better than non-ARCH models. Second, when asymetric loss functions are introduced to penalize under predictions, ARCH-type models’ performance is better than non-ARCH models’ performance. On the other hand, Conventional models produce better forecast when over predictions are penalized more heavily. EGARCH is the best forecasting model among ARCH models, and GJR-GARCH is the second best. 6. REFERENCES Akgiray, V. (1989) Conditional Heteroscedasticity in Time Series of Stock Returns: Evidence and Forecasts, Journal of Business, 62, 55-80. Balaban, E., Bayar, A. and R. Faff (2002) Forecasting Stock Market Volatility: Evidence From Fourteen Countries, University of Edinburgh Center For Financial Markets Research Working Paper, 2002.04. Bollerslev, T. (1986) Generalized Autoregressive Conditional Heteroscedasticity, Journal of Econometrics, 31, 307-327. Brailsford, T. J. and R. W. Faff (1996) An Evaluation of Volatility Forecasting Techniques, Journal of Banking and Finance, 20, 419-438. Cao, C.Q. and R.S. Tsay (1992) Nonlinear Time-Series Analysis of Stock Volatilities, Journal of Applied Econometrics, December, Supplement, 1S, 165-185. Dimson, E. and P. Marsh (1990) Volatility Forecasting Without Data-Snooping, Journal of Banking and Finance, 14, 399-421. Engle, R. F (1982) Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of U.K. Inflation, Econometrica, 50, 987-1008. Figlewski, S. (1994) Forecasting Volatility Using Historical Data, New York University Working Paper Series, FD-94-32. Franses, P. H. and D. V. Dijk (1996) Forecasting Stock Market Volatility Using (Non-Linear) Garch Models, Journal of Forecasting, Vol. 15, 229-235. Glosten, L., R. Jagannathan and D. E. Runkle (1993) On the Relation Between the Expected Value and the Volatility of the Nominal Excess Return on Stocks, Journal of Finance, 48, 1779-1801. Magnus, F. J. and O. A. E. Fosu (2006) Modelling and Forecasting Volatility of Returns on the Ghana Stock Exchange Using GARCH Models, MPRA Paper, No.593. Nelson, D. B. (1991) Conditional Heteroscedasticity in Asset Returns: A New Approach, Econometrica, 59, 347-370. Pagan, A. R. and G. W. Schwert (1990) Alternative Models for Conditional Stock Volatility, Journal of Econometrics, 45, 267-290. Pan, H. and Z. Zhang (2006) Forecasting Financial Volatility: Evidence From Chinese Stock Market, Durham Business School Working Paper Series, 2006.02. Poon, S.H. and C. Granger, (2003) Forecasting Volatility in Financial Markets: A Review, Journal of Economic Literature, XLI, 478-539. Taylor, S. J. (1987) Forecasting the Volatility of Currency Exchange Rates, Internatioal Journal of Forecasting, 3, 159-170. Tse, Y. K. (1991) Stock Returns Volatility in the Tokyo Stock Exchange, Japan and The World Economy, 3, 285-298. Tse, S. H. and K. S. Tung (1992) Forecasting Volatility in the Singapore Stock Market, Asia Pacific Journal of Management, 9, 1-13. APPENDIX Table 2: RMSE, MAE, MAPE and TIC of Forecasting Weekly Volatility RW HM ES ARCH (1) GARCH (1,1) EGARCH (1,1) APARCH (1,1) GJR-GARCH (1,1) RMSE Rank MAE Rank MAPE Rank TIC Rank 0.0102 0.0121 0.0101 0.0102 0.0101 0.0100 0.0101 0.0101 7 8 5 6 3 1 2 4 0.0081 0.0097 0.0068 0.0079 0.0077 0.0072 0.0077 0.0076 7 8 1 6 5 2 4 3 64.68 93.64 46.58 63.19 59.88 51.41 59.85 58.43 7 8 1 6 5 2 4 3 0.2588 0.2686 0.2867 0.2595 0.2614 0.2719 0.2614 0.2608 1 6 8 2 4 7 5 3 Table 3: Mean Mixed Error (MME) Statistics of Forecasting Weekly Volatility RW HM ES ARCH (1) GARCH (1,1) EGARCH (1,1) APARCH (1,1) GJR-GARCH (1,1) MME(U) Rank MME(O) Rank Underestimation (%) Overestimation (%) 0.0195 0.0165 0.0201 0.0121 0.0119 0.0084 0.0105 0.0095 7 6 8 5 4 1 3 2 0.0249 0.0346 0.0186 0.1952 0.1454 0.0904 0.1193 0.1812 2 3 1 8 6 4 5 7 54.3 73.1 41.9 1.4 2.7 3.1 1.1 0.9 45.7 26.9 58.1 98.6 97.3 96.9 98.9 99.1 Figure 1: Istanbul Stock Exchange National100 Index 70000 60000 50000 40000 30000 20000 10000 0 Jan-02 Nov-02 Sep-03 Jul-04 May-05 Mar-06 Jan-07 Nov-07 Sep-08 Figure 2: Istanbul Stock Exchange National100 Index Daily Return (%) 15 10 5 0 -5 -10 -15 Jan-02 Nov-02 Sep-03 Jul-04 May-05 Mar-06 Jan-07 Nov-07 Oct-08

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)