the police station when

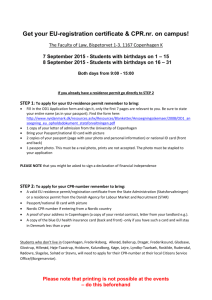

advertisement

When new in Bergen/Norway Bergen police station: The first you do soon after settled down in Bergen (for some of you within 7 days), is to go down town and look up Bergen Police Station (Bergen Sentrum Politistasjon) to register and apply for residence permit or/and work permit. Bergen Sentrum Politistasjon Allehelgens g 6 Opening hours: Monday – Wednesday – Friday From 9am till 1pm. Tuesday – Thursday: Closed. But you can phone them if you have any questions. Alien police: Direct phone number: (+47) 55 55 67 75 The sooner you go the better. You must have the right stamps in your passport accomplished by the police to get a Norwegian identity number (D-number) and a tax card. If you come from an *EU/EEA/EFTA country and have before arrival obtained a residence permit or from every other countries likewise have obtained a residence and work permit, you can go directly to the National Population Registry/Tax Assessment office. *Nationals from EU/EEA/EFTA without a residence permit, can also go directly to the National Population Registry. Though within 3 months from your arrival you have to apply for a residence permit anyway. Go the police station when: You have been granted a visa to Norway and needs a work permit: Application form for a first-time residence permit and work permit with passport photo (attachment no1.) Photo requirements: Taken from the front against a light background. When filling in your address in Norway: If you have a flat in one of the student hostels, please remember to write down your room number. If not; letters (from the police) will never reach you. You are a skilled worker/specialist. What do you have to enclose with your application? Copy of your passport. (It’s the best to have a passport with an expiry date at least two months longer than the end of your employment. It can be rather expensive and take a lot of time to renew it when in Norway). A filled-in Offer of employment form and a Contract of employment providing the same information as the Offer of employment form. Documentation of education/training/work experience translated into English or Norwegian In addition: The more documentation you bring with the better. So if you have the Offer of admission and employment (received when offered the research scholar position together with the Contract); bring it with you! If you lack any of the documents issued by the school or documentation of education et cetera, please contact Heine Skaar Nilsen in Personnel office. Phone numbers: 59390 / (+47) 959 35 868. What happens: Outside the police station it’s sign telling you to enter (publikumsinngang). Within it’s a system where you have to pull a queue number and wait (sometimes for hours). When your number turns up, you come forward to the window for registration and then queuing up again (keeping the same queue number) waiting for to be let in to an office. When inside the office, an executive officer checks that the application form is correctly filled in. It takes some time to get the work permit. So it’s essential that you remember to ask for a temporary work permit!! To get the permission to submit your application, you must pay a fee of NOK 1 100 before you leave the police station. If you have been granted residence and work permit before arriving Bergen: You can drop the visit to Bergen police station and go directly to the National Population Registry/Tax assessment office. Go to the police station when: You are from EU/EEA/EFTA countries and needs a residence permit. Application form for a first-time residence permit with passport photo (attachment no 2.) Photo requirements: Taken from the front against a light background. When filling in your address in Norway: If you have a flat in one of the student hostels, please remember to write down your room number. If not; letters (from the police) will never reach you. What do you have to enclose with your application? A filled-in Offer of employment or Contract of employment showing the scope and duration of the work. Copy of your passport or approved identity card. If you already are working, it is a good idea to enclose copies of your payslips to ensure that there is no doubt about the scope of the work. The cooperation between the EU and Norway is covered by the European Economic Area Agreement (EEA-Agreement). The EEA comprises 25 EU countries (Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden, United Kingdom, Malta, Cyprus, Poland, the Czech Republic, Hungary, Estonia, Latvia, Lithuania, Slovakia and Slovenia) and three EFTA countries (Iceland, Liechtenstein, and Norway). The principle of free movement of persons includes all nationals from the EEA states. They have approximately the same rights as Norwegian nationals regarding employment, remuneration and other conditions of work and employment. All *EEA nationals must apply for a residence permit to reside in Norway within 3 months. A residence permit will grant the holder leave to work, thus the term “work permit” will, in practice, become redundant. *Norway has introduced transitional rules for employees from eight of the ten new EU states – Poland, the Czech Republic, Hungary, Estonia, Latvia, Lithuania, Slovakia, and Slovenia. These applicants are not permitted to start to work before a residence permit has been granted. You have been granted residence permit before arriving Bergen: You can drop the visit to Bergen police station and go directly to the National Population Registry/Tax assessment office. Bergen Tax Assessment Office/National Population Registry: Second you do after you have got the residence and work permit stamped in your passport is to apply for a D-number and a tax card. Bergen likningskontor/Folkeregisteret (starting from Bergen police station) Valkendorfs g 6 (Reception: 1 floor) It’s the same reception both for applying for a D-number (attachment no 3) and a tax card (attachment no 4). D-number: You must have a D-number for establishing your identity in Norway. Without you can not get paid or open a bank account et cetera. Taxes in Norway: In Norway income tax and wealth tax are direct taxes. Income tax is paid directly as a percentage of income, whereas wealth tax is a tax on things you own, such as a house, bank deposits et cetera. Taxes are paid both to the state and the local municipality. In addition, a premium is paid to the social security system to finance public hospitals, medical treatment and various social benefits. Tax card As your employer we are obliged to deduct tax from you wages before you are paid. The tax card states what percentage of your income your employer must deduct in tax. If you start work without a tax card, your employer is obliged to deduce 50 % tax. This is of course more than would be deducted from you wages if you had a tax card, but if you have paid too much tax, you will receive a refund in the spring or autumn of the following year when the tax assessments are completed. Tax return. Tax return is an overall summary of your financial position. It includes a simple tax calculation which states how much you have earned over course of a year. You will receive your tax return of the previous year from the Tax Assessment Office each spring. You must then check that the information it contains is correct, and send it back to the Tax Assessment Office. In addition to the tax deductions all taxpayers get in Norway, you have as a foreigner standard deduction of 10%. In September you will receive more information about the Norwegian tax regulations. Health service for immigrants (tuberculosis test) Most people who are going to live in Norway for more than three months must be tested for tuberculosis. Usually you will receive a referral form for this at the same time as you register at the police station. Helsetjenesten for nyankomne innvandrere (Phone number (+47) 55 56 58 80) C. Sundtsgt. 51(starting from the Tax Assessment office) Social Insurance. Norway has implemented a universal, public health service financed by taxation, and a national insurance scheme, applicable to all citizens and residents, that provides a number of social benefits. Everyone who is legally resident in Norway, and who lives in Norway or who will live in the country for more than 1 year, is a member of the Norwegian National Insurance Scheme. If you fulfil these requirements, your membership is calculated from your first day in Norway. Membership of the National Insurance Scheme entitles you to benefits such as health care, financial benefits at various stages of your life, the right to a pension and several other rights. National insurance contributions are deducted from your salary. The Norwegian National Insurance Scheme covers hospital treatment in cases of illness that requires hospitalisation. It does not cover expenses incurred by ordinary doctor or dentist check-ups, routine appointments or vaccinations. When you undergo a health check or receive medical treatment, you are obliged to pay a moderate “user fee”. In September you will receive more information about social insurance system. Learning Norwegian. We want very much to invite you to attend the Norwegian language classes that take place at school this autumn. More information you can get from Inger-Marie Milde; phone number 59502 or visit the Department of Professional and Intercultural Communication. Norwegian news in English: http://www.aftenposten.no/english/ http://www.norwaypost.no/ News in Norwegian – local papers: http://www.bt.no/ http://www.ba.no/