4 Empirical Analysis

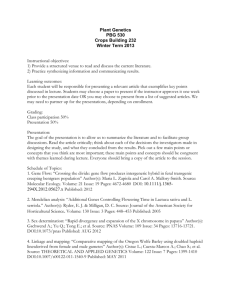

advertisement