Pay a Visiting Speaker an honorarium in US Funds

advertisement

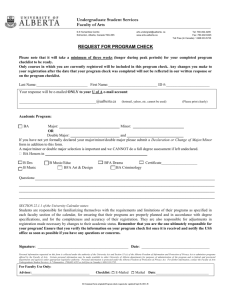

Pay a Visiting Speaker an Honorarium and Travel Expenses in US or Foreign Funds (Cheque or Wire Transfer) What you will need: 1. Visiting Speaker Honorarium Payment Form (US Funds) OR Visiting Speaker Honorarium Payment Form (Foreign Currencies) (available in the forms cabinet at www.hrs.ualberta.ca/Forms) 2. Non-Employee Travel Expense Payment Form (available in the Financial Services forms cabinet at www.financial.ualberta.ca/FormsCabinet) 3. Wire Transfer Payment Request form (if wire payment is required) (available in the Financial Services forms cabinet at www.financial.ualberta.ca/FormsCabinet) 4. US Exchange Rate – see the Financial Services website – Quick Links. Submit all completed forms together to Payroll Operations, Human Resource Services Form Completion - required for the correct processing of this form. Department Name and ID Personal Information - information is required for T4A/T4A-NR preparation. Person ID Number: Provide this number if the Visiting Speaker has been assigned one during a previous engagement with the U of A. Leave blank if a Person ID number has not been previously assigned. Social Insurance Number (SIN): If the individual has a SIN number it must be provided for T4A purposes. Do not include the Social Security Number of Visiting Speakers from the United States. Correspondence Address Date of Birth: Required for the correct assignment of the Person ID. Immigration Status: Check the appropriate box. If the speaker is not a Canadian Citizen, indicate their country of citizenship. Payment/Account Information Speed Code Account Number is 500046 Start Date and End Date of the individual’s engagement at the U of A. Fund Source (Research or Operating). Payroll Operations, Human Resource Services Oct 2013 Tax Code - Choose the appropriate income tax description: Non-Resident – US Citizen or Resident of the US (15%) (525-T4A NR Tax) Non-Resident – Foreign Citizen or Resident of a Foreign Country (15% tax) (525 – T4A NR Tax) Non-Resident with CCRA Exemption (tax waiver letter must be attached) (520 – T4A NR No Tax) Payment to be made in US Funds/Foreign Funds: 1. Honorarium Amount: Canadian Equivalent Enter the Canadian dollar amount. 2. Tax Codes: Subtract Canadian Income Tax Non–Resident - US Citizen/Resident (15% tax) Non-Resident – Foreign Citizen/Resident (15% tax) 3. Net Canadian Honorarium Amount: This Net Canadian Honorarium amount will have to be converted to US funds. 4. US Exchange Rate: see the Financial Services website – Quick Links for the correct US exchange rate. US Exchange Rate = Sell Rate 5. Amount of Payment in US Funds: Calculate the amount to be paid using the US Exchange Rate OR Indicate currency: euros, pounds, pesos etc. The foreign currency exchange rate will be determined by Financial Services at the time of the wire transfer. 6. Click: Cheque (for US Funds) OR Wire Transfer (for Foreign Currency) Please Note: Departments will be charged a wire transfer fee. Authorization and Approval: Provide date, printed names, phone numbers and authorizing signatures. For more information on the Signing Authority and Approval policy, refer to the Guide to Financial Management on the Financial Services website www.financial.ualberta.ca Comments: Provide any information relevant to this payment Note: Cheques will be mailed directly to the visiting speaker at the address indicated on the Non-Employee Travel Expense Payment form. Payroll Operations, Human Resource Services Oct 2013 Non-Employee Travel Expense Payment Form: (available in the Financial Services forms cabinet at www.financial.ualberta.ca/FormsCabinet) Complete the following and attach all receipts: 1. Currency: Select USD box or Foreign box and specify currency of payment Note: Currency of Honorarium travel expenses must be the same 2. Claimant Name: Full name of visitor 3. Address: Cheque will be mailed directly to this address 4. Business Purpose: Select most appropriate purpose from the drop down list Enter Dates of Travel and if expenses are paid using research funds include project ID, claimant’s affiliation and supporting details 5. Enter the Speed Code 6. Expense Type: select most appropriate from the drop down list 7. Total Receipted Amount: Consolidate receipts by expense type, convert to currency of payment and enter one total amount per expense type per speed code 8. Approval Signatures Payroll Operations, Human Resource Services Oct 2013 Wire Transfer Payment Request Form: (available in the Financial Services forms cabinet at www.financial.ualberta.ca/FormsCabinet) Payroll Operations, Human Resource Services Oct 2013