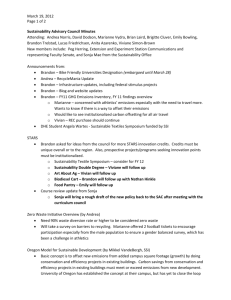

Part I - The Framemakers

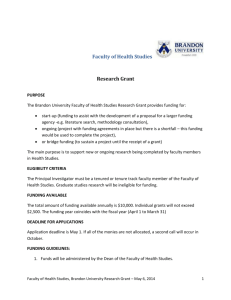

advertisement

THE FRAMEMAKERS 1. What aspects of Robert and Teresa Norman’s background would contribute to success if they decide to go ahead with the picture-framing store? The Norman’s have several things going for them if their decision is to proceed with the new business. a. Robert has had business and interior design college training – both aspects should be helpful in managing the new business. b. Both Robert and Teresa enjoy working with people and have had considerable retail experience. The new business will undoubtedly involve this type of customer contact. c. The Normans have some background in the picture framing business having done it on the side for the some time. d. Robert is independent. He does not enjoy working for others. e. Teresa is interested in and is very fond of framing. f. The business may have more growth opportunities than the painting business which to some extent is limited being a service business because of the expertise of the owner. g. The proposed business is something both Robert and Teresa enjoy. 2. What positive things have Robert and Teresa done in investigating the feasibility of the new store and what additional information might they have collected? From what sources could this information be obtained? The Normans have done several positive things in their investigation: a. They have talked to a manager of a framing shop and has learned valuable information about the operations. b. They have learned about industry growth and have made contacts with the industry association, suppliers and other dealers. c. They have subscribed for the trade magazines which are relevant to the proposed business. d. They have prepared a preliminary evaluation of saturation of this type of business in the City of Brandon and a per customer profit analysis. One of the first things Robert should be doing at this point is to evaluate the new opportunity relative to his goals, capabilities, and experience. He should also collect more information in order that he can prepare a financial feasibility study for the proposed business. For example: Market Potential: a. He did not clearly define his market area. Was it just the City of Brandon or a surrounding area as well? What is the population of this area? This information is likely available form the City of Brandon or the Brandon Chamber of Commerce. b. He has no idea of sales revenues in the market area for this type of business. He may be able to obtain this information from provincial or municipal government sources. If this is not available, per capita expenditures from Federal Government data may be helpful. The $32.00 spent per customer is helpful but Robert needs to get some idea of number of customers that he can expect. Another weakness of the secondary data is that it is for the "typical" store. Robert needs to obtain some information about "his" store in Brandon. He may solve this problem and lack of availability of secondary data by doing a consumer survey for his market to assess level of demand for the store. c. Some adjustments to the secondary data may be required. These would involve such things as updating the data, and allowing for in-shopping from the outlying regions around Brandon. The result of estimating market potential should be a dollar revenue based on number of customers multiplied by the amount spent per customer. Market Share: Robert should then calculate a potential market share by multiplying his store's share of retail-service capacity by the market potential. This capacity probably could be measured in square footing devoted to framing in the city. He should also make some adjustments to this amount by assessing consumer satisfaction with the existing store in Brandon (which could be obtained from the survey), and by assessing the competitive strengths and weaknesses his store might have. The above information could provide an estimated sales revenue amount Robert and Teresa could expect for the first year. Projected Income Statement: Using the figure obtained from the market share calculation combined with the expense figures already obtained, Robert should be able to construct a projected income statement. He may be well advised to verify the material and overhead expense figures of his business for the Brandon area. As part of the financial feasibility he should also calculate start-up costs. Robert and Teresa also probably moved too quickly in closing down the painting business. They should have at least waited until they had collected some of this data. 3. From the information provided, evaluate the business plan they have prepared from their new business. Robert has covered some of the key aspects of a business plan such as target market, financial requirements, location, personnel, layout and regulations. However, he has left some critical points out of the plan. Objectives: Robert's only objective is to own a "big" business "someday." He should try to quantify this goal and others if possible and set a time limit. Sales and profit targets for the first year would be a good place to start. Market Approach: Although he has defined his target customer he hasn't obtained information about its size, characteristics and needs. He also needs to do more work on firming up his plans for his marketing mix (i.e., product, pricing, location and promotion) in response to the target market's needs. Robert may be overlooking some important environmental influences such as the (potential) competition in Brandon, and the economy's influence on the business. More data could be obtained on the trend to do-it-yourself picture framing as well as any legislation that might affect the business. Financial: It doesn't appear Robert has done a very thorough job of estimating the financial requirements for the business. This was discussed in Framemakers part II. He has taken much of his data from the store in Winnipeg. A part of his business plan should include the type of financial record keeping he will employ as well as operating standards which can be evaluated. Personnel: Even if he and Teresa do not plan to hire anyone at present, they should set down a division of responsibilities between themselves and begin developing plans for the recruitment and management of other employees as the business grows. Physical Facilities: Robert again appears to be approaching this aspect of planning in a haphazard way. Estimates should be obtained and evaluated before purchases are made. The location decision appears also to have been made without much evaluation although there was recognition of the need for a high traffic location. Regulations: Robert knows he must obtain a business license. There are several other potential regulations which should be investigated however. Does he need a provincial license as well as one from the city? Are there any zoning regulations which preclude the Framemakers type of business in certain locations? What taxes apply to the business? Would incorporation reduce some of the risk in starting the business? Robert would be well advised to consult a lawyer in seeking answers to these questions. 4. Weigh the relevant pros and cons for the Normans of operating a U-Frame-It franchise instead of starting their business from scratch. The relevant pros and cons to franchise for the Normans are: Pros - They have little experience in the industry. A franchise would provide considerable training to overcome this deficiency which could be especially valuable during start-up. They would have some instant recognition of the name to help with market demand. This may help them in planning and obtaining needed financing. The franchiser may provide additional services such as location selection (a very important aspect in this situation), interior layout, training, advertising, possible financing and would undoubtedly speed up the establishment time. The "U Frame It" franchise is looking at expanding to Brandon even if the Normans do not sign on with them. This will be additional competition. - - - Cons - 5. The $20,000 franchise fee would be particularly burdensome for the Normans. Robert appears to be very independent and would no doubt resent franchiser monitoring and restrictions over their operations. It is unclear without further research what increase in sales would come from affiliation with the franchise. There is potential for non-delivery of franchiser obligations in terms of training, advertising, discounts, etc. Evaluate the Norman’s initial approach to obtaining financing for The Framemakers. Robert and Teresa were due to run into difficulties obtaining financing because of their lack of investigation. Some of the things they could have done to alleviate the problem are as follows: - Give some thought to the proportion of debt versus equity they would employ. Perhaps they might have obtained equity financing from family or prospective partners. - Much more care should have been taken in obtaining estimates of financial requirements. This information should have been tailored to Framemakers in Brandon rather than a "typical" store in Winnipeg. This would have involved utilizing both secondary and primary sources such as checking with government agencies and suppliers of necessary inventory and equipment. - The Normans might have investigated the possibility of obtaining financing from government sources. It appears that they were aware of this source. - The investigation of financial requirements should have taken place well in advance of the need for funding. This would have resulted in much less stress on the Normans as the store opening approached. - each item of start-up and operating costs should be sourced if possible with some backup for "estimates." 6. Assuming you are the banker, evaluate the financial requirements and projections Robert and Teresa prepared. From the information provided in the case, we can see that Robert underestimated several items. In general, a verified source for each item on both statements should have been provided. Once again Robert appears to have been following the P.P.F.A. averages rather than obtaining information specific to Brandon. The P.P.F.A. averages also reflect results of businesses currently operating - not one just starting up. Based on the format, it is easy to see why the banker required the Normans to rework their statements several times. Some of the specific weaknesses of the proposal, some of which were mentioned, are: Proposal Requirements Inventory - 4000 appears low - should have used amounts from existing stores Equipment & Fixtures - low - should have obtained specific quotes First Month's Rent - should have verified amount from landlord Utilities & Phone deposit - should have verified amount from utility and phone company. Supplies - did not estimate an amount for supplies Contingency - should have budgeted an amount for contingencies First Year Projection Revenue - 76,800 - should have made this estimate by looking at more than P.P.F.A. averages i.e. - Winnipeg stores, adjust for Brandon and its competitive situation, surprising that Framemakers was new and would take some time to build up a clientele. Expenses - 57,600 - these should have been itemized and verified rather than rely on P.P.F.A. estimates only i.e. cost of goods sold, salaries, supplies, promotion, rent, utilities, interest, phone, repairs, and depreciation. Each of these expenses could have been different for framemakers than for the average framing shop.