Project

advertisement

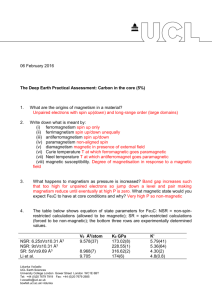

Designing a Co-Development Contract in the Pharmaceutical Industry © 2004 by Nicos Savva & Stefan Scholtes (Cambridge) DESIGNING A CO-DEVELOPMENT CONTRACT IN THE PHARMACEUTICAL INDUSTRY NSR, an established biotech firm, has a few candidate drugs in the pipeline. The company does not have the cash reserves or the expertise required to develop the drugs alone all the way through to launch. Furthermore it is a strategic goal of NSR to become a Biopharmaceutical firm by creating a sales and marketing division. NSR has recently sold a candidate drug, Hymax, for a substantial upfront fee with a buyback option to an established BioPharmaceutical firm and is now negotiating a bigger deal with the Biopharma for codevelopment of drugs for particular target diseases. The initial thinking is that NSR and the BioPharma will contribute 50/50 to the expenses of the drug development and share the revenues and costs 50/50 if the project is successful. Any technical or financial decisions are taken jointly. Furthermore NSR will have the opportunity to gain experience in selling and marketing a drug, whilst the BioPharma will gain access to new technology. NSR wants to understand the effect of the contract on a typical drug candidate. To this end, it uses a new drug candidate called Curex as benchmark. The new drug appears promising but it needs to go through a series of long, expensive and risky clinical trials to get FDA approval. It is expected that the whole testing process will take 6 years. Projections for costs, revenues and success probabilities for the three main stages of the testing are given in the table below. Revenue projections Phase I (years 1-2) Phase II (years 3-4) Launch (years 5-6) $900 M Cost projections $20 M $100 M $650 M Success probability 70% 50% All costs and revenues are discounted to today at the company’s standard project discount rate. Traditional Valuation In a first attempt to value the co-development project, the CFO calculates the risk-adjusted NPV (r-NPV) at the company’s standard discount rate. The risk-adjusted NPV is obtained by multiplying discounted future cash flows with the chance of their occurrence. This results in -$20 M-$100*70%+($900M - $650M)*70%*50% = -$2.5M. Therefore if NSR owns 50% of the drug the r-NPV value for NSR is -$1,25M. Real Option Valuation The CFO knows that the risk-adjusted NPV, whilst taking the technical risk of test failure into account, does not take account of the market risk. Indeed, whilst the cost estimates for the testing of the drug are fairly reliable, there is considerable uncertainty about the revenue estimate, which is likely to change over the 6 years until the launch as the company learns more about the potential of the drug and the size of its market. The financial markets follow the evolution of the drug quite closely and when phase results are publicised industry analysts will update and publicise their revenue projections. Traditionally, an increased risk is accounted for through an increased discount rate in discounted cash flow analyses, reducing the value even further. The CFO knows that this approach misses the point in the case of phased projects, where the company can opt out of further development if the market does not develop as expected, thus cutting costs in downside scenarios while maintaining high profits in upside scenarios. He decides to build a scenario tree model, based on historical analyst data, which shows that in about 35% of the cases revenue projections are indeed changed quite significantly when a phase is finished. The result is positive in about 15% of cases, which leads to an average increase of the projection by 33%; significant negative results are reported in 20% of cases and lead to an average reduction of the revenue estimation to 75% of it’s pre-phase value. In the remaining cases the projections remain largely unchanged. Open the spreadsheet ROCase.xls. In the first worksheet Drug Value you will find the data given above and a scenario tree for the phase-to-phase evolution of the revenue value in the yellow cells. The value can move to a neighbouring cell upwards, horizontally with no change, or downwards. Notice that an upwards move Designing a Co-Development Contract in the Pharmaceutical Industry © 2004 by Nicos Savva & Stefan Scholtes (Cambridge) followed by a downwards move or a downwards move followed by an upwards move brings the value back to its original value since 1.33*0.75=4/3*3/4=1. The blue scenario tree contains the corresponding risk-adjusted NPV values, taking into account the option to abandon the project after a phase if the revenue estimates are too low. The corresponding real options value of the drug is about $10M. Therefore the co development project has a value of $5M. The evaluation of an Opt-out option In a managerial meeting, another possibility was discussed: Co-develop the Drug 50/50 as described above, but NSR will retain the Option to Opt-out of co-development after the first phase is successfully completed. Should NSR exercise this option, the ownership of the project is transferred to the BioPharma. If the drug passes the second phase successfully, then NSR receives a fixed amount of money (milestone payment) and if the drug is launched, NSR receives a percentage of the revenues (royalties). This is an Opt-out option as NSR has the right but not the obligation to Opt-out of co-development and receive Royalties and Milestones (R&M). A) It was suggested that NSR should ask for 3% Royalties and $3M milestones. How much would the project be worth to NSR in such a case? The CFO is interested in cash because he has many other projects in the company that are waiting to be financed. He therefore asks to investigate how much they should ask in Royalties if they wanted to have a Milestones payment of $10M but not change the overall value of the deal by too much. Can you help him decide? (See worksheet Co-development) The VP for Strategy made the following comments: NSR’s main reason for going into the co-development project besides sharing risk, is the opportunity to learn from the BioPharma how to take a drug from scientific research to the market. He firmly believes that NSR should specialise in marketing and selling small/mediocre drugs rather than blockbusters1, which are very expensive to market and are the domain of big pharma. Therefore he believes that the learning from co-development will be more substantial and more valuable to NSR if the drug has value less than $1000M and is not a blockbuster. He therefore thinks that the terms of the Opt-out option should be such that it is optimal to Opt-out of co-development only if the drug is a blockbuster. This will be in the interest of the BioPharma as well because they are predominantly interested in marketing blockbuster drugs. How much should the Royalties and Milestones be for that to happen without changing the value of the deal by too much? Discuss what happens as the royalties increase. The figure ‘Contract value for Biotech’ should be very helpful in this discussion. What is the effect of changing the milestones received? Your discussion should include an intuitive explanation of the notion of ‘level of knowledge’ used in the model. Hint: You don’t need to change any formulas in the Excel Spreadsheet to be able to answer the above. B) BioPharma comes back with a counter offer: They accept to give NSR the option to opt out after phase one and they accept to pay $3M in milestones but instead of a flat 3% royalty rate they offer to pay 4% if the drug is a blockbuster, 3% if the drug is mediocre and only 1% if the drug is a ‘poor seller’. How much is this deal worth to NSR? Can you come up with a counter proposal with variable royalty rates that would make Opt-out optimal only when the drug is a blockbuster as the VP for Strategy suggested? Hint: Now you need to change the formulas in a few cells to allow for variable royalty rates. C) Now simulate the revenue estimation process in a spreadsheet. Use the exercise policy (decision rules) you came up with in part A for the Co-development deal and the Opt-out Option (Royalties 3% Milestones $3M) to simulate the value of these two options2. Draw a common graph of both value-at-risk charts (or a single graph if you have only managed to simulate the more straight-forward co-development deal) and give intuitive explanations of its shape. 1 A drug is a blockbuster if it creates revenues of more than $1000M. It is mediocre if it has sales between $8001000M and poor if the revenue falls below $800M. 2 This is quite a challenging modelling exercise for the Opt-out option. So don’t be discouraged if you have difficulties with this.