Can an employer lay staff off if they are in financial difficulty

advertisement

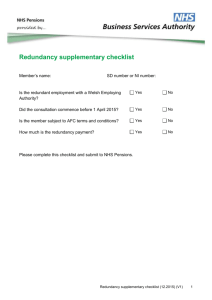

FREQUENTLY ASKED QUESTIONS ABOUT REDUNDANCY Is the non-renewal of fixed term employees a dismissal? Section 95(1)(b) of the Employment Rights Act 1996, states that the expiry of a fixed term contract without renewal is a dismissal. If the reason for non-renewal of the contract is redundancy, then this is a potentially fair reason. Redundancy occurs when an organisation closes down part of an organisation closes down the requirement for particular work reduces or disappears. Most redundancy situations that arise from the ending of grants or because of reduced funds, will fall under the third option. If a dismissal arises, there may be claims for unfair dismissal and/or redundancy. Therefore the employer needs to follow a fair procedure – consult, adopt a fair basis for selection (if you are not sure seek advice), consider any possible alternative work and consult with the staff member before, giving notice. Adopting a fair and open procedure is important to protect against claims of discrimination. 1 In addition, an employee who has worked for two years or more becomes entitled to a redundancy payment. The law requires that fixed-term employees should not be treated less favourably than similar permanent employees, without objective justification, similar to the rules protecting part-time workers. Can an employer lay staff off if they are in financial difficulty? To “lay off” staff means a specific thing in employment law. Acas describes it as “when employees are not provided with work by their employer, and the situation is expected to be temporary.” “Short-time working” also has a specific meaning. It “occurs when employees are laid off for a number of contractual days each week, or for a number of hours during a working day.” Employers have no statutory or implied contractual right to lay off employees or to keep them on short-time working. So employers in financial difficulties could ask employees to agree to being laid off or kept on short-time working, but should only take this action with the employees' signed agreement. Most employers in the voluntary sector will not issue contracts with provisions for lay offs and short-time working. An employee who is laid off in breach of their contract could submit a claim for constructive dismissal. Any employee who is legally laid off or kept on short-time working for four or more consecutive weeks, or for more than six weeks in a 13-week period, may claim a statutory redundancy payment. Employees are to be taken as having been laid off in any week if they are not provided with any work during that week and are not entitled under their contract to be paid any wages or salary in respect of that week. Employees who have been temporarily laid off have a statutory right to guarantee payments up to a maximum of five days in any 13-week period. The guarantee payment rate from 1 February 2012 is £23.50 per day (£22.20 per day to 31 January 2012). What right does an employee under notice of redundancy have to time off? An employee who is under notice of dismissal by redundancy has the right to take reasonable paid time off during working hours to 2 look for new employment or make arrangements for training for future employment. To exercise this right the employee must have two years' continuous service by the end of the notice period. What is 'reasonable' will depend on the individual circumstances of the case and relevant factors could include how difficult finding new employment is likely to be, the distance that the employee may have to travel in order to do so, and the needs of the employer. An employee may bring a complaint to a tribunal that time off has been refused unreasonably. If the complaint is upheld the employee will be entitled to a payment equal to the amount that he or she would have received had the time off been permitted, subject to a limit of 40% of one week's pay. Is it possible for an employer to withdraw notice of redundancy? The contractual position is that once notice of redundancy has been issued to an employee, it is legally binding and cannot be unilaterally withdrawn by the employer, even if the employee is still working out his or her notice period. If the employer subsequently withdraws the notice because of a change in business or economic circumstances, e.g. further funding, the withdrawal of the notice will only become effective if the employee agrees to carry on working. However, the Employment Rights Act provides that an employee who is dismissed by reason of redundancy loses the right to a statutory redundancy payment if he or she unreasonably refuses an offer of suitable alternative employment. The offer must be made before the end of the employee's employment under the previous contract and must take effect either immediately on the end of the employment under the previous contract or after an interval of not more than four weeks. The employment must either be on the same terms and conditions as the previous contract or be suitable alternative employment in relation to the employee. If, after notice of redundancy has been issued, the employer makes an offer to the employee of his or her old job back on the same terms and conditions of employment, but the employee turns it down, the employer can then argue that no statutory redundancy payment is due because the employee has unreasonably refused an offer of suitable alternative employment. The suitability of an offer of alternative employment is an objective matter for assessment, whereas the issue of the reasonableness of an employee's refusal has to be assessed on an individual basis by 3 considering the employee's personal circumstances. If, for example, during the notice period the employee has already secured alternative employment, it is likely that an employment tribunal will find that the employee's refusal was reasonable in the circumstances. On the other hand, refusing to accept a job back simply to obtain a redundancy payment is likely to be construed unreasonable. What is the trial period when alternative work is offered? An employee has a statutory right to accept an offer of alternative employment with the employer (or an associated employer) where the terms differ from the terms of the previous contract, on a trial basis without automatically forfeiting the right to a redundancy payment. The trial period begins when the employment under the old contract ends, and ends four weeks after the employment under the new or renewed contract begins, unless a longer trial has been agreed for the purpose of retraining the employee for the new employment. An agreement to extend the trial period for the purpose of retraining must: (a) be made between the employer and the employee or representative before the employee starts work under the new or renewed contract (b) be in writing (c) specify the date on which the period of retraining ends, and (d) specify the terms and conditions of employment which will apply to the employee after the end of the trial period. Provided the rules are complied with, if the job proves unsatisfactory for the employee he or she can leave and does not lose the right to a payment provided, of course, that the job was not in fact suitable for him or her and provided that his or her action in refusing the job was not unreasonable. The employee is treated as having been dismissed on the date on which the employment under the previous contract ended. There may be more than one trial period — if one job is found to be unsuitable the employee may try out another. Employers should also note if they offer to re-engage a member of staff or renew their contract before the ending of the previous employment, for example if they get some new funding in place, then, the renewal or re-engagement should take effect immediately, 4 or after a period of not more than four weeks, and the employee is not regarded as having been dismissed by the employer by reason of the ending of the employment under the old contract. The dismissal, therefore, is expunged and no redundancy payment is due unless his or her refusal of the offer is reasonable. It may be reasonable for example, where the offer is made at a late stage and the employee has already found a new job on the same or better terms or the re-engagement is for a job that is not suitable. Where an employee has recently changed from parttime to full-time, how should their redundancy payment be calculated? An employee is entitled to receive a statutory redundancy payment if he or she is dismissed by the employer by reason of redundancy and meets the relevant qualifying conditions. A redundancy payment is based on 'a week's pay' and takes into account the employee's age and the number of years of employment. Years of employment count equally for this purpose regardless of whether the employee worked full time or part time. To calculate a redundancy payment, the employer must first determine the period, ending with the relevant date (i.e. the date on which the notice of redundancy expires or the date on which the termination of employment takes effect if no notice is given), during which the employee has been continuously employed. The employer must then work backwards from the end of that period to calculate the number of complete years of employment falling within that period. Finally, the employer must allow the appropriate amount for each of those years of employment. The appropriate amounts are currently: one and a half weeks' pay for each year of employment in which the employee was aged 41 or over; one week's pay for each year of employment in which the employee was aged between 22 and 40; and half a week's pay for each year of employment in which the employee was aged between 18 and 21. The maximum number of years of employment that can be taken into account is 20 and the maximum week's pay that can be taken into account is £430 from 1 February 2012, normally increased each February (£400 up to 31 January 2012). If the employee's normal working hours are the same every week and his or her wages for employment in normal working hours do not vary with the amount of work done, the amount of a week's pay is the amount that is payable by the employer under the contract of 5 employment in force on the date on which the employer gives the employee the minimum statutory notice to which he or she is legally entitled. This is the ‘calculation date’. If the employee's wages do vary with the amount of work done but the number of normal working hours does not vary, the amount of a week's pay is the amount of pay for the number of normal working hours in a week calculated at the average hourly rate of pay payable in respect of a 12-week period ending with the last complete week before the calculation date (or, where the calculation date is the last day of a week, with that week). Where the employee is required under the contract of employment to work during normal working hours on days of the week or at times of the day that differ from week to week or over a longer period (so that pay varies from week to week), the amount of a week's pay is based on the average pay and the average number of hours worked in the last 12 weeks before the calculation date. Therefore, if the employee's change to part-time hours was a permanent contractual change and his or her normal working hours are now the part-time hours, the whole redundancy payment will normally be calculated based on the reduced part-time salary. However if the employee’s hours have been reduced on a temporary basis, e.g. a temporary reduction of hours in a time of financial difficulty a subsequent redundancy payment should be calculated on the basis of the hours prior to the temporary reduction. If the employee is on maternity leave, statutory redundancy pay should be calculated using their normal week’s pay or average week’s pay received before the maternity leave period started. It should not be based on the Statutory Maternity Pay rate or contractual maternity pay rate. Is it unlawful to make employees on maternity leave redundant? No, although selecting a woman for redundancy because she is on maternity leave is automatically unfair. Making a woman redundant who has had nobody covering her while on maternity leave, for example, risks falling foul of the “but for” legal test – she would not have been made redundant “but for the fact” she was on maternity leave. This makes the reason for the redundancy maternity-related and potentially illegal. 6 A woman on maternity leave can be fairly dismissed for redundancy provided it is genuine, and a fair consultation and selection process is followed. Employers need to work out how to consult fairly with an employee absent from work, and must ensure selection is free from bias linked to pregnancy or maternity leave to avoid sex discrimination. The employee’s right to contractual maternity pay normally stops when their contract ends (unless specified in the contract). If an employee who is on maternity leave is made redundant she will probably lose her contractual pay from the date of her redundancy. However she will still be entitled to get Statutory Maternity Pay for any remaining weeks. What protection against redundancy exists for those on maternity leave? A woman on maternity leave whose post is redundant must be offered any suitable post available (regulation 10, Maternity and Parental Leave etc Regulations 1999). The new role must be appropriate work, on terms not substantially less favourable than her previous role. This obligation extends to an associated employer and to a new employer if the business transfers. Can we interview for the suitable vacancy if one of several employees at risk of redundancy is on maternity leave? No, unless it has already been offered to, and rejected by, the woman on maternity leave. Employees on maternity leave have the right to be offered a suitable vacancy without competition, even if there are other suitably qualified or better-qualified candidates. Should we wait until an employee’s maternity leave finishes before confirming redundancy? An employer can implement redundancy during maternity leave if it can show this was necessary. The consultation does not have to be extended automatically until the employee returns to work. Employers may choose to postpone a redundancy dismissal until the end of maternity leave so they can assess whether or not a redundancy situation still exists, but this is not a legal requirement. 7 © LVSC (PEACe), January 2012 LVSC’s Personnel, Employment Advice and Conciliation Service The material in this document does not give a full statement of the law, nor does it reflect changes after January 2012. It is intended for guidance only and is not a substitute for professional advice. No responsibility for loss occasioned as a result of any person acting or refraining from acting on the basis of this material can be accepted by the author or by LVSC or by Russell-Cooke LLP. 8