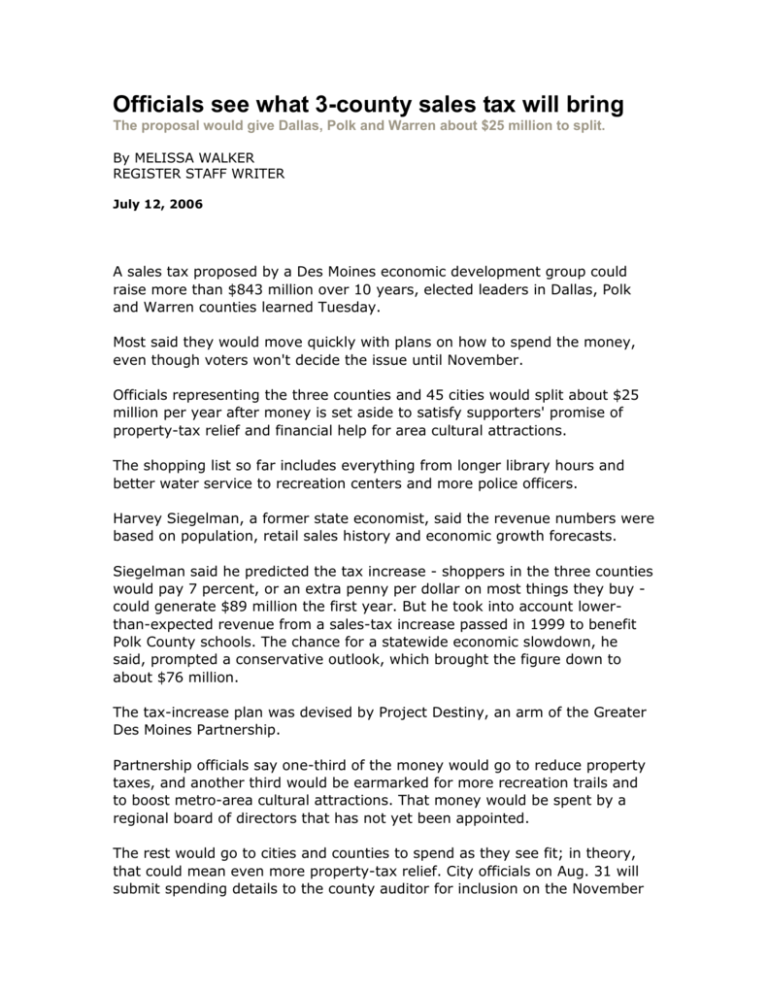

Officials see what 3-county sales tax will bring

advertisement

Officials see what 3-county sales tax will bring The proposal would give Dallas, Polk and Warren about $25 million to split. By MELISSA WALKER REGISTER STAFF WRITER July 12, 2006 A sales tax proposed by a Des Moines economic development group could raise more than $843 million over 10 years, elected leaders in Dallas, Polk and Warren counties learned Tuesday. Most said they would move quickly with plans on how to spend the money, even though voters won't decide the issue until November. Officials representing the three counties and 45 cities would split about $25 million per year after money is set aside to satisfy supporters' promise of property-tax relief and financial help for area cultural attractions. The shopping list so far includes everything from longer library hours and better water service to recreation centers and more police officers. Harvey Siegelman, a former state economist, said the revenue numbers were based on population, retail sales history and economic growth forecasts. Siegelman said he predicted the tax increase - shoppers in the three counties would pay 7 percent, or an extra penny per dollar on most things they buy could generate $89 million the first year. But he took into account lowerthan-expected revenue from a sales-tax increase passed in 1999 to benefit Polk County schools. The chance for a statewide economic slowdown, he said, prompted a conservative outlook, which brought the figure down to about $76 million. The tax-increase plan was devised by Project Destiny, an arm of the Greater Des Moines Partnership. Partnership officials say one-third of the money would go to reduce property taxes, and another third would be earmarked for more recreation trails and to boost metro-area cultural attractions. That money would be spent by a regional board of directors that has not yet been appointed. The rest would go to cities and counties to spend as they see fit; in theory, that could mean even more property-tax relief. City officials on Aug. 31 will submit spending details to the county auditor for inclusion on the November ballot. Partnership spokesman Jay Byers said the agreement guarantees that onethird of the money would be used to reduce property taxes. Residents would see a line on their tax bills showing how much money the sales tax contributed, he said. City and county leaders "have to show their citizens what that means in terms of dollar amount," he said. De Soto Mayor Marty Glanz, chairman of the Project Destiny committee in Dallas County, said if voters approved the plan, the property-tax rate in his city would drop $3.75 per $1,000 of assessed value, which would save the owner of a $100,000 home nearly $400 per year. De Soto would receive about $137,900 to spend as it pleases. "When you sign the agreement, you're saying you're going to use that 33 percent to offset taxes," Glanz said. "If people don't stick to that plan, then it's kind of all for nothing. The whole point of this plan is to make this place attractive for business" and homeowners. Des Moines City Manager Rick Clark said he thought property-tax reduction was the most important part of the sales-tax proposal. Savings for Des Moines property owners have not been calculated. City leaders have said they might spend their share on expanded library hours, Blank Park Zoo and law enforcement, among other things. Clark suggested that some of the revenue could also be used to pay off municipal debt. Officials in West Des Moines and Urbandale have said they would spend their shares of sales-tax money on recreation and community centers. City Council members in Norwalk have worked for years to pay for street improvements and pave roads in preparation for residential growth. City Administrator Mark Miller said leaders there would also improve water service and construct connections to nearby recreational trails. George Dickerson, 69, of West Des Moines said he's unconvinced that property taxes would go down. He worries that elected officials would go on a spending spree and said his doubt was sparked by the ongoing salary scandal at the Central Iowa Employment and Training Consortium, where top officials were paid salaries and bonuses deemed excessive by a state audit. "That's where the lack of trust comes in," Dickerson said. "I think it's bad timing to try to get it through." Beth Ingram of West Des Moines said city officials are good stewards of public money, and they need more of it. She said she would rather see higher sales taxes than a property-tax increase. "I think they're already doing as much as they can for the money they have," she said. "I'd rather see them raise funds than cut services."