“For the land is Mine”:

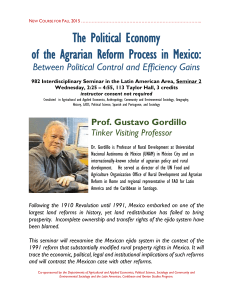

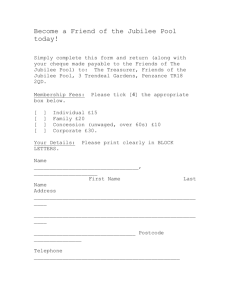

advertisement