IAC PRIORITY LEGISLATION - Idaho Association of Counties

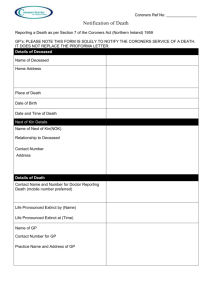

advertisement

Legislative Bulletin 2009 P.O. Box 1623, Boise, ID 83701 – (208) 345-9126 www.idcounties.org February 20, 2009 COUNTY ISSUES ASSESSORS Section 42 Low Income Properties: The IACA supports legislation to create a uniform statewide method for valuing these types of property. Members of the Senate Local Government Committee are working on this and also talking to the State tax Commission. CORONERS H0175 Death certificates, add'l fee. Adds an additional one dollar ($1.00) fee to each certified death certificate issued. The funds generated from the fee would solely be used for training of new county coroners as well as the continuing education of coroners. This would also enable the coroners to provide training around the state for parttime deputy coroners. The bill also amends the statute to reflect the current fee charged for a certified copy of a death certificate which has been increased over time through the rule making process as allowed per this statute. To Print H0176 County Coroners, education requirements. Requires new coroners to attend a coroner’s school or training endorsed by the Idaho State Association of County Coroners within one year of taking office as a county coroner. The purpose of Section 2 of this bill is to require county coroners to complete twenty four hours of continuing education classes every 2 years. The classes would be developed, sponsored and monitored by the Idaho State Association of County Coroners. This will help professionalize the office of county coroner. On a short term basis, the St Louis University School of Medicine offers a weeklong course which is widely recognized nationwide. The intent is to develop schooling within Idaho. To Print SHERIFFS Reimbursement Rate/State Inmates: The ISA has requested an increase in the daily rate paid by the Idaho Department of Correction for inmates housed in county jails. The IAC supports the ISA in their effort to gain a fee increase for housing state prisoners. The Governor is including a $1 increase phased in over 5 yrs. in his budget. S1098 Off-highway vehicles. Cleans up language from 2008 HB602, codify insurance requirements for off highway vehicles and to allow for the use of a "sticker" only registration option for ATV/UTV/Motorbikes. A new classification for "Restricted Use" vehicles has been defined creating a "Specialty" category for those vehicles outside of current definitions. Further defines the definition of UTV and ATV vehicles and allows the purchase of restricted vehicle stickers and plates by nonresidents that use Idaho's trail systems. These changes become effective upon approval. On January 1, 2010, users wanted to create a user fee account like that of the Idaho boating users that will be used by the County Sheriffs for off highway related law enforcement activities and by the Department of Lands for off highway opportunities and repair damage caused on state land by off highway vehicle use. Language also limits state liability of state or political subdivisions for restricted vehicle use. Senate Transportation 1 PROSECUTORS Felony Murder Rule: Amend I.C. 18-4003(d) in order to add unlawful discharge into an occupied dwelling or "drive by shootings" (I.C. 18-3317) to the current list of specified crimes for which one may be charged with first degree murder when a murder occurs during the perpetration of the specified crime. Aggravated Reckless Driving: Create a new section, I.C. 49-1401A, in order to enact significant penalties for reckless driving that causes great bodily harm, permanent disability or permanent disfigurement to another. S1106 Restitution for blood draws for Driving Under the Influence: Amend Idaho Code to allow courts, upon guilty plea conviction, to order restitution for the cost of blood draws and blood alcohol concentration analysis conducted during driving under the influence investigations. (Co-sponsoring with Law Enforcement) Senate Judiciary and Rules H0087 Vulnerable Adults: Amend Idaho Code 18-1505(4)(e) Exploitation of Vulnerable Adults to clarify the definition of "vulnerable adult" by adding that a vulnerable adult is a person that lacks sufficient understanding or capacity to make or communicate or implement decisions regarding his funds, property, or resources. House Judiciary and Rules TRANSPORTATION H0093 Motor vehicle rental tax. Imposes a six percent (6%) fee on the daily lease or rental rate on all short term leases and rentals of motor vehicles not exceeding thirty (30) days. SUPPORT H0094 Motor fuel taxes, revisions. This bill would increase the state tax on motor fuel by a total of ten cents (2 cents/gallon per year) over a period of five years. SUPPORT H0095 Hwy distrib acct, distrib rev'd. Shifts an amount equivalent to the (5%) of the Highway District Account (HDA) to the General Fund over a period of five (5) years. This shift will be accomplished by reducing the percent distribution to ISP by one percent (1%) a year starting in FY 2010. Concurrently, the percent distribution going to the State Highway Account (SHA) will increase by one percent (1%) a year until FY 2014 at which point the percent distribution to the SHA will be sixty-two percent (62%). The distribution to local jurisdictions will remain at thirty-eight percent (38%). SUPPORT H0096 Fuels, deductions deleted. This legislation will eliminate the current ten percent (2.5 cents/gallon) tax exemption for biodiesel and gasohol. SUPPORT H0098 Motor vehicles, fees, revised. Increases the standard motor vehicle registration fees for passenger cars with a gross vehicle weight (GVW) of 8,000 pounds or less, school buses, farm and noncommercial vehicles with a GVW of 8,001 to 60,000 pounds, and for commercial trucks and wreckers with a GVW of 8,001 to 60,000 pounds. The standard registration fees for cars and light trucks registered at the county level would increase in the first year by a range from $6.00 to $24.00 depending on the age of the vehicle and then increase by 10%, 12.5%, 15%, 17.5%, annually over the next four years. Registration fees for heavy trucks registered at the State level are increased one time by five percent (5%). This legislation will be effective January 1, 2010, and registration increases will be effective on January 1 of each year 2011 through 2014. SUPPORT H0153 Load Limit Exemption. This legislation increases the load limit exemption for double axle sanitation trucks similar to existing exemptions for single axle sanitation trucks on public highways. House Transportation S1053 Motor vehicles, registration, title. Would enable the department to require the collection the following information, including full legal name, driver license number, or social security number, or a business' employer identification number, as well as physical and mailing address, of owners of vehicles when registering or titling vehicles or vessels. Senate 3RD Reading S1055 Motor vehicles, materials on hwys. This legislation provides some general guidelines that make compliance easier, eliminates confusion and give law enforcement the ability to correct violations before they become hazards for motorists. Senate 3rd Reading 2 Legislative Bulletin 2009 P.O. Box 1623, Boise, ID 83701 – (208) 345-9126 www.idcounties.org February 20, 2009 ELECTIONS Election Consolidation. There will likely be a new bill introduced that include the process and funding. It also will remove the concern counties have been expressing about raiding their revenue sharing funds. Rep. Lake has been working hard on this and is trying to get additional general fund dollars. We will hopefully get a copy early next week and do a more detailed report. The funding would come from general fund dollar, funds from special districts, funds from cities and billing schools for the costs of conducting their elections in March and August. The funding will be close but very workable. H0068 Election Consolidation: These bills consolidate elections into 4 dates and have the county clerks conduct the elections. It will also provide uniformity and professionalism in all elections. SUPPORT H0069 Election Consolidation: This is the funding proposal. The amount is now $4.5 million with a $40,000 base plus population. It seems clear that the cost to fund 6 elections dates will be about $9 million plus the county funding of the primary and general at over $2 million each. The state would provide $2 million from the general fund, $500,000 from the city revenue sharing account and $2 million from the county revenue sharing account. This severely impacts the county funds. House State Affairs HEALTH CARE Catastrophic Health Care Cost (CAT) Funding: Because of the State of Idaho economic crisis, Senator Cameron created a committee to look at ways to reduce the costs to the CAT Fund. IAC has been asked to gather information after each meeting and has provided it the committee. The initial recommendation to the legislature was to have a $5,000 increase in the deductible. Because of the budget cap how are counties to fund this? Recommendations to give to your legislators: 1. Avoid a $5,000 increase. Any increase beyond $1,000 should exempt the indigent levy from the 3% cap. 2. Information was provided regarding the counties that contract for review services and the number of applications received, approved and denied. 3. Any recommendations need to be beneficial for the county indigent funds as well. There will be another meeting on Wednesday February 26. More information will be sent in the next bulletin H0144 Hospitalization/mentally ill, costs. Clarifies that counties will be responsible for payment of hospitalization of the mentally ill at the Medicaid rate. SUPPORT S1110 Public benefits/documentation revised. Adds lawfully present persons with any type of immigration service document that validates their presence under refugee or asylee status to the list of eligible groups for public benefits. Including these groups will allow them to assimilate more quickly, and allow them to access services that help their families survive the transition period, while they await full citizenship. Senate H/W S1108 EMS Licensing: The EMS Bureau is proposing legislation that provides and updates criteria for licensing, such as data collection on service benefits and affects on existing system, adds penalties for license violations, updates EMS terminology to match emerging national standards, and creates a waiver for volunteers of non-transport, non-24-7 agencies. Senate Health and Welfare SUPPORT 3 S1065 Mental Health Boards, revised. Increases children's mental health representation on regional mental health boards and clarifies statutory language about representation for adults with mental illness. House Health and Welfare PROPERTY TAXATION H0083 Personal Property Exemption-Application. This bill would enable a small business to simply file an affidavit on the Tax Commission form, if the conditions are satisfied, and be relieved of an annual inventory of all personal property to be filed. It also provides penalties for fraudulent application. Additionally some technical changes include: Clarifying that the exemption becomes effective the year following the year the State Controller certifies the required increase in the general fund; Corrects the calculation for reimbursement to urban renewal districts of revenue that would have come from the exempted personal property; Removes a duplicative provision requiring inclusion of reimbursements in the calculation of budget limits to prevent double counting; and Requires inclusion of the exempt personal property in taxable value for levy setting. This replaces HB29 and HB49. House Floor H0030 Property tax, notices. Requires that the percentage change from the prior year's property taxes, and the acreage of the property are included in the property tax notice. Kerry Ellen is determining what the costs would be to implement this. OPPOSE HELD Senate Local Government and Taxation H0122 Renewable Energy Enterprise Zone. Gives county commissioners authority to apply to the PUC for designation of a certain area within there county as a renewable energy enterprise zone. These zones would receive certain tax incentives, including property tax exemptions. OPPOSE House Revenue and Taxation H0141 Property/Float Homes. Defines “floating home” as stationary, waterborne dwelling. Clarifies whether property is personal property or real property. Replaces H0063. House Revenue and Taxation Renewables/Payment-In-Lieu-Of. Rep. Jaquet is proposing legislation to make all forms of renewable energy eligible for the payment-in-lieu-of revenue mechanism initially extended to wind power generators. The proposal includes cogenerating facilities as well as wind, geothermal, bio-mass, solar, and landfill gas. OTHER ISSUES H0077 Tuition, prof-tech students, aid. This legislation would provide for use of excess county liquor fund money for tuition for professional technical students. It provides for a list of enrollees and declares an emergency to allow for use of funds for the spring semester. REVIEW THE IMPACTS IN YOUR COUNTY. OPPOSE House Education Building Codes. Consensus bill will provide for updates to the building code without legislative approval; increase the building code board by one; and provide for a hearing process should local governments choose to adopt more stringent requirements. Alcohol Beverage Control: A rewrite of the Alcohol Beverage Control laws has been completed by a task force created by Governor Otter. The legislation will include the separation of the licensing and enforcement of the ABC laws at the state level; eliminate the quota system and issuance of new state licenses; provide for the creation of municipal licenses by the cities and counties; establish a fee system; and require server training. The proposal should be scheduled for a print hearing sometime in the next week. Check the IAC Website – IAC Legislative Bulletin – “ABC Draft legislation Executive Summary” for more information. SUPPORT H0140 Beer and Wine: The Common Interest is proposing legislation to raise the tax on beer and wine and convert it from a tax on volume to a tax on wholesale price. The new funding would be utilized to fund the state’s substance abuse treatment budget. Legislative support for this idea is on the increase, given the economic downturn and pressures on the state general fund. House Revenue and Taxation on Monday Feb. 23 at 9:00 a.m. H0178 Sex offendr reg act, provisions. Provides that the act applies to persons convicted of certain crimes and to clarify that an offender is not required to comply with the sex offender registration requirements while incarcerated; and to require electronic monitoring of violent sexual predators. S1111 Pub safety officer, disability benefit. Provides a onetime payout of $100,000 to help families to replace lost income and offset some of their increased expenses. A onetime payout is necessary to prevent being offset by PERSI, 4 Legislative Bulletin 2009 P.O. Box 1623, Boise, ID 83701 – (208) 345-9126 www.idcounties.org February 20, 2009 Social Security, and Workers Compensation benefits. This will require public safety officers to increase their PERSI contribution rate by .04% S1024 Firearms, regulations. Provides that political subdivisions of the state may regulate the possession of firearms at certain public meetings and provides that certain political subdivisions of this state may regulate the possession of firearms within and on the property of public libraries. Senate State Affairs 5 HEALTH DISTRICTS S1112 Basic daycare license. Revises and extend the State's licensing requirements for child care providers. The current code provides minimum health and safety standards for day care centers with thirteen or more children, but does not provide licensure for providers with fewer than thirteen. This legislation would extend licensing to all providers who receive compensation and care for four or more children, with specific exceptions maintained. Basic requirements include: criminal history background checks, health, safety and fire inspections and restrictions on firearms, alcohol and tobacco use. Minimum standards for infant CPR and first aid training are specified. This act establishes staff-child ration recommendations consistent with nationally accepted standards and provides for fees to be established based upon the number of children. The Health and Welfare Department will serve as the portal or administrator for the program. The Department will contract for the inspection services, receive and compile complaints and provide for a one stop application process Senate Health and Welfare S1089 Child Safety Restraints. This bill removes exemptions for safety seat restraints for children under age 6. Senate Transportation S1083 Food establishments/licensing fee. Increases the annual license fee for food establishments in the Food Establishment Act from $65 to a higher level depending on the type of food facility. The new fees will be based on a three tiered system to ensure a more equitable means to have industry share in a portion of the cost for Idaho food safety program. The tiers and fees are as follows: $191 for intermittent, temporary and mobile food establishments; $200 for medium risk food establishments; and $212 for high risk food establishments. The fees will be phased in over a two-year period. The first year the fee will move halfway between the current fee and the new fees. The second year the fees will move to the full fee. The fee increase will require that the food industry pay a larger portion of the cost of the food safety program. Senate Health and Welfare SUPPORT H0185 Midwifery, board powers/duties. Establishes a framework for licensure of midwives in the state of Idaho. The mandatory licensure provisions of this bill are intended to enhance maternity care options for Idaho’s families and to help ensure that those who provide midwifery care not only have the training necessary to do so, but also have the access to the medications that are necessary to safely provide this service. The legislation establishes provisions for what midwives are allowed to do, what they may not do, when they shall advise their clients to seek other medical advice and when to transport a client. To Print H0055 Nursing Licensing. Statutorily provides for discretion and consideration by the Nursing Board of alternative documentation and experience when licensing out-of-state nurses in the state of Idaho. House Health and Welfare H0089 Barber Licensing. This legislation provides a licensing exemption for those practicing barbering in state prison facilities. To House Floor H0039 State-Sponsored Group Health Insurance. Changes the eligibility of for access to and defines the state’s contribution to any state-sponsored health insurance plan or plans for retirees and their dependents. This will reduce the state’s annual cost by $5.1 mil. and reduce the GASB funding requirement an additional $35.1mil. House State Affairs 6