Sec Reg Outline

advertisement

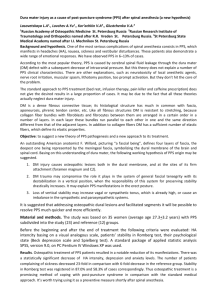

Securities Regulation Outline Fall 2008 1. Post Effective Period a. Occurs after the registration statement has become effective i. 5(a)(1) no longer prohibits closing sales and 5(a)(2) allows for the delivery of the security ii. Delivery – must be accompanied by a § 10 prospectus; must be a final pps - § 5(b)(2) 1. Final PPS includes offering price, underwriter compensation, amount of the proceeds, and other information that is dependent on the offering price b. Rule 172 i. 172(a) 1. No longer have to meet § 5(b)(1)’s written confirmation requirement as well as notifications that allocations will be made from a registered offering 2. No longer have to physically provide a final pps 3. EXCEPTION a. Exchange Act Rule 15c2-8(b) – underwriter must deliver a preliminary pps to buyers at least 48 hours before sending confirmation of sales ii. 172(b) 1. 5(b)(2) normally allows sale of securities interstate commerce only if accompanied by a final pps 2. 172(b) creates an exception – if final §10(a) pps is filed with SEC, provided also that registration statement is not subject to enforcement actions c. Rule 433 i. Encourages distribution participants to use the Free writing period rules 1. must comply with legend and filing requirements d. Duration of Section 5 Requirements i. Issuers 1. subject to § 5 as long as they are offering the security to the public ii. Underwriters and Dealers 1. Subject to § 4(3)(C) as long as their allotment or subscription is unsold 2. Rule 172 and 174 reduces this a. 172(a) – dealers no longer have to deliver a pps b. Rule 172(c)(4) – dealers do not have to deliver when transporting securities 3. Rule 173 – if not exempt under 172 or 174, must deliver a pps within 2 business days after the sale e. Section 4(3) and Delivery of a PPS by a Dealer i. Dealer v. Broker 1. Dealer solicits investor’s interest in a security ii. 4(3) applies if you are a dealer iii. Rule 153 1. dealer no longer has to deliver a pps in connection with the delivery of securities iv. Rule 174 1. a dealer that is not an underwriter does not have to file a pps if the issuer was a reporting company under the ’34 act 2. 174(d) - if not a reporting company and security is listed on a national exchange or registered with interdealer quotation system of a registered SRO, then no delivery of a pps v. 172(c)(4) and 174(h) - No delivery of a pps for a dealer as long registration statement is not the subject of SEC enforcement proceeding vi. 173 – fallback provision – if not excepted then you must deliver a pps within 2 business days f. Section 4(4) and Broker’s Exemption i. Broker that does not solicit her client’s interest in a registered security ii. Broker merely serves as an agent 2. Shelf Registration Under Rule 415 a. Generally i. Shelf Registration – registration of securities to be offered on a delayed or continuous basis 1. issuers use this to take advantage of market windows 2. Can be used to accomplish a series of acquisitions with stock ii. Problem was with § 6(a) – stated that a registration shall be effective only as to those securities specified therefore as proposed to be offered 1. trying to ensure that registration info is as current as possible iii. Deal with these fears by filing post effective amendments to keep info current 1. Filing is pursuant to 415(a)(3) and is set forth in 512(a) of S-K 2. must file an amendment covering any pps required under § 10(a)(3) a. essentially update financial statements annually b. Rule 415 i. Traditional shelf offerings are permitted under (a)(1)(i) through (a)(1) (ix) expressly authorize shelf registration ii. 415(a)(1)(x) permits shares to be registered on S-3 or F-3 and they can be offered and sold on a delayed or continuous basis, by or on behalf of the registrant iii. Good vs. Bad 1. Good a. Decreases underwriting fees b. Allows for quick deals 2. Bad a. Less time for diligence because deals occur quickly b. Increases the bought deal iv. 415 doesn’t specify the form to use – have to look at eligibility for that form c. WKSI i. 2005 reform allowed for automatic registration for WKSI – Release No. 8591 ii. WKSI can register unspecified number of securities that become immediately effective when Form S-3 or F-3 is filed 1. gives lots of leeway in determining amount and type of security to offer iii. allows WKSI to omit more information from base pps than is allowed under 430B 1. can omit – whether the offering is primary or secondary, description of securities, names of any selling security holders, and plan of distribution 2. can add info later through post-effective amendment, incorporation by reference, or pps or pps supplement iv. statements are effective on filing and last for three years d. Updating via 430B and 430C i. 430B authorizes mission from base prospectus information that is unknown or not reasonably available ii. Base prospectus is not a final pps iii. 430B(d) – info that is omitted is added later though amendment, pps filed pursuant to 424, or incorporation by reference iv. 430B(e) – any omitted information that is later added becomes part of registration statement so that § 11 liability attaches v. 430C – information supplemented in other offerings becomes part of registration statement as well

![013—BD Global [DOC 117KB]](http://s3.studylib.net/store/data/005892885_1-a45a410358e3d741161b3db5a319267b-300x300.png)