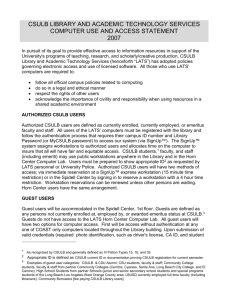

Tax Changes in 2010 Personal Income Tax 1. Increase general

advertisement

Tax Changes in 2010 Personal Income Tax 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Increase general personal income tax rate from 23% to 26% Broaden personal income tax base, including all capital income, applying 10% tax rate to dividends and interest payments and 15% rate to capital increase (all capital income, including dividends, should be taxed as of 2010) Impose personal income tax on the benefit gained from the use of employer’s (company’s) passenger car for personal needs Decrease the amount of PIT non-taxable present of the employer from the amount of nominal wage (Ls 180) to Ls 0 Increase the tax rate for self-employed persons (performers of economic activities) applying general personal income tax rate Impose tax on presents exceeding 1000 lats per year if they were received from a person having no marriage or kinship relations with the presentee up to third generation (in terms of Civil Law). If the presenter has marriage or kinship relations with the presentee up to third generation (in terms of Civil Law) and descending kin, then the present should not be subject to the tax Apply tax on expropriation of growing forest for cutting and expropriation of wood materials obtained from such forest, apply 10% rate only to the owner of the forest (norms referring to economic activities should be applied to intermediaries) Decrease non-taxable amount of revenue from agriculture production and provision of rural tourism services from 4000 lats to 2000 lats per year Change tax incentives for reserves (in private pension funds, insurance companies and investment funds) Include in calculation of taxable income sums paid as state aid to agriculture or EU aid to agriculture and rural development Revise personal income tax eligible expenditure for education and treatment services referring to services received in 2010 decreasing the limit of expenditure from 300 lats to 150 lats (impact in 2011) Impose personal income tax (wage tax) on income from leased personnel A procedure was prescribed envisaging possibility to pay patent fee in particular sectors Real Estate Tax 14. 15. 16. 17. 18. Increase tax on land and buildings used for economic activities till 1.5% Impose nominal tax payment 5 lats from each taxable object (land, building) Impose increased 3% rate on non-cultivated agriculture land Broaden real estate tax base imposing 0.1% rate on dwelling houses with cadastral value up to 40 thousand lats; 0.2% - with cadastral value 40001-75000 lats; 0.3% - with cadastral value above 75 thousand lats Impose RET on engineering technical constructions Excise Duty 19. 20. 21. 22. 23. As of January 1, 2010, impose nominal excise duty level on cigarettes – 48 lats per 1000 cigarettes, as well as cancel condition regarding tax repayment for heavy fuel oil for heating purposes and hot water production (hereinafter excise duty rate 11 lats per 1000 kilograms will be imposed) As of February 1, 2010, increase excise duty on wine and fermented products from 40 lats (per 100 litres) till 45 lats or by 12.5% and on intermediate products with absolute alcohol content not exceeding 15 per cent by volume (including) from 42 lats (per 100 litres) till 45 lats (per 100 litres) or by 7.1% As of April 1, 2010, implement computerized Excise Goods Transportation and Control System specifying correspondingly the terms, scope of tax payers, norms regarding excise goods transportation applying payment of postponed excise duty within the computerized system and other provisions in the Law As of May 1, 2010, impose tax on natural gas for heating purposes applying rate 15.60 lats per 1000 m3 and natural gas used as fuel applying rate 70 lats per 1000m3 As of July 1, 2010, impose decreased excise duty rate – 15 lats per 1000 litres – on fuel for heating purposes if it contains rapeseed oil or biodiesel fuel produced from the rapeseed oil; however on fossil fuel for heating purposes the rate will be 40 lats per 1000 litres Tax on Cars and Motorcycles 24. Calculate tax on previously not registered cars or cars registered abroad after January 1, 2010 according to the amount of carbon dioxide emissions, however on motorcycles – according to the engine capacity (m3) Corporate Income Tax 25. 26. 27. Decrease the amount of representation expenditures deductable from taxable amount from 60% to 40% For purposed of corporate income tax calculations increase by 1.5 times the part of costs excluded from expenditure not related with the economic activity and losses caused by maintenance of social infrastructure objects Broaden possibilities for tax payers to decrease their advance payments if the profit has decreased. It is also planned that in case the difference between the resulting calculation of the tax and decreased advance payments calculated by the tax payer does not exceed 20% of the resulting tax calculated in the taxation year the tax sum to be paid additionally will not be considered as a delayed tax payment and delay interest will not be imposed on it Value Added Tax 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. Specified norms regarding VAT taxation period It is stated that VAT statements on taxation year should be submitted only in separate cases prescribed by the Law Special VAT payment procedure and pre-tax deduction procedure (“cash principle”) has been prescribed for separate groups of taxable persons The term for tax payment to the state budget has been prolonged – till 20 days after the end of taxation period VAT compensation amount for farmers increased from 12% to 14% New, improved VAT repayment system has been introduced referring to overpaid VAT sum starting from July 1, 2010 For tax calculation purposes documents without signature and stamp confirming transaction not exceeding 20 lats without tax can be used (it is not necessary to confirm cheques with stamp and signature anymore) Customs value of imported goods subject to VAT has been specified in the goods import transaction, and VAT collection procedure has been prescribed for cases when actual value of imported goods is not known at the moment of import In relation with cancellation of delivery notes with SRS numbers it is stated that one of details in the VAT calculation is serial number of one or more series uniquely identifying the bill, and new statement on goods delivered and services provided inland has been introduced The place of supply of services specified according to Council Directive 2008/8/EC of 12 February 2008 amending Directive 2006/112/EC as regards the place of supply of services Annual Duty on Transport Vehicles 38. The following duty rates have been increased: on motorcycles 24 lats (currently 3 lats); cars up to 1500 kg 24 lats (currently 12 lats); 1501-1800 kg 48 lats (currently 24 lats); 1801-2100 kg 75 lats (currently 45 lats); 21012600 kg 95 lats (currently 54 lats); 2601-3500 kg 115 lats (currently 72 lats); 3501 kg and more 150 lats (currently 78 lats).