Technical Account Message

Revision

Date

16/01/2013

29/05/2013

Previous

Revision

Date

Project: eAccounts

Technical Account Interface Specification for use with Release 2.0

Summary of Changes

Release: 2.0

Version: 1.1

Date: May 2013

Author: Xchanging

Changes

Marked

Version

Number

First issue for Release 2.0 No

Appendix 7 updated with validation changes agreed at EAPG – new rules M66, TB11 and LP16 and

Yes amended rules M47 and M61

R2.0 v1.0

R2.0 v1.1 eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

1 of 60

Date: 16/04/2020

TABLE OF CONTENTS

eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

2 of 60

Date: 16/04/2020

1

Introduction

1.1 Background and Objectives

The eAccounts process will enable brokers to use ACORD Technical Account and Financial Account messages to process accounting transactions with Xchanging.

The use of these messages will remove the need for the broker to submit LPANs and Work Orders for premium submissions, as currently required in the A&S process, and will also enable Xchanging to automatically load the structured data provided by the broker into its data capture systems, reducing the need for re-keying.

1.2 Objectives of this Document

This document is intended to support the use of eAccounts Release 2.0.

It describes the use of ACORD RLC Technical Account messages to advise the details of accounting transactions for processing by Xchanging.

The additional features introduced in release 2.0 are:

The London Market Deferred Scheme

More than one instalment with the same due date

DRI Slice.

1.3 Scope and Exclusions

This delivery will enable:

ACORD Technical Account messages to provide details of the accounting transactions

ACORD Level 3 Acknowledgement messages to advise Xchanging’s acceptance or rejection of

Technical Accounts as valid messages

ACORD Level 4 Acknowledgement messages to advise business queries and rejections, or to confirm completion of business processing by Xchanging and provide a Broker Signing Number &

Date.

The following exclusions will apply:

Business transactions that are deemed out of scope, as defined in the eAccounts Support Guide . eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

3 of 60

Date: 16/04/2020

2

Technical Standards

2.1 DRI and RLC Messages

2.1.1 ACORD Standards Versions

Documents will be delivered by ACORD DRI messages.

ACORD business messages (e.g. Technical Account) will be used to supply structured data.

The following combination of ACORD standards versions will be supported:

ACORD Messaging Service (AMS) Version 1.4 framework standards, Inbox Post Function

ACORD 2008.1 Reinsurance and Large Commercial (RLC) message standards

ACORD 2008.1 Code lists

No other versions or combinations will be supported at this time.

2.1.2 Reference Sources

The following ACORD documentation contains details of these standards 1 :

ACORD Messaging Service Specification and SOAP Implementation Guide (version 1.4)

Security Profiles for the ACORD Messaging Service (Version 1.0)

ACORD Reinsurance and Large Commercial (RLC) Message Specification (Version 2008.1)

ACORD Reinsurance and Large Commercial (RLC) Implementation Guidelines (Accounting and

Claims) (Version 2008.1)

ACORD Reinsurance and Large Commercial (RLC) Accounting & Settlement Quick Reference

Guide (Version 1.0)

ACORD Code manual (Version 2008.1)

1

These documents are available at the ACORD website at www.acord.org

eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

4 of 60

Date: 16/04/2020

3

Process Description

Documents will be submitted using the ACORD Document Repository Interface (DRI) standards. Documents can be submitted using either the Upload Request or Notify & Download operations.

Further detailed technical information concerning these operations can be found in the Technical Information for London Market Implementation of ACORD DRI Messages.

The following pages describe the processing of the Technical Accounts.

3.1 Broker Submission

The broker will send a Technical Account message for each carrier line, currency and instalment (if applicable). Each message will be contained in a separate SOAP package.

N.B

. The broker will need to send one TA for each carrier line for each accounting split that they create

– be that a fundamental or a non-fundamental split:

- e.g. one per closing section if different coverage applies

- e.g. one per risk code if the broker is creating risk code splits.

If there is more than one Technical Account in the submission, each message will contain a Service Provider

Group Reference and Service Provider Items In Group Total, to indicate the number of messages that must be processed together as one business case.

Each message may also contain a separate SupportingDocument aggregate to provide the DocumentId

(containing the UUID), or Document Reference and Version, of each document that supports the Technical

Account.

Unless the broker is registered to use the “DRI Slice” operation then all supporting documents must have been supplied previously to the Market Repository.

3.2 Xchanging Gateway Processing

Upon receipt of a SOAP message XAG will apply SOAP level validation (e.g. authenticate message sender) and immediately return an ACORD synchronous Post Response (or SOAPFault) to the broker, to confirm successful receipt or to advise the reason for rejection. This completes the SOAP handshake.

XAG will validate each message for technical compliance, using the ACORD Schema. In the event of a translation failure (i.e. a schema validation error) an ACORD synchronous Post Response (or SOAPFault) will be sent to the broker.

Field level validation will then be applied, as described in Appendix 7. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

5 of 60

Date: 16/04/2020

When all Technical Accounts in a Service Provider Group have been validated, if any errors have been detected then a Level 3 Acknowledgement message will be sent to the broker for each message received, to advise the reason(s) for their rejection.

Each Acknowledgement message will be sent in a separate SOAP envelope.

The reason(s) will be provided in text form, in ResponseDescription.

The completion of the Level 3 Acknowledgement message is shown in Appendix 2.

Note 1: If one message in a service provider group fails validation then all of the messages having the same ServiceProviderGroupReference will also be rejected.

If a message is rejected only because of an error in another message in that group then the reason for rejection will be given as “REJECTED BECAUSE OF ERROR IN GROUP”.

Note 2: XAG will accumulate all messages required to complete the Service Provider group.

If, after one hour, a group of messages remains incomplete then all messages relating to that group will be rejected and an ACORD Level 3 Acknowledgement will be sent to the broker for each message that has been received.

If a message is rejected only because a group is incomplete, then the reason for rejection will be given as “THIS ITEM BELONGS TO A GROUP WHICH IS NOT COMPLETE”

At this point, if all of the messages for the Service Provider Group have been received and all have successfully passed XAG validation, the Technical Account messages will be passed to the XIS processing application. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

6 of 60

Date: 16/04/2020

3.3 Application Processing

3.3.1 Business Validation

The processing application will apply further business validation, as described in Appendix 7.

3.3.2 Send a Level 3 Acknowledgement

When all Technical Accounts in a Service Provider Group have been validated a Level 3 Acknowledgement message will be sent to the broker for each message received, to either confirm acceptance by the XIS system or to advise the reason(s) for their rejection.

Each Acknowledgement message will be sent in a separate SOAP envelope.

In the case of rejections, the reason(s) will be provided in text form, in ResponseDescription.

The content and format of the Level 3 Acknowledgement message is shown in Appendix 2.

Note: If one message in a service provider group fails validation then all of the messages having the same ServiceProviderGroupReference will also be rejected.

Messages being rejected only because of an error in another message in that group then the reason for rejection will be given as “REJECTED BECAUSE OF ERROR IN GROUP”.

3.3.3 Construct Premium Advices

In order to meet the processing requirements of the XIS legacy applications, Technical Accounts will be grouped into Premium Advices, based on a number of common factors:

UMR

Bureau (Lloyd’s, LIRMA, or ILU)

Broker Number

Original Currency

Settlement Currency

Broker Reference 1

Broker Reference 2

Correction Indicator

Where Technical Accounts contain the same values for all of the above elements, XIS will group them into one Premium Advice and one bureau signing.

Where any Technical Account contains a different value for any of the above elements, XIS will create a separate Premium Advice and a separate bureau signing.

Critical elements of the data supplied in, or derived from, the Technical Account will also be automatically loaded into the XIS premium database. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

7 of 60

Date: 16/04/2020

3.3.4 Construct Work Orders

The Premium Advice data will also be used to construct an XIS Work Order.

The resulting Work Orders will be loaded to the Market Repository as XML documents. A style sheet will be applied to these XML documents to allow a familiar view of the data to be presented to

XIS Business Operations technicians.

When the Work order is loaded to the Market Repository it triggers the following actions:

1. A Work Package 2 view is built in the Market Repository, to allow XIS technicians to access all of the related documents for that submission.

2. An XIS workflow record is created.

3.4 Xchanging Business Processing

Each Work Package will be allocated to a technician, who will access the documentation on the IMR to carry out the normal business checks.

In the event of a business query regarding the submission, the XIS technician may contact the broker technician responsible for the submission (i.e. the contact given in the Technical Account) by telephone or email.

If the query cannot be informally resolved the technician will record the query details on the system and a

Level 4 Acknowledgement message will be sent to the broker for each Technical Account. The content and format of the Level 4 Acknowledgement message for a query response is shown in Appendix 3.

Note – There is no Level 4 rejection message for a Technical Account.

If there are no queries, or once all queries have been successfully resolved, the technician will use APIX (a new data capture system for XIS) to supplement the data that was loaded into the XIS premium database with additional data required for reporting to carriers.

Once the work package has been completed the technician will release it for bureau signing and each transaction will be given a permanent unique reference, known as the Signing Number and Date (SND) and the transaction data for those signings will be automatically loaded to POSH and/or LIDS.

Packages of work that contain transactions for both Lloyd’s and the company market will result in entries on both POSH and LIDS.

2

A Work Package is formed of a Work Order and the necessary and supporting information to enable Xchanging to carry out premium and/or policy processing activities on behalf of its customers. eAccounts Technical Account Interface Specification

Date: 16/04/2020

Release 2.0, Version 1.1 Page

8 of 60

3.5 Level 4 Acknowledgement

Overnight a Level 4 Acknowledgement message will be sent to the broker in respect of each Technical

Account that formed part of the signing, to confirm the completion of business processing and to advise the broker of the Signing Number & Date.

If the Technical Account Payment Means was given as “in_cash” the Level 4 Acknowledgement will also contain the date on which the funds will be settled. This is known as the Actual Payment Date.

Note: For Technical Account submissions for the London Market Deferred Scheme the Level 4

Acknowledgement messages will contain the APD of the particular instalment to which the referred Technical Account related

The content and format of the Level 4 Acknowledgement message is shown in Appendix 4. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

9 of 60

Date: 16/04/2020

4

Completion of the Technical Account Message

This section describes the completion of the individual elements within the message.

The XML for the Technical Account message is shown in Appendix 1.

4.1 Use of Group References

4.1.1 Service Provider Group Reference

This allows the broker to group Technical Accounts for XIS to process together as one business case. This is required when more than one carrier participates in a transaction and/or when more than one Technical Account is submitted for a carrier.

Grouping is done by giving the same value in <ServiceProviderGroupReference> for each of the messages to be grouped. In addition each message must also contain the number of Technical

Accounts that are included in the group, in <ServiceProviderGroupItemsTotal>

Group Reference

This allows the broker to group Technical Accounts for an individual insurer or reinsurer, for a reason other than settlement.

Grouping is done by giving the same value in <GroupReference> for each of the messages to be grouped. In addition each message must also contain the number of Technical Accounts that are included in the group, in <ItemsInGroupTotal>

Where a premium is being paid by instalments (either as APs or using the London Market Deferred

Scheme) the broker must provide this reference to link those instalment Technical Accounts for processing together. The number of instalments must also be given in <ItemsInGroupTotal>.

eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

10 of 60

Date: 16/04/2020

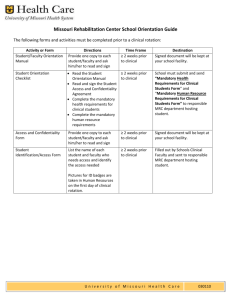

The example shown below demonstrates how group references, and the number in each group, should be applied.

The business example here involves two reinsurers who subscribe to the same contract, for which four transactions are to be paid in three currencies that are to be settled together.

TA

Identifier

Reinsurer

Id Currency

Instalment

Number Group Reference

Items In

Group Total

Service Provider

Group Reference

Service Provider

Group Items Total

TA1

TA2

TA3

TA4

TA5

TA6

TA7

TA8

TA9

TA10

TA11

TA12

TA13

TA14

TA15

TA16

A4704

A4704

A4704

A4704

A4704

A4704

A4704

A4704

A4704

A4704

A4704

A4704

A0504

A0504

A0504

A0504

GBP

GBP

GBP

GBP

USD

USD

USD

USD

CAD

CAD

CAD

CAD

GBP

GBP

GBP

GBP

01

02

03

04

01

02

03

04

01

02

03

04

01

02

03

04

ABC-A4704-GBP

ABC-A4704-GBP

ABC-A4704-GBP

ABC-A4704-GBP

ABC-A4704-USD

ABC-A4704-USD

ABC-A4704-USD

ABC-A4704-USD

ABC-A4704-CAD

ABC-A4704-CAD

ABC-A4704-CAD

ABC-A4704-CAD

ABC-A0504-GBP

ABC-A0504-GBP

ABC-A0504-GBP

ABC-A0504-GBP

04

04

04

04

04

04

04

04

04

04

04

04

04

04

04

04

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

24

24

24

24

24

24

24

24

24

24

24

24

24

24

24

24

TA17

TA18

TA19

TA20

TA21

TA22

TA23

TA24

A0504

A0504

A0504

A0504

A0504

A0504

A0504

A0504

USD

USD

USD

USD

CAD

CAD

CAD

CAD

01

02

03

04

01

02

03

04

ABC-A0504-USD

ABC-A0504-USD

ABC-A0504-USD

ABC-A0504-USD

ABC-A0504-CAD

ABC-A0504-CAD

ABC-A0504-CAD

ABC-A0504-CAD

04

04

04

04

04

04

04

04

ABC

ABC

ABC

ABC

ABC

ABC

ABC

ABC

24

24

24

24

24

24

24

24

SND5

SND6

SND7

SND8

SND9

SND10

SND11

SND12

Note - The references do not require any particular format or structure (the values used here are to aid the reader’s understanding).

SN&D

SND1

SND2

SND3

SND4

SND5

SND6

SND7

SND8

SND9

SND10

SND11

SND12

SND1

SND2

SND3

SND4 eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

11 of 60

Date: 16/04/2020

4.2 Identification of Parties

London market company codes (i.e. stamp numbers) and Lloyd’s syndicate numbers will be provided in either <Insurer><Party><Id> or <Reinsurer><Party><Id> to identify the participating carriers.

Note that for Lloyd’s consortia, it is the consortium number that should be provided

In each case the <Party><Id Agency> will be given to identify the bureau as one of ‘lloyds’ or

‘institute_of_london_underwriters’ or ‘london_insurance_and_reinsurance_market_association’ .

XIS will validate that the party identifiers given are valid codes for the applicable agency

London market broker codes will be provided in <Broker><Party><Id> with a <Party><Id Agency> given as ‘lloyds’.

Details of either the insured or the reinsured name must also be given, in

<Insured><Party><Name> or <Cedent><Party><Name> as appropriate.

XIS will be identified in <ServiceProvider><Party><Id> with a <Party><Id Agency> given as

‘ DUNS_dun_and_bradstreet’ . The Party Id used for XIS will be ‘236196817’ .

4.3 Broker References 1 and 2

Broker References 1 and 2 are required for brokers’ reconciliations and are returned by XIS in the BSM and

IPCBSM messages that advise brokers of XIS signings.

However, these references are not explicitly provided in the Technical Account. Therefore these two fields must be concatenated in the Technical Account, in <SubAccount><Description>

This will be mapped to the XIS legacy systems as follows:

Broker Reference 1 will be set to characters 1-12 in the element <SubAccount><Description>

Broker Reference 2 will be set to characters 13-24 in the element <SubAccount><Description>

N.B. Broker Reference 1 and Broker Reference 2 can only contain characters A-Z, 0-9, / and space.

These are the only characters permitted by the XIS mainframe systems. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

12 of 60

Date: 16/04/2020

4.4 Explanation

<Explanation> can be used by brokers to provide any narrative details to clarify any aspect of a transaction.

It is recommended that, where a broker submits more than one Technical Account for a carrier’s line other than for different currencies and/or due dates, a description of what the Technical Account is in respect of should be provided as narrative in <Explanation>.

In particular, XIS request that:

1. Where the broker is submitting separate closing sections due to different carrier exposures or to separate direct and reinsurance coverage, <Explanation> should contain a description of the section to which each Technical Account relates.

2. Where the broker has created non-fundamental splits and is submitting separate Technical Accounts for each non-fundamental split, <Explanation> should contain a description of the non-fundamental split to which each technical Account relates.

XIS does not require this narrative to be in any particular form, but absence of some explanation in these cases may lead to a query being raised by XIS if it is not clear what the Technical Account is in respect of. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

13 of 60

Date: 16/04/2020

4.5 Defining the Type of Business

4.5.1 Treaty or Facultative Indicator

For Direct Insurance, <Contract><TreatyFac> must have a value of “direct”

For Facultative Reinsurance, <Contract><TreatyFac> must have a value of “facultative”

For Excess of Loss Reinsurance, <Contract><TreatyFac> must have a value of “treaty”

For Binding Authorities, <Contract><TreatyFac> must have a value of “direct” or “facultative”

For Bulking Lineslips, <Contract><TreatyFac> must have a value of “direct” or “facultative”

For Non Bulking Lineslips, <Contract><TreatyFac> must have a value of “direct” or “facultative” or

“treaty”

For Covers, <Contract><TreatyFac> must have a value of “direct” or “facultative”

4.5.2 Contract Nature

For Direct Insurance, <Contract><ContractNature> must have a value of “nonproportional”

For Facultative Reinsurance, <Contract>><ContractNature> must have a value of

“nonproportional”

For Excess of Loss Reinsurance, <Contract>><ContractNature> must have a value of

“nonproportional”

For Binding Authorities, <Contract>><ContractNature> must have a value of “nonproportional”

For Bulking Lineslips, <Contract>><ContractNature> must have a value of “nonproportional”

For Non Bulking Lineslips, <Contract>><ContractNature> must have a value of “nonproportional”

For Covers, <Contract>><ContractNature> must have a value of “nonproportional”

4.5.3 Cover Type

For Binding Authorities, <ContractSection><CoverType> must have a value of “binding_authority” or “limited_binder”

For Bulking Lineslips, <ContractSection><CoverType> must have a value of “lineslip”

For Non Bulking Lineslips, <ContractSection><CoverType> must have a value of “lm_facility”

For Covers, <ContractSection><CoverType> must have a value of “open_cover” eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

14 of 60

Date: 16/04/2020

4.6 Defining the Type of Transaction

The type of transaction will be defined in <AccountTransactionType>, using a subset of code values from the ACORD A17 code set.

Details of the code values permitted for eAccounts are provided in Appendix 6.

4.7 Use of Original Broker Signing Numbers & Dates

For AP and RP submissions, unless the AP/RP is being submitted at the same time as the original premium, the broker must provide the Original Broker Signing Number & Date (OBSND) of the relevant original premium/FDO signing in the element <Contract><ServiceProviderReference>.

Similarly, for OP declarations on non-bulking lineslips, the broker must provide the OBSND of the relevant facility FDO signing in the element <Contract><ServiceProviderReference>.

The required formats of the signing references f or Lloyd’s, ILU and LIRMA are shown in Appendix 5.

4.8 Use of Percentages

The following format conventions will apply to percentage fields given in the Technical Account:

For <ContractSection><InsurerSharePercentage> up to 7 decimal places may be given

For <ContractSection><ReinsurerSharePercentage> up to 7 decimal places may be given

For all other percentages up to 7 decimal places may be given

It should be noted that the Insurer or Reinsurer Share Percentage should be expressed such that, when applied to 100% amounts, it results in the share amount of the receiver.

The 100% amounts will represent the 100% values as seen by the originating client/cedent (i.e. without application of any sort of order etc). This is to enable the receiver to reconstitute the 100% amounts from their share percentage” eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

15 of 60

Date: 16/04/2020

4.9 Use of Amounts

4.9.1 Amount Types

Any amount types from the ACORD 5025 code set may be included with an AmtStatus of

“ informational ”. These amounts must not contribute to the Technical Account balance and will be ignored by Xchanging.

The non-informational amount types that may be provided in the Technical Account are limited to those that XIS have mapped to the Premium Advice. The list of amount types that can be provided, and their mapping to the Premium Advice, is shown in the table below.

Technical Account Amount Type adjustment_premium_due_by_sender adjustment_premium_due_to_sender adjustment_reinstatement_premium_due_by_sender adjustment_reinstatement_premium_due_to_sender adjustment_sliding_scale_commission_due_from_sender adjustment_sliding_scale_commission_due_to_sender brokerage deferred_premium_released_net_of_commission deferred_premium_retained_net_of_commission deposit_premium deposit_released_outstanding_losses deposit_released_outstanding_losses_original deposit_released_premium_fund deposit_retained_outstanding_losses deposit_retained_outstanding_losses_original deposit_retained_premium_fund differences_on_exchange_rate_fluctuations_due_to_sender differences_on_exchange_rate_fluctuations_due_from_sender fire_protection_charges fronting_fee gross_premium income_tax instalment_premium

Premium Advice

Field

Gross Premium

Gross Premium

Gross Premium

Gross Premium

Other Deductions

Other Deductions

Brokerage

Gross Premium

Gross Premium

Gross Premium

Gross Premium

Gross Premium

Gross Premium

Premium Reserve

Premium Reserve

Premium Reserve

Gross Premium

Gross Premium

Other Deductions

Other Deductions

Gross Premium

Taxes

Gross Premium

DR/CR to the Carrier

Credit

Debit

Debit

Debit

Debit

Credit

Debit

Debit

Credit

Debit

Credit

Credit

Debit

Credit

Debit

Credit

Debit

Debit

Credit

Debit

Credit

Credit

Credit eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

16 of 60

Date: 16/04/2020

Technical Account Amount Type insurance_premium_tax interest_on_premium_reserve inuring_or_common_account_ri_premium management_expenses margin_premium noclaim_bonus overriding_commission premium premium_portfolio_in premium_portfolio_withdrawal premium_tax_fet premium_tax_excl_fet profit_commission reinsurance_commission reinsurance_deductions reinstatement_premium retrospective_premium_adjustment_due_by_sender retrospective_premium_adjustment_due_to_sender tax_amount tax_on_deposit_interest taxable_interest_on_balances transfer_tax

Premium Advice

Field

IPT

Gross Premium

Gross Premium

Other Deductions

Gross Premium

Gross Premium

Other Deductions

Gross Premium

Gross Premium

Gross Premium

Taxes

Taxes

Gross Premium

Other Deductions

Other Deductions

Gross Premium

Gross Premium

Gross Premium

Taxes

Taxes

Gross Premium

Taxes

DR/CR to the Carrier

Debit

Credit

Debit

Debit

Credit

Debit

Debit

Credit

Credit

Debit

Debit

Debit

Debit

Debit

Debit

Credit

Credit

Debit

Debit

Debit

Debit

Debit eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

17 of 60

Date: 16/04/2020

4.9.2 XIS Calculation of Premium Advice Amounts

All amounts given in the Technical Account will be expressed as the individual carrier share amount in original currency. Where a non de-linked transaction is being advised in convertible currency, the balance amount will also be given as the carrier’s share amount in settlement currency.

However, on the Premium Advice:

Gross premium is given as the 100% amount in original currency

Total bureau share percentage is shown

Rate of exchange is shown (if applicable)

Net premium is shown as the bureau share amount in settlement currency.

XIS will accumulate those individual share amounts to arrive at the total bureau values for processing and will calculate the 100% values and rate of exchange as necessary.

4.9.3 Signs of Amounts

Amounts within the Technical Account are usually given without a positive (+) or negative (-) sign.

However, if an amount is given with a negative sign then it will have the opposite meaning to normal

– i.e. an amount that would normally represent a credit to the receiver would instead be a debit.

Please refer to the ACORD RLC Codes Manual for details of whether each amount represents a default debit or credit to the receiver of a Technical Account.

Please also note the following points:

1. The default flow of money for an Insurance Premium Tax (IPT) amount is designated by

ACORD as being from the insurer/reinsurer to the broker – i.e. it is regarded as a deduction.

In fact IPT operates in the opposite manner to this, as it is treated as an addition to the premium.

Therefore, for premium transactions an IPT amount must be sent as a negative value and for RP transactions it must be sent as a positive value.

2. For transactions where the Technical Account balance is due to the broker (e.g. an RP), although the individual amount items given in the sub account may have negative signs because the flow of money is contrary to the normal direction, the

<Subaccount><BalanceAmtItem> and <BalanceAmtItem> will in these cases be qualified as “due to the sender” and therefore those balance amounts must be sent as positive values. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

18 of 60

Date: 16/04/2020

Example 1 - An Original Premium

This is an example of a transaction with:

A Gross Premium of £1000

Deductions of £200 Brokerage

An addition of £60 IPT

A net p remium of £850 due to the reinsurer

In the Technical Account the amounts would be presented as follows:

Amount Type

Premium

Brokerage

Insurance Premium Tax

Balance Due By Sender

Amount Value

£1000.00

£200.00

£60.00

£860.00

Flow of Money

Due to the insurer/reinsurer

Due to the broker

Due to the insurer/reinsurer

Due to the insurer/reinsurer

Example 2 - A Return Premium

This is an example of a transaction with:

A Gross Premium of £700

Deductions of £140 Brokerage

An addition of £42 IPT

A net premi um of £602 due to the broker

In the Technical Account the amounts would be presented as follows:

Amount Type

Gross Premium

Brokerage

Insurance Premium Tax

Balance Due To Sender

Amount Value

£700.00

£140.00

£42.00

£602.00

Flow of Money

Due to

Due to

Due to the broker the insurer/reinsurer the broker

Due to the broker

Note that in Example 2 the Gross Premium and Brokerage amounts are given as negative values, and the IPT amount is given as a positive amount, because the flow of money is the opposite to the normal direction.

However, the balance is given as a positive value because it is qualified as being due to the sender

(i.e. the broker). eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

19 of 60

Date: 16/04/2020

4.9.4 Insurance Premium Tax

Insurance Premium Tax (IPT) will be given as a <TechAccountAmtItem Type> of

‘insurance_premium_tax’

The Lloyd’s and company markets have different requirements for the presentation of UK and non-

UK IPT. XIS will deal with this internally, by using <TechAccountAmtItem Type><Description>

to differentiate between UK IPT and non-UK IPT.

Therefore a description must always be provided with an IPT amount.

For UK IPT the description must contain the value “insurance_premium_tax” .

For non-UK IPT the description may contain any other value, such as the country for which the tax applies.

In cases where a premium has been incorrectly signed without IPT and a subsequent transaction is required to process the IPT amount only, the broker must process a cancellation for the original transaction followed by a replacement transaction for the premium plus the IPT.

Due to the reporting requirements of Lloyd’s, where a transaction includes a non-UK IPT amount that exceeds the deductions, XIS is required to sign the premium and the IPT amount separately.

Therefore, where a Technical Account for a Lloy d’s carrier includes a non-UK IPT amount that is greater than the deductions, XIS will automatically create two Premium Advices.

On completion of business processing each Premium Advice will be given a separate OBSND.

Only the Broker Signing Number & Date for the premium transaction will be returned in the Level 4

Acknowledgement for each Technical Account. If the signing is an original premium then this will be the OBSND that must be provided with subsequent AP/RP submissions.

However, it should be noted that both the premium and the IPT signings will be included in the BSM.

Use of the Tax Rate Field

The Tax Percentage field in the Technical Account message is an optional field that can be used by brokers to provide the tax rate for taxes that are deducted from premiums (e.g. US Federal Excise

Tax) and/or taxes that are added to premiums (e.g. UK IPT).

Xchanging uses the figures provided by brokers within the tax amount field to calculate the figures that are displayed in boxes 17 and 20 on the system-generated Premium Advices that are loaded on to the Market Repository. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

20 of 60

Date: 16/04/2020

4.10 Payment Means

Where a transaction is to be de-linked then <PaymentMeans> must contain ‘as_per_financial_account’.

The broker will then submit Financial Account messages, or use the on-line De-linking Trigger or RESETT message, to release that transaction for settlement, when ready to do so.

Where a transaction is not to be de-linked then <PaymentMeans> must contain ‘in_cash’. This will be taken as an instruction to XIS to proceed to settlement upon business agreement of the transaction. No

Financial Account will be expected.

Note - For Technical Accounts that have a nil balance (e.g. FDOs and nil adjustments) the

<PaymentMeans> must be ‘in_cash’.

Where it is known that a transaction is to be paid entirely outside of central settlement, then

<PaymentMeans> must contain ‘settled_direct’ . In this case no Financial Account will be expected.

4.11 Due Date

For premiums that are to be paid by instalments, <DueDate> must be provided as the due date of the particular instalment that is being advised in the technical Account.

<DueDate> will not be required for nil balance accounts.

For all other transactions it is recommended that the Settlement Due Date, as recorded on the slip, be provided in <DueDate>. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

21 of 60

Date: 16/04/2020

5

London Market Deferred Scheme

The following pages provide additional completion instructions that are specific to submissions for premium instalments that are to be processed using the London Market Deferred Scheme.

5.1 Account Transaction Type

It will be necessary to differentiate instalments that are to be processed via the deferred scheme from instalments that are to be processed as individual APs.

Where an instalment is to be processed via the deferred scheme, the Technical Account will include a specific ACORD code value for <AccountTransactionType>.

The code value used will depend on the type of transaction as shown in the table below.

Transaction Type

Original Premium

Additional Premium

Return Premium

Account Transaction Type

“premium_deferreds_original”

“premium_deferreds_additional_premium”

“premium_deferreds_return_premium”

5.2 Grouping Requirements

Each Technical Account must include:

<GroupReference> to identify the messages for processing together and

<ItemsInGroupTotal> to define the number of instalments

5.3 Broker References 1 and 2

Each instalment that relates to the same premium transaction must have the same Broker Reference 1 and

Broker Reference 2, which is provided in the Technical Account in <SubaccountDescription>.

If the broker submits at the fundamental level then each fundamental bureau transaction will require a different Broker Reference 1 & 2 (but all splits created by XIS will then share the same Broker Reference 1 & 2).

If the broker submits at a non-fundamental level then each split bureau transaction will require a different Broker Reference 1 & 2.

5.4 Instalment Amount

Each Technical Account must include a <TechAccountAmtItem> with a type of “instalment_premium” to give the gross premium amount of the instalment eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

22 of 60

Date: 16/04/2020

5.5 Instalment Number

Each Technical Account must include an <InstalmentNbr> with the “instalment_premium” amount item.

This is a sequence number to uniquely identify each instalment. Therefore it must be different for each instalment.

An example of the use of the InstalmentNbr is shown here:

<TechAccountAmtItem Type="instalment_premium"

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">0.0</Amt>

<InstalmentNbr>

<Count>1</Count>

</InstalmentNbr>

</TechAccountAmtItem

5.6 Instalment Due Date

Each Technical Account must include a <DueDate>. This is the settlement due date for each instalment, which must be equal to or greater than the due date of the previous instalment.

5.7 Payment Means

Deferred instalments may be submitted as:

non de-linked ( <PaymentMeans> is “ in_cash ”), or

de-linked ( <PaymentMeans> is “ as_per_financial_account ”),

If the first instalment is “ in_cash ” then all of the subsequent instalments must also be “ in_cash ”).

If the first instalment is “ as_per_financial_account ” then all of the subsequent instalments may also be

“ as_per_financial_account ”, or all of the subsequent instalments may be “ in_cash ”).

Note – All subsequent instalments must have the same value for Payment Means.

See the Financial Account Interface Specification for details of the impact of the choice of Payment Means on the requirements for the submission of Financial Accounts.

Regardless of the Payment Means specified in the Technical Accounts, it should be noted that, as today, when the first instalment is released for settlement each subsequent instalment will be automatically released for settlement on its due date. eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

23 of 60

Date: 16/04/2020

6

Operational Issues

6.1 Service Availability

XAG and the Repository, including the Direct Load facility, will generally be available 24x7 to receive submissions 3 .

However, these services are only supported during normal working hours (07:00-19:00 UK time from

Monday to Friday, excluding public holidays). Availability outside of these hours cannot be guaranteed.

6.2 Presentation Date

Presentation Date is used in a variety of situations by market firms as well as by Xchanging, including monitoring Xchanging’s performance against service levels and, in some circumstances, to establish premium payment by a broker. It is therefore important to understand how a certain Presentation Date is established. In the electronic accounts environment, although the Xchanging ACORD gateway may be available to receive brokers’ submissions outside of normal working hours, the allocation of the Presentation

Date w ill follow today’s paper procedures.

The validity of a Technical Account is determined by the return by Xchanging of a positive Level 3

Acknowledgement to the broker (which will also confirm date of receipt). Between the time when submission of a Technical Account is made and Xchanging return a Level 3 Acknowledgement there are a number of technical validation steps that need to occur. Validation may therefore occur after 5pm.

Therefore, Presentation Date will be established as follows:

Where a Technical Account is received by XIS by 5pm and that Technical Account subsequently proves to be valid, as confirmed by return of a positive Level 3 Acknowledgement, a Presentation Date of the day of receipt will be allocated.

Where a Technical Account is received by XIS after 5pm and that Technical Account subsequently proves to be valid, as confirmed by return of a positive Level 3 Acknowledgement, a Presentation Date of the next working day will be allocated.

6.3 Business Service Levels

Existing XIS business service levels will apply.

.

3

This is subject to agreed service levels.

eAccounts Technical Account Interface Specification

Release 2.0, Version 1.1 Page

24 of 60

Date: 16/04/2020

Appendix 1 – Technical Account Message

The following pages describe the completion of the ACORD 2008.1 RLC Technical Account.

N.B. The XML shown here includes all of the elements that XIS use. However, where a data element is not present empty XML tags should not be sent.

Acord Tag/Element Requirement Conditionality/Population Rules

Mandatory <Jv-Ins-Reinsurance Version="2008-1"

xmlns="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1

Jv-Ins-Reinsurance-2008-1.xsd">

<TechAccount Sender="broker" Receiver="reinsurer">

<UUId></UUId>

<BrokerReference>-</BrokerReference>

<CreationDate>-<CreationDate>

<AccountTransactionType>-</AccountTransactionType>

<Explanation>-</Explanation>

<GroupReference>-</GroupReference>

<ItemsInGroupTotal>

<Count>-</Count>

</ItemsInGroupTotal>

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Optional

Conditional

Receiver must be either "insurer" or "reinsurer" depending on which of those parties is given below

Format: CCYY-MM-DD

From ACORD codeset A17

Text to provide any additional information or instructions to the XIS technician

A reference to group instalment transactions to be processed together for this insurer/reinsurer. Only required if there is more than one in the group

Conditional

Conditonal

Conditional

The number of instalment transactions to be processed together for this insurer/reinsurer. Only required if there is more than one in the group eAccounts Technical Interface Specification

Version 2.9 Page

25 of 60 Date: 16/04/2020

<ServiceProviderGroupReference>-</ServiceProviderGroupReference>

<ServiceProviderGroupItemsTotal>

<Count>-</Count>

</ServiceProviderGroupItemsTotal>

<Cedent>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</Cedent>

<Reinsurer>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</Reinsurer>

<Insurer>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</Insurer> eAccounts Technical Interface Specification

Version 2.9 Page

26 of 60

Conditional

Conditional

Conditional

A reference to group all of the Technical Accounts to be processed together for all transactions for all participating carriers. Only required if there is more than one in the group

The total number of Technical Accounts to be processed together for all transactions for all participating carriers. Only required if there is more than one in the group

Conditional

Conditional

Conditional

Conditional

Conditional

Conditional

Conditional

Conditional

Conditional

Conditional

From ACORD 3055 codeset

Mandatory for reinsurance business.

Optional

Conditional

Conditional

Conditional

Conditional

Conditional

Mandatory if not reinsurance business. Mutually exclusive with <Reinsurer> element.

Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

Optional

Conditional

Conditional

Mandatory for reinsurance business.

Mutually exclusive with <Insurer> element.

Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

Date: 16/04/2020

<Broker>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

<Contact>

<PersonName>-</PersonName>

<Telephone>-</Telephone>

<Email>-</Email>

</Contact>

</Broker>

<ServiceProvider>

<Party>

<Id Agency="DUNS_dun_and_bradstreet">-</Id>

<Name>-</Name>

</Party>

</ServiceProvider>

<Insured>

<Party>

<Name>-</Name>

</Party>

</Insured>

<OriginalPolicyholder>

<Party>

<Name>-</Name>

</Party>

</OriginalPolicyholder> eAccounts Technical Interface Specification

Version 2.9 Page

27 of 60

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Mandatory

Mandatory

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Agency must be 'lloyds'.

Id will contain Lloyd's broker code

The broker technician name

The broker technician telephone number

The broker technician email address

Set Agency to "DUNS_dun_and_bradstreet"

Set Id to "236196817"

Set to "XIS"

Include if applicable. Recommended for direct insurance business

Include if applicable. Recommended for facultative reinsurance business

Date: 16/04/2020

<AccountingYear>-</AccountingYear>

<AccountPeriod>

<StartDate>-</StartDate>

<EndDate>-</EndDate>

</AccountPeriod>

<ReferenceCurrency>

<Ccy>-</Ccy>

</ReferenceCurrency>

<TargetCurrency>

<Ccy>-</Ccy>

</TargetCurrency>

<AmtShareIndicator>-</AmtShareIndicator>

<CorrectionIndicator>-</CorrectionIndicator>

<ReferredTechAccount>

<UUId>-</UUId>

<BrokerReference>-</BrokerReference>

</ReferredTechAccount>

<Contract>

<ContractName>-</ContractName>

<TreatyFac>-</TreatyFac>

<ContractNature>-</ContractNature>

<BrokerReference>-</BrokerReference>

<ReinsurerReference>-</ReinsurerReference>

<InsurerReference>-</InsurerReference>

<ServiceProviderReference>-</ServiceProviderReference>

</Contract> eAccounts Technical Interface Specification

Version 2.9 Page

28 of 60

Optional

Optional

Optional

Optional

Optional

Mandatory

Mandatory

Mandatory

Conditional

Conditional

Conditional

Mandatory

Conditional

Conditional

Conditional

The year of account. Formay CCYY

Format: CCYY-MM-DD

Format: CCYY-MM-DD

From ISO codeset 4217

Mandatory where settlement is in a different currency.

From ISO codeset 4217.

Must be a valid settlement currency for the market concerned.

Set to "receiver_share"

Set to "reversal" for a cancellation. Else omit.

The UUID of a Technical Account that is being cancelled or replaced.

Provided for cancellations and reversals but not replacements

The broker reference of a Technical Account that is being cancelled or replaced.

Conditional

Conditional

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Conditional

Conditional

The broker's contract name

One of 'treaty' or 'facultative' or 'direct'

Currently this will be limited to 'nonproportional'.

When proportional treaty business is included a value of 'proportional' will also be allowed.

The UMR

Mandatory when <Reinsurer> element is included. Mutually exclusive with <Contract><InsurerReference>

Mandatory when <Insurer> element is included.

Mutually exclusive with <Contract><ReinsurerReference>

Include where the transaction is an AP or RP, or an OP declaration on a non-bulking lineslip, to provide the OBSND of the original premium/FDO

Mandatory

Date: 16/04/2020

<Subaccount>

<SequenceNbr>-</SequenceNbr>

<Description>-</Description>

<ContractSection>

<CoverType>-</CoverType>

<LayerOrSurplusNbr>-</LayerOrSurplusNbr>

<InsuredRiskOrInterestDescription>-</InsuredRiskOrInterestDescription>

<ContractPeriod>

<StartDateTime>-</StartDateTime>

<EndDateTime>-</EndDateTime>

</ContractPeriod>

<UnderwritingYear>-</UnderwritingYear>

<ReinsurerSharePercentage>

<Rate RateUnit="percentage">0.0</Rate>

</ReinsurerSharePercentage>

<InsurerSharePercentage>

<Rate RateUnit="percentage">0.0</Rate>

</InsurerSharePercentage>

<BrokerSharePercentage>

<Rate RateUnit="percentage">0.0</Rate>

</BrokerSharePercentage> eAccounts Technical Interface Specification

Version 2.9 Page

29 of 60

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Only a single subaccount will be provided per message.

Set to 1

Characters 1-12 will be mapped into the Broker Reference 1

Characters 13-24 will be mapped into Broker Reference 2 .

Set to 'binding_authority' or 'limited_binder' for a Binding Authority

Account, to "lineslip" for a Bulking Lineslip, to 'lm_facility' for a Non

Bulking Lineslip and to "open_cover" for a Cover.

Optional

Optional

Mandatory

Mandatory

Mandatory

Format: CCYY-MM-DDThh:mm:ss*hh:mm

Time need not be given Note

- ss can be set to 00 and * can be '+' or '-' relative to GMT

Format: CCYY-MM-DDThh:mm:ss*hh:mm

Time need not be given Note

- ss can be set to 00 and * can be '+' or '-' relative to GMT

Mandatory

Mandatory

Conditional

Conditional

Conditional

Conditional

Conditional

Conditional

Mandatory

Mandatory

Mandatory

Mandatory when <Reinsurer> element is included. Mutually exclusive with <InsurerSharePercentage>

Mandatory when <Insurer> element is included.

Mutually exclusive with <ReinsurerSharePercentage>

Used to provide the broker's slip order percentage

Date: 16/04/2020

<ContractCoverage CoverageType="-">

< Description > </ Description >

</ContractCoverage>

<Brokerage>

<Description>-</Description>

<BrokeragePercentage>

<Rate RateUnit="percentage">0.0</Rate>

</BrokeragePercentage>

<BrokerageBasis>-</BrokerageBasis>

</Brokerage>

<TaxPercentage>

<Rate RateUnit="percentage">0.0</Rate>

</TaxPercentage>

</ContractSection>

<JvClassOfBusiness>-</JvClassOfBusiness>

<NaicClassOfBusiness>-</NaicClassOfBusiness>

<RiskLocation>

<Location>

<Country>-</Country>

</Location>

</RiskLocation>

<!-- SupportingDocument is repeatable-->

<ac:SupportingDocument>

<ac:DocumentId>-</ac:DocumentId>

<ac:DocumentReference>-</ac:DocumentReference>

<ac:DocumentVersion>-</ac:DocumentVersion>

<ac:DocumentTypeCd>-</DocumentTypeCd>

</ac:SupportingDocument> eAccounts Technical Interface Specification

Version 2.9 Page

30 of 60

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Optional

Mandatory

Mandatory

Optional

Optional

Optional

Optional

Optional

Optional

Conditional

Conditional

From ACORD codeset A86

Include if applicable.

From ACORD codeset A67 if applicable

Include if applicable

One of "aviation", "marine" or

"nonmarine_general_and_miscellaneous_liability"

From ACORD codeset A150

Conditional

Conditional

Conditional

Conditional

A separate <ac:SupportingDocument> aggregate must be included for each document provided in support of the Technical Account

The UUID of the document. One of <ac:DocumentId> or

<ac:DocumentReference> must be provided. Mutually exclusive with

<ac:DocumentReference>.

The sender's reference for the document. One of <ac:DocumentId> or

<ac:DocumentReference> must be provided. Mutually exclusive with

<ac:DocumentId>.

Must be given if <ac:DocumentReference> is given

From ACORD codeset A54. Must be provided if the Supporting

Document aggregate is included

Date: 16/04/2020

<!-- TechAccountAmtItem is repeatable-->

<!-- A non-informational amount that contributes to the sub-account balance -->

<TechAccountAmtItem Type="premium" >

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">123.00</Amt>

</TechAccountAmtItem>

<!-- An premium instalment amount that contributes to the sub-account balance -->

<TechAccountAmtItem Type="instalment_premium" >

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">123.00</Amt>

<InstalmentNbr>

<Count>1</Count>

</InstalmentNbr>

</TechAccountAmtItem>

<!-- A nil amount -->

<TechAccountAmtItem Type="premium" >

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">0.00</Amt>

</TechAccountAmtItem>

<!-- An informational amount that is advised, but does not form part of the balance -->

<TechAccountAmtItem Type="underlying_premium" AmtStatus="informational">

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">123.00</Amt>

</TechAccountAmtItem>

<!-- Insurance Premium Tax can repeat where multiple IPTs apply -->

<TechAccountAmtItem Type="insurance_premium_tax" >

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">123.00</Amt>

<Description>-</Description>

</TechAccountAmtItem>

<!-- Tax amount can repeat where multiple Taxes apply -->

<TechAccountAmtItem Type="tax_amount" >

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">123.00</Amt>

<Description>-</Description>

</TechAccountAmtItem> eAccounts Technical Interface Specification

Version 2.9 Page

31 of 60

Include for each amount in the Technical Account. The amount items shown below are examples of how this aggregate should be completed.

Conditional

Mandatory

Conditional

Conditional

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Conditional

Mandatory

Conditional

Conditional

Mandatory

Conditional

Conditional

Mandatory

Mandatory

InstalmentNbr is mandatory with this amount type

Description is mandatory to advise whether the amount is in respect of

UK IPT or non-UK IPT. A description of "insurance_premium_tax" means UK. Anything else means non-UK

Conditional

Conditional

Mandatory

Optional

Conditional

Description can be used where necessary to identify the specific tax.

Date: 16/04/2020

<!-- An individual claim amount to link a reinstatement AP/RP to a claim -->

<IndividualClaimAmtitem Type="current_payment_losses_and_expenses for contract"

AmtStatus="informational">

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">0.0</Amt>

<Claim>

<BrokerReference>-</BrokerReference>

</Claim>

<ClaimEntry>

<BrokerReference>-</BrokerReference>

</ClaimEntry>

</IndividualClaimAmtItem>

<BalanceAmtItem Type="-">

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">0.0</Amt>

<Amt Share="receiver_share" CcyIndic="target_currency" Ccy="-">-</Amt>

</BalanceAmtItem>

</Subaccount>

<PaymentMeans></PaymentMeans>

<BalanceAmtItem Type="-">

<Amt Share="receiver_share" CcyIndic="reference_currency" Ccy="-">0.0</Amt>

<Amt Share="receiver_share" CcyIndic="target_currency" Ccy="-">-</Amt>

<DueDate>-</DueDate>

</BalanceAmtItem>

</TechAccount>

</Jv-Ins-Reinsurance> eAccounts Technical Interface Specification

Version 2.9 Page

32 of 60

Conditional

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Mandatory

Mandatory

Mandatory

Conditional

Conditional

The UCR of the related claim

The TR of the related claim

Mandatory

Conditional

Mandatory

Mandatory

For an RP set to

"technical_account_subaccount_balance_due_to_sender". Otherwise set to "technical_account_subaccount_balance_due_by_sender"

Mandatory where settlement is in a different currency.

Set to "as_per_financial_account" if the premium is de-linked or the

Tech Account has a nil balance.

Set to "in_cash" if the premium is not de-linked.

Set to "settled_direct" if the premium is not to be paid by central settlement

For an RP set to

"technical_account_settlement_balance_due_to_sender" Otherwise set to "technical_account_settlement_balance_due_by_sender"

Mandatory where settlement is in a different currency.

Format: CCYY-MM-DD

Mandatory for premiums that are to be paid by instalments, to give the due date of the instalment Not required for nil balance accounts.

Recommended that Settlement Due Date be given for all other transactions

Mandatory

Mandatory

Mandatory

Date: 16/04/2020

Appendix 2 – Level 3 Acknowledgement Message

The following pages describe the completion of the ACORD 2008.1 RLC Acknowledgement.

N.B. Empty XML tags will not be sent.

ACORD Tag/Element

<Jv-Ins-Reinsurance Version="2008-1"

xmlns="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1

Jv-Ins-Reinsurance-2008-1.xsd">

<Acknowledgement Sender="reinsurer" Receiver="broker">

Requirement Conditionality/Population Rules

Mandatory May be"insurer" or "reinsurer" depending on which of those parties is given below

<UUId>-</UUId>

<CreationDate>-</CreationDate>

<ReinsurerReference>-</ReinsurerReference>

<InsurerReference>-</InsurerReference>

<AcknowledgementTransactionType>-</AcknowledgementTransactionType>

<Reinsurer>

Mandatory

Mandatory

Conditional

Conditional

Mandatory

Conditional

Format: CCYY-MM-DD

Mandatory if Sender = "reinsurer"

Mandatory if Sender = "insurer"

Set to "response"

Mandatory for reinsurance business.

Mutually exclusive with <Insurer> element.

<Party>

<Id Agency="-">-</Id>

Conditional

Conditional Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

<Name>-</Name>

</Party>

</Reinsurer>

<Insurer>

Optional

Conditional

Conditional

Conditional Mandatory if not reinsurance business.

Mutually exclusive with <Reinsurer> element.

<Party>

<Id Agency="-">-</Id>

Conditional

Conditional Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

<Name>-</Name>

</Party>

</Insurer> eAccounts Technical Interface Specification

Version 2.9 Page

33 of 60

Optional

Conditional

Conditional

Date: 16/04/2020

<Broker>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</Broker>

<ServiceProvider>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</ServiceProvider>

<ReferredTransactionType>

<DocumentType>-</DocumentType>

</ReferredTransactionType>

<ReferredTechAccount>

<UUId></UUId>

<BrokerReference>-</BrokerReference>

<ServiceProviderReference>-</ServiceProviderReference>

</ReferredTechAccount>

<Response>

<AcknowledgementLevelIndicator>-</AcknowledgementLevelIndicator>

<AcknowledgementStatus>-</AcknowledgementStatus>

<ResponseDescription>-</ResponseDescription>

<ErrorIndicator>-</ErrorIndicator>

</Response>

</Acknowledgement>

</Jv-Ins-Reinsurance> eAccounts Technical Interface Specification

Version 2.9 Page

34 of 60

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Mandatory

Mandatory

Mandatory

Mandatory

Conditional

Conditional

Mandatory

Mandatory

Mandatory

Agency must be 'lloyds'.

Id will contain Lloyd's broker code

Set Agency to "DUNS_dun_and_bradstreet"

Set Id to "236196817"

Set to "XIS"

This will be "technical_account"

Identifies the Technical Account being acknowledged

The UUID of the original Technical Account

The reference of the original Technical Account

Include where <AcknowledgementStatus> = "acknowledged".

Will contain the XIS Work Package Reference.

"application_validation"

Set to "rejected" or "acknowledged".

Include where <AcknowledgementStatus> = "rejected".

Will contain narrative description of reason for error.

Include where <AcknowledgementStatus> = "rejected".

Will contain the value "error_free_format".

Date: 16/04/2020

Appendix 3 – Level 4 Query Message

The following pages describe the completion of the ACORD 2008.1 RLC Acknowledgement for a query response.

N.B. Empty XML tags will not be sent.

ACORD Tag/Element

<Jv-Ins-Reinsurance Version="2008-1"

xmlns="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1

Jv-Ins-Reinsurance-2008-1.xsd">

<Acknowledgement Sender="reinsurer" Receiver="broker">

Requirement Conditionality/Population Rules

Mandatory May be"insurer" or "reinsurer" depending on which of those parties is given below

<UUId>-</UUId>

<ReinsurerReference>-</ReinsurerReference>

<InsurerReference>-</InsurerReference>

<CreationDate>-</CreationDate>

<AcknowledgementTransactionType>-</AcknowledgementTransactionType>

<Reinsurer>

Mandatory

Conditional

Conditional

Mandatory

Mandatory

Conditional

Mandatory if Sender = "reinsurer"

Mandatory if Sender = "insurer"

Format: CCYY-MM-DD

Set to "query"

Mandatory for reinsurance business.

Mutually exclusive with <Insurer> element.

<Party>

<Id Agency="-">-</Id>

Conditional

Conditional Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

<Name>-</Name>

</Party>

</Reinsurer>

<Insurer>

Optional

Conditional

Conditional

Conditional Mandatory if not reinsurance business.

Mutually exclusive with <Reinsurer> element.

<Party>

<Id Agency="-">-</Id>

Conditional

Conditional Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

<Name>-</Name>

</Party>

</Insurer>

Optional

Conditional

Conditional eAccounts Technical Interface Specification

Version 2.9 Page

35 of 60 Date: 16/04/2020

<Broker>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</Broker>

<ServiceProvider>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</ServiceProvider>

<ReferredTransactionType>

<DocumentType>-</DocumentType>

</ReferredTransactionType>

<ReferredTechAccount>

<UUId>-</UUId>

<BrokerReference>-</BrokerReference>

<ServiceProviderReference>-</ServiceProviderReference>

</ReferredTechAccount>

<Query>

<QueryDescription>-</QueryDescription>

</Query>

</Acknowledgement>

</Jv-Ins-Reinsurance> eAccounts Technical Interface Specification

Version 2.9 Page

36 of 60

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Agency must be 'lloyds'.

Id will contain Lloyd's broker code

Set Agency to "DUNS_dun_and_bradstreet"

Set Id to "236196817"

Set to "XIS"

This will be "technical_account"

Identifies the Technical Account being acknowledged

The UUID of the original Technical Account

The reference of the original Technical Account

This will contain the XIS Work Package Reference.

Will contain text: QUERY RAISED VIA TRACKER HAS BEEN

EMAILED TO THE BROKER CONTACT.

Date: 16/04/2020

Appendix 4 – Level 4 Acknowledgement Message

The following pages describe the completion of the ACORD 2008.1 RLC Acknowledgement to advise the Broker Signing Number & Date.

N.B. Empty XML tags will not be sent.

ACORD Tag/Element

<Jv-Ins-Reinsurance Version="2008-1"

xmlns="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1"

xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.ACORD.org/standards/Jv-Ins-Reinsurance/2008-1

Jv-Ins-Reinsurance-2008-1.xsd">

<Acknowledgement Sender="reinsurer" Receiver="broker">

Requirement Conditionality/Population Rules

Mandatory May be"insurer" or "reinsurer" depending on which of those parties is given below

<UUId>-</UUId>

<ReinsurerReference>-</ReinsurerReference>

<InsurerReference>-</InsurerReference>

<CreationDate>-</CreationDate>

<AcknowledgementTransactionType>-</AcknowledgementTransactionType>

<Reinsurer>

Mandatory

Conditional

Conditional

Mandatory

Mandatory

Conditional

Mandatory if Sender = "reinsurer"

Mandatory if Sender = "insurer"

Format: CCYY-MM-DD

Set to "response"

Mandatory for reinsurance business.

Mutually exclusive with <Insurer> element.

<Party>

<Id Agency="-">-</Id>

Conditional

Conditional Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

<Name>-</Name>

</Party>

</Reinsurer>

<Insurer>

Optional

Conditional

Conditional

Conditional Mandatory if not reinsurance business.

Mutually exclusive with <Reinsurer> element.

<Party>

<Id Agency="-">-</Id>

Conditional

Conditional Agency may be 'lloyds' or 'institute_of_london_underwriters' or

'london_insurance_and_reinsurance_market_association'

Id will contain the Lloyd's, ILU or LIRMA code

<Name>-</Name>

</Party>

</Insurer> eAccounts Technical Interface Specification

Version 2.9 Page

37 of 60

Optional

Conditional

Conditional

Date: 16/04/2020

<Broker>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</Broker>

<ServiceProvider>

<Party>

<Id Agency="-">-</Id>

<Name>-</Name>

</Party>

</ServiceProvider>

<ReferredTransactionType>

<DocumentType>-</DocumentType>

</ReferredTransactionType>

<ReferredTechAccount>

<UUId>-</UUId>

<BrokerReference>-</BrokerReference>

<ServiceProviderReference>-</ServiceProviderReference>

</ReferredTechAccount>

<Response>

<AcknowledgementLevelIndicator>-</AcknowledgementLevelIndicator>

<AcknowledgementStatus>-</AcknowledgementStatus>

</Response>

</Acknowledgement>

</Jv-Ins-Reinsurance> eAccounts Technical Interface Specification

Version 2.9 Page

38 of 60

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Mandatory

Agency must be 'lloyds'.

Id will contain Lloyd's broker code

Set Agency to "DUNS_dun_and_bradstreet"

Set Id to "236196817"

Set to "XIS"

This will be "technical_account"

Identifies the Technical Account being acknowledged

The UUID of the original Technical Account

The reference of the original Technical Account

Characters 1-15 will contain the Broker Signing Number & Date.

Additionally, if the Technical Account Payment Means was

"in_cash", characters 17-20 wil contain "APD=" and characters 21-

30 will contain the Actual Payment Date, formatted as

CCYY-MM-DD

Mandatory

Mandatory

Mandatory

Conditional

Mandatory

Mandatory

Mandatory

"business_validation"

Set to "acknowledged".

Date: 16/04/2020

Appendix 5 – Format of XIS Signing References

Lloyd’s CCYYMMDDSSSSS (13 characters)

Where CC is the Century

YY is the Year

MM

DD

SSSSS is the Month is the Day is the Serial Number

ILU TTCYYSSSSSSDDMM (15 characters)

Where TT

C

YY

SSSSSS is the Transaction Type (e.g. PM, AP, RP) is the Class of Business (A=Aviation, C= cargo, H=Hull) is the Year is the Serial Number

DD

MM is the Day is the Month

LIRMA YYMMDDPQSSSSS (13 characters)

Where YY

MM

DD is the Year is the Month is the Day

P

Q

SSSSS is the Primary Transaction Type (see table below) is the Transaction Type Qualifier is the Serial Number

LIRMA Primary Transaction Type LIRMA Transaction Type Qualifier

Code Description Code Description

4

5

6

2

3

0

1

Premium

Treaty FDO

Additional Premium

Treaty Statement (Credit balance)

Return Premium

Treaty Statement (Debit balance)

Claim

4

5

6

2

3

0

1

No modification to primary type

Cancellation of primary type

Release of reserve set up by primary type

PF rather than PM for primary type 0

Not used

Adjustment additional or return premium

Reinstatement additional or return premium eAccounts Technical Interface Specification

Version 2.9 Page

39 of 60 Date: 16/04/2020

Appendix 6 – Account Transaction Types

The table below defines the Account Transaction Types that are in scope for eAccounts and the XIS mapping of each code value to the Premium Advice values of PM, AP and RP.

Account Transaction Type

adjustment_account_for_all_types_of_adjustments adjustment_premium commission commission_adjustment commission_original deposit_premium fees lm_additional_premium_ap lm_adjustable_premium lm_adjustment_ap lm_adjustment_rp lm_ap_release_of_reserve lm_ap_reserve_deferred lm_audit_fees_additional_premium lm_audit_fees_return_premium lm_cancellation_ap lm_cancellation_premium lm_cancellation_premium_fdo lm_cancellation_premium_reserve_deferred_ap lm_cancellation_premium_reserve_deferred_premium lm_cancellation_premium_reserve_deferred_rp lm_cancellation_premium_reserve_released_deferred_ap lm_cancellation_premium_reserve_released_deferred_premium lm_cancellation_rp lm_interest_ap lm_interest_premium lm_interest_rp

PM/AP/RP

AP

PM

RP

AP

PM

RP

RP

AP

PM

PM

AP

PM

RP

RP

AP

AP

AP

PM

AP

PM

AP

AP

AP

AP

AP

PM

PM eAccounts Technical Interface Specification

Version 2.9 Page

40 of 60 Date: 16/04/2020

Account Transaction Type

lm_no_claims_bonus_add_premium lm_no_claims_bonus_return_premium lm_portfolio_transfer_in_additional_premium lm_portfolio_transfer_in_premium lm_portfolio_transfer_out lm_premium_fdo lm_premium_release_of_reserve_deferred lm_premium_reserve_deferred lm_profit_commission_ap lm_profit_commission_rp lm_rate_of_exchange_adj_binding_authority lm_rate_of_exchange_adjustment_listing_scheme_ap lm_rate_of_exchange_adjustment_listing_scheme_rp lm_rate_of_exchange_ap lm_rate_of_exchange_rp lm_reinstatement_ap lm_reinstatement_ap_on_adj_prem lm_reinstatement_rp lm_reinstatement_rp_on_adj_prem lm_release_of_reserve_ap lm_release_of_reserve_rp lm_release_reserve lm_replacement_ap lm_replacement_premium lm_replacement_premium_fdo lm_replacement_premium_reserve_deferred_ap lm_replacement_premium_reserve_deferred_premium lm_replacement_premium_reserve_deferred_rp eAccounts Technical Interface Specification

Version 2.9 Page

41 of 60

PM/AP/RP

AP

PM

RP

PM

AP

PM

PM

RP

RP

AP

RP

AP

RP

AP

AP

PM

PM

PM

AP

RP

AP

AP

RP

AP

RP

AP

PM

RP

Date: 16/04/2020

Account Transaction Type

lm_replacement_premium_reserve_released_deferred_ap lm_replacement_premium_reserve_released_deferred_premium lm_replacement_rp lm_return_premium_rp lm_rp_release_of_reserve_deferred lm_rp_reserve_deferred lm_small_transaction_ap lm_small_transaction_rp lm_survey_fees_additional_premium lm_survey_fees_return_premium lm_tax_relief_on_life_assurance_additional_premium lm_tax_relief_on_life_assurance_premium lm_tax_relief_on_life_assurance_refund_of_premium new_business_original nonoriginal_premium portfolio_transfer premium premium_deferreds_additional_premium premium_deferreds_original premium_deferreds_return_premium profit_commission reinstatement renewal_adjustment renewal_lapse renewal_original renewal_premium renewal_reinstatement replacement_additional_premium reversal_return_premium

PM/AP/RP

AP

AP

RP

AP

PM

PM

PM

PM

RP

AP

AP

AP

PM

PM

AP

AP

RP

AP

RP

AP

PM

RP

PM

AP

PM

RP

RP

RP

RP eAccounts Technical Interface Specification

Version 2.9 Page

42 of 60 Date: 16/04/2020

Appendix 7 – Technical Account Validation Rules

1. Xchanging ACORD Gateway Validation

Main Details

Rule Check Required

M1

M2

M4

M5

M6

M7

M9

M15

M17

If one of ServiceProviderGroupReference and