useful machine

advertisement

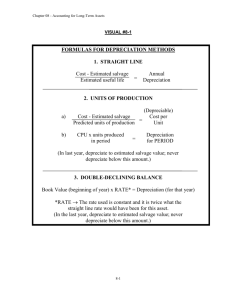

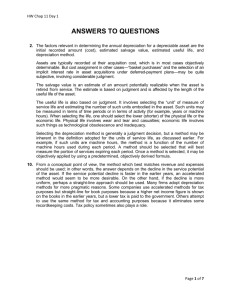

Module 11 Noncurrent Assets: Depreciation and Exchange Depreciation of Tangible Assets Depreciation is the systematic and rational allocation of the cost of noncurrent, tangible, fixed assets over their estimated useful lives. When a fixed asset is purchased, it is recorded as an asset. The amount of the asset’s cost that is allocated to an expense account in every period is called depreciation expense. Depreciation does not do the following: Ensure that the book value of assets equals their market value Accumulate cash to replace noncurrent tangible assets. Depreciation is recorded as follows: Debit Depreciation Expense Credit Accumulated Depreciation The Accumulated Depreciation account is a contra-asset account and represents the value of the asset allocated to depreciation from the time the asset was acquired, the term accumulated depreciation refers to the amount in the Accumulated Depreciation account. The book value of an asset, at any time, is the original cost minus the amount in the Accumulated Depreciation account up to that point in time. In calculating the amount of depreciation per period, the following factors are relevant: Cost, which is the price at which the asset was purchased. Estimated useful life, which is the length of service the business expects from an asset. For example, the useful life of a computer is the number of years it is expected to be used. Salvage value, which is the expected cash value of the asset at the end of its useful life. (The cost of the asset minus the salvage value is called depreciable cost.) Many methods are used to for calculate depreciation expense: Straight-Line Method. Accelerated methods. Declining-Balance Method. Sum-of-the-Years’ Digits Method. Use Factor Methods. Service Hours. Units of Production. Group/Composite Methods. Straight-Line Method 1 The straight-line method allocates an equal amount of depreciation expense to each period of the asset’s useful life. Depreciation expense each period is calculated as follows: Depreciation expense = Depreciable cost/Useful life = (Cost – Salvage value)/ Useful life At the end of each period, the depreciation for that period is added to the current Accumulated Depreciation account. Thus, the Accumulated Depreciation account includes the total depreciation from the date the asset was purchased to the current date. The difference between the cost and the accumulated depreciation amount is called the book value of the asset as noted earlier. Example: Marks Company purchased a machine for $41,000 on January 1, 2002. The machine’s salvage value is $5,000 and its useful life is 4 years. Calculate the depreciation expense, accumulated depreciation at the end of the year, and the book value at the end of the year for each year of the useful life of the asset. Depreciation expense each year = ($41,000 – $5,000)/4 = $9,000 per year Year ending 12/31/2002 12/31/2003 12/31/2004 12/31/2005 Book value at Depreciation Accumulated Book value at year beginning expense depreciation end of year $ 41,000 $ 9,000 $ 9,000 $ 32,000 32,000 9,000 18,000 23,000 23,000 9,000 27,000 14,000 14,000 9,000 36,000 5,000 Accelerated Methods for Calculating Depreciation Declining-Balance Method and Other Declining-Balance Methods Accelerated Depreciation methods allocate larger amounts to depreciation expense in the earlier periods of the assets’ useful life than in later periods. The declining-balance method is an accelerated method. We discuss the double-declining-balance method in detail. As noted later, the other declining-balance method is substantially similar, they vary according to the multiplication factor used to multiply the straight-line rate. In the double-decliningbalance method, depreciation expense is calculated as follows: Step 1: Calculate the straight-line depreciation rate. Straight-line depreciation rate = 1/Useful life Step 2: Calculate the double-declining-balance (DDB) rate. DDB rate = 2 x Straight-line rate Step 3: Calculate depreciation expense. Depreciation expense = DDB rate x Book value at the beginning of the period 2 Note 1: For the first period, the book value equals the cost of the asset. For each subsequent period, the book value is the difference between the asset’s cost and the amount of accumulated depreciation. Note 2: The asset must not be depreciated below its salvage value. If the amount of depreciation expense for a year calculated using the preceding formula reduces the book value below salvage, the amount of depreciation expense for that year is the amount needed to reduce the asset's book value to its salvage value. Example Spencer Company purchased a machine for $25,000 on January 1, 2002. The machine’s salvage value is $3,000, and its useful life is 4 years. Calculate the depreciation expense, accumulated depreciation at the end of the year, and the book value at the end of the year for each year of the asset’s useful life. Step 1: Straight line rate = 1/Useful life = ¼ = 0.25 Step 2: DDB rate = 2 x Straight-line rate = 2 x 0.25 = 0.50 Year ending Book value at year beginning B $ 25,000 12,500 6,250 3,125 Depreciation expense C = B x 0.50 $ 12,500 6,250 3,125 125* Accumulated depreciation D $ 12,500 18,750 21,875 22,000 Book value at end of year E=B–C $ 12,500 6,250 3,125 3,000 A 12/31/2002 12/31/2003 12/31/2004 12/31/2005 Note: For the final year, depreciation expense is the “plug” number. Because salvage value is given to be $3,000, the book value at the end of 2005 must equal $3,000. Because the book value at the beginning of 2005 is $3,125, the depreciation expense for the year must be $125 so that the book value becomes equal to $3,000. The approach for other declining-balance methods is very similar. The only difference is in step 2. For the DDB method, step 2 is as follows: DDB rate = 2 x Straight-line rate If we use the 150% declining-balance (as opposed to DDB) method, step 2 is as follows: 150% declining-balance rate = 1.5 x Straight-line rate If we use the 125% declining-balance (as opposed to DDB) method, step 2 is as follows: 125% declining balance rate = 1.25 x Straight-line rate In other words, the only change is in the multiplication factor used to multiply the straight-line rate, as noted earlier. Sum-of-the- Years’-Digits Method The sum-of-the-years’-digits method is another accelerated method. Under it, the depreciation expense is calculated as follows. Assume that a machine has an estimated useful life of 4 years. The sum-of-the-years’-digits equals 10 (1 + 2 + 3 + 4). In the first 3 year, the depreciation expense is 4/10 of the total depreciable cost; in the second year, the depreciation expense is 3/10 of the total depreciable cost, and so on. In the fourth and final year, the depreciation expense is 1/10 of the depreciable cost. Thus, under this method, the denominator equals the sum of the years involved. If an asset has a useful life of N years, the denominator equals (1 + 2 + 3 . . . + N–1 + N). The shortcut to calculate this is as follows: 1 + 2 + 3 . . . + N–1 + N = N x (N+1)/2 The numerator for the first year is N, for the second year is N–1, for the third year is N–2, and so on; for the final year, the numerator is 1. Use-Factor Methods Under use-factor methods, depreciation is viewed as being related to the extent to which an asset is used. Thus, the more an asset is used in a given period, the higher is its depreciation expense for that period. Example Williams Company purchased a truck on January 1, 2002, for $35,000 and estimated that the it would be driven for 200,000 miles after which it would be sold for $5,000. The actual number of miles driven in the first three years of the truck’s life was as follows: 30,000 miles in 2002; 45,000 miles in 2003; 37,000 miles in 2004. What is the depreciation expense in each of the first three years? The total depreciable cost = $30,000 ($35,000 cost – $5,000 salvage value) Total use factor = 200,000 miles Depreciation per use-factor unit = $30,000/200,000 miles = $0.15 per mile Thus, depreciation in each year is as follows: Year Use factor (miles) Depreciation expense 2002 30,000 $4,500 (30,000 x 0.15) 2003 45,000 $6,750 (45,000 x 0.15) 2004 37,000 $5,550 (37,000 x 0.15) In this, depreciation was calculated based on the input factor (miles driven). Other examples of input factors used for calculating depreciation include machine hours, service hours, and labor hours. In other situations, it may be more appropriate to calculate depreciation based on the output factor, such as the number of units produced or the number of customers served. Note that when depreciation expense is calculated based on the output (for example, when using the units-of-production method), depreciation is a variable expense in the income statement. In contrast, when depreciation is calculated using the time-factor methods (such as straight line, declining balance, or sum of the years’ digits), the expense is fixed in the income statement. Amortization of Intangible Assets 4 Noncurrent intangible assets are amortized over their estimated useful lives, just as noncurrent tangible assets are depreciated over their estimated useful lives. Thus, amortization is similar to depreciation except that the word “amortization” is used only in the context of intangible assets while depreciation is used for tangible assets. (A similar word is depletion, which is used only in the context of natural resources, such as oil and gas wells.) Some differences exist between the amortization of intangible assets and the depreciation of tangible assets. First, intangible assets are amortized by directly crediting (that is, reducing the balance of) the intangible asset. Thus, intangible assets have no Accumulated Amortization account. Second, intangible assets must be amortized according to the straight-line method unless compelling reason exists to use another method. Change in Estimates Related to Depreciation Depreciation calculations are based on estimates, such as the estimated salvage value, estimated useful life or estimated output. Estimates are not precise and may change over time. Any change in an estimate impacts the depreciation for only the current and future periods; past periods’ depreciation remains unchanged (that is, companies do not go back and correct prior periods’ depreciation). Example Cabrero Company bought a machine on January 1, 2002, for $24,000 and estimated its useful life to be eight years. On January 1, 2005, the company revised the estimated useful life to be only seven years. Calculate the depreciation expense for each year using the straight-line method. Depreciation expense for each of the years 2002, 2003, and 2004 equals $3,000 per year ($24,000/8). As of December 31, 2005, accumulated depreciation equals $9,000 ($3,000 multiplied by 3). Thus, as of January 1, 2006, the book value of the machine equals $15,000 ($24,000 minus $9,000). Thus, the amount left to be depreciated as of January 1, 2006, equals $15,000. This $15,000 must be depreciated over the next four years (because the revised estimated useful life is seven years, and the machine has already been used for three years). Hence, the revised depreciation expense (for each of the years 2005 through 2008) equals $3,750 per year ($15,000/4). Impairment of Long-Lived Assets Sometimes an asset may become impaired before the end of its estimated useful life. SFAS No. 121 provides guidance on accounting for impairment of long-lived assets. SFAS No. 121 allows an asset to be considered impaired when the undiscounted (that is, without consideration of present value discounting) sum of estimated future cash flows from the asset is less than the book value (that is, cost less accumulated depreciation) of the asset. 5 If the asset is considered impaired, another calculation is required to determine the difference between the fair value of the asset and its book value. The fair value usually equals the discounted present value of the estimated future cash flows from the asset. Note that in the first step (to determine whether the asset is impaired), we use the undiscounted future cash flows, but in the second step (to determine the amount of impairment), we use the discounted future cash flows. The book value of the asset is brought down to its fair value by reducing the original cost and amount of accumulated depreciation and by recording a loss. Example Jones Company purchased a building for $500,000 on January 1, 2002. Its estimated useful life was 20 years. On January 1, 2008, the company determined that the undiscounted sum of future cash flows from the building (asset) was $340,000 but the discounted sum of future cash flows from the asset was $210,000. Prepare the necessary journal entries. Depreciation per year on the building equals $25,000 ($500,000/20). Accumulated depreciation as of January 1, 2008 equals $150,000 ($25,000 multiplied by 6 years). Book value of the building as of January 1, 2008 equals $350,000 ($500,000 minus $150,000). Since the undiscounted sum of future cash flows ($340,000) is less than the building’s book value ($350,000), the building is considered impaired. The amount of impairment equals $140,000 ($350,000 minus $210,000). (Note: To calculate the amount of impairment, we must use the discounted future cash flow amount). Journal entry Debit Loss on Impairment (step 1) $ 140,000 Debit Accumulated Depreciation (step 2) 150,000 Credit Building (step 3) $ 290,000 Note: After the journal entry, the new cost of the building is brought down to $210,000 ($500,000 minus $290,000), which is its estimated fair value. Disposal of Assets Businesses dispose of plant assets after they cease to meet their needs. Businesses may dispose of a plant asset by selling or exchanging it. If the asset cannot be sold or exchanged, it may be discarded. When a noncurrent asset is sold, a gain or loss may occur. If the price at which the asset is sold is higher than its book value at the time of the sale, a gain is recognized. If the price at which the asset is sold is less than its book value, a loss is recognized. The journal entries for the disposal of an asset are as follows: Step 1: Since the asset is no longer with the company, it must be removed from the company’s books. This means that the previous asset account must be credited for the (historical) cost of the asset. 6 Step 2: Since the asset has been removed from the books, the accumulated depreciation associated with the asset also must be removed. Hence, the Accumulated Depreciation account is debited for the amount of accumulated depreciation associated with the old asset. Step 3: If the old asset is sold for cash, the Cash account is debited. Step 4: Based on these three entries, if some amount is needed on the debit side to make debits equal credits, a loss occurs; conversely, if some amount is needed on the credit side to make debits equal credits a gain is recognized. Example David Company bought a machine on January 1, 2002, for $23,000. Its estimated useful life was four years, and its estimated salvage value was $3,000. Assume that the business uses the straight-line method for calculating depreciation. The company sold the machine on January 1, 2005, for $6,000. Prepare the necessary journal entries for the transaction. Solution At the time of the sale, the business has used the machine (asset) for three years (2002, 2003, and 2004). In each of these years, the depreciation expense was $5,000 per year ([$23,000 minus $3,000]/4). Thus at the time of the sale, the amount in the Accumulated Depreciation account is $15,000, and the book value of the machine is $8,000 ($23,000 minus $15,000). The price at which the machine is sold ($6,000) is less than its book value ($8,000). Thus, a loss of $2,000 is recognized. The journal entry for the sale follows: Debit Cash (step 3) $ 6,000 Debit Accumulated Depreciation (step 2) 15,000 Debit Loss on Disposal (step 4) 2,000 Credit Machine (step 1) $ 23,000 Nonmonetary Asset Exchanges Nonmonetary asset exchanges involve exchanges of assets without paying the full market price solely in the form of cash. For example, a company may exchange a building for land, one machine for another, or a car for a truck. Such exchanges are called nonmonetary because a company acquires the asset without paying the full amount of its market price in the form of cash. Nonmonetary asset exchanges may involve similar assets (such as one car for another, or one building for another) or dissimilar assets (such as land for building, a truck for a crane). In accounting for such exchanges, we assume that the exchanges are armslength transactions. This means that the fair market value (FMV) of the old asset(s) given up must equal the FMV of the new asset(s) received. (Note: Total FMV of assets being given up includes both the FMV of the asset being given up in the exchange plus any cash paid; similarly, the total FMV of any assets received includes the FMV of the asset being received in exchange plus any cash received.) 7 When an exchange of nonmonetary assets occurs , the journal entries involve the following Step 1: Credit the book value of the asset being given up (because the comapnay no longer owns it, the asset must be removed from the books). Step 2: Debit the Accumulated Depreciation Account of the asset being given up (if the asset is removed from the books, the amount of the accumulated depreciation related to the asset also must be removed from the books). Step 3: Debit a cash account if cash is being received, or credit a cash account if cash is being paid. Step 4: Compare the book value of the old asset against its FMV. If the FMV of the asset given up is less than its book value, a loss occurs. Losses on exchanges are always recognized. If the FMV of the asset given up is more than its book value, then a gain occurs. Gains on exchanges are sometimes recognized, depending on the type of exchange. The details are discussed later. Step 5: If the exchange results in a loss as calculated earlier, first debit the new asset received for its FMV and then debit the account Loss on Exchange. If the exchange results in a gain, determine how much of the gain can be recognized based on rules discussed later. First credit the account Gain on Exchange and then debit the account for the new asset received (that is, the new asset account is debited for the plug number that will make debits equal to credits). Dissimilar Asset Exchanges, Different Lines of Business Accounting for dissimilar asset exchanges are simple. In this case, the entire amount of gain from the exchange can be recognized. (Remember that losses on exchange are always recognized). Example 1 Assume that a building with a book value of $50,000 (original cost $70,000) was exchanged for land with a market value of $62,000. Because original cost of the building was $70,000 but its book value is only $50,000, the mount of accumulated depreciation on the building must be $20,000 ($70,000 minus $50,000). The journal entry for this transaction follows: Debit Land (step 3) Debit Accumulated Depreciation (building) (step 2) Credit Building (step 1) Credit Gain on Exchange (step 4) $ 62,000 20,000 $ 70,000 12,000 Example 2 Assume that a building with a book value of $30,000 (original cost $45,000) was exchanged for land with a market value of $44,000. In addition, cash of $10,000 was received in the exchange. The journal entry for this transaction follows: 8 Debit Land (step 4) Debit Cash (step 3) Debit Accumulated Depreciation (building) (step 2) Credit Building (step 1) Credit Gain on Exchange (step 5) $ 44,000 10,000 15,000 $ 45,000 24,000 Example 3 Assume that a building with a book value of $80,000 (original cost $90,000) was exchanged for land with a market value of $78,000. In addition, cash of $12,000 was paid in the exchange. The journal entry for this transaction follows: Debit Land (step 4) Debit Accumulated Depreciation (building) (step 2) Debit Loss on Exchange (step 5) Credit Building (step 1) Credit Cash (step 3) $ 78,000 10,000 14,000 $ 90,000 12,000 If the assets exchanged are considered similar, but are used in different lines of business, they are accounted for as if they were dissimilar assets. That is, if two similar machines used in different lines of business are exchanged, they are accounted for exactly as noted here. Both gains and losses are fully recognized. Similar Asset Exchanges, Same Line of Business Accounting for exchanges of similar assets used in similar lines of business is different than exchanges for different lines of business because gains on exchanges may not always be fully recognized. (As before, losses on exchange are always fully recognized.) If it appears that gain on the exchange of similar assets may occur (that is, if the FMV of assets being given up is higher than their book value), did the company receive any cash during the exchange? (Note that the question asks only if cash was received, not if it was paid. Of course, one company’s cash receipt must mean that the other company paid cash, but accounting by the cash-receiving company is unrelated to accounting by the cash-paying company). If cash was not received, no gain is recognized on the exchange. In this case, the last step is to record the new asset. The amount used is a plug number to make debits equal credits. Note that this means the new asset is recorded for an amount less than its FMV. (If no cash is or received, the new asset is recorded at the same value as the book value of the old asset.) If cash was received and if it received is at least 25% of the FMV of the assets received, the entire gain can be recognized (that is, the accounting is just like that for dissimilar assets). In this case, after recording the removal of the old asset and the receipt of cash, a credit for the gain; the final step is recording a debit for the new asset (a plug number to make debits equal credits must be recorded). 9 If cash was received and is less than 25% of the FMV of the assets received, then a partial gain is recognized. The amount of gain recognized is determined as follows: (Cash received / Cash received + FMV of asset received) multiplied by Gain In other words, the gain recognized is proportional to the cash portion of the overall assets received by the company. In this case, after recording the removal of the old asset and the receipt of cash, record a credit for the partial gain; the final step is a debit for the new asset (a plug number to make debits equal credits). Glossary Accelerated depreciation methods allocate larger amounts to depreciation expense in the earlier periods of the asset’s useful life than in later periods. Accumulated Depreciation is a contra-asset account and represents the value of the asset allocated to depreciation from the time the asset was acquired; accumulated depreciation refers to the amount in the Accumulated Depreciation account. Amortization is similar to depreciation but is used only in the context of intangible assets. Book value of an asset is the original cost minus the accumulated depreciation up to a specific point in time. Depreciation is the systematic and rational allocation of the cost of noncurrent assets over their estimated useful lives. Double-declining-balance method is an accelerated method of calculating depreciation. Estimated useful life is the length of service a business expects from an asset. Nonmonetary asset exchanges involve exchanges of assets without paying the full market price solely in the form of cash. Salvage value is the expected cash value of an asset at the end of its useful life. Straight-line method of depreciation allocates an equal amount of depreciation expense to each period of the asset’s useful life. Sum-of-the-years’-digits method is an accelerated method of depreciation. Use-factor methods assume that depreciation as being related to the extent to which the asset is used. 10 Demonstration Problem 1 Wexler Company Wexler Company purchased a machine on January 1, 2002. Details about it are as follows: Cost $120,000 Estimated salvage value $20,000 Estimated useful life 5 years Estimated service hours 8,000 hours Estimated production 200,000 units The company operated the machine for 1,500 hours and 2,000 hours during 2002 and 2003, respectively. The number of units produced is 30,000 and 50,000 during 2002 and 2003, respectively. Calculate the depreciation expense for 2002 and 2003 under each of the following methods: (a) straight line, (b) double declining, (c) sum of years’ digits, (d) service hours, and (e) units of production. 11 Solution to Demonstration Problem 1, Wexler Company a. Straight-line method Annual depreciation = (Cost minus Salvage value)/Estimated useful life = ($120,000 – $20,000)/5 = $20,000. b. Double-declining-balance method Straight line rate = 0.20 (1/5) Double-declining rate = 0.40 (2 x 0.20) Year ending Book value at Depreciation year beginning expense A B C = B x 0.40 12/31/2002 $ 120,000 $ 48,000 12/31/2003 72,000 28,800 Accumulated depreciation D $ 48,000 76,800 Book value at end of year E=B–C $ 72,000 43,200 c. Sum-of-the-years’-digits method Estimated useful life = 5 years Sum-of-the -years’-digits = 15 (1 + 2 + 3 + 4 + 5) Depreciation for 2002 = $100,000 x 5/15 = $33,333.33 Depreciation for 2003 = $100,000 x 4/15 = $26,666.67 Note: The depreciable cost (Cost – Salvage value) is $100,000. d. Service hours method Estimated total service hours = 8,000 hours Thus, depreciation per service hour = $100,000/8,000 = $12.50 per hour Depreciation for 2002 = $12.50 x 1,500 = $18,750.00 Depreciation for 2003 = $12.50 x 2,000 = $25,000.00 e. Units of production method Estimated total production = 200,000 units Thus, depreciation per unit produced = $100,000/200,000 = $0.50 per unit Depreciation for 2002 = $0.50 x 30,000 = $15,000.00 Depreciation for 2003 = $0.50 x 50,000 = $25,000.00 12 Demonstration Problem 2 Reid Company Reid Company gave one of its machines to Grant Company and in return obtained a building. In addition, Reid Company paid $15,000 cash to Grant Company. The cost, book value, and market values of the two assets were as follows: Asset owned by Asset given to Cost Book value Fair market value Reid Grant $ 95,000 $ 75,000 $ 65,000 Grant Reid 72,000 63,000 80,000 Record the transaction in Reid Company’s books. 13 Solution to Demonstration Problem 2, Reid Company Note: This is an exchange of dissimilar assets. Hence, all gains and losses on exchange must be recognized. Reid Company’s books a. The market value of the machine given up is $65,000. b. The book value of the machine given up is $75,000, so the loss on the exchange is $10,000. c. Accumulated depreciation of machine = Cost minus Book value = $20,000 ($95,000 minus $75,000) Journal entries for Reid Company Account New Asset (step 5) Accumulated Depreciation–Old Asset (step 2) Loss on Exchange (step 4) Old Asset (step 1) Cash (step 3) 14 Debit $ 80,000 20,000 10,000 Credit $ 95,000 15,000 Demonstration Problem 3 Troy Company Troy Company gave one of its machines to Drew Company and in return obtained another. In addition, Drew Company paid $15,000 cash to Troy Company. The cost, book value, and market values of the two machines were as follows: Machine owned Machine given Cost Book value Fair market by to value Troy Drew $ 105,000 $ 50,000 $ 75,000 Drew Troy 90,000 70,000 60,000 Record the transaction in Troy Company’s books, assuming the two machines to be similar and used in the same line of business. 15 Solution to Demonstration Problem 3, Troy Company Note: This is an exchange of similar assets used in the same line of business. Troy Company’s books a. The market value of assets given up by Troy Company is $75,000. b. The book value of assets given up by Troy Company is $50,000, so this exchange involves a gain for Troy Company. The initial calculation of the gain is $25,000 ($75,000 minus $50,000). c. Troy Company receives cash, but it is less than 25% of the total assets received ($15,000/$75,000 is 20%), so only a partial gain can be recognized. Gain recognized = (Cash received / [Cash received + FMV of asset received]) x Gain = ($15,000 / [$15,000 + $60,000)] x $25,000 = $5,000 d. Accumulated depreciation of old machine of Troy Company = Cost minus Book value = $55,000 ($105,000 minus $50,000). Journal entries for Troy Company Account New Asset (plug number) (step 5) Cash (step 3) Accumulated Depreciation–Old Asset (step 2) Old Asset (step 1) Gain on exchange (step 4) 16 Debit $ 40,000 15,000 55,000 Credit $ 105,000 5,000 Demonstration Problem 4 Drew Company Drew Company gave one of its machines to Troy Company and in return obtained a machine. In addition, Drew Company paid $15,000 cash to Troy Company. The cost, book value, and market values of the two machines were as follows: Machine owned Machine given Cost Book value Fair market by to value Troy Drew $ 105,000 $ 50,000 $ 75,000 Drew Troy 90,000 70,000 60,000 Record the transaction in Drew Company‘s books, assuming the two machines to be similar and used in the same line of business. 17 Solution to Demonstration Problem 4, Drew Company Note: This is an exchange of similar assets used in the same line of business. Drew Company’s books a. The market value of the machine given up by Drew Company is $60,000. b. The book value of the assets given up by Drew Company is $70,000, which creates a loss for Drew Company. The loss on exchange is $10,000 ($70,000 – $60,000). c. Accumulated depreciation of the old Drew Company machine = Cost – Book value = $20,000 ($90,000 – $70,000) Journal entries for Drew Company Account New Asset (step 4) Accumulated Depreciation–Old Asset (step 2) Loss on exchange (step 5) Old Asset (step 1) Cash (step 3) 18 Debit $ 75,000 20,000 10,000 Credit $ 90,000 15,000 Practice Problem 1 Moore Company Moore Company purchased a machine on January 1, 2002. Details about it are as follows: Cost $250,000 Estimated salvage value $10,000 Estimated useful life 5 years Estimated service hours 12,000 hours Estimated production 500,000 units The company operated the machine for 2,000 hours and 2,400 hours during 2002 and 2003, respectively. The number of units produced were 70,000 and 90,000 during 2002 and 2003, respectively. Calculate the depreciation expense for 2002 and 2003 under each of the following methods: (a) straight line, (b) double declining, (c) sum of the years’digits, (d) service hours, and (e) units of production. 19 Solution to Practice Problem 1, Moore Company a. Straight-line method Annual depreciation = (Cost – salvage value)/Estimated useful life = ($250,000 – $10,000)/5 = $48,00 b. Double-declining balance method Straight line rate = 0.20 (1/5) Double-declining rate = 0.40 (2 x 0.20) Year ending Book value at Depreciation year beginning expense A B C = B x 0.40 12/31/2002 $ 250,000 $ 100,000 12/31/2003 150,000 60,000 Accumulated depreciation D $ 100,000 160,000 Book value at end of year E=B–C $ 150,000 90,000 c. Sum-of-the-years’-digits method Estimated useful life = 5 years Sum-of-years’-digits = 15 (1 + 2 + 3 + 4 + 5) Depreciation for 2002 = $240,000 x 5/15 = $80,000 Depreciation for 2003 = $240,000 x 4/15 = $64,000 Note: $240,000 is the depreciable cost (Cost – Salvage value). d. Service hours method. Estimated total service hours = 12,000 hours. Thus, depreciation per service hour = $240,000/12,000 = $20 per hour. Depreciation for 2002 = $20 x 2,000 = $40,000. Depreciation for 2003 = $20 x 2,400 = $48,000. e. Units of production method Estimated total production = 500,000 units Thus, depreciation per unit produced = $240,000/500,000 = $0.48 per unit Depreciation for 2002 = $0.48 x 70,000 = $33,600 Depreciation for 2003 = $0.48 x 90,000 = $43,200 20 Practice Problem 2 Grant Company Reid Company gave one of its machines to Grant Company and in return obtained a building. In addition, Reid Company paid $15,000 cash to Grant Company. The cost, book value, and market values of the two assets were as follows: Asset owned by Asset given to Cost Book value Market value Reid Grant $ 95,000 $ 75,000 $ 65,000 Grant Reid 74,000 63,000 80,000 Record the transaction in Grant Company’s books. 21 Solution to Practice Problem 2, Grant Company Note: This is an exchange of dissimilar assets. Hence, all gains and losses on exchange must be recognized. Grant Company’s books a. The market value of the building given up is $80,000. b. The book value of the building given up is $63,000, so the gain on the exchange is $17,000. c. Accumulated depreciation of building = Cost – Book value = $11,000 ($74,000 – $63,000) Journal entries for Grant Company Account New Asset (step 5) Accumulated depreciation–Old Asset (step 2) Cash (step 3) Old Asset (step 1) Gain on Exchange (step 4) 22 Debit $ 65,000 11,000 15,000 Credit $ 74,000 17,000 Practice Problem 3 Pedro Company Pedro Company gave one of its machines to Roger Company and in return obtained another machine. In addition, Roger Company paid $5,000 cash to Pedro Company. The cost, book value, and market values of the two machines were as follows: Machine owned Machine given Cost Book value Fair market by to value Pedro Roger $ 42,000 $ 30,000 $ 50,000 Roger Pedro 64,000 55,000 45,000 Record the transaction in Pedro Company’s books, assuming the two machines to be similar and used in the same line of business. 23 Solution to Practice Problem 3, Pedro Company Pedro Company’s books a. The market value of the assets given up by Pedro Company is $50,000. b. The book value of the assets given up by Pedro Company is $30,000, so this exchange involves a gain. The initial calculation of the gain is $20,000 ($50,000 – $30,000). c. Pedro Company receives Cash but it is less than 25% of the total assets received ($5,000/$50,000 is 10%), so only a partial gain can be recognized. Gain recognized = (Cash received / [Cash received + FMV of asset received]) x Gain = ($5,000 / [$5,000 + $45,000)] x $20,000 = $2,000 d. Accumulated depreciation of the old machine of Pedro Company = Cost – Book value = $12,000 ($42,000 – $30,000) Journal entries for Pedro Company Account New Asset (plug number) (step 5) Cash (step 3) Accumulated Depreciation–Old Asset (step 2) Old Asset (step 1) Gain on Exchange (step 4) 24 Debit $ 27,000 5,000 12,000 Credit $ 42,000 2,000 Practice Problem 4 Roger Company Roger Company gave one of its machines to Pedro Company and in return obtained another machine. In addition, Roger Company paid $5,000 cash to Pedro Company. The cost, book value, and market values of the two machines were as follows: Machine owned Machine given Cost Book value Fair market by to value Pedro Roger $ 42,000 $ 30,000 $ 50,000 Roger Pedro 64,000 55,000 45,000 Record the transaction in Roger Company ‘s books, assuming the two machines to be similar and used in the same line of business. 25 Solution to Practice Problem 4, Roger Company Note: This is an exchange of similar assets used in the same line of business. Roger Company’s books a. The market value of the machine given up by Roger Company is $45,000. b. The book value of the machine given up by Roger Company is $55,000, so this exchange involves a loss for Roger Company. Loss on the exchange is $10,000 ($55,000 – $45,000). c. Accumulated depreciation of the old machine of Roger Company = Cost – Book value = $9,000 ($64,000 – $55,000) Journal entries for Roger Company Account New Asset (step 4) Accumulated Depreciation–Old Asset (step 2) Loss on Exchange (step 5) Old Asset (step 1) Cash (step 3) 26 Debit $ 50,000 9,000 10,000 Credit $ 64,000 5,000 Homework Problem 1 Putin Company Putin Company purchased a machine on January 1, 2002. Details about the machine are as follows: Cost $500,000 Estimated salvage value $50,000 Estimated useful life 5 years Estimated service hours 15,000 hours Estimated production 360,000 units The company operated the machine for 2,500 hours and 3,000 hours during 2002 and 2003, respectively. The number of units produced is 65,000 and 80,000 during 2002 and 2003, respectively. Calculate the depreciation expense for 2002 and 2003 under each of the following methods: (a) straight line, (b) double declining, (c) sum of the years’ digits, (d) service hours, and (e) units of production. 27 Solution to Homework Problem 1, Putin Company a. Straight-line method Annual depreciation = (Cost – salvage value)/Estimated useful life = ($500,000 – $50,000)/5 = $90,000. b. Double-declining balance method Straight-line rate = 0.20 (1/5) Double-declining rate = 0.40 (2 x 0.20) Year ending Book value at Depreciation year beginning expense A B C = B x 0.40 12/31/2002 $ 500,000 $ 200,000 12/31/2003 300,000 120,000 Accumulated depreciation D $ 200,000 320,000 Book value at end of year E=B–C $ 300,000 180,000 c. Sum-of-the-years’-digits method Estimated useful life = 5 years Sum-of-the-years’-digits method= 15 (1 + 2 + 3 + 4 + 5) Depreciation for 2002 = $450,000 x 5/15 = $150,000 Depreciation for 2003 = $450,000 x 4/15 = $120,000 Note: $450,000 is the depreciable cost (cost – salvage value). d. Service hours method Estimated total service hours = 15,000 hours Thus, depreciation per service hour = $450,000/15,000 = $30 per hour Depreciation for 2002 = $30 x 2,500 = $75,000 Depreciation for 2003 = $30 x 3,000 = $90,000 e. Units of production method Estimated total production = 360,000 units Thus, depreciation per unit produced = $450,000/360,000 = $1.25 per unit Depreciation for 2002 = $1.25 x 65,000 = $81,250 Depreciation for 2003 = $1.25 x 80,000 = $120,000 28 Homework Problem 2 Gorby Company Yeltsin Company gave one of its machines to Gorby Company, and in return obtained a building. In addition, Gorby Company paid $10,000 cash to Yeltsin Company. The cost, book value, and market values of the two assets were as follows: Asset owned by Asset given to Cost Book value Market value Yeltsin Gorby $ 45,000 $ 37,000 $ 40,000 Gorby Yeltsin 42,000 34,000 30,000 Record the transaction in Gorby Company’s books. 29 Solution to Homework Problem 2, Gorby Company Note: This is an exchange of dissimilar assets. Hence, all gains and losses on exchange must be recognized. Gorby Company’s books: a. The market value of the building given up is $30,000. b. The book value of the building given up is $34,000, so the loss on the exchange is $4,000. c. Accumulated depreciation of building = Cost – Book value = $8,000 ($42,000 – $34,000) Journal entries for Gorby Company Account New Asset (step 5) Accumulated Depreciation–old asset (step 2) Loss on Exchange (step 4) Old Asset (step 1) Cash (step 3) 30 Debit $ 40,000 8,000 4,000 Credit $ 42,000 10,000 Homework Problem 3 Hayes Company Hayes Company gave one of its machines to Patel Company and in return obtained a machine. In addition, Patel Company paid $14,000 cash to Hayes Company. The cost, book value, and market values of the two machines were as follows: Machine owned Machine given Cost Book value Market value by to Hayes Patel $ 85,000 $ 60,000 $ 70,000 Patel Hayes 75,000 55,000 56,000 Record the transaction in Hayes Company’s books, assuming the two machines to be similar and used in the same line of business. 31 Solution to Homework Problem 3, Hayes Company Hayes Company’s books a. The market value of the machine given up by Hayes Company is $70,000. b. The book value of the machine given up by Hayes Company is $60,000 so this exchange involves a gain for Hayes Company. The initial calculation of the gain is $10,000 ($70,000 – $60,000). c. Hayes Company receives Cash but it is less than 25% of the total assets received ($14,000/$70,000 is 20%), so only a partial gain can be recognized. Gain recognized = (Cash received / [Cash received + FMV of asset received]) x Gain = ($14,000 / [$14,000 + $56,000)] x $10,000 = $2,000 d. Accumulated depreciation of old machine of Hayes Company = Cost – Book value = $25,000 ($85,000 – $60,000) Journal entries for Hayes Company. Account New Asset (plug number) (step 5) Cash (step 3) Accumulated Depreciation–Old Asset (step 2) Old Asset (step 1) Gain on Exchange (step 4) 32 Debit $ 48,000 14,000 25,000 Credit $ 85,000 2,000 Homework Problem 4 1. Depreciation is a variable expense in the income statement when using the a. sum-of-the-years’-digits method. b. units of production method. c. straight-line method. d. double-declining-balance method. 2. Salvage value is ignored in calculating annual depreciation when using the a. sum-of-the-years’-digits method. b. units of production method. c. straight-line method. d. double-declining-balance method. 3. Intangible assets are normally amortized using the a. sum-of-the-years’-digits method. b. units of production method. c. straight-line method. d. double-declining-balance method. 4. Rehnquist Company purchased a machine for $30,000 on January 1, 2002. Its estimated useful life is four years, and it has no salvage value. If the sum-of-the-years’digits method is used, depreciation expense for the year ending December 31, 2003, is a. $3,000. b. $9,000. c. $7,500. d. $12,000. 5. Ginsberg Company purchased a machine for $30,000 on January 1, 2002. Its estimated useful life is four years, and it has no salvage value. If the double-declining balance method is used, depreciation expense for the year ending December 31, 2002, is a. $7,500. b. $9,000. c. $15,000. d. $12,000. 6. Jackson Company purchased a building for $400,000 on January 1, 2002. Its estimated useful life is 20 years, and it is depreciated using the straight-line method. On January 1, 2007, the company determines that the undiscounted sum of future cash flows from the asset was $280,000 but the discounted sum of future cash flows from the asset was $170,000. As of January 1, 2007, a. there has been no impairment in the value of the building. b. the impairment in the value of the building is $130,000. 33 c. the impairment in the value of the building is $110,000. d. the impairment in the value of the building is $20,000. 7. Scalia Company acquired Thomas Company and recorded goodwill on the purchase. When the goodwill is amortized, the journal entry a. debits Amortization expense and credits Goodwill. b. debits Goodwill and credits Amortization Expense. c. debits Amortization Expense and credits Accumulated Amortization. d. debits Accumulated Amortization and credits Amortization Expense. 8. Souter Company sold a machine and recorded a loss on the transaction. This means that the machine was sold for a. less than fair market value. b. less than book value. c. less than the original cost. d. more than book value 9. Kennedy Company sold a machine to Breyer Company for $25,000. The machine had been bought six years earlier for $40,000, and the accumulated depreciation on it was $18,000. In recording the sale, Kennedy Company recognizes a: a. gain of $7,000. b. loss of $7,000. c. loss of $3,000. d. gain of $3,000. 10. In a nonmonetary exchange, gain cannot be recognized when the exchange involves a. dissimilar assets in the same line of business. b. dissimilar assets in different lines of business. c. similar assets in the same line of business. d. similar assets in different lines of business. 34