Solutions

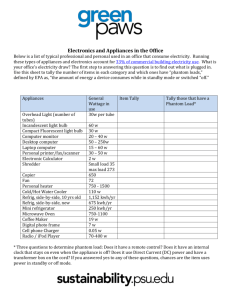

advertisement

College of Engineering and Computer Science Mechanical Engineering Department Mechanical Engineering 483 Alternative Energy Engineering II Spring 2010 Number: 17724 Instructor: Larry Caretto February 15 Homework Solutions 1. Determine whether it is advantageous to use compact fluorescent bulbs instead of conventional incandescent lights by comparing annual expenditures, $/yr, or present worth over an appropriate time horizon for bulbs having equivalent light output and the following characteristics: Compact fluorescent 15 9,000 $18 Power, W Useful light, hr Today’s cost, each Incandescent Use rate: 1,000 hr.yr 60 1,000 $1 Electricity cost: $0.10/kWh Interest (discount) rate 7%/yr The appropriate time period is nine years for which it is necessary to purchase one compact fluorescent bulb and nine incandescent bulbs. The total present worth for the fluorescent bulb is the sum of the initial capital cost plus the nine years of electricity costs. The annual electricity cost for the compact fluorescent bulb is (15 W)(1000 hr/yr)($0.10/kWh)*(1 kW/1000 W) = $1.50/yr. We can use the P/A formula (equation [11] in the notes on engineering economics) to get the present worth of the annual electricity costs. P 1 1 i A i N 1 1 i A i N Pelec $1.50 1 1 0.07 0.07 yr yr 9 $9.775 Adding this present worth to the initial purchase price gives the total present worth for the compact fluorescent bulb as $27.775. The annual electricity cost for the incandescent bulb is (60 W)(1000 hr/yr)($0.10/kWh)*(1 kW/1000 W) = $6.00/yr. The present worth of this electricity is also found from the P/A equation. 1 1 i i N Pelec A $6.00 1 1 0.07 0.07 yr yr 9 $39.81 We also have the initial purchase price of $1 for the incandescent bulb that will last only one year. We will have to purchase eight additional bulbs to match the nine-year lifetime of the compact fluorescent bulb. The present worth of these additional purchases is also found from the P/A equation. Pnew A 1 1 i N $1 1 1 0.07 8 $5.97 0.07 i yr yr Engineering Building Room 1333 E-mail: lcaretto@csun.edu Mail Code 8348 Phone: 818.677.6448 Fax: 818.677.7062 February 15 homework solutions ME 483, L. S. Caretto, Spring 2010 Page 2 Adding the three present worth costs (original oine-dollar purchase, Pnew, and Pelec gives the total present worth for the incandescent bulbs as $1 + $5.97 + $39.81 = $46.78. Compact fluorescent bulbs have the lower present worth and would be preferred. b. Economists find that consumers often behave as if their required rate of return is very high. Repeat the above comparison for a discount rate of 40%/yr. Repeating the calculations above for the total present worth with i = 40% gives $1.50 1 1 0.4 $18 0 .4 yr yr 9 PCF $21.57 $1 1 1 0.4 $6.00 1 1 0.4 PI $1 0 . 4 0.4 yr yr yr yr 8 9 $16.60 Incandescent bulbs have the lower present worth and would be preferred. c. List other major consumer sector examples of items where inexpensive first cost dominates purchasing decisions even though future continuing expenditures are actually high enough to justify behaving otherwise. Other household appliances such as refrigerators, air conditioners, etc. Home costs for a low energy home. Solar water heaters. Some hybrid cars. Photovoltaic solar cells with subsidy. d. Briefly discuss any aspects not included in the above analysis which should be taken into account in a complete lifetime analysis. If the compact fluorescent were broken in an accident the cost differential would not pay off. One would have to consider the low probability of such an accident. Use rate is also important. Although an annual use of 1000 hr was specified in this problem, an incandescent bulb that was used only infrequently could have lower costs than a compact fluorescent bulb. 2. The cost of electricity depends on three main factors: (a) initial capital costs, (b) ongoing fuel costs, and (c) maintenance costs. The fuel cost depends on (i) the energy cost of the fuel, (ii) the plant efficiency (sometimes expressed as a heat rate) and (iii) the load factor (the average fraction of the total power at which the plant is operated during the year). A natural gas combined cycle plant has the following characteristics. Capital cost:1 $500/kWe Heat rate = 1/(Thermodynamic efficiency) = 6000 Btu/kWh Capacity factor = 75% Operation and maintenance cost (includes taxes and insurance) = $0.0025/kWe Fuel cost = $5/MMBtu Return on invested capital = 15% Plant lifetime = 30 years Determine the annual busbar2 electricity cost for this plant in units of $/kWh. 1 The notation kW e, sometimes written as kW(e) or kWe, denotes an energy rate of electricity as opposed to a thermal heat rate for a power plant input, which could be designated as kW th, kW(th) or kWth. February 15 homework solutions ME 483, L. S. Caretto, Spring 2010 Page 3 To compute the annual cost we have to determine the annual capital charge for the initial capital cost. Using the A/P formula from equation [10] in the notes on engineering economics gives the following annualized capital cost, CC. A i P 1 1 i N CC A P i 1 1 i N $500 0.15 yr $76.15 30 kWe 1 1 0.15 kWe yr The denominator in this equation is the energy that would be generated if the plant ran at full capacity during the year. According to the problem statement, the plant will operate at a capacity factor of 75%. This is the actual power generation rate, kW e,actual, over a year divided by the maximum power plant capacity used in the capital cost calculation, kW e. Thus the cost per unit of electrical energy generated can be found as follows using an average number of hours per year for a four year cycle with one leap year. This gives an average of (4*365+1)*24/4 = 8766 h/yr. CC' CC kWe $76.15 yr $0.0116 kWe yr 8766 h .75 kWe,actual kWhe,actual A similar approach is used to allocate the annual maintenance cost rate of $0.0025/kW eyr to the electricity generated. MC kWe $0.0025 yr $3.797 x10 7 kWe yr 8766 h .75 kWe ,actual kWhe ,actual This is apparently an error in the unit O&M cost!!! Finally we compute the annual fuel costs per kWh of electricity generated, FC. This is simply the product of the heat rate, HR, and the unit cost of fuel, UC. 6000 Btu $5 x10 6 $0.03 FC HR * UC kWhe ,actual kWhe,actual Btu Adding these three components gives a busbar cost of 4.16 cents per kWh. 3. Determine the residential cost of electricity generated by a solar photovoltaic cell operating in the Los Angeles area with the following characteristics: Capital cost after rebates: $11,000/kWe Rated peak power of 3 kWe Expected annual generation: 4400 kWh Operating and Maintenance costs: 1% of initial capital cost per year System lifetime 20 years Look at two cases for the annual return on investment: 3% and 15%, To compute the annual cost we have to determine the annual capital charge for the initial capital cost. Using the A/P formula from equation [10] in the notes on engineering economics gives the following annualized capital cost, CC, for the initial investment of $33,000. First we consider a return rate of 15%. 2 The busbar cost is the cost to produce electricity at the power plant; it does not consider transportation and distribution costs. February 15 homework solutions A i P 1 1 i N ME 483, L. S. Caretto, Spring 2010 CC A P Page 4 i 0.15 yr $5,272 $33,000 N 20 yr 1 1 i 1 1 0.15 The annual operating and maintenance costs are 1% of the initial costs of $330 per year and there are no fuel costs. Thus the total annual cost with a 15% return is $5,602 per year. The annual electricity cost is $5,602/(4400 kWh) = $1.27/kWh. For a return rate of 3%, the annual capital charge is found as follows. A i P 1 1 i N CC A P i 0.03 yr $2,218 $33,000 N 20 yr 1 1 i 1 1 0.03 Adding the $330/year operating and maintenance cost gives a total annual cost of $2548/yr. The annual electricity cost is $2548/(4400 kWh) = $0.58/kWh with a return rate of 3%.