III. trade policies and practices by measure

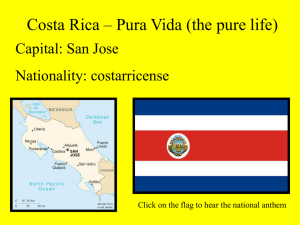

advertisement