Tax Topics – Year End Considerations

advertisement

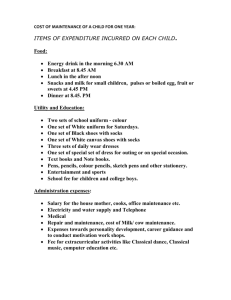

Tax Topics – Year End Considerations Once again it’s time for you to organize your records for preparation of your income tax return and to begin advance planning for next year. Some of the records your tax preparer may need, include: Weekly Accomplishment sheet Pink tickets – copies of customers’ sales tickets Picking tickets – record of your product orders from Corporate Director’s commission schedules Monthly analysis report by unit, if applicable Monthly consultant statements Receipts for auto expenses (gas, oil, repairs, insurance auto license) Support for cost of property used in business and other business-related expenses Annual Information Letter – prepared by the Company, outlining your commissions and the taxable value of the various programs in which you participated. This letter was recently sent to you. As you know, it is your obligation to file a Federal Tax Return (and Provincial, if applicable) if your total income equals or exceeds the minimum taxable amount established by law. Questions about Federal and Provincial Income Taxes will be answered at a local Income Tax Office, if an explanation is not available in the tax guide supplied with your Income Tax Return. As a Mary Kay Consultant, you are considered a self-employed person and may be entitled to special tax deductions. Generally, it is preferable to have a tax accountant prepare your return for you. The cost is usually small when compared to the savings that may be accomplished and is deductible on our income tax return. You should spend time with the preparer to ensure that he/she fully understands your method of doing business and your status as a self-employed person. This enables the accountant to claim deductions for you which otherwise might not be evident. However, if you prepare your own return, you can obtain various publications free of charge from any local Income Tax Office explaining income tax laws if an explanation is not available in the Tax Guide supplied with your income tax return. The most important thing in preparing your tax return and assuring that you have the benefit of all proper deductions is to keep adequate records of all income and expenses. Such records are essential in the preparation of the return and substantiation of income and expenses if your return is examined by Revenue Canada Taxation. Income and expenses incurred in your Mary Kay career are normally reported on a special tax form, which is provided by Revenue Canada Taxation. This form is designed especially for self-employed persons. Following are points that should be considered in calculating your net income for tax purposes. 1. Income The calculation of the gross receipts made during the year is the first step in preparing your income tax return. Totaling your pink tickets or your Weekly Accomplishment Sheets can do this. Income also includes the following: car programs, dovetailing prizes and awards, and recruiting commission less sales returns. Any recruiter and director commissions received and the fair market value of Company prizes and awards received during the year, should be reported as other income. The total of these items comprises total income from which all costs and business expenses are deducted. Be sure that in the calculation of your business income, hostess credits and charge card discounts are not deducted more than once. For example, if cost of goods includes the cost of hostess credits (Section 1 products), they cannot be deducted again as a business expense. BUSINESS EXPENSES Highlighted below are a number of the major costs and expenses that may be applicable to your business. 2. Cost of Goods Sold The primary deduction from gross receipts is the cost of merchandise that you have sold during the year. The calculation of your merchandise cost is demonstrated as follows: ADD: Net wholesale value of inventory plus applicable taxes at beginning of year. PLUS: Net wholesale value of inventory plus applicable taxes at the end of year. LESS: Net wholesale value of inventory plus applicable taxes at the end of year. EQUALS: Cost of goods sold during the year. In the calculations above, it is necessary that you determine the wholesale value of your inventory of goods on hand at the beginning and at the end of each year. Listing merchandise on hand on a consultant order sheet as you would a regular order easily does this. If the inventory is counted a few days after year end, merely add to the total the wholesale value of merchandise sold, based on information from sales tickets dated after year end. 3. Automobile Expenses As a self-employed person working from your home, you are permitted to deduct the cost of operating your automobile for business-related transportation costs, eg, to and from skin care classes. Two methods are available for determining the amount of expense deductible: the business portion of actual expenses incurred or a standard mileage rate. Automobile expenses incurred during the year – gas, oil, maintenance, etc. are deductible based on a formula which includes the percentage of business kilometers driven to the total kilometers during the year. To substantiate this deduction, you should note in your date book each day the kilometers driven to and from shows, unit meetings, workshops, etc. 4. Travel Expenses This includes meals, lodging and necessary incidental costs and are deductible while the taxpayer is away from home in the pursuit of a trade or business. The expenses must be ordinary and reasonable in amount under the circumstances. As long as the purpose of the trip is primarily for business reasons, travel expenses are deductible, even though the taxpayer may spend some time in sightseeing, visiting, entertaining, etc. Such expenses however are not deductible if the trip is primarily personal in nature. A spouse’s travel expenses are not deductible unless the spouse’s presence on the trip has a business purpose. 5. Entertainment Expenses Generally, entertainment expenses are deductible if they are ordinary and necessary and if they are either (a) directly related, or (b) associated with the active conduct of your business. Expenses for entertainment for the purpose of generating goodwill are normally deductible if there is a good possibility of the entertainment producing future income. However, no deduction is allowed for entertainment expenses to the extent that they are extravagant in the circumstances. Business meals can be deducted if they are held in surroundings conductive to the business discussion. In the area of entertainment expenses, documentation of the business purpose is generally necessary. This would include the name and relationship of the person entertained and the items of business discussed during the entertainment. 6. Office-in-Home Expenses The office-in-home deduction is available only where a specific portion of the home is used exclusively and on a regular basis, as the tax payer’s principal place of business or used by the tax payer for meetings or dealings with customers. This requirement is not met if the portion is used for both business and personal purposes. Deductions are allowed for items allocable to space in the home regularly used for inventory storage. 7. Child Care Credit Individuals are entitled to a tax credit for qualifying childcare expenses. Household and personal care expenses for a dependent under fifteen, or a dependent incapable of self-care, qualify if incurred in order to allow the tax payer to earn income. EXPENSES THAT MAY BE DEDUCTIBLE Commissions you pay to others for holding a skin care class (such as 15% dovetail commission) Bad debts (and your net cost of refunds to customers) Postage used in your business Seminar, Career Conference, Leadership Conference or workshop expenses, including travel, meals and lodging Advertising Telephone and long distance calls Cost of Starter Kit or samples used Product insurance expense Accounting costs Stationary, business cards and other printing to support your business Cost of gifts to promote your business Contract labour paid to someone to assist you Legal expense pertaining to business Dues to professional societies Interest paid on business debts Office supplies Customer entertainment (such as recruiting luncheon) – be sure the environment of the business meeting place, eg, restaurant, etc, is conductive to the meeting’s purpose Provincial sales taxes remitted to the Company of r sales aids and hostess gift merchandise DETERMINING YOUR NET PROFITS Net profit is determined by subtracting cost of goods sold and other allowable deductions from gross business income. As tax laws and regulations are constantly being amended or changed, you should seek the advice of a competent tax accountant of your choosing for application of this general information to your specific income tax return. It should be emphasized that the information has covered only the major tax aspects of your Mary Kay career and your status as a self-employed person. We have provided this information solely to draw your attention to certain responsibilities and rights that you may have as a taxpayer. Taxes are, however, your personal responsibility and the Company comments in this area not intended as tax advice concerning your specific situation. NOTE If you have the Mary Kay Date Book, use the bottom of the weekly daytimer. Use your Accomplishment Sheets every week to record your sales, hostesses and profit. This form is called our Weekly Goals page, and it’s great for recruiting. EXPENSE INFORMATION Fill in this area – it helps you to keep a record of your mileage and miscellaneous expenses. MONTHLY RECORD ENVELOPES Keep on top of your expenses and income – file them all into your Monthly Envelopes. Identify the expense on each receipt.