Seminar 6

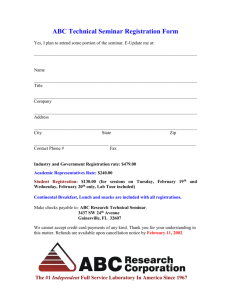

advertisement

Seminar 6 The New Keynesian Phillips curve Consider the following New Keynesian Phillips curve: t Et t 1 yt a. Find the ‘forward solution’ of the Phillips curve (where only current and future output gaps enter on the right-hand side). b. Assume that the process for the output gap is given by yt yt 1 t , 0 1 , where t is a white noise shock. Find the solution for inflation as a function of yt and t only. Seminar 7 1. Assume that output is given by (0.1) yt ( t Et 1 t ) ut where Et 1ut 0 . Consider two alternative specifications of the preferences of the monetary authorities: (0.2) 1 * * Lt [( t t ) 2 ( yt y t ) 2 ] 2 (0.3) Lt 12 ( t * ) 2 yt A. Give an economic interpretation of the difference between the two specifications. B. Derive the solution for inflation and output under a discretionary policy for the two loss functions. Compare and discuss the results. 2. Consider two monetary policy regimes; (i) discretionary policy, and (ii) strict inflation targeting, i.e., t * . Let var(ut ) 2 . Compute the expected loss, i.e., ELt, under the two regimes based on the loss function (0.2). Is one regime always superior to the other? How does the relative performance of the two regimes depend on the output target y*? Seminar 8 Suppose that the economy can be represented by the following New Keynesian model: (0.4) (0.5) t Et t 1 yt e t yt Et yt 1 1 (it Et t 1 ) ut where et and ut are white noise processes. Suppose that the central bank sets the interest rate according to the following “Taylor rule”: (0.6) it t y yt A. Discuss advantages and disadvantages with simple interest rate rules like (1.3) B. Solve the model, i.e., write the endogenous variables as functions of the exogenous shocks. (Hint: Et t 1 Et yt 1 0 because of no autocorrelation) C. Suppose that the central bank’s loss function is 1 L [ t2 yt2 ] 2 Can the central bank achieve optimal policy by using a rule like (1.3)? Seminar problem 9 Consider the following model: (0.7) yt Et yt 1 1 (it Et t 1 ) ut (0.8) t Et t 1 yt e t (0.9) L Et k [( t2k yt2k ) k 0 A. Explain in words the difference between discretion and commitment. B. Derive the first-order conditions under discretion and commitment respectively. What characterizes the difference? C. It can be shown that the commitment solution implies a stationary price-level. Vestin (2001) shows that the optimal monetary policy can be replicated under a discretionary policy if the inflation target is replaced by a price-level target. Write a loss function that can be interpreted as price-level targeting. D. Discuss similarities and differences between inflation targeting and price-level targeting. Seminar problem 10 Consider the following model: (0.10) yt Et yt 1 t (it Et t 1 ) ut (0.11) t Et t 1 yt et (1.3) 1 Lt [ t 2 yt2 ] 2 The shocks ut and et are white-noise processes. 1. Suppose that the demand shock ut cannot be observed perfectly by the central bank, but the central bank can observe everything else. Assume further that the central bank receives a noise signal of the shock, such that the bank’s estimate is given by ut ut zt , where zt is white noise with variance E ( zt2 ) var( zt ) z2 . Write the first-order condition for optimal policy under discretion. Solve for the interest rate. (Hint: All expected future variables are zero, due to discretion and no auto-correlation). How does uncertainty about ut affect monetary policy? 2. Suppose that αt is given by t t , where εt is a white-noise shock with variance E ( t2 ) var( t ) 2 . Suppose further that the central bank sets the interest rate before εt is realised. Write the first-order-condition for optimal policy under discretion. Solve for the interest rate. How does uncertainty about αt affect monetary policy? Explain the difference between additive uncertainty and multiplicative uncertainty.