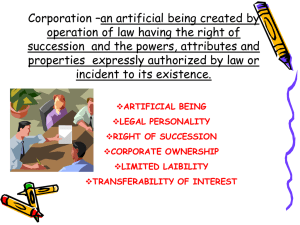

BUSINESS ASSOCIATIONS OUTLINE

advertisement