THE MEDICAL DEVICES SECTOR IN GREECE

advertisement

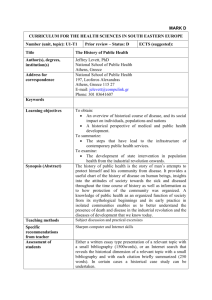

The Medical Devices Sector in Greece EMBASSY OF ISRAEL SECTORIAL STUDY THE MEDICAL DEVICES SECTOR IN GREECE CONDUCTED BY: ATHENS, FEBRUARY 2007 © EUROPEAN PROFILES SA The Medical Devices Sector in Greece TABLE OF CONTENTS 0. INTRODUCTION - METHODOLOGICAL REMARKS ..................................................... 1 1. TOTAL MARKET SIZE ........................................................................................................ 2 1.1. GENERAL OVERVIEW ................................................................................................ 2 1.2. IMPORTS ........................................................................................................................ 3 3. EXPORTS .......................................................................................................................... 4 1.4. DOMESTIC PRODUCTION .......................................................................................... 5 2. DEMAND.............................................................................................................................. 6 2.1. STRUCTURE OF THE DEMAND ................................................................................ 6 2.2. DEMAND OF HIGH TECHNOLOGY DEVICES BY HEALTH ESTABLISHMENTS ............................................................................................................. 7 2.3. DEMAND BY THE FINAL CONSUMER .................................................................... 8 2.4. FACTORS INFLUENCING THE DEMAND ................................................................ 8 3. SUPPLY ............................................................................................................................... 10 3.1. NUMBER OF ENTERPRISES ..................................................................................... 10 3.2. KEY PLAYERS ............................................................................................................ 10 3.2.1. Whole sector ........................................................................................................... 10 3.2.2. Some specific sectors.............................................................................................. 11 3.2.3. Local Manufacturers ............................................................................................... 12 4. REGULATORY ASPECTS ................................................................................................. 13 4.1. PRODUCTION AND MARKETING ........................................................................... 13 4.2. PUBLIC PROCUREMENT PROCEDURES ............................................................... 13 4.2.1. Existing legislation ................................................................................................. 13 4.2.1. Introduction of New Legislation regarding the procurement procedures ............... 14 5. PROBLEMS OF THE SECTOR AND PROSPECTS ......................................................... 15 5.1. MAJOR PROBLEMS OF THE SECTOR .................................................................... 15 5.2. TRENDS AND POTENTIALITY ................................................................................ 16 ANNEXES ............................................................................................................................... 17 ANNEX I .................................................................................................................................. 17 LIST OF THE BIGGER COMPANIES OF THE SECTOR ACCOMPANIED WITH CONTACT DETAILS OF THE COMPANY AND OF THE PURCHASE MANAGER ...... 17 ANNEX II ................................................................................................................................ 28 ANNEX III ............................................................................................................................... 30 GOVERNMENT GAZETTE 518/19.4.2005 WITH THE MAXIMUM PRICES OF MEDICAL DEVICES .............................................................................................................. 30 © EUROPEAN PROFILES SA The Medical Devices Sector in Greece 0. INTRODUCTION - METHODOLOGICAL REMARKS The present study is submitted by European Profiles SA, to the Embassy of Israel in Greece in accordance with the terms of the agreement signed on 13th December 2006 and presents an overview of the medical devices market in Greece. The study covers “medical devices” in the sense of EU Directive 93/42/EEC, as well as “active implantable medical devices” and “in-vitro diagnostics” in the sense of EU Directives 90/385 and 09/79 respectively. A key problem that the authors faced in conducting this study was the lack of homogeneity of the available statistical data according to a common classificatory scheme, the reason been that the Greek Standardisation Organisation (ELOT) has not yet adopted the International Classification System regarding Health Care Technology1]. Data concerning the trade flows are presented following the Combined Nomenclature of External Trade Flows of Intrastat 20042]. With regard to more detailed aspects of this study, and depending on the available data, we use a more “functional” classificatory scheme as follows: a) Demand related data, are presented for high technology appliances and installations used for diagnostic and therapeutic purposes, permanently installed in hospitals; b) b) Supply related data concerning the main sub-markets are defined by the classificatory scheme employed by the Association of Suppliers of Scientific and Health Equipment, which distinguishes the following categories: - General equipment for chemical laboratories, analytic apparatus and apparatus for environment control; - Appliances and disposables for hospital laboratories (biochemical, haematology, microbiology, immunology, etc); - Surgery equipment, products of endoscopic diagnosis and treatment, and appliances for intensive care units; - Enterprises with main activity: Pacemakers – defibrillators, cardiac valves, other cardiology implantables, orthopaedics implantables and hearing implantables; - Imaging apparatus, lasers and their disposables; - Enterprises with main activity: General use disposables; - Hospitals furniture. Data used for this study have been extracted from different sources: - National Statistical Service of Greece, - ICAP, - Publications and professional websites, - Interviews with sector opinion leaders. 1] The new Bill for the Health Procurement Methods (discussed in chapter 4) will list all products subject to procurement procedure according to the international standards terminology and coding system. 2] Cf. Commission Regulation (EC) No 1549 / 2006. © EUROPEAN PROFILES SA 1 The Medical Devices Sector in Greece 1. TOTAL MARKET SIZE 1.1. GENERAL OVERVIEW Aggregate data of the medical devices market in Greece are presented in the following Table 1. The data refer to the whole sector of medical devices, and comprise: Imaging apparatus, Diagnostic and therapeutic devices using radiation, Disposable equipment, Dental instruments and appliances, Diagnostic reagents, General use equipment, Anaesthetics Machines and Monitors, Implantable (active, non active), Cardiologic instruments and appliances, Orthopaedic instruments and appliances, Nephrology instruments and appliances, Ophthalmic instruments and appliances, Urologic instruments and appliances, Laboratory equipment, Hospital Furniture, Home care devices, Other articles and appliances to compensate for a defect and disability (excluding implantables and artificial parts of the body), In-vitro Diagnostics. Table 1 - Market Size of Medical Devices (€ million) Source: ICAP © EUROPEAN PROFILES SA 2 The Medical Devices Sector in Greece Evolution of Market Size 1600 1400 1200 1000 800 600 400 200 0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Comments - The market is constantly increasing at an average annual rate of 12,7% (the decrease between 2004 and 2005, is exceptional, due to investments necessary for the Olympic games); - The market is characterised by a predominance of imports over domestic production; - There is a decrease of domestic production in the last five years - There is a constant increase of exports (exports are higher than domestic production which suggests that a certain part of imports is re-exported. 1.2. IMPORTS Table 2 - Imports by main category of products Category of products Diagnostic instruments and appliances used in medical, surgical and dental treatment including imaging apparatus (CN Codes: 90.18.11.00 - 90.18.90.85) Mechanotherapy appliances (CN Codes: 90.19.10.10 - 90.19.20.00) Orthopaedic appliances, artificial parts of body, carried or implanted in the body (CN Codes: 90.21.10.10 - 90.21.90.90) Radiological Equipment (CN Codes: 90.22.11 - 90.22.90.90) In-vitro Diagnostics (CN Codes: 38.21.00 and 38.22.00) Other (CN Codes: 30.05.10.00-30.05.90.99, 30.06.10.10 - 30.06.80.00, 37.01.10.10, 84.19.20.00, 90.25.11.91, 94.02.10.00, 94.02.90.00 TOTAL 2002 187.1 Value € million 2003 2004 273.8 365.1 2005 304.5 27.5 117.4 23.2 165.6 32.5 202.3 27.4 213.5 40.0 36.2 47.5 29.7 82.2 86.9 28.7 87.1 98.4 21.9 99.3 109.1 455.7 661.4 814.41 775.7 Table 3 - Imports by main country of origin (Value in € thousand) Country Germany Netherlands Cyprus* Italy United Kingdom Belgium France Other EU Countries 2002 29.656,9 36.056,3 % 29% 12% 0% 11% 14% 2003 Value % 111.491,3 25% 63.991,2 14% 0% 65.896,2 15% 50.946,5 11% 2004 Value 138.505,2 93.183,4 55.753,3 99.948,1 58.737,7 % 23% 15% 9% 17% 10% 2005 Value 138.539,9 90.970,9 67.545,5 59.494,3 55.312,8 % 24% 16% 12% 10% 10% 28.830,5 28.539,5 34.206,1 11% 11% 13% 44.836,0 46.366,7 59.564,0 37.004,5 47.236,6 73.821,4 6% 8% 12% 46.284,9 43.651,1 80.048,1 8% 8% 14% Value 77.722,1 31.400,1 © EUROPEAN PROFILES SA 10% 10% 13% 3 The Medical Devices Sector in Greece 604.190,2 100,00% 581.847,5 100,00% 134.947,8 64,3% 109.641,4 56,6% 24.809,2 11,8% 31.609,4 16,3% TOTAL EU USA Switzerland 266.411,5 113.899,1 23.511,4 100% 60,5% 12,5% 443.091,9 118.576,3 22.103,5 100,00% 54,3% 10,1% Japan China Israel Cyprus* Other third countries 14.351,0 5.636,0 4.019,5 14.574,9 26.876,6 7,6% 3,0% 2,1% 7,7% 14,3% 14.369,4 6.484,7 5.810,6 33.653,8 50.924,4 6,6% 3,0% 2,7% 15,4% 23,3% 13.299,7 10.782,8 5.634,4 20.464,1 6,3% 5,1% 2,7% TOTAL TOTAL EU & OTHER COUNTRIES 188.293,6 454.705,1 100,0% 218.268,9 661.360,8 100,0% 209.938,0 814.128,2 100,0% 10.777,6 11.713,9 5.771,9 24.359,2 9,7% 193.873,4 775.720,9 5,6% 6,0% 3,0% 12,6% 100,0% *From 2004 is an EU member EU is main supplier of imported medical devices, with over half € million. From the third countries, the biggest supplier was USA with the 56,6% from the total. 3. EXPORTS Table 4 - Exports by main category of products Category of products Diagnostic instruments and appliances used in medical, surgical and dental treatment including imaging apparatus (CN Codes: 90.18.11.00 - 90.18.90.85) Mechanotherapy appliances (CN Codes: 90.19.10.10 - 90.19.20.00) Orthopaedic appliances, artificial parts of body, carried or implanted in the body (CN Codes: 90.21.10.10 - 90.21.90.90) Radiological Equipment (CN Codes: 90.22.11 - 90.22.90.90) In-vitro Diagnostics (CN Codes: 38.21.00 and 38.22.00) Other (CN Codes: 30.05.10.00-30.05.90.99, 30.06.10.10 - 30.06.80.00, 37.01.10.10, 84.19.20.00, 90.25.11.91, 94.02.10.00, 94.02.90.00 TOTAL Country Germany Netherlands 2002 7.9 Value € million 2003 2004 11.3 8.1 2005 15.5 0.6 2.6 1.1 3.0 0.2 2.7 0.3 9.1 3.7 2.7 7.6 1.7 4.7 8.2 1.1 8.5 7.7 1.8 9.2 10.0 25.1 29.9 28.2 46.0 Table 5 - Exports by main country of destination 2002 2003 2004 Value % Value % Value % 4.414,5 45,53% 4.240,0 27,33% 2.934,6 13,2% 887,6 9,16% 2.522,3 16,26% 4.402,4 19,7% 2005 Value 3.707,0 4.669,8 % 11,8% 14,8% Cyprus* Italy United Kingdom 0,0 758,9 961,7 0,00% 7,83% 9,92% 0,0 1.078,3 3.342,6 0,00% 6,95% 21,55% 5.401,0 1.386,0 2.316,5 24,2% 6,2% 10,4% 10.274,4 2.835,6 4.024,9 32,6% 9,0% 12,8% France Spain Other EU Countries 1.383,7 51,3 1.237,1 14,27% 0,53% 12,76% 2.426,5 538,8 1.364,0 15,64% 3,47% 8,79% 1.763,2 2.079,3 2.020,0 7,9% 9,3% 9,1% 2.484,7 443,2 3.037,8 7,9% 1,4% 9,7% TOTAL EU Romania Albania USA 9.694,8 3.213,7 597,4 979,4 100,00% 24,5% 4,6% 7,5% 15.512,5 2.945,0 484,5 653,4 100,00% 19,7% 3,2% 4,4% 22.303,0 1.823,7 371,1 156,0 100,0% 31,0% 6,3% 2,6% 31.477,4 2.711,0 1.798,0 1.642,9 100,0% 18,7% 12,4% 11,3% © EUROPEAN PROFILES SA 4 The Medical Devices Sector in Greece 244,0 4,1% 1.325,4 9,1% 399,0 6,8% 819,7 5,7% 186,6 3,2% 809,5 5,6% 51,6 0,9% 584,4 4,0% Bulgaria FYROM Iran Switzerland 449,6 286,4 70,2 461,6 3,4% 2,2% 0,5% 3,5% 336,8 395,5 110,0 1.453,8 2,3% 2,6% 0,7% 9,7% Turkey Other TOTAL TOTAL EU & OTHER COUNTRIES 23,2 7.036,9 13.118,4 0,2% 53,6% 100,0% 318,6 8.235,2 14.932,8 2,1% 55,1% 100,0% 355,2 2.302,9 5.890,1 6,0% 39,1% 100,0% 422,0 4.394,3 14.507,2 2,9% 30,3% 100,0% - 30.445,3 - 28.193,1 - 45.984,6 - 22.813,2 *From 2004 is an EU member The biggest foreign buyers from Greek medical devices’ companies are EU countries with almost twofold value of exports comparing to third countries. The grater EU buyer for 2005 is Cyprus and from the third countries is Romania. 1.4. DOMESTIC PRODUCTION Local production concentrates mainly on the following categories: - Cotton and medical gauzes, - Syringes, - Bandages, - Orthopaedic appliances, - Diagnostic chemicals, - Surgery tables, - Hospital furniture, - Dental material (artificial teeth and prosthetics), - Artificial kidney filters, - Small injection pumps, - Assembly of dentist appliances and physiotherapy equipment. © EUROPEAN PROFILES SA 5 The Medical Devices Sector in Greece Table 6 - Domestic production and sales of some medical devices 2. DEMAND 2.1. STRUCTURE OF THE DEMAND The main bulk of the demand of the medical devices stems from two main sources: Public health establishments, including Hospitals, Health Centres, Rural Dispensaries, Emergency Pre-hospital Treatment Centres; Private health establishments, including Hospitals, Clinics, Diagnostic Centres, Special Treatment Units, private practitioners; Individual consumers. According to estimates produced by the Institution of Biometrical Technology public sector hospitals account for about 80% of the total generated demand. According to anecdotal sources this high percentage does not actually reflect real needs, but reflects rather a problematic management of supplies from the part of public hospitals especially management of stocks of disposables. Individual demand, directly from the final users covers a small but constantly increasing portion of the total demand especially for home care devices and for articles and appliances that help to compensate for a physical defect. © EUROPEAN PROFILES SA 6 The Medical Devices Sector in Greece 2.2. DEMAND OF HIGH TECHNOLOGY DEVICES BY HEALTH ESTABLISHMENTS The installed capacity high tech medical devices during the years 1996-2003, both in the public and private sectors. Table 7 - High tech medical devices installed in hospitals In 2006, the public sector represented 65% on the average of the total installed capacity, and the private 35%. Higher demand is observed for artificial kidney apparatus, followed by laboratory automatic analysis equipment and X-Ray diagnostic equipment. Highest growth rates are observed in the medical lasers, electronic microscopes, CT Scanners and magnetic resonance imaging apparatus. A decrease is observed in the ultrasound cardiac monitors. © EUROPEAN PROFILES SA 7 The Medical Devices Sector in Greece Angiographic Apparatus Distribution of high tech medical devices X-Ray Diagnostic Equipment CT Scanners Laboratory Automated Analysis Equipment Linear Accelerators Gamma Radiation Cameras Lithotripters Magnetic Resonance imaging apparatus 1% 3%1% 3% 1% 3% 5%1% 6% 4% 15% Artif icial Kidney Apparatus (blood transf usion and f iltration devices) Ultrasound Cardiac Monitors 1% Ultrasound Tomography Scanners 4% 23% Ultrasound Images Cardiotomography Scanners 1% 0% 0% 1% 27% Electronic Microscopes Intravascular Catheters & cannulae Electroencephalographs Medical Lasers Holder Apparatus Radiotherapy Machines Evolution of high tech Medical Devices 8000 6518 7000 6000 5000 4830 4873 5157 1996 1997 1998 5341 1999 7140 7388 2002 2003 5937 4000 3000 2000 1000 0 2000 2001 2.3. DEMAND BY THE FINAL CONSUMER The Households Budget Survey conducted by the National Statistical Service of Greece, provides an estimation of the demand in medical devices generated by the final consumer. The average monthly spending per household was € 1.4 for the category of “other pharmaceutical products” and € 3.1 for the category “therapeutic devices”1]. 2.4. FACTORS INFLUENCING THE DEMAND Apart from the typical factors i.e.: demographic, technological developments, insurance system, household income), we present briefly below two main factors influencing the demand of medical devices. 1] Other pharmaceutical products: (bandages, gauzes, thermometers, syringes, hot-water bottles, kneecaps, drugstores, alcohol, condoms and other contraception methods, sugar and cholesterol testing apparatus, etc. Therapeutic devices: (myopia glasses, contact lens, hearing aids, artificial parts, orthopaedic shoes and others, medical belts, trusses, corsets, bath chairs auto moving or not, special beds, manometers, massage medical devices, x-ray tubes, artificial teeth, collars, services of therapeutic devices) © EUROPEAN PROFILES SA 8 The Medical Devices Sector in Greece a) Capacity of the health care establishments In 2003 in Greece operated 327 health institutions with 51.762 beds. Public hospitals with 35.814 beds covered the 69,2% of the total beds while the private sector with 14.528 beds covered the 28,1%. The breakdown by category of hospitals is shown in the following Table. Table 8 - Number of hospitals and beds Category of Hospital Number Hospitals of Number of Beds General Hospitals 184 35.397 Anticancer Hospitals 4 1.212 Venereal Diseases Hospitals 2 167 Cardiologic Hospitals 2 42 Hospitals of Pestilent Diseases 1 100 Obstetric Hospitals 37 1.290 Neuropsychiatry 49 9693 Orthopaedics 5 366 Urologic - - Ophthalmologic 4 80 Pathologic 10 502 Paediatrics 6 1.586 Hospitals for Phthisis 1 51 Surgery 5 245 Cosmetic surgery - - Otolaryngology 2 52 Mixed 15 979 Total 327 51.762 Public sector hospital beds represent approximately 70% of the total bed capacity, and this share has remained constant throughout the period 1996-2003. Specialisation of the public sector hospitals does not seem to be a decisive factor influencing the demand of specific categories of medical devices, since nearly all major hospitals operate all kinds of clinics (cardiologic, pathology, surgery, orthopaedic, etc). In the absence of systematic planning concerning the procurement of equipment by public hospitals, high technology equipment is purchased on an ad-hoc basis, depending on the reputation of the specific clinic and its medical director. On the other hand private sector demand is expected to increase. There is an observed tendency of establishment of increasing number of new private diagnostic centres, which compensate for the lack of capacity of public sector hospitals to procure appropriate modern technology equipment. It is quite characteristic to observe that (according to anecdotal sources) in 1980 the public hospitals accounted for 67% of the total number of installed CT Scanners, while in 2006 public hospitals accounted only for 36%. b) Regulatory aspects of public procurement This is discussed in Chapter 4. It suffices here to state that the demand from the public sector hospitals is negatively affected by the inherent rigidities of the public sector to respond in an efficient way, on the basis of systematic planning, to real ascertained needs. © EUROPEAN PROFILES SA 9 The Medical Devices Sector in Greece 3. SUPPLY 3.1. NUMBER OF ENTERPRISES The number of registered enterprises in Greece in the sector of medical devices, according to ICAP, is 291 in the year 2006. This number comprises both importers and manufacturers (according to ICAP 78 companies were registered as activated in the manufacturing of medical preparations 2]), but in terms of turnover the sector is dominated by importers. Moreover, it is worth noting that: - Manufacturing companies are also active as importers, - Manufacturing and marketing of medical devices is not an exclusive field of activity for the great majority of registered companies. The most active companies of the sector are registered with the Association of Suppliers of Scientific and Health Equipment (currently, the Association has 123 members). According to the Association’s classification of the products the following enterprises are activated in each field: Table 9 - Enterprises by main sub-market Field of activity Number of enterprises 1. Analytic diagnostic apparatus, general equipment of chemists and environmental control 82 2. Machines and disposables of hospital laboratories 96 3. Surgery equipment, products of endoscopic and minimal invasive medicine and units of intensive care 28 4. Pacemakers – defibrillators and various cardiologic equipment, orthopaedics and hearing implantables. 16 5. Imaging apparatus, lasers and their disposables 14 6. Hospitals’ Furniture Equipment 4 It can be observed from the above table that a very high number of companies are active in the first two segment markets. According to the experts in the fields, this situation reflects an overspending from the public sector hospitals due to a rather inefficient management of stocks. Similarly, the number of companies in segment 4, is considered to be rather high for the size of the Greek market, and this is also explained by the very high prices paid by the national insurance system for this kind of devices. 3.2. KEY PLAYERS 3.2.1. Whole sector Key players in the market are defined here as those companies with a annual turnover over € 20 million, and with the part of sales from medical devices over 50% (2005). Table 10 - Key Players having as primary activity sales of medical devices COMPANY TYCO HEALTHCARE HELLAS SA MEDISPES SA ELECTROMEDICAL SA DIOPHAR SA GENERAL ELECTRIC MEDICAL SYSTEMS HELLAS SA KARAYANNIS P.N. ORTHOPAEDICS SA PLUS ORTHOPEDICS HELLAS SA AMVIS HELLAS SA IAMEX SA BIOCHEM DIAGNOSTICS SA PSIMITIS EL SA Turnover in € 43,634,119 40,592,429 40,141,013 31,535,913 31,102,810 25,581,508 25,554,084 22,917,344 22,796,903 21,293,644 21,012,684 2] Manufacturing companies mainly produce specific kinds of products such as disposable equipment, artificial kidney apparatus, dental implantables, gauzes, reagents, hospital furniture equipment © EUROPEAN PROFILES SA 10 The Medical Devices Sector in Greece The 10 most important companies in the sector accounted for about 28% of the market in 2005, while the respective share in 2004 was 25,6%. This indicates that the sector is characterised by a rather low concentration rate. For 2005 TYCO’s market share was 3,4%, MEDISPES’s 3,1%, ELECTROMEDICAL 3,1%, GE MEDICAL SYSTEM 2,4%. The average gross margin for the period 2001-2005 was 44, 29%, while the average net margin was 17,47% (these are to be compared with the average of the sector which were 43,05% and 11,49% respectively). - Highest gross margin: IAMEX SA with 68,87%, BIOCHEM DIAGNOSTICS SA with 51,48%, CARAYANNIS ORTHOPEDICS (51,15%). - Highest net margin: IAMEX SA with 30,92%, BIOCHEM DIAGNOSTICS SA with 30,92%, ELECTROMEDICAL SA with 25,08%. The average general liquidity of the total enterprises of the sector during the period 2001-2005 was 1,29 while the average specific liquidity was 1,05 and the cashier 0,07. The low liquidity ratios indicate improper leverage or very unfavourable terms of transactions with the suppliers or the creditors. In addition, there are 11 very big companies active in trading medical devices, but with their main part of turnover coming from other neighbouring activities (pharmaceutical products, electric appliances). These are presented in the table below (2005). Table 11 - Big companies having medical devices as part of their activities COMPANY SIEMENS SA ROCHE HELLAS SA ASSOCIATION OF CHEMISTS OF SALLONICA JOHNSON AND JOHNSON HELLAS SA PHILIPS HELLAS SA BAYER HELLAS SA PHARMASERV LILLY SA ABBOT LABORATORIES SA SARANTIS SA GEROLYMATOS SA 3M HELLAS LTD Turnover in € 350,017,797 227,485,138 184,726,437 169,818,923 165,813,891 147,924,096 144,811,735 130,748,649 111,007,883 100,079,884 44,853,638 These companies have a significant share of the medical devices market. The share of JOHNSON & JOHNSON HELLAS S.A is estimated at about 5,5% of the total market, while the share of SIEMENS S.A and BAYER HELLAS S.A is estimated at about 2%-2,5% of the total market of medical devices. 3.2.2. Some specific sectors We present below data for specific market products. a) Active Implantable (pacemakers) Table 12 - Key players in the category “active implantables” were: COMPANY Turnover in € Manufacturer ELECTROMEDICAL 40,141,013 BOSTON SCIENTIFIC (USA) LADAKIS SA 18.631.403 SAINT JUDE MEDICAL (USA) INTERTRONICS SA 13.160.698 BIOTRONICS (Germany) MEDRONIC HELLAS SA 5.303.495 MEDRONIC MEDICAL (USA) ALAN MEDICAL SA 4.937.741 SORIN (Italy) b) CT Scanners Table 13 - Sales of TC Scanners in 2006 by manufacturer Manufacturer Pieces sold % Market share SIEMENS 114 37.13 PHILIPS 84 27.36 GENERAL ELECTRIC 63 20.57 TOSHIBA 44 14.33 HITTACHI 1 0.1 © EUROPEAN PROFILES SA 11 NEWSOFT 1 The Medical Devices Sector in Greece 0.1 d) Magnetic Resonance Scanners Table 14 - Sales of Magnetic Resonance Scanners in 2006 by manufacturer Manufacturer SIEMENS PHILIPS GENERAL ELECTRIC TOSHIBA Pieces sold 72 46 36 6 % Market share 45 28.75 22.5 3.75 3.2.3. Local Manufacturers Locally manufactured devices concentrate mainly on the following categories: - Cotton and medical gauzes, - Syringes, - Bandages, - Orthopaedic appliances, - Diagnostic chemicals, - Surgery tables, - Hospital furniture, - Dental material (artificial teeth and prosthetics), - Artificial kidney filters, - Small injection pumps, - Assembly of dentist appliances and physiotherapy equipment. In 2003 78 companies manufacturing companies were registered with a total turnover € 1.698, 7 million. The most important local manufactures are presented below. Several of these companies are also active in import of medical devices as well as in the manufacturing of other products. Their turnover (2005) covers the all sales. Table 15 - Key domestic manufacturers COMPANY Turnover in € MEDISPES SA 40,592,429 VIOSER INDUSTRIES 23,184,344 FEIDAS SA 20,416,644 MEDICON HELLAS SA 14,301,033 KOUDOUNAS SA 8,351,272 SKOUTAS SA 7,738,655 VERMA DRUGS SA 7,304,011 DOCTUM PHARMACEUTICALS YOKARIS &Co SA 6,824,585 © EUROPEAN PROFILES SA 12 The Medical Devices Sector in Greece 4. REGULATORY ASPECTS NB. The complete list of legal acts which regulate the medical equipment sector (national and EU legislation is represented in Annex 1) 4.1. PRODUCTION AND MARKETING Manufacturing and marketing of medical devices are regulated by three laws, fully transposing the provisions of the relevant EU Directives, as shown below. Device Active Implantable Medical Devices Medical Devices In-Vintro Diagnostic EU DIRECTIVE Directive 90/385 Directive 93/42 Directive 98/79 GREEK LAW Presidential Decree 2351, Government Gazette 639B/26.8.94 Presidential Decree 2480, Government Gazette 679B/13.9.94 Presidential Decree 3607, Government Gazette 1060B/10.8.01 The National Authority in charge for the implementation of this legislation is the National Drugs Organisation. (In summary, marketing of medical devices is subject to third party certification, according to the class of risk they represent. For economy of the text we do not analyse this legislation which s well known to the manufacturers). 4.2. PUBLIC PROCUREMENT PROCEDURES 4.2.1. Existing legislation Procurement of equipment in public hospitals are regulated by Law No 2955, and in accordance with the provisions of Presidential Decree 394 of 4 December 1996, which lays down the procedural aspects of public tenders, in accordance with the EU relevant legislation on public procurement. The key points of the current legislation are as follows: a) Contracting Authorities can be the Hospitals, the Regional Health Administrations, or the Ministry of Health, depending on the size and kind of supplies. It is worth noting that Hospitals have a large degree of autonomy concerning small supplies of consumables. b) The hospitals and the Regional Health Administrations have the obligation to produce an annual supplies programme and plan. It is questionable whether this is effectively followed, because experience shows that in most cases supplies, especially for consumables, are ordered in a rather adhoc basis. c) The kinds of medical devices and disposable equipment that can be procured, as necessary for the unhindered and efficient operation of the hospitals and of health centres are defined by decision of the Minister of Health and Social Care, and enter into a special registry, (positive list), under a special code number. For every product in the list specifications are defined common for all the public hospitals and the health centres. This registry will be gradually developed by decisions of the Minister of Health and Social Care. d) There is a specific category of medical devices, the so called “out of closed medical treatment” where public procurement is done through direct negotiations with the suppliers on the basis of unit prices (under the reasoning that it is not possible to foresee the necessary quantities). These concern: - Artificial implantable bones, - Jaw facial surgery, - Pacemakers, defibrillators and electrodes, certain cardio-surgery equipment, - Artificial kidney filters. The maximum prices for such devices are fixed by Ministerial decisions on a regular basis. Experts in the market consider that for several items the unit prices are rather high (for instance the authorised price of a pacemaker, depending on the type, range from € 5.520 to € 10.400). © EUROPEAN PROFILES SA 13 The Medical Devices Sector in Greece The maximum prices per unit of medical devices (artificial implantable bones, jaw facial surgery, pacemakers-defibrillators, electrodes and cardio surgery equipment and artificial kidney apparatus) are presented at the Government Gazette 518/19.4.2005 which is annexed at the end of the Study. 4.2.1. Introduction of New Legislation regarding the procurement procedures A new bill is in the pipeline of adoption concerning the procurement of supplies by the public hospitals and public health centres, with the purpose to rationalize the current system. The key issue under the new legislation is the “centralisation’ of procurement procedures through the creation of a new independent Administrative Authority the “Central Committee of Health Supplies”, which will unify some 9.000 tenders that are carried out annually by public hospitals. The Committee will be assisted by other existing or new organisations to be created for this purpose, with the aim to monitor and control the whole spectrum of supplies to public hospitals. . The draft bill contains also provisions to prevent monopoly or oligopoly distortions of the market and specific criteria for defining tender conditions. © EUROPEAN PROFILES SA 14 The Medical Devices Sector in Greece 5. PROBLEMS OF THE SECTOR AND PROSPECTS 5.1. MAJOR PROBLEMS OF THE SECTOR The problems of the medical devices market can be summarised as follows: a) High supplies cost, because of “sensitive payments”, High supplies cost is observed to specific categories of medical devices, the final choice of which depends on the physician (especially pacemakers, artificial kidneys). It is estimated that these kind of payments for the pacemakers accounts for about 17% of the operational costs of supplier and this cost is finally embodied to the price of the device charged to the health insurance fund. This kind of dependency of supplier to the choice of the physician, is an established practice, distorts conditions of competition in the market and creates a kind of “price fixing” to high levels in order to compensate for these hidden costs. The tendency of the Ministry of Health is to fix lower price limits for the “out of closed treatment” devices (see Ch.4.2.1, d) and this will put a pressure on the companies to the extent that the practice of dependency mentioned above might be difficult to eradicate. b) Weakness of consumption control in public hospitals It is a well known fact that the management system concerning control and monitoring of supplies in the public hospitals, especially for disposals, is ineffective, thus creating an extra demand, which in turn gives space for the existence of a rather high number of suppliers and a rather low concentration ratio in the sector. c) Delays in debt payments While the delivery of ordered goods is direct - up to 30 days from the date of order, the settlement of payment of payment is significantly delayed, and may reach 18 months as far as the public hospitals are concerned. Until the end of 2004 the debt of the public hospitals towards suppliers of medical equipment amounted to € 1, 4 billion, which contributed to negative effects on the companies’ trade cycle and their liquidity. To this amount a new debt of € 400 million is added during 2005. The debts are mainly accumulated by the malfunctioning of the insurance funds which they fail to pay out the nursing expenses. Settlement of the dept accumulated till 2004, through a discount offered to the pending invoices, is estimated to result to a loss of profit of € 50 million for the sector. Overall, this results to problems of liquidity within the sector. The average general liquidity of the total enterprises of the sector during the period 2001-2005 was 1,29 while the average specific liquidity was 1,05 and the cashier 0,07. The low liquidity ratios reflect the unfavourable terms of transactions. d) Technical barriers There seems to be a widespread practice among public hospitals to reject offers of products based on an alleged issue with the security level of the product, despite the fact that the latter is certified in conformity with the relevant EU Directives. The Commission considers that this practice violates both Directives 93/36/EEC (public supply contracts) and 93/42/EEC (medical devices). The Greek authorities do not contest this violation, but despite the measures that they have taken since 2004, after the intervention of the Commission in this respect, to remedy this infringement, the problems unfortunately still persist in many hospitals all around the country. e) Imperfections of the existing legislation concerning procurement of supplies Law 2955/2001 and its executing Ministerial Decrees, provide that medical supplies can be procured directly, without a prior tender procedure, when the award concerns devices without substitutes. It appears that an abuse is made of this provision due to lack of appropriated compilation of the positive list of devices. The European Commission has decided to refer Greece to the European Court of Justice, for breach of Directives 93/36/EEC and 2004/18 (public supply contracts). © EUROPEAN PROFILES SA 15 The Medical Devices Sector in Greece 5.2. TRENDS AND POTENTIALITY We present below four main factors that to our opinion characterise the trends of the sector. a) There is an unquestionable expansion of the private sector health care provision, which is manifested in the increased number of private diagnostic centres and special treatment units, as well as in new forms of health services (medical tourism). According to experts opinion in the field this tendency will continue b) Modernisation of the public hospitals infrastructure which started with financing under the 3rd Community Support Framework (Measure 1.2 “Functional modernisation of hospital units”), will continue also under the 4th Community Support Framework, through the Regional Entrepreneurial Programmes. c) It is expected that the modifications of the new bill concerning system of the public supply contracts in the field of health will rationalise the circuitry of supplies, towards establishment of better competition conditions in the market. d) There is an observed tendency that the manufacturers come to reside in Greece and the intermediates-importers tend to disappear. This has been a move of the parent companies in response to the high profitability of the sector, as well as to the need of reducing extra costs. It is estimated that about 50% of the parent companies have already been located in Greece and are followed by others. The contracts that the parent companies have with Greek representatives are valid for 2-3 years. This gives the manufacturers the possibility to terminate their cooperation, after the expiring of their contract. The usual practice is to offer the previous representative a compensation and then take over his key personnel, thus securing the necessary know-how of the local market practices and the client network. Factors (a) and (b) above will undoubtedly contribute favourably to a continued development of the sector of medical devices, and especially the liberalisation of the health services market which sets the terms of entrepreneurial activity in an environment where traditionally the public sector shows weakness in responding. Based on these assumptions, experts in the field estimate that the rate of growth of the sector will be approximately 7% in 2007. Liquidity will remain for a certain period a key problem for the sector, and many companies despite the large turnover present negative outcome. The new bill concerning the public supplies contracts seems prominent to the sector and, if properly applied, will deprive the sector of its major drawback. It might be argued on the other hand that the expected rationalisation of the public supplies and the tighter control and management of the hospitals stock of disposables might reduce the demand for this kind of products. This factor, in combination with factor (d) above, might entail a restructuring of the supply towards a higher concentration dominated by fewer companies and by the manufacturers themselves. ----------- © EUROPEAN PROFILES SA 16 The Medical Devices Sector in Greece ANNEXES ANNEX I LIST OF THE BIGGER COMPANIES OF THE SECTOR ACCOMPANIED WITH CONTACT DETAILS OF THE COMPANY AND OF THE PURCHASE MANAGER At the following list are entailed all the companies with turnover over € 4 million. The comment n/a (not available) stands for companies that denied providing us the name of their purchase manager. © EUROPEAN PROFILES SA 17 The Medical Devices Sector in Greece No 1 COMPANY'S NAME TYCO HEALTHCARE HELLAS S.A. Turnover (Year 2005) 43.634.119 € 2 MEDISPES S.A 40.592.429 € 3 ELECTROMEDICAL S.A. 40.141.013 € 31.535.913 € 4 DIOPHAR S.A. 5 GE MEDICAL SYSTEMS HELLAS S.A. 6 ΑLCON LABORATORIES HELLAS S.A. 29.676.867 € 7 PLUS ORTHOPEDICS HELLAS S.A. 25.554.084 € 8 CARAYANNIS P.N ORTHOPEDICS S.A. 24.581.508 € 9 AMVIS HELLAS S.A. 22.917.344 € 10 IAMEX S.A. © EUROPEAN PROFILES SA 31.102.810 € 22.796.903 € Profile Import & trade of medical devises & disposables. Representations, exclusive imports & wholesale trade of medical equipment. Production of disposal supplies. Representations, exclusive imports & wholesale trade of medical disposal supplies and implants. Representations, exclusive imports & wholesale trade of medical apparatus , tools and disposable supplies, imlants, laboratory instruments, hospital equipment, beauty parlor's machinery & cosmetics. Representations, imports & wholesale trade of medical apparatus. Representations, exclusive imports & wholesale trade of medical apparatus, instruments, implants & disposable supplies, machines and medicated products. Representations, exclusive imports & wholesale trade of surgical tools, orthopedic supplies, implants and physiotherapy machinery. Representations, exclusive imports & wholesale trade of surgical tools, goods & implants. Representations, exclusive imports & wholesale trade of opthalmology apparatus, tools, intaocular lenses and opticals. Representations, exclusive imports & wholesale trade of medical apparatus, orthopedics, implantsand medical disposal supplies. Rental of medical Purchase Manager Mrs. Nasopoulou Magda Telophone email address website 2106127000 katerina.giannopoulou@emea.t ycohealthcare.com 67 Pentelis str., 151 26, Marousi, Athens www.tyco.com www.medispes.gr www.electromedical.gr Mr. Vassilopoulos Th. 2106109090 info@medispes.gr 38 Sorou str., Marousi, 151 25, Athens Mr. Tzinis Ioannis 2310326002 elmedcal@otenet.gr 50 Voulgari str., 524 29, Thessaloniki Mr. Kontovrakis Panagiotis 2106849058 Mr. L.O. Contucci 2109690990 368 Kifisias Ave & Ithakis, 152 33, Halandri, Athens 156 Kyprou & 91 Konstantinoupoleos, 164 51, Argyroupoli, Athens Mr. Mpalinovits Edward 2106810348 18 Kifisias Ave, 151 25, Marousi, Athens Mrs. Alexiou Angeliki Mr. Stozakoglou Eyangelos Mr. S.Mordoh Mr. Mnimatidis George (Orthopedics) Mr. Topis Dimitris info@diophar.gr 2109913190 info@endoplus.gr 8 Kleanthous str., 163 46, Ilioupoli, Athens 2109254900 iko@otenet.gr 10 Drosou str., 145 64, Kifisia, Athens 2106000400 postmaster@amvis.gr 160 Spaton Ave, 153 51, Pallini, Athens iamex@iamex.gr 1 Evoias, 143 41, Nea Filadelfeia, Athens 2102513698 www.diophar.gr www.gemedicalsystems.gr www.iamex.gr 18 The Medical Devices Sector in Greece No COMPANY'S NAME Turnover (Year 2005) 11 IATRIKI EF ZIN S.A. 22.587.805 € 12 BIOCHEM DIAGNOSTICS S.A 21.293.644 € 13 PSIMITIS EL. S.A. 21.012.684 € 14 IATRIKI TECHNIKI S.A. 20.731.121 € Profile apparatus. Imports & wholesale trade of medical apparatus and disposal supplies. Representations, exclusive imports & wholesale trade of laboratory and diagnostic instruments, disposable supplies, reagents,medicines and biotechnological products. Representations, exclusive imports trade & regional agent of medical supplies 16 LADAKIS S.A. 18.631.403 € 17 MEDICON HELLAS S.A. 17.979.699 € Wholesale trade of medical tools & hospital disposable supplies. Representations, exclusive imports and whosale trade of medical and hospital apparatus, protective goods, disposable supplies and implants. Representations, exclusive imports & wholesale trade of medical apparatus, disposable supplies and imlants. Representations, exclusive imports, production & wholesale trade of reagents, laboratory istruments, cosmetics & medicated products. 17.885.613 € Exclusive imports, wholesale trade of medicines and medical disposable supplies. 15 18 HOSPITAL LINE S.A JASONPHARM S.A. © EUROPEAN PROFILES SA 19.126.506 € Purchase Manager (Medical Products) Telophone email address website contact details from BOSTON SCIENTIFIC HELLAS (IATRIKI EF ZIN has become BOSTON SCIENTIFIC HELLAS 2109537890 efzin@efzin.gr 10 Athinas str., 176 73, Kallithea, Athens www.efzin.gr Mr.Vagenas Ioannis 2109400861 unfo@biochem.gr 6 Zisimopoulou str., Palaio Faliro, Athens www.biochem.gr Mr. Parisi Efi 2107244562 cpsimitis@otenet 59 Andr.Dimitriou str., Kaisariani, Athens www.psimitis.gr Mrs. Kousieri Agoritsa 2106234350 i.at-tec@otenet.gr 1 Kefalariou str., 145 62, Kifisia, Athens www.iatriko.gr Mr. Karellas A. 2102510040 hospillin@hol.gr 36 K. Palama & 41 Petala, 143 43, Nea Halkidona, Athens Mr. Pelikanakis Konstantinos 2102723300 info@ladakis.gr 74 Lauriou str., 142 35, Nea Ionia, Athens www.ladakis.gr Mr. Bobolakis Stauros 2106606000 medicon@mediconsa.com 5-7, Melitonos, G153 44, erakas, Athens www.mediconsa.gr jasonpharm@jasonpharm.gr 26 Ethnikis Antistaseos, Kaisariani n/a 2107517608 19 The Medical Devices Sector in Greece No COMPANY'S NAME 19 ARITI S.A. Turnover (Year 2005) 17.257.298 € Profile Representations, exclusive imports & wholesale trade of haemodialysissolutions and filters, hospital equipment, medical apparatus, instruments & disposable supplies. 17.038.524 € Representations, imports & wholesale trade of orthopedic implants. 20 ORTHOMEDICAL S.A. 21 DADE BEHRING HELLAS S.A. 22 PARAPHARM INTERNATIONAL S.A. 15.887.354 € 23 PAPAPOSTOLOU N.A LTD 15.308.748 (Year 2004) 24 OMIKRON MEDICAL S.A. 15.303.593 € 25 BOSTON SCIENTIFIC HELLAS S.A. 14.070.490 € 26 SELIDIS A.BROS ANTISEL S.A. 13.850.144 € 27 ARTHROSIS SA © EUROPEAN PROFILES SA 16.294.872 € 13.642.666 € Representations, imports & wholesale trade of dignostic reagents and labatory apparatus. Imports & wholesale trade of medicated products, medicines, cosmetics & medical disposal supplies. Representations, exclusive imports & wholesale trade of medical apparatus, tools and disposable supplies, orthopedics, imlants, scientific instruments, hospital equipment. Representations, exclusive imports & wholesale trade of hospital disposable supplies, implants, dialyzers, reagents, medical apparatus & instruments. Exclusive imports & trade of medical tools. Representations, exclusive imports & wholesale trade of scientific and laboratory instruments, medical apparatus, reagents, medical and hospital disposable supplies. Representations, exclusive imports & wholesale trade of medicaldisposable supplies, tools, instruments, orthopedics, implants and hospital equipment. Purchase Manager Telophone email Mr. Bousounis Giorgos 2106204835 ariti@otenet.gr Mrs. Gonata Vicky 2108002331 info@orthomedical.gr Mr. Panagiotarako s George Mrs. Lianoudaki Angeliki Mrs. Panteloglou Kyriaki Mrs. Koulaxizi Aspasia Mr. Eystathiadis Epameinonda s Mr. Gatsos Konstantinos Mr. Karipidis Nikolaos address 246 Tatoiou Ave, 136 71, Aharnes, Athens National Road Athens-Lamia (17th km), 145 64,Kifissia, Athens website www.ariti.gr 2106560900 357-359 Messogeion Ane, 15 31, Halandri, Athens 2109651889 parapharm@internet.gr 56 Kyprou str., 16451, Argyroupoli, Athens info@papapostolou.gr 4 Plateia Syntrivaniou sqr., 54 621, Thesallonici www.papapostolou.gr 2109425166 omikron@omikron.gr 29 Tagm.Plessa str. & 214 Sokratous, 176 74, Kallithea, Athens www.omikron.gr 2109542300 bsh@bshellas.com.gr 336 Syngrou Ave, Kalithea, Athens 2310322525 antisel@antisel.gr 6 Karatasiou str., 542 50, Thesallonici www.antisel.gr info@athrosis.gr Athinon - Lamias Rd (12th km), 144 52, Metamorfosi, Athens www.arthrosis.gr 2310233251 2102826045 www.dadebehring.com 20 The Medical Devices Sector in Greece No COMPANY'S NAME 28 MENARINI DIAGNOSTICS SA Turnover (Year 2005) 13.332.506 € 29 INTERTRONICS HELLAS S.A 13.160.698 € 30 BIOMERIEUX HELLAS S.A 13.014.718 € 31 KYRIAKIDIS J.M SA 12.716.855 € 32 BECTON DICKINSON HELLAS S.A 12.259.847 € 33 PROTON S.A. 12.035.640 € 34 MANTZARIS B & J S.A. 11.960.424 € 35 PETSIAVAS S.A. 36 METAXAS DIAGNOSTICS © EUROPEAN PROFILES SA 11.741.000 € 11.405.629 € Profile Representations, exclusive imports & trade of laboratory instruments, diagnostic apparatus & reagents. Representations, exclusive imports & wholesale trade of scientific and laboratory instruments, medical apparatus, reagents, medical and hospital disposable supplies. Exclusive imports & wholesale trade of reagents, scientific instruments & components Exclusive imports & wholesale trade of rlabatory instruments, reagents anddisposal supplies. Representations, imports, wholesale trade and sales promotion of medical instruments, reagents and disposable supplies. Exclusive imports & wholesale trade of medical apparatus and disposable supplies, hospital equipment, scientific instruments and special security systems. Exclusive imports and whosale trade of cardial implants and pacemakers. Representations, exclusive imports & wholesale trade of medical tools, implants and disposal supplies, orthpedic goods, labaroty instruments, plastic raw materials, dyestuffs, chemical products, medicines, yarms, medicated products, underwear, pyzamas, tights, socks, swimming suitsand textil machinery. Exclusive imports and whosale trade of medical apparatus, spare parts and reagents. Technical customer services. Purchase Manager Mrs. Anthopoulou Marinela Mr. Kouskoutis A.(Manager Director) Mrs. Staurakopoulo u Katerina Mr. Kyriakidis Ioannis Mrs. Beza Violeta-Eleni Telophone 2109944950 2106420181 email address website mendiagr@otenet.gr 575, Vouliagmenis Ave, 164 51, Argyroupoli, Athens www.menarinidiagnostics.gr jmksa@acci.gr 2 Oreivassiou str. & Kon.Tsaldari 78, 114 76, Athens 70 Papanikoli str., 152 35, Halandri, Athens 1 Acherontos, 153 43, Agia Paraskevi, Athns magda-andria@europe.bd.com 5 Amfitheas Ave, 171 22, Nea Smyrni, Athens info@intertronics.gr 2108172400 2106004010 2109407741 Mrs. Messini Roula 2102806200 admin@protoncy.gr 2 Ioulianou str., 144 51, Metamorfosi, Athens Mr. Tsakiris Harris 2107706452 b-i-mantzaris@ath.forthnet.gr 2-4 Mesogeion Ave, 115 27, Athens Mr. Anastassopou los Sotirios 2106202301 npsa@petsiavas.gr 21 Ag. Anargyron, Kifissia, 145 64, Athens Mr. Petropoulos Konstantinos 2109213001 info@metaxas-diagnostics.gr 9a Leontiou, 11745, Athens www.intertronics.gr www.biomerieux.gr www.jkyriakidis.gr www.proton-sa.gr www.metaxas-diagnostics.gr 21 The Medical Devices Sector in Greece No COMPANY'S NAME 37 MEDICAL INNOVATION S.A. 38 STERILE HELLAS S.A. Turnover (Year 2005) 10.786.513 € 10.510.393 € 10.170.357 € 39 BIOANALYTICA S.A. 40 VAMVAS CHR.I & CO O.E 10.093.560 € 41 DEPUY HELLAS S.A. 10.023.946 € 42 NEXUS MEDICALS S.A. 43 MAGEIRAS DIAGNOSTICS S.A. 9.255.656 € 44 KARAYANNIS ATH. MEDICAL PLUS S.A 9.085.045 € 45 HEALTHCARE SOLUTIONS S.A. 8.648.061 € 46 PAPAELLINAS C.A (HELLAS) S.A. © EUROPEAN PROFILES SA 9.764.344 € 8.331.511 € Profile Imports and whosale trade of medical & hospital disposal supplies. Exclusive imports and whosale trade of hospital equipment, medical tools, protective goods, disposal supplies, and doctor's garments. Representations, exclusive imports and whosale trade of labatory instruments and reagents. Representations, exclusive imports and whosale trade of medical apparatusand tools, orthopedic goods, impants, hospital equipment, and disposal supplies. Technical Support. Representations, exclusive imports and trade of orthopedic implants. Exclusive imports and trade of opthalmic lenses, apparatus and contat lense cleaning materials. Representations, exclusive imports and trade of labatory instruments, reagents and medical disposal supplies. Representations, exclusive imports and trade of medical disposals supplies and implants. Representations, exclusive imports and trade of medical apparatus spare parts and disposal supplies. Representations, exclusive imports and trade of reagents, bandages, surgical supplies, medical apparatus, disinfectants, detergents, cosmetics, medicated produts, implants, insect repellents and hair care products. Purchase Manager Telophone email Mr. Vasileios Pavlou 2102502029 medinnov@otenet.gr address 41 Th. Petala, 143 43, Nea Halkidona, Athens 2106836353 sterile@ath.fortnet.gr 13 Thisseos str., 152 32, Halandri, Attiki www.sterilehellas.gr 2106400318 bioanalyt@hol.gr 3A-5 Illision str., 11528, Athens www.bioanalytica.gr Mrs. Kolokytha Panagiota Mrs. Oikonomou Xristina, Mrs. Tsiokanou Maya Mrs. Tsitonaki Lilian Mr.Koutroulis Haralambos Mrs. Papastavrou Fotini 2106078400 info@vamvasmedicals.gr 2106233034 marketing@depuy-medec.gr 2106039791 info@nexusmedicals.gr 533 Messogeion Ave, 153 43, Agia Paraskevi, Athens Ag.Kyriakis 20 str., 145 61, Kifisia, Athens Athinon - Lamias Rd (12th km), 144 51, Metamorfosi, Athens website www.vamvasmedicals.gr Mrs.Maragkou daki Eirini 2102856330 magiras-diagnostics@otenet.gr Ag. Eirinis & Yakinthon, 141 23,Likovrisi, Athens Mr. Kouris Diamandis 2108254070 kioannou@medicalplus.gr 32 Korinthou, 145 64, Metemorfossi, Athens www.medicalplus.gr Mr. Kechagias Mixalis 2106993040 healthcare@healthcaresolutions.gr 9 Katechaki, 115 25, Athens www.healthcare-solutions.gr info@costaspapaellinas.com Paianias Markopoulou Ave (26th km), 194 00, Athens Mr. Papaellinas Thanasis 2106626210 22 The Medical Devices Sector in Greece Turnover (Year 2005) No COMPANY'S NAME 47 EBEDENT S.A 8.323.602 € 48 HOSPAL HELLAS ΜΟΝΟΠΡΟΣΩΠΗ ΕΠΕ 8.233.726 € 49 BARD HELLAS MEDICAL EQUΙPMENT S.A. 7.873.525 € 50 UNIMED LTD 7.839.243 € 51 SKOUTAS S.A. 7.783.656 € 52 IAKOBIDIS HELLAS S.A. 7.621.031 € 53 AKTIS IATRIKA S.A. 7.371.295 € 54 BIOKOSMOS S.A. 7.255.244 € 55 BIOMET HELLAS S.A © EUROPEAN PROFILES SA 7.240.621 € Profile Representations, exclusive imports and trade of dental and denture making machinery, tools, supplies, implants and medicines. Imports & trade of haemodialysis machiner and disposal supplies. Representations, exclusive imports and trade of medical apparatus tools and disposal supplies. Representations, exclusive imports and whosale trade of orthopedc supplies, impants and surgical tools. Representations, exclusive imports and trade of medical apparatus, cosmetics, hospital, physiotherapy, gymnasium and beauty parlor equipment. Representations, exclusive imports and trade of medical disposal supplies, tools, implants, orthopedics and hospital equipment. Representations, imports and whosale trade of medical disposal supplies. Representations, exclusive imports and trade of radio isotopes, reagents, medical instruments and apparatus. Production of reagents. Representations, exclusive imports and trade of implants, orthopedics, surgical tools and medichines. Purchase Manager Telophone email Mr. Rekoutis Panagiotis 2103829392 info@ebedent.gr Mr. Prevalis Xristos 2102836006 Mr. Kontopoulos Alexandos 2109690770 bard.hellas@cbard.com 4 Themistokleous str., 106 78, Athens 114 Kymis Ave, Maroussi, 151 23, Athens 22 Alkiviadou & 72 Vouliagmenis Ave., 16675, Glyfada, Athens n/a 2106728500 unimed@acci.gr 170 Kifissias Ave, 115 25, Athens Mr. Skoutas Panagiotis 2107795118 sales@skoutas.gr 28 Avlidos str., 115 27, Athens www.skoutas.gr 210685687 info@msjacovides.com 24 Fillelinon str., 152 32, Halandi, Athens www.msjacovides.com 2107470585 aktis@aktismed.gr 112 Vas. Sofias str.,115 27, Athens 2292063900 info@biokosmos.gr Panormos, 19500, Lavrio, Athens info@bh.ath.fothnet.gr 78 Sigrou Ave. & 4951 Botasari str., 11742, Athens Mrs. Tzortzi Pegy Mr. Papanikolaou Nikolaos Mr. Pagonos Aggelos Mrs. Elazeb Katerina 2109200600 address website www.ebedent.gr www.cbard.gr www.biokosmos.gr 23 The Medical Devices Sector in Greece No COMPANY'S NAME 56 BACACOS S.A. 57 GENERAL CHEMICAL PRODUCTS S.A. 58 ST MEDICAL PRODUCTS LTD Turnover (Year 2005) 7.199.579 € 7.015.015 € 6.649.840 € 6.606.861 € 59 DENTOFAIR S.A. 60 MEDICAL PRODUCTS Ltd. 6.561.679 € 61 ENDOSCOPIKH S.A. 6.479.844 € 62 STRYKER HELLAS LTD 6433072 € (Year 2004) 63 Ε & Ε MEDICAL S.A 6.410.455 € © EUROPEAN PROFILES SA Profile Representations, exclusive imports and trade of chemical, medicated and pharmaceutical products, scientific and medical instruments and tools, optical goods, orthopedic equipment, radiosotopes, reagents, medical protective goods and disposal supplies, hospital equipment, cosmetics and baby foods. Service of medical apparatus. Representations, exclusive imports and trade of chospital equipment, medical apparatus and clothing, disposal supplies and orthopedic goods. Mfg of medical disposal supplies and hospital clothing. Representations, exclusive imports and trade of medical & hospital disposable supplies, tools, apparatus and implants. Representations, exclusive imports and trade of dental and denture making apparatus, tools & swupplies. Representations, exclusive imports and trade of medical apparatus, tools and disposable supplies, haemodialysis solutions, orthopedic and vetinary pharmaceuticals. Imports and wholesale trade of medical gases and hospital equipment. Representations, exclusive imports and wholesale trade of prthopedic implants and medical apparatus. Representations, exclusive imports and wholesale trade of hospital equipment, medical apparatus, labatory instruments, implants, reagents and disposable supplies. Purchase Manager Telophone email address Mr. Bacacos George 2105232631 pharmacy@bacacos.gr 34 Deligianni & Maizonosstr., 104 38, Athens Mr. Papadopoulos Ioannis 2106203000 gcp@hol.gr 60 Avgis, Kifissia, 145 64,Athens Mr. Tsoutsouras Spyros 2106927327 tsoutsouras@ath.forthnet.gr 9 Krimaias str. 115 26, Athens Mr. Papadimitriou Gr. 2107789512 dentofair@otenet.gr 24 Tetrapoleos str., 115 27, Athens website www.gcp.gr www.dentofair.gr n/a 2109647500 info@mediprod.gr 54 G. Gennimata, 16562, Glyfada, Athens Mr. Kaloglou Th. 2107470090 info@endoscopiki.gr 12 Zagoras str., 11527, Athens www.endoscopiki.gr 455 Messogion Ave. 15343, Ag. Paraskeyh, Athens www.stryker.gr 64 L. Rinakourstr., 11523 Athens www.eement.gr Mr. Kalimeris Jhon 2106003222 Mr. Epifanis Evaggelos 2106996191 info@eement.gr 24 The Medical Devices Sector in Greece Turnover (Year 2005) No COMPANY'S NAME 64 BIOMEDICA LIFE SCIENCES S.A 65 TECHNOMEDICS ASSETS SA 5.982.954 € 66 DIA MED HELLAS S.A 5.888.586 € 67 68 69 70 71 MESSER HELLAS SA EDWARDS LIFESCIENCES HELLAS LTD DIGAPHARM S.A. NEPHROTECH A.E HELLAMCO S.A © EUROPEAN PROFILES SA 6.294.518 € 5.771.611 € 5.642.744 € 5.620.944 € 5.468.809 € 5.433.393 € Profile Exclusive imports and wholesale trade of reagents, scientific instruments, and components. Representations, imports and wholesale trade of medical apparatus, hospitals equipment and disposable supplies. Repairs and maintenance service. Representations, imports and wholesale trade of medical labaroty instruments and reagents. Exclusive imports and trade of industrial, medical and special gasses, medical apparatus, bottles of gasses, gas network andlabatory safety equipment. Installation of gas distribution systems. Special technicalstudies. Prduction (on - site) of industrial and medical gasses. Representations, imports and trade of medical apparatus, disposable supplies and implants. Representations, exclusive imports and trade of medical and labatory apparatus, instruments, dsposable supplies, disinfects and reagents. Representations, exclusive imports and trade of haemodialysis materials and solutions and medicines. Representations, exclusive imports and trade of scientific and labatory instruments, apparatus and equipment, reagents, gas generators and electronic weighing systems. Purchase Manager Telophone email Mr. Drosos Spyros 210 6899801 info@biomedica.gr address 4 Papanikoli & Possidonos, 152 32, Halandri, Athens Mr. Arvanitis Konstandinos 2109690900 technomedics@technomedics. gr 124 Saki Karagiorga str., 165 61, Glyada, Athens n/a 2104819098 diamedel@otenet.gr 6-8 Hiou str., 18345, Moschato, Athens info@messer.gr Ag. Varvaras &11 Aristidou, 175 63, Palaio Faliro, Athens website www.biomedica.gr Mr. Apsotolelis Apostolos 2109882579 Mr. Grioris Krisos 2102854640 11 Velestinou, 141 22, Hrakleio, Athens 2310461667 grdinga@otenet.gr Karaoli Dimitriou, P.O. Box 60031, 57001,Themri, Thessaloniki www.dingas.gr info@nephrotech.gr Athinon Lamias Rd (12 km), 144 52, Athens www.nephrotech.gr info@hellamco.gr 7 Matathonos str., 152 35, Halandri, Athens www.hellamco.com n/a Mr. Kosmetatos Efstathios (orthopedics), Mr. Vanos Spyros (pharmaceutic als) n/a 2102810528 2106895260 www.messer.gr 25 The Medical Devices Sector in Greece No COMPANY'S NAME 72 MEDICAL DEVELOPMENT S.A. Turnover (Year 2005) 5.399.870 € 5.328.845 € 73 DELTA MEDICAL S.A. 74 MEDTRONIC HELLAS S.A 5.303.495 € 5.228.071 € 76 ANALYTICAL INSTRUMENTS A.E "Dr. C.J.Vamvakas" GROUP MEDICAL PURCHASING 77 AGIORAMMA Ltd 5.207.703 € 78 D.P.C - "Ν.ΤSAKIRIS" S.A. 80 PARPAS K.P HELLAS S.A. 4.993.055 € 81 ASPIS MEDICAL LTD 4.988.686 € 82 BIODYNAMICS S.A. 4.960.777 € 75 © EUROPEAN PROFILES SA 5.210.093 € 5.148.235 € Profile Representations, exclusive imports and trade of medical disposable supplies, tools, implants, orthopedics and hospital equipment. Representations, exclusive imports and trade of medical apparatus and instruments, disposable supplies and vaccines. Imports and wholesale trade of medical apparatus and implants. Representations, exclusive imports and wholesale trade an service of scinetific instruments, medical apparatus, labatory furniture, computers and peripherals. den to sikonan, xana Exclusive distribution of medical disposable supplies and orhopedics. Representations, exclusive imports and trade of regeants and labatory instruments. Representations, exclusive imports and whosale trade of medical apparatus and disposable supplies, cosmetics, beauty parlor's machinery, spa equipment, whirlpool units and saunas. Maintenance service of medical equipment. Exclusive imports and whosale trade of medical implants and disposable supplies. Representations, exclusive imports and whosale trade of labatory instruments, disposable supplies and reagents. Purchase Manager Telophone email address Mr. Anagnostakos Nikos 2106400006 medev@ath.forthnet.gr 18-10 Tsocha str., 115 21, Athens deltamed@otenet.gr 48 Maratonos str., 153 54, Glyka Nera, Athens n/a 2106046835 website 5 Ag. Varvaras str., 15231, Halandri, Athens Mr. Karakasis George 2106779099 Mr. Bartsokas Nikos 2106748973-7 contact@analytical.gr Mr. Ioannidis Petros 2310846003 pioannides@the.forthnet.gr Mr. Nikolaidis Mihael 2310784713 dpcgr@otenet.gr 4 Katsimidou str., 546 39, Thessaloniki Symmachiki Odos Ionias - Oraiokastrou, P.O. Box 238, 570 08, Ionia, Thessaloniki. 9 Tzavela str., 152 31, Halandri, Athens Mr.Parpas K. 2106840700 parpas@otenet.gr 21 Nikis str. & Zireias str., 151 23, Maroussi, Athens Mr. Artouros Frantzolini 2106811768 sigfrido@hol.gr 12 K. Varnali, 152 33, Halandri, Athens Mr. Botinis Theodoros 2106449421 biodynamics.s.a.@biodynamics .gr L. Katsono, 114 71, Athens www.analytical.gr www.parpashellas.com 26 The Medical Devices Sector in Greece No 83 COMPANY'S NAME ALAN MEDICAL S.A. Turnover (Year 2005) 4.937.741 € 84 SANTAIR S.A. 4.885.223 € 85 MEDIMEK S.A. 4.849.153 € 86 SARGENTIS Z, S.A. 4.651.001 € 4.579.718 € 88 PNOI S.A. RISALKO TRADING OF MEDICAL PRODUCTS S.A. 89 ELETRON S.A. 4.288.717 € 90 MEDI SUP S.A. 4.233.410 € 91 DOURMOUSSOGLOU S.A. 4.075.930 € 92 LYRITIS-BIOLINE S.A. 4.006.751 € 87 © EUROPEAN PROFILES SA 4.540.401 € Profile Representations, exclusive imports and whosale trade of medical tools, protective goods and hospital disposable supplies. Representations, exclusive imports and whosale trade of medical apparatus and hospital disposable supplies. Imports and whosale trade of medical and hospital disposable supplies and medical tools. Exclusive imports and trade of implants and orthopedics. Representations, exclusive imports and whosale trade of medical apparatus, labatory instruments and disposable supplies. Imports and trade of medical disposable suppliesand apparatus. Exclusive imports and trade of medical appparatus and implantable devices. Representations, exclusive imports and wholseale trade of medical disposable supplies. Representations, exclusive imports, production & wholesale trade of gauze bandages, orthopedics and medical protective goods. Representations, exclusive imports, production & wholesale trade of medical apparatus, instruments, tools, reagents, orhopedics and implants. Purchase Manager Telophone email address website Mr. Karaouzos Aristotelis 2106998215 alanmed@otenet.gr 27 Geroulanou str., 115 24, Athens www.alanmedical.gr www.santair.gr Mr. Giannis Kelopas 2109714444 info@santair.gr 41 Agamemnonos str., 172 35, Dafni, Athens n/a 2821044119 health@medimeq.gr 10 N. Plastira str., 731 34, Hania, Crete Mr. Sargendis Dionisis 2106017000 24 Hpeiroustr., 152 35, Vrilissia, Athens Mr. Thodoros Prineas 2106801663 info@pnoi.gr 40 Vas. Georgiou str., 152 33 Halandri, Athens n/a 2107234804 risalkosa@ath.forthnet.gr 11-13 Ravine str., 115 21, Athens Mrs. Daskalaki Kali 21077783861 eletron@eletron.gr Mr. Dimeas Nikos 2106000661 athens@medisup.gr 13 Feidippidou, 11526 Athens 7 Ag. Ioannou, 15342 Ag. Paraskevi, Athens Mr. Pappailiou Nikos 2102447410 ducasco@otenet.gr 43 K. Katarastr., 13671, Acharnes, Athens n/a 2108215930 bioline@hol.gr 50 Alexandras Ave, 114 73, Athens www.eletron.gr 27 The Medical Devices Sector in Greece ANNEX II NATIONAL LEGISLATION a. Laws L.2286/95 (Government Gazette 19A/1.2.1995) Public Supplies and regulation of relevant issues L.2522/97 (Government Gazette 178A/8.9.1997) Juridical Protection at the preceding stage of the conduction of the contracts of public projects, public supplies and services according to the Directive 89/665 E.C.C L.2741/99 (Government Gazette 199A/28.9.1999) Hellenic Food Authority, other regulations of issues under the auspices of the Ministry of Development and other stipulations L.2955/01 (Government Gazette 256A/2.11.2001) Supplies of Hospitals and other Health Units of the Regional Health System (PESY) and other stipulations L3329/4.4.05 (Government Gazette 91/A’ ) Structuring and Management of the National Health System and Social Solidarity. Government Gazette 518/19.4.2005 The maximum prices (without VAT) of artificial implantable bones, jaw facial surgery, pacemakers-defibrillators, electrodes and cardio surgery equipment and artificial kidney apparatus (Modification of Ministerial Decree 8130/30.12.2003, Government Gazette 1952) b. Presidential Decrees P.D. 370/95 (Government Gazette 199A/14.9.1995) Adjustment of the Greek legislation regarding public supplies to the Community legislation, mostly to the stipulations of the Directive of the European Community Council 93/36/EU of the 14th June 1993 (E.U No. L199 of 9.8.1993, page 1) regarding procedures coordination for the contract of public supplies. P.D 82/96 (Government Gazette 66/A.11.4.1996) Registration of shares of Greek Joint Stock Companies that participate to the procedures of projects undertaking or public supplies or supplies of other public legal entities P.D 394/96 (Government Gazette 266A/4.12.1996) Regulation of Public Supplies P.D 105/00 (Government Gazette 100/A/17.3.2000) Adjustment of the Greek legislation regarding public supplies to the Community Law and mostly to the stipulations of article 2 of the Directive 97/52/E.U of the European Council and the council of the 13th October 1997 and modification of the P.D 370/1995 (A199) c. Ministerial Decrees No P1/214 (Government Gazette 79B/2.2.2000 Supplies of important economic and technological value No P1/7445 (Government Gazette112B/31.1.2002) Exclusion of supplies from their incorporation to the Unified Supplies Programme No P1/7446 (Government Gazette 112/B/31.1.2002) Application of the stipulations of Article 2 (paragraphs 5,12,13 & 16) of L.2286/95 COMMUNITY LEGISLATION Directives 93/36/ECC/14.6.1993 Coordination of the procedures for the public supply contracts 93/42/EEC/14.6.1993 Medical Devices and its accessories © EUROPEAN PROFILES SA 28 97/52/E.U/ 13.10.1997 The Medical Devices Sector in Greece Modification of the Dierectives 92/50/ECC, 93/36/ECC and 93/37E.C.C regarding coordination of procedures of contracting of public services, contracting of public supplies, and contracting of public projects. 2001/78/EC/13.9.2001 Modification of the Annex IV of the Directive 93/96/E.C.C, of the Annexes IV, V, VI of the Directive 93/37/E.C.C, of the Annexes III & IV of the Directive 92/50/E.C.C as they were modified by the Directive 97/52/E.C as well as the Annexes XII up to XV, XVII and XVIII of the Directive 93/38/E.C.C as it was modified by the Directive 98/4 E.C (Directive for the use of standardised documents for the publication of Calls for public Contracts. 2004/18/EC Coordination of procedures for the award of the public works contracts, public supply contracts, and public service contracts © EUROPEAN PROFILES SA 29 The Medical Devices Sector in Greece ANNEX III GOVERNMENT GAZETTE 518/19.4.2005 WITH THE MAXIMUM PRICES OF MEDICAL DEVICES © EUROPEAN PROFILES SA 30