Fees and Charges - Local Government Association of South Australia

advertisement

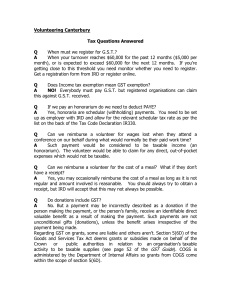

LOCAL GOVERNMENT (SA) FEES AND CHARGES GUIDE TO DIVISION 81 INTERPRETATION A project of the Local Government Financial Management Group and the Local Government Association December 2002 These Guidelines have been prepared on the basis of A New Tax System (Goods and Services Tax) (Exempt fees and Charges) Determination 2002 and is current as at 28 October 2002. However the contents of this document should not be taken as advice on the law. Councils should make their own enquiries and obtain their own independent advice in relation to these issues. Norman Waterhouse, the Local Government Association and the Consultants to this project accept no liability arising from the information in this document being incorrect, incomplete or misleading. To the extent permitted by law, all terms (including conditions and warranties are excluded). Contents INTRODUCTION .................................................................................................1 HOW TO USE THESE GUIDELINES .................................................................2 Fees and Charges .........................................................................................2 Other Information ..........................................................................................2 Model Format ................................................................................................3 GST TERMINOLOGY .........................................................................................2 GST Free ........................................................................................................3 Input Taxed ....................................................................................................3 GST Exempt...................................................................................................3 Division 81 Determination ............................................................................3 TABLE OF FEES AND CHARGES ....................................................................4 GST COMMENTARY ........................................................................................22 GLOSSARY OF LEGISLATION .......................................................................42 Local Government (SA) Fees and Charges Guide to Division 81 Interpretation, December 2002 INTRODUCTION These Guidelines have been prepared to assist South Australian Councils apply the correct treatment of the GST to Council fees and charges. It reflects the Local Government Association’s interpretation of the relevant legislation. The Australian Tax Office has reviewed these Guidelines and confirmed that they accurately reflect the ATO view on the GST treatment of fees and charges. However, these Guidelines do not constitute any form of statement or ruling by the Australian Tax Office. With the introduction of A New Tax System (Goods and Services Tax) Act 1999 in July 2000, Local Government was required to comply with the Federal Treasurer’s “Division 81” determination of GST exempt fees and charges. Interpretation of the Division 81 determination has been made more complex as it requires a thorough knowledge of the range of legislation under which Councils can raise fees and charges. The Local Government Act 1999 also requires each Council to keep an up-to-date list of fees and charges on public display and to take reasonable steps to bring the fee or charge or any variation to that fee or charge to the notice of persons who may be affected. In recognition of the complexity of the situation and the need for a consistent approach across the sector, the Local Government Financial Management Group has successfully obtained funding from the Local Government Research and Development Scheme to prepare these guidelines. The objectives of this project were to: develop a schedule of the most common fees imposed by Council; clarify the correct GST treatment in respect of each fee; identify the appropriate legislation under which the fee is imposed; provide appropriate advice on the more complex fees, such as fees to occupy road reserves, caravan park charges etc; and identify current fees and charges that are not included in the Division 81 determination that could, or should, be referred to the Treasurer for future inclusion. This project has been undertaken by Johanna Churchill, assisted by Liz Dowd and Kim Evans of Norman Waterhouse, and with the valuable support and contributions of 28 Councils. The project has been managed by a project management committee comprising the Local Government Association’s Stuart Mathews, Kevin Powell from the City of Mitcham and Brian Sincock from the Australian Tax Office. All Councils were invited to provide information on the fees and charges they levy or collect and from that information Norman Waterhouse has compiled these guidelines. 1 Local Government (SA) Fees and Charges Guide to Division 81 Interpretation, December 2002 HOW TO USE THESE GUIDELINES Fees and Charges The following Table sets out the fees and charges levied by Local Government in South Australia. The GST treatment of each fee/charge is set out as are other relevant references to the GST and other legislation. The Table of Fees and Charges has been prepared on the basis of grouping like charges across functional areas of necessity there has been some editorial licence as Councils do not use consistency of language in describing the various charges. It may be that in the Table of Fees and Charges an individual Council does not recognise verbatim its description of a charge or levy, however the project management committee is confident that all of the charges or levies imposed by the participating Councils are covered. Other Information Further explanation of some issues are included in the GST Commentary segment of this document. Cross references to that information are included where applicable in the Table of Fees and Charges. Terminology is consistent with that found in the principal legislation, A New Tax System (Goods and Services Tax) Act 1999 and a glossary of other terminology is contained on the last page of the Table of Fees and Charges. Model Format It was one of the objectives of the project to provide a “model list” which could be adapted by Councils to suit their specific needs (for example with inclusion of the actual fee declared by Council). Whether or not Councils choose to adopt and adapt the Table of Fees and Charges, they are encouraged to follow the format which has been used. 2 Local Government (SA) Fees and Charges Guide to Division 81 Interpretation, December 2002 GST TERMINOLOGY There are four categories of GST treatment of fees and charges. The Table of Fees and Charges contains references to all four. Those categories are: GST free; Input taxed; GST exempt; Not subject to GST. It is important that this distinction is understood as differing GST consequences arise in relation to these different sorts of supplies. GST Free No GST is payable on the supply of GST free goods or services however an input tax credit may be included on Council’s BAS returns for anything acquired or imported to make a GST free supply. Input Taxed In contrast, an input taxed supply is not subject to GST and no input tax credits can be included on Council’s BAS returns for anything acquired or imported to make an input tax supply. Input tax fees and charges are designated as such under the ordinary operation of GST law. An example of an input tax supply is residential housing. GST Exempt It is this category that is most important for this project. GST exempt fees and charges are set out within a determination of the Commonwealth Treasurer and known as “Division 81 Fees and Charges”. These are mainly compulsory charges, fees and taxes which the Commonwealth Treasurer has determined as a general principal should be outside the scope of the GST legislation. The technical effect of the Division 81 Determination is to deem the fees and charges not to be consideration for a taxable supply. The practical effect is that no GST is payable on those fees and charges however input tax credits may still be included on Council’s BAS returns. It should be noted that Division 81 Fees and Charges themselves should not be included on BAS returns. Not Subject to GST Where amounts are entirely outside the scope of GST, they will be referred to in the Guidelines as “Not subject to GST”. These amounts are not specifically exempted by the legislation or by the Division 81 Determination because the GST legislation does not apply to them in the first place. A common example is where a payment is received that is not for any identifiable ‘supply’ (such as many fines). The practical effect is that no GST is payable on those fees and charges but input tax credits may not be claimed. These amounts should not be included on BAS returns. Division 81 Determination As discussed above, the “Division 81 Fees & Charges” Determination is a determination of the Commonwealth Treasurer. Division 81 of the GST legislation provides that all “Australian taxes, fees and charges” are subject to GST unless they are set out in the Treasurer’s Determination as being exempt. The Determination is www.treasury.gov.au updated twice a year, and can be downloaded from 3 Local Government (SA Fees and Charges Table of Fees and Charges TABLE OF FEES AND CHARGES INDEX COMMUNITY SERVICES ........................................................................................................... 5 DEVELOPMENT ......................................................................................................................... 9 ENVIRONMENT ........................................................................................................................ 11 HEALTH SERVICES ................................................................................................................. 13 INFORMATION SERVICES ...................................................................................................... 14 LICENCES AND PERMITS ……………………………………………………………………. .......... 15 MISCELLANEOUS…… ………………………………………………………………………….......... 18 Airport ……………………………………………………………………………………… ......... 18 Caravan Park ………………………………………………………………………………......... 18 Cemetery ……………….…………………………………………………………………........... 18 Electricity Supply …………………………………………………………………………......... 18 Rental ………………………………………………………………………………………. ......... 18 Sale Proceeds ……………………………………………………………………………........... 18 PRIVATE WORKS …………………………………………………………………………….. ............ 19 WASTE MANAGEMENT ……………………………………………………………………….. ......... 20 WATER SUPPLY ……………………………………………………………………….……….. ......... 21 4 Local Government (SA Fees and Charges Table of Fees and Charges COMMUNITY SERVICES FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY FURTHER INFORMAT -ION Aged / Youth / Disabled Programmes Activity & social programmes conducted for aged, young & disabled persons Taxable S188 LGA Child Care Provision of child care services GST Free ANTS (FA) (potentially) S38-145 Courses & Education Community educational, recreational & craft courses Taxable Home Assistance Home assistance services including maintenance, cleaning, home security, respite care and transport etc GST Free Road Safety Road safety courses & sessions Taxable S188 LGA Transport Charter Charter of community bus or other transport (with or without driver) Taxable S188 LGA Transport Charter Bonds Refundable security bonds in relation to vehicle hire Taxable if forfeited S99-1 S188 LGA refer Chapter 10 Transport Charter Deposits & Cancellation fees Deposits refunded/absorbed on full payment or forfeited on cancellation Taxable if forfeited S99-1 S188 LGA refer Chapter 10 Transport Community Bus Passage on community bus or other transport Taxable S188 LGA Transport - Taxi Use of Council taxi service Taxable S188 LGA Advertising Business Space rental (tourist information bay, window display boards, litter bins, brochures & road signage), newsletter advertising & sign writing Taxable S188 LGA S38-30 (2) S188 LGA refer Chapter 8 S188 LGA refer Chapter 7 S188 LGA Only GST Free if Council has HACC funding for the supply, otherwise it is Taxable 5 Local Government (SA Fees and Charges Table of Fees and Charges Advertising Special Events Erection of banner boards & other advertising for special events Taxable S188, S221, S222 LGA Blue Light Disco Entry Taxable S188 LGA CATV Services Provision of common antennae television transmission service Exempt Loans Council taking out loan on behalf of clubs & associations Input Taxed Admin Fee for EFTPOS Bank EFTPOS fees for non bank customers Taxable Golf Course Membership & round fees Taxable Hire Bonds Refundable cleaning & security bonds in relation to lease, hire & rental arrangements Taxable if forfeited Hire Buildings Lease, hire or rental (including long term rental) of chambers, halls, rooms & other buildings including call out fees Taxable Hire Deposits & Cancellation Fees Deposits refunded/absorbed on full payment or forfeited on cancellation Taxable if forfeited Hire Insurance Provision of insurance for use of Council property (may be by way of increased hire fee) Taxable Hire Key Deposits Refundable key deposits Taxable if forfeited Hire Parks & Reserves Hire and site fees for occupation of parks, gardens & reserves Hire Plant Hire Recreation S81-5 Det 13.1 S40-5 Chapter 10 of LGA S188 LGA refer Chapter 6 S188 LGA S99-1 S99-1 S188 LGA refer Chapter 10 S188, S202 LGA refer Chapter 2 S188, S202 LGA refer Chapter 10 S188, S202 LGA S99-1 S188 LGA refer Chapter 10 Taxable S188, S202 LGA refer Chapter 2 Hire/rental of plant, equipment & facilities (such as bbq equipment, sound systems) including call out fees Taxable S188 LGA Lease, hire or rental (including long term rental) of sports grounds & equipment Taxable S188, S202 LGA 6 Local Government (SA Fees and Charges Table of Fees and Charges Library fines Lost/replacement cards & items, overdue books, Not subject to GST Library fees Reservations, interlibrary loans, internet & computer training, brochures, help manuals, projector sheets, disks and fund raising products Taxable S188 LGA Library – other See also Office & Professional Services Library - Toy All membership & damaged/lost toys Taxable S188 LGA Office - Duplicate Photographs Provision of duplicate photographs (ie.historical) Taxable S188 LGA Office Laminating & Binding Provision of laminating & binding services or facilities Taxable S188 LGA Office - Printing, Photocopying, Facsimile etc Copies & extracts of council agendas, minutes, reports, registers, policies, codes of conduct, financial statements etc (including Council electoral rolls) Exempt All other printing, microfilming, photo copying & facsimile services or facilities Taxable S188 LGA Office - Typing Typing & word processing services Taxable S188 LGA Professional Services Provision of training and other consulting services & professional advice Taxable S188 LGA Publications Sale of books, trail and road maps Taxable S188 LGA Recreation & Swimming Centres Swimming pool patronage including for lessons and for spectators, use of spas, saunas, lockers & crèches Taxable S188 LGA Sale of Art Commission on sale of art works Taxable S188 LGA (see also under ‘Information Services’) S188 LGA (no supply) S81-5 S188 LGA Det 13.32 refer Chapter 1 7 Local Government (SA Fees and Charges Table of Fees and Charges Sponsorship Sponsorship moneys in relation to memorial property/engraved property (benches, gardens etc) Taxable S188 LGA Tourism Tours/admission to tourist attractions Taxable S188 LGA refer Chapter 5 8 Local Government (SA Fees and Charges Table of Fees and Charges DEVELOPMENT FEE OR CHARGE DESCRIPTION AND COMMENTS Bond Documents Preparation & administration of bond documents Taxable Construction Industry Training Levy Levy collected to fund training in the building & construction industry Exempt Advertising Advertising in newspaper as required under the Development Act (category 3) Taxable Lodgement fees Lodgement fees under the Development Act Exempt Land division fee under the Development Act Exempt Registration of private certifiers Application for registration of private certifiers & annual registration fee under the Development Act Exempt Building rules fees Building rules fees under the Development Act Taxable Development Act Development plan assessment fee Exempt Public Notification Fee (category 2 & 3) Public Notification Fee (category 2 & 3) under the Development Act Exempt Referral fees Referral fees under the Development Act Exempt Certificate of Approval Fee Certificate of Approval Fee under the Development Act Exempt Consent to Development at Variance with Building Rules Consent to Development at Variance with Building Rules under the Development Act Taxable Non-complying Development Fee Non-complying Development Fee under the Development Act Exempt Land division fee GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY FURTHER INFORMATION S51 DA & S188 LGA S81-5 CITFA Det 8.4 DA Schedule 6 1(7) S81-5 Det 13.3 S81-5 Det 13.5 S81-5 Det 13.16 DA Schedule 6 1(1) DA Schedule 6 1(3)(a) Payable to Minister not Council DA Schedule 6 1(8)(a),(b)&F S81-5 Det 13.4 S81-5 Det 13.10 S81-5 Det 13.9 S81-5 Det 13.8 DA Schedule 6 1(2)(c)&(d) DA Schedule 6 1(6) DA Schedule 6 1(5) DA Schedule 6 1(3)(c) DA Schedule 6 1(9) S81-5 Det 13.7 DA Schedule 6 1(4) 9 Local Government (SA Fees and Charges Table of Fees and Charges Application for assignment of classification of a building Application for assignment of, or change in, classification of a building under the Development Act Taxable DA Schedule 6 2(a),(b)&F Certificate of Occupancy Fee Certificate of Occupancy Fee under the Development Act Taxable DA Schedule 6 3 Application for issue of Schedule of Essential Safety Provisions Application for issue of Schedule of Essential Safety Provisions under the Development Act Taxable DA Schedule 6 4 Referral to Building Rules Assessment Commission Referral to Building Rules Assessment Commission under the Development Act Exempt Statement of Requirements Fee Statement of Requirements Fee under the Development Act Exempt Enterprise Roads Sale of land Taxable S188 LGA Land Management/ Water Agreements Private Water Services Agreements & Land Management Agreements including inspection, preparation & administration Taxable S188 LGA S57 DA Parking Making car parking spaces to accommodate new development in business centre Taxable Developers’ Contributions toward Street Signs Contributions by developers towards installation & kerbside etching of street signs Exempt Developer’s Cash Contributions Levies imposed on or made by developers when creating land divisions Exempt Developer’s “InKind” Contributions Non-cash contributions made by developers when creating land divisions Exempt Installation of Street Signs Installation of additional street signs at ratepayers request Taxable S81-5 Det 13.11 DA Schedule 6 1(10)and/or 6(a)&(b) Det 13.12 S81-5 Det 13.6 DA Schedule 6 1(3)(b) S81-5 refer Chapter 2 refer Chapter 3 Det 13.17 S81-S refer Chapter 3 Det 13.17 S81-S refer Chapter 3 Det 13.17 S188 LGA 10 Local Government (SA Fees and Charges Table of Fees and Charges ENVIRONMENT FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY Animal Collars Sale or hire of cat & dog collars (including citronella & anti barking collars) Taxable S188 LGA Animal Kennelling Boarding of animals Taxable S188 LGA Block Clearing On site rubbish removal & block clearing Taxable SAMFSA Cat & Pest Control Hire of cat/possum traps & bird boxes Taxable S188 LGA Dog Control Impounding & dog destruction Exempt S81-5 Det 13.22 DCMA Schedule 2 Dog Expiations Dog nuisance, attack, harassment, injury, wandering, presence in schools, shops & other areas, failure to register, display registration disc, advice of change of address or owner, muzzle, leash, desex, remove faeces Exempt S81-5 S43 DCMA Dog registration (desexed, nondesexed, working dogs, guide dogs, greyhounds registered with SA DRCB), advising of change of address or owner and disc replacement Exempt Fines & expiations in relation to burning, burning out of hours & burning particular material Not subject to GST Expiations - By Laws Fines & expiations in relation to Council bylaws Expiations – Littering Fines & expiations in relation to littering Expiations – Parking Fines & expiations in relation to stopping & parking of motor vehicles, double parking & obstruction of access Dog Registration Expiations – Burning FURTHER INFORMATION Det 13.22 S81-5 Det 13.22 DCMA Schedule 2 S81-5 EP (Burning) Policy 1994 Not Subject to GST (no supply) Not subject to GST (No supply) S81-5 S246 LGA S81-5 S235 LGA & EOA Not subject to GST S81-5 ARR & PPAA (no supply) (no supply) 11 Local Government (SA Fees and Charges Table of Fees and Charges Impounding of Vehicles Impounding of vehicles (including towing & storage) Exempt Pest Control Supply of mosquito blocks Taxable Removal of Property Removal & storage of property (i.e Abandoned cars, shopping trolleys, sign boards etc) Exempt Removal of Vegetation Slash/burning & other removal of vegetation for fire prevention or pest control purposes Taxable S81-5 Det 13.20 S188, S237 LGA refer Chapter 1 S188 LGA S81-5 Det 13.21 S188, S237 LGA refer Chapter 1 S40 CFS or APCA 12 Local Government (SA Fees and Charges Table of Fees and Charges HEALTH SERVICES FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT Fire Safety Inspection and reporting on fire safety in nursing homes Taxable Provision of Food Safe Handling Kits & Videos Provision of Food Safe Handling Kits & Videos Taxable Inspection of nursing homes Inspection & reporting on food safety in nursing homes Taxable Fines - Food Safety Fines & expiations under the Food Act Not subject to GST GST REFERENCE LEGISLATIVE AUTHORITY FURTHER INFORMATION S188 LGA S81-5 FA (no supply) Immunisation Provision of immunisation services Taxable Fines - Public & Environmental Health Act Fines & expiations under the Public & Environmental Health Act Not subject to GST Application & licence fees for Supported Residence Application & licence fees including renewals & transfers for Supported Residence Exempt Fines - Supported Residential Facilities Act Fines & expiations in relation to the Supported Residential Facilities Act Not subject to GST Retirement Villages Accommodation in retirement village Input Taxed S188 LGA S81-5 PEHA S81-5 SRFA refer Chapter 9 (no supply) Det 13.18 S81-5 SRFA (no supply) S40-35 refer Chapter 2 or GST-free S38-25(4) ACA cf Chapter 2.5 13 Local Government (SA Fees and Charges Table of Fees and Charges INFORMATION SERVICES FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY S81-5 S188 LGA Council Documents Copies & extracts of council agendas, minutes, reports, registers, policies, codes of conduct, financial statements & other records & documents (including Council electoral rolls) Exempt Council Documents Freedom of Information Freedom of Information Act applications in relation to Council documents Exempt Provision of general statistical information Provision of general statistical information & research/reporting (including building statistics, business information & local history) Taxable Searches Rate searches (section 7 & 187), certificates of liability & extracts from assessment book Exempt Det 13.32 S81-5 FURTHER INFORMATION refer Chapter 1 LG (FOI) Regs Det 13.25 S188 LGA S81-5 LB(SC)A Det 13.24 & 13.27 14 Local Government (SA Fees and Charges Table of Fees and Charges LICENCES AND PERMITS FEE OR CHARGE Burning Diving DESCRIPTION AND COMMENTS GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY Consent to carry out burning Exempt S81-5 EP (Burning) Policy 1994 Diving permits Exempt Det 13.34 S81-5 FURTHER INFORMATION S188 LGA refer Chapter 1 S188 LGA refer Chapter 1 S188, S221 LGA refer Chapter 1 S188 refer Chapter 1 S188, S200 LGA refer Chapter 1 S188, S232A LGA refer Chapter 1 S188, S202 LGA refer Chapter 1 S188, S222 LGA refer Chapter 1 Det 13.34 *Filming Fee for filming commercials & feature films in Council area Exempt if raised under S188(1)(f) LGA S81-5 Det 13.34 Taxable if raised under S188(1)(a) LGA Firewood Fireworks Gravel/Sand Authority to collect roadside firewood Exempt Authority to discharge fireworks Exempt Authority to collect gravel or sand from Council pit Exempt if raised under S188(1)(f) LGA S81-5 Det 13.34 S81-5 Det 13.34 S81-5 Det 13.34 Taxable if raised under S188(1)(a) LGA Horse Riding Horse riding on foreshore Exempt Marinas, Boat Ramps & River Access Use of moorings, marinas, boat ramp & river access (including fees for applications & transfers) Exempt Mobile Vendors Permit for mobile ice cream & other food vendors Exempt if raised under S188(1)(f) LGA S81-5 Det 13.34 S81-5 Det 13.34 S81-5 refer Chapter 2 Det 13.34 Taxable if raised under S188(1)(a) LGA 15 Local Government (SA Fees and Charges Table of Fees and Charges Outdoor Dining Permit for outdoor cafes & dining inc applications and transfers Exempt if raised under S188(1)(f) LGA S81-5 S188, S222 LGA refer Chapter 1 Det 13.34 Taxable if raised under S188(1)(a) LGA Parking Petrol Pumps Parking permit (including replacement permit) Exempt Kerbside petrol pumps Exempt if raised under S188(1)(f) LGA S81-5 ARR Det 13.31 S81-5 S188, S222 LGA refer Chapter 1 Det 13.34 Taxable if raised under S188(1)(a) LGA Road Closures Road Rents All applications & consents (inc advertising fees charged) in relation to temporary road closures Exempt Commercial & agricultural road rents inc fees for agistment, cropping and de pasturing Exempt if raised under S188(1)(f) LGA S81-5 Det 13.30 S81-5 LGA 1934 & RTA S188, S222 LGA refer Chapter 1 S188 LGA refer Chapter 1 S188 LGA refer Chapter 1 Det 13.34 Taxable if raised under S188(1)(a) LGA Seed Collection Authorisation for the collection of seeds for tree planting purposes Exempt Permit to occupy Shacks Permit allowing shacks to be retained and occupied on council land (in addition to rates) Exempt Taxi & Hire Car Taxi & hire car licenses including application, renewal & transfer Exempt S81-5 Det 13.34 S81-5 Det 13.34 S81-5 Det 13.29 refer Chapter 2 S667 LGA 1934 16 Local Government (SA Fees and Charges Table of Fees and Charges Trading Permit for trading or displaying goods (i.e. On street or in shopping complex) Exempt if raised under S188(1)(f) LGA S81-5 S188, S202, S222 LGA refer Chapter 1 S188, S221 LGA refer Chapter 1 Det 13.34 Taxable raised under S188(1)(a) LGA Under Road Pipelines All application & licence fees in relation to under road pipe laying. Refer to Private Works for reinstatement charges & Development for bonds Exempt if raised under S188(1)(f) LGA S81-5 Det 13.34 Taxable if raised under S188(1)(a) LGA 17 Local Government (SA Fees and Charges Table of Fees and Charges MISCELLANEOUS FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY FURTHER INFORMATI ON Airport Landing charges, terminal & parking area rental, advertising fees Taxable S188 LGA refer Chapter 1 Caravan Park Caravan park sites /accommodation & amenities Taxable S188 LGA refer Chapter 2 Cemetery Burial, cremation, interment, exhumation, administration and development fees,maintenance and grave digging services, burial enquiries & searches, etc Taxable S188 LGA Long term leases Exempt if raised under 188(1)(f) Div 13.34 Licence, permit and search fees associated with the Enfield and West Terrace cemeteries Exempt Electricity Supply Supply of electricity including connection, disconnection and meter readings charged by Council as Power Distribution Authority under the Roxby Downs Indenture Ratification Act Rental S81-5 EGCA Det 6.65 WTCA Taxable S81-5 EA Rental in relation to private residences of Council employees Input Taxed S40-35 Res Ten Act Sale Proceeds of residential allotments Sale of residential allotments Taxable S188 LGA Sale proceeds of plant and equipment Sale of plant & equipment Taxable S188 LGA Sale Proceeds of plants and mulch Sale of plants & mulch Taxable S188 LGA Cemetery refer Chapter 2 18 Local Government (SA Fees and Charges Table of Fees and Charges PRIVATE WORKS FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT GST REFERENCE LEGISLATIVE AUTHORITY Footpaths, Stormwater Pipes, Culverts, Inverts & Crossovers Works on footpaths, stormwater pipes & culverts & driveway inverts, kerbing & crossovers Taxable S213 LGA Graffiti Removal Graffiti removal Taxable S188 LGA Nature Strips Lawn and nature strips on footpaths Taxable S188, S221 LGA Other Supply of labour, plant & materials Taxable S188 LGA Re-instatement Reinstatement of roads, foot paths, paved areas & kerbing after work carried out by residents Taxable S188, S213 LGA Street Tree Removal Removal of street trees for driveway construction Taxable S188 LGA Truck Wash Facilities Use of truck wash facilities & wash down bays Taxable S188 LGA FURTHER INFORMATION 19 Local Government (SA Fees and Charges Table of Fees and Charges WASTE MANAGEMENT FEE OR CHARGE DESCRIPTION AND COMMENTS Dumps All dump fees CEDS service & connection fees CEDS service & connection fees for effluent Applications for septic tank installations GST TREATMENT GST REFERENCE Taxable LEGISLATIVE AUTHORITY FURTHER INFORMATION S188 LGA Exempt Det 13.1 LGA Applications for septic tank installations & upgrades (including referrals to SA Health Commission) & inspection of septic tanks Exempt S81-5 PEHA Rubbish Collection Collection of green waste, rubbish & recyclables Exempt S81-5 (potentially) Det 13.1 Sales Sale of car wash mats Taxable S188 LGA Sale of compost bins & worm farms Sale of compost bins & worm farms Taxable S188 LGA Sale of rubbish & recycling bins & receptacles Sale of rubbish & recycling bins & receptacles Taxable S188 LGA Sales Sale of paper & recyclables Taxable S188 LGA Sharps Containers Sale of needle/sharps containers Taxable S188 LGA refer Chapter 10 Storm Water Drainage Provision of downstream storm water drainage to a developer in lieu of Developer providing infill drainage as part of development GST Free S188 LGA refer Chapter 4 Det 13.19 (potentially – see Chapter 4) S38-300 S188 LGA Only exempt if charged as a rate under Chapter 10 LGA, otherwise it is Taxable 20 Local Government (SA Fees and Charges Table of Fees and Charges WATER SUPPLY FEE OR CHARGE DESCRIPTION AND COMMENTS GST TREATMENT DIV 81 REF Service Fees for Water Supply All service fees charged to Developer Exempt S81-5 (potentially) Det 13.1 Supply of Water Supply of water GST Free LEGISLATIVE AUTHORITY FURTHER INFORMATION S188 LGA Exempt if charged as a rate under Chapter 10 LGA, otherwise it is Taxable S38-285 S188 LGA refer Chapter 4 RDIRA Exempt if charged as a rate under Chapter 10 LGA, otherwise it is Taxable RDIRA refer Chapter 4 (potentially – see Chapter 4) Service Fees (Roxby Downs) All service fees for connection etc charged under the Roxby Downs Indenture Ratification Act Exempt S81-5 (potentially) Det 13.1 Supply of Water (Roxby Downs) Supply of water under Roxby Downs Indenture Ratification Act GST Free S38-285 (potentially, see Chapter 4) 21 Local Government (SA Fees and Charges GST Commentary GST COMMENTARY INTRODUCTION: THE BASICS ................................................................................................... 23 CHAPTER 1: SECTION 188 OF THE LOCAL GOVERNMENT ACT ........................................... 25 CHAPTER 2: LAND ..................................................................................................................... 28 2.1 2.2 2.3 2.4 2.5 Sale ....................................................................................................................... 28 Lease ..................................................................................................................... 29 Margin Scheme..................................................................................................... 30 Caravan Parks ...................................................................................................... 32 Retirement Villages .............................................................................................. 33 CHAPTER 3: DEVELOPER’S CONTRIBUTIONS ........................................................................ 34 CHAPTER 4: WATER AND SEWERAGE .................................................................................... 35 CHAPTER 5: SPONSORSHIP, GRANTS AND APPLICATIONS ................................................. 36 CHAPTER 6: FINANCIAL SUPPLIES .......................................................................................... 37 CHAPTER 7: EDUCATION .......................................................................................................... 38 CHAPTER 8: CHILDCARE .......................................................................................................... 39 CHAPTER 9: IMMUNIZATION AND SHARPS CONTAINERS ..................................................... 40 CHAPTER 10: SECURITY BONDS .............................................................................................. 41 GLOSSARY OF LEGISLATION ................................................................................................... 42 22 Local Government (SA Fees and Charges GST Commentary INTRODUCTION – THE BASICS The basics of GST are conceptually very simple. The key elements of the GST system are as follows. In the course of its business an enterprise purchases goods/services and also sells its own goods/services to others. GST applies to all of those transactions. A business must remit GST to the Australian Tax Office (“ATO”) out of all the moneys it receives for the taxable goods/services it sells. In turn, the cost of the goods and services which the business purchases will include a component of GST. The business will receive a credit (known as “an input tax credit”) for the GST component of the goods/services it buys. In other words, a business collects GST on its sales and pays GST on its purchases. The two amounts are offset against each other and the balance remitted to the ATO. In this way, the GST taxes the value added by a business. Section 9-40 of A New Tax System (Goods and Services Tax) Act, 1999 (“the Act”) sets out that GST will apply to a transaction if there is a “taxable supply”. Section 9-5 explains that there will be a “taxable supply” when five factors are present. Those 5 factors are: 1. A supply is made Section 9-10 of the Act defines “supply” to include a supply of goods, a supply of services, a supply of rights, a supply of advice or information, a supply of any interest in real property, or an entry into any obligation (whether that obligation is to do something, to refrain from doing something or to allow something to be done). The definition goes on to include the supply of “any other thing”. Basically, any enforceable obligation can be a “supply”. 2. The supply must be for consideration The most obvious example of “consideration” is a fee or price. However, consideration can include non-cash consideration such as in a barter arrangement or land swap, and consideration may be voluntary. The consideration does not need to be made by the person receiving the supply. (See Section 9 -15 of the Act). 3. The supply must be made “in the course of an enterprise” “Enterprise” is defined in Section 9-20 of the Act. An enterprise is an activity or series of activities done: in the form of a business; in the form of an adventure or concern in the nature of trade; on a regular or continuous basis in the form of a lease, licence or other grant of an interest in property; by a gift deductible fund; by a charitable institution or by a trustee of charitable fund; by a religious organization; or 23 Local Government (SA Fees and Charges GST Commentary by a government or government body. Exclusions are: hobbies or recreational activities; activities conducted by individuals and partnerships of individuals without a reasonable expectation of profit or gain; activities as an employee or other PAYE earner; and activities as a member of a local governing body. That is, a local government council is assumed to have an “enterprise” and everything it does is taken to be in the course of that enterprise. 4. The supply must be connected with Australia Broadly speaking, a transaction which takes place wholly within Australia will be connected with Australia, as will any transaction related to property (goods or land) which is located in Australia. The rules are set out in greater detail in Section 9-25 of the Act. 5. The entity making the supply is registered or required to be In general, entities must be registered if they have an annual turn over of $50,000.00 per annum or more ($100,000.00 for non-profit bodies). If all of these 5 factors exist the supply is taxable and GST applies to the transaction unless a special exemption applies. 24 Local Government (SA Fees and Charges GST Commentary CHAPTER 1 – SECTION 188 OF THE LOCAL GOVERNMENT ACT, 1999 Chapter 11 of the Local Government Act 1999 (“LG Act”) a council is permitted by sections 202, 221 and 222 to: grant a licence for alienation of local government land (s202); issue authorisations for the alteration of a public road (s221); and issue authorisations for permits for business purposes of public road (s222). Under Chapter 10 of the LG Act a council is permitted to impose fees and charges. Section 188(1) reads as follows: “(1) A council may impose fees and charges – (a) for the use of any property or facility owned, controlled, managed or maintained by the council; (b) for services applied to a person at his or her request; (c) for carrying out work at a person’s request; (d) for providing information or materials or copies of or extracts from council records; (e) in respect of any application to the council; (f) in respect of any authorisation, licence or permit granted by the council; (g) in respect of any matter for which another Act provides that a fee fixed under this Act is to be payable; (h) in relation to any other prescribed matter. (2) Fees or charges under subsection (1)(a), (b) or (c) need not be fixed by reference to the cost to the council. (3) A council may provide for(a) specific fees and charges; (b) maximum fees and charges and minimum fees and charges; (c) annual fees and charges; (d) the imposition of fees or charges according to specified conditions or circumstances; (e) the variation of fees or charges according to specified factors; (f) the reduction, waiver or refund, in whole or in part, of fees or charges. 25 Local Government (SA Fees and Charges GST Commentary (4) If(a) a fee or charge is fixed or prescribed by or under this or another Act in respect of a particular matter; or (b) this or another Act provides that no fee or charge is payable in respect of a particular matter, a council may not fix or impose a fee or charge in respect of that matter. (5) Fees and charges may be fixed, varied or revoked(a) by by-law; or (b) by decision of the council. (6) The council must keep a list of fees and charges imposed under this section on public display (during ordinary office hours) at the principal office of the council. (7) If a council(a) fixes a fee or charge under this section; or (b) varies a fee or charge under this section, the council must up-date the list referred to in subsection (6) and take reasonable steps to bring the fee or charge, or the variation of the fee or charge, to the notice of persons who may be affected.” The GST Act provides that payments of taxes and charges which are charged by an Australian government agency will be subject to GST unless they are specifically exempted by a determination of the Treasurer pursuant to Division 81. The Determination exempts those fees and charges imposed under Sub-section 188(1)(d), (e) or (f). In short, the Determination only exempts fees and charges for providing: information or materials or copies of or extracts from council records; fees and charges in respect of any application to the council; and fees and charges in respect of any authorisation, licence or permit granted by the council. Thus, merely raising a fee or charge under section 188 of the LG Act does not satisfy all the criteria of a fee or charge which is exempt under the Determination. The fee or charge must be raised under subsection 188(1)(d), 188(1)(e), and 188(1)(f) of the LG Act . Thus, the council must determine under which subsection of 188(1) the fee is raised so that they may determine if GST applies to the fee or charge. Example 1: Fee for a permit for a mobile ice cream vendor to operate in the residential streets of the council area A small business applies to council for a permit to operate a mobile ice cream vending van in the local residential streets. Council issues a 6 month permit and imposes a fee under section 188(1). The permit allows the operator to sell ice cream from a mobile van along the residential street of the local district. 26 Local Government (SA Fees and Charges GST Commentary Under section 188(1)(a) of the LG Act, the council may impose a fee for the use of any property or facility owned, controlled, managed or maintained by the council. As the council maintains all residential streets in the local area, it is reasonable to consider the fee has been raised under section 188(1)(a). A fee raised under section 188(1)(a) is not listed in the Determination, therefore the fee is subject to GST. Example 2: Fee for a licence to moor a private vessel on a private pier A local resident applies for a 6 month licence to moor their private runabout to the private pier located in front of their residence. Council issues a 6 month licence and imposes a fee under section 188(1). The licence allows the use of the pier subject to the adherence of safety regulations. It is reasonable to determine that the granting of the licence is made under section 188(1)(f). This is because the pier is not 'property or facility owned, controlled, managed or maintained by the council'. A fee or charge raised under section 188(1)(f) is listed in the Determination therefore the fee is exempt of GST. Example 3: Improperly levied fee If a fee, such as the fee discussed in Example 2, is not levied in accordance with the formal requirements of section 188(1)(d), (e) or (f) it will NOT be GST exempt. For example, the fee must be fixed by decision of council or by-law and must be publicly displayed. If these formal requirements are not met, the fee has not been levied pursuant to section 188(1)(d), (e) or (f). Rather, the fee has been raised without legislative authority, and is not exempted by the Determination. 27 Local Government (SA Fees and Charges GST Commentary CHAPTER 2 – LAND 2.1 Sale of Land A sale of land will generally be subject to GST. It is, simply, a supply for consideration and GST applies unless there is a relevant exemption. The most commonly used exemption in relation to the sale of land is for Residential Premises. Under the Act (Section 40-65), sales of residential premises are “input taxed” to the extent that they are to be used predominantly for residential accommodation. There are two major exceptions, being for sales of “new residential premises” and “commercial residential premises”. There are two parts to this exemption. First, the property must be “residential premises”. Second, the sale is input taxed only to the extent that they are to be used predominantly for “residential accommodation”. The sale of residential premises will be ordinarily taxable if the premises amount to “commercial residential premises” such as a hotel, caravan park or boarding house. An exception may apply where the sale constitutes a supply of a going concern under Division 135 of the GST Act. Residential premises will also be ordinarily taxable if they are “new residential premises”. New residential premises are premises which have not previously been sold as residential premises (whether created through substantial renovations or by complete construction or reconstruction). Residential premises are not considered “new residential premises” if for the period of at least 5 years since the premises first became residential premises (either through change in use, substantial renovation or being built) the premises have been used only for making input tax supplies of residential rent. It should be noted that vacant land cannot be “residential premises”. There is no specific clause in the Act relating to vacant land. That is, there is no special provision to make the sale of vacant land GST free or input taxed. If a sale of vacant land fulfils the criteria of a “taxable supply” it will be ordinarily taxable. More information is available from www.taxreform.ato.gov.au in the Property and Construction Industry Partnership Issues Register, and in GST Ruling 2000/20. 28 Local Government (SA Fees and Charges GST Commentary 2.2 Lease of Land In the same way that a sale of land is a supply of land to which GST applies, so is a lease of land. That is, the rent and any outgoings will be subject to GST in the hands of the Lessor. However, there are some exceptions to this general principal. Transition Period There are special provisions which apply to contracts which span 1 July 2000. If the lease was entered into before 2 December 1998 or 8 July 1999 and there is “review opportunity”, the lease may be GST free. Long term leases A supply of residential premises by way of long term lease is input taxed in the same way that a sale of residential premises is input taxed. That is, the lease of the premises is input taxed to the extent that the property is residential premises to be used predominantly for residential accommodation, with the exception of commercial residential premises and new residential premises. A long term lease is a supply by way of lease, hire or licence for at least 50 years. Residential Rent Similarly, ordinary residential leases are also input taxed. Pursuant to Section 40-35 of the Act, a supply of premises by way of lease, hire or licence is input taxed if it is a supply of residential premises other than commercial residential premises. Special rules apply to residential premises which are caravan parks. Those are set out at Chapter 2.4. A supply of a berth at a marina that is by way of lease, hire or licence is input taxed as residential rent if the berth is occupied by a ship used as a residence. The supply in either case is input taxed only to the extent that the premises are to be used predominantly for residential accommodation. More information is available from www.taxreform.ato.gov.au in the Property and Construction Industry Partnership Issues Register and in: Recipient Created Tax Invoice Determination 2000/37 in relation to recipient tax invoices and renting; GST Determination 2000/10 in relation to outgoings payable by a commercial tenant. GST Ruling 2000/35 in relation to Division 156, supplies and acquisitions made on a progressive or periodic basis, and the erratum to that ruling; GST Ruling 2000/20 in relation to commercial residential premises; GST Ruling 2000/16 in relation to agreements spanning 1 July 2000; and The Property and Construction Industry Partnership Fact Sheet (NAT 5235) on how to apply GST to suppliers of commercial accommodation. See also the comments made in relation to Section 188 of the Local Government Act 1999 in Chapter 1 of this GST Commentary Notes in relation to charges levied by Councils for the use of local government land. 29 Local Government (SA Fees and Charges GST Commentary 2.3 Margin Scheme Under general GST principles, if you are registered or required to be registered and you make a taxable supply of your property then you must pay GST on that supply. If you make a taxable supply of real property, the GST payable is 1/11th of the price. However, under Section 75-5 of the Act, if you make a taxable supply of real property by selling a freehold interest in land, selling a strata unit or granting or selling a long term lease (50 years or more) you can choose to use the “margin scheme” method of calculation instead. The margin scheme is a special method of calculating GST in relation to the sale of land (or lease for more than 50 years). It does not apply to any other interests in land (such as other leases, easements or encumbrances). The margin scheme may only be used if the relevant land was acquired before 1 July 2000, or acquired after 1 July 2000 by a purchase under which GST was not calculated in the ordinary manner. That is to say, to use the margin scheme you must have originally purchased the land GST free, input taxed or under the margin scheme. Under the margin scheme, GST is 1/11th of the “margin” for the supply. The intention of the margin scheme is to ensure that GST is only payable on the increase in the value of the land. The GST payable under the margin scheme can be a lot lower than under the ordinary method of calculating GST. The margin scheme can apply to all types of property including residential, commercial, retail and industrial. How is the margin calculated? If the land was held before 1 July 2000, the “margin” is the difference between the sale price and the valuation of the land at a date required by GST Ruling 2000/21. GST = Value - Sale Price 11 The valuation must comply with all requirements determined in writing by the Tax Commissioner. For land acquired after 1 July 2000, and certain conditions are satisfied, the margin is the difference between the sale price and the price for which the land was originally acquired. GST = Acquisition Price - Sale Price 11 In both cases if the sale price is lower than the value of the cost of acquisition (leaving a negative margin) there is no GST. However, there is no provision for a negative amount of GST. How do you determine the value of land? The value of land (for completed premises or land subdivision or projects) can be determined in a number of ways. You can use the market value as certified by a professional valuer in accordance with the Tax Commissioner’s requirements, or you can use the price in an “arms length” sale contract if it was executed before 1 July 2000. Alternatively, you can use the Surveyor-General’s site value or capital value. 30 Local Government (SA Fees and Charges GST Commentary Different rules about valuations apply to premises which were not completed on the valuation date. If you use a valuer, they should provide a signed certificate which specifies a full description of the property being valued, the valuation date, the date the valuer provides the valuation, the market value of the property including the valuation approach and the valuation calculation and the qualification to the valuer. Why use the margin scheme? Under the Act whether or not to use the margin scheme is the choice of the vendor. However, the benefit (if any) is to the purchaser. The only benefit to the vendor in using the margin scheme is indirect in that the purchase price to the purchaser is reduced. Assuming that the vendor can and will pass on the GST under the terms of the contract, it makes no difference to the vendor as to how much that GST will actually be. As a matter of practicality, it is likely that a decision will be made by the purchaser. Some standard contracts effectively reverse the position under the Act, by requiring the vendor to use the margin scheme if the purchaser directs it to do so. Also, because stamp duty is calculated on the GST inclusive purchase price, there will generally be some stamp duty savings in using the margin scheme. On the other hand, the purchaser (regardless of whether they are registered) will not be entitled to an input tax credit for the GST under the margin scheme, meaning that the margin scheme is only attractive to those who are not entitled to an input tax credit in any event. For this reason, if the margin scheme is used a tax invoice should be not issued. The margin scheme can also be attracted to developers who wish to on-sell using the margin scheme, as they will only be able to do so if the original purchase of the land is under the margin scheme. More information is available from www.taxreform.ato.gov.au in the Property and Construction Industry Partnership Issues Register, and in GST Ruling 2000/21. 31 Local Government (SA Fees and Charges GST Commentary 2.4 Caravan Parks As discussed under Chapter 2.2 in relation to residential leases, the lease, hire or licence of commercial premises (which will include a caravan) is subject to GST. Their position is somewhat more complicated in relation to caravan parks. Under the Act, supplies of commercial accommodation are subject to GST, notwithstanding that commercial accommodation is residential premises. For example, renting a house in the suburbs for six months does not attract GST whereas renting a room at the hotel for a weekend will attract GST. Certain concessions have been made for supplies of “long term accommodation”, such as is often the case in caravan parks. The supplier may choose not to apply the concessions and input tax all supplies of long term accommodation instead. Commercial accommodation is accommodation in commercial residential premises. Commercial residential premises include hotels, motels, boarding houses, caravan parks and camping grounds. You provide short term accommodation to an individual when they stay for less than 28 continuous days in your premises. GST in relation to short term accommodation applies at the ordinary rate. You provide long term accommodation to an individual when they stay for 28 continuous days or more in your premises. In that case, the supply is input taxed. You provide predominantly long term accommodation if at least 70% of the individuals to whom you provide commercial accommodation stay for 28 or more continuous days. You may then choose either to treat your long term accommodation as input taxed and your short term accommodation as ordinarily taxable and keep you accounting separate in that regard. Alternatively you may apply certain special concessional treatments to the predominantly long term accommodation. You may calculate the GST amount on half the price of the long term accommodation from the beginning of the occupant’s stay. If you provide long term accommodation to less than 70% of your guests, you do not provide predominantly long term accommodation. However there is still a concession for the long term accommodation that you do provide. The first 27 days are taxable in the same way as short term accommodation (the ordinary 1/11th of the price). From the 28th day onwards you calculate GST on half of the GST inclusive price of the accommodation. More information is available from www.taxreform.ato.gov.au and in: GST Ruling 2000/20 in relation to commercial residential premises; GST Bulletin 2001/2 in relation to caravan parks; and Media Release NAT 01/70 in relation to the applied method for caravan parks. 32 Local Government (SA Fees and Charges GST Commentary 2.5 Retirement Villages Accommodation in a retirement village is only GST Free if the Council is an approved provider of residential care services under Aged Care Act 1997 (S38-25). Alternatively, the rent will be treated as input taxed if it is regarded as rent for non commercial accommodation. If the rent is taken to be for commercial accommodation, it will be taxable, subject to the special concessions for long term commercial accommodation. More information is available from www.taxreform.ato.gov.au in the Retirement Villages Industry Partnership Issues Register, and in this GST Commentary under Chapters 2.2 and 2.4. 33 Local Government (SA Fees and Charges GST Commentary CHAPTER 3 – DEVELOPER’S CONTRIBUTIONS Contributions by Developers, both in cost and in kind, have been the subject of much debate as regards GST. It is common practice for Developers to make such contributions, for example towards infrastructure and open space, when creating land divisions. In most states of Australia these Developer’s contributions are made pursuant to a specific provision in the relevant equivalent of the Development Act. No such provision exists in the South Australian Development Act, nor in the Local Government Act 1999. These contributions are instead made by mutual agreement. As such, strictly speaking, Developer’s contributions in South Australia are not eligible for inclusion on the Treasurer’s Division 81 Determination. Indeed, the first few versions of that Determination did not seek to exempt South Australian Developer’s contributions. However, to achieve parity of treatment in like charges in each state, these contributions have now been included in the Determination (Paragraph 13.17). Notwithstanding that, strictly, these amounts may not be eligible for exemption under Division 81, it is clear that both the Commonwealth Treasury and the ATO intend to treat these amounts as exempt, and Councils may safely rely on that position. However, out of an abundance of caution Councils should ensure that such contributions are not made pursuant to contracts which might make the contributions appear more in the nature of, for example, a construction contract. These provisions may not apply to the Local Government Act, which does not fall within the definition of “Australian Government Agency”. They have been drafted with the specific intention of clarifying ambiguities that have arisen at a State and Commonwealth level. It should also be noted that at the date of issuance of these Guidelines, the Taxation Laws Amendment Bill (No. 3) 2002 is before the Commonwealth Parliament. This Bill proposes, among other things, to clarify the GST treatment of certain transactions involving a government body during land development. The amendments deal with situations where, as part of development approval, a developer provides infrastructure or other works to a landowner. Such situations may arise where, for example, a developer provides roads and sewage for an estate and these are transferred to public ownership. As the GST rules stand, it is likely that for GST purposes that the supply of the right to develop the land and the subsequent return of infrastructure would both be considered to be a taxable supply and so subject to GST. These provisions may not apply to the Local Government Act, which does not fall within the definition of “Australian Government Agency”. They have been drafted with the specific intention of clarifying ambiguities that have arisen at a State and Commonwealth level. 34 Local Government (SA Fees and Charges GST Commentary CHAPTER 4 – WATER AND SEWERAGE Section 38-285 of the Act provides that a supply of water is GST free (provided it is not supplied in a container or transferred into a container of less than 100 litres or such other quantity as specified by the GST Regulations). Section 28-290 of the Act provides that a supply of sewerage services is GST free. Sub-Section 38-290(3) goes on to provide that a supply that consists of servicing a domestic self contained sewerage system is also GST free. Section 38-295 provides that a supply of a service that consists of the emptying of a septic tank is GST free. Section 38-300 provides that a supply of a service that consists of draining stormwater is GST free. More information is available from www.taxreform.ato.gov.au in the Property and Construction Industry Partnership Issues Register, and in GST Ruling 2000/25. 35 Local Government (SA Fees and Charges GST Commentary CHAPTER 5 – SPONSORSHIP, GRANTS AND APPROPRIATIONS Many organizations receive funding or grants of financial assistance to carry out their activities. The parties may think of this funding as a donation, sponsorship or gift. Under the ordinary rules of GST set out in the Introduction to this commentary, if party is registered (or required to be registered) for GST and it supplies something in exchange for a payment, it may have to remit GST from that payment. As discussed in the Introduction, GST is payable if you make a taxable supply. A supply will include any obligation to do something. Thus, the recipient of sponsorship (or a gift, grant, donation etc) agrees to do something in exchange for the grant, GST will apply. More information is available from www.taxreform.ato.gov.au in the Charities Industry Partnership Issues Register and Fact sheets, and in GST Ruling 2000/11 in relation to grants of financial assistance. 36 Local Government (SA Fees and Charges GST Commentary CHAPTER 6 – FINANCIAL SUPPLIES Section 40-5 of the Act provides that financial supplies are input taxed. Financial supplies include the provision of bank accounts, loans, security transactions, superannuation funds, guarantees and similar supplies. More information is available from www.taxreform.ato.gov.au and in: GST Ruling 2001/2 in relation to foreign conversations; GST Ruling 2002/22 in relation to apportionment of input taxed credits for providers of financial supplies; and Recipient Created Tax Invoice Determinations 2000/48 and 49. 37 Local Government (SA Fees and Charges GST Commentary CHAPTER 7 – EDUCATION Pursuant to Section 38-85 of the Act a supply is GST free if it is a supply of an education course. An education course is defined to mean a pre-school, primary, secondary or tertiary course, and also includes special education courses, adult and community education courses, professional or trade courses, and others. Adult education and community education courses and special education courses are carefully defined in the Act. They are intended to cover specific kinds of courses for adults to add to their employment skills and for children or students with disabilities. Hobby and recreational courses are not likely to be GST free. Advice should be taken before applying this exemption. The relevant ruling suggests that suppliers of courses should consider whether the course is similar to an accredited vocational education and training (VET) program pursuant to the Education Minister’s determination of educational institutions and courses under Sub-Section 3(1) and 5D(1) of the Student Assistance Act 1973. More information is available on www.taxreform.ato.gov.au under the Education Industry Partnership and in: GST Determination 7 in relation to apprentices and trainees; and GST Rulings 2000 27 and 30. 38 Local Government (SA Fees and Charges GST Commentary CHAPTER 8 – CHILDCARE Section 38 – 140 of the Act provides that a supply is GST free if it is a supply of childcare by a registered carer within the meaning of Section 3 of A New Tax System (Family Assistance) (Administration) Act 1999. Section 38 –145 provides that a supply is GST free if it is a supply of childcare by an approved childcare service within the meaning of Section 3 of A New Tax System (Family Assistance) (Administration) Act 1999 or it is a supply of an excursion which is directly related to a supply of childcare in that regard. Section 38 – 150 provides that a supply is GST free if it is a supply of childcare by a supplier that is eligible for funding, whether or not in respect of that particular supply, from the Commonwealth under guidelines made by the Childcare Minister that relate to the funding of family day care, occasional care, outside school hours care, vacation care or any other type of care determined in writing by that Minister. Section 38 –155 provides that supplies which are incidental and directly related to all of the above will also be GST free. 39 Local Government (SA Fees and Charges GST Commentary CHAPTER 9 – IMMUNISATION AND SHARPS CONTAINERS Further specific queries in relation to the issues of immunisation services and sharps containers, a Private Ruling was sought from the ATO and received on 7 February 2002. The conclusion which the Ruling reaches is that A sharps container is not covered by any of the items listed in the written determination of the Health Minister as being GST free health goods under Section 38-47 of the Act, and is as a result taxable; and Where Councils contract directly with individual patients to provide vaccination services, and the services are provided by registered nurses and the nursing profession generally accepts it as necessary for the appropriate treating of the patient, then the supply will GST free. Also, vaccine supplied to the patient as an integral part of the vaccination service will be GST free. 40 Local Government (SA Fees and Charges GST Commentary CHAPTER 10 – SECURITY DEPOSITS Division 99 of the Act contains the provisions which relate to GST and security deposits. A security deposit is an amount paid by the recipient of a supply pursuant to an agreement whereby the deposit may be forfeited by the recipient to the supplier if the recipient defaults under the Agreement. Section 99-5 of the Act provides that a deposit held as security for the performance of an obligation is not treated as consideration for a supply unless the deposit is forfeited on default or is applied as all or part of the consideration for a supplier. As a result, you do not account for GST or input tax credits when a deposit to which the Division applies is received or provided. The supplier accounts for the GST payable in the tax period in which the deposit is forfeited, or all or part of the deposit is applied as consideration for the supplier. The recipient accounts for input tax credits in the tax period in which the deposit is forfeited or the supplier applies a deposit as all or part of the consideration for a supplier. When an amount of money represents a part payment or an instalment, rather than a security deposit, then it will not be a payment to which Division 99 of the Act applies. In that case, that first instalment will trigger GST liability on the whole contract price. More information is available on www.taxreform.ato.gov.au under Property and Construction Industry Partnership issue register and in GST Determination 2000/1. 41 Local Government (SA Fees and Charges GST Commentary GLOSSARY OF LEGISLATION All statutory references are to A New Tax System (Goods and Services Tax) Act 1999, unless reference is specifically made to the following Acts, Regulations and Determinations. ACA Aged Care Act 1997 ANTS(FA) A New Tax System (Family Assistance) (Administration) Act 1999 APCA Animal & Plant Control (Agricultural Protection & Other Purposes) Act 1986 ARR Road Traffic (Road Rules - Ancillary & Miscellaneous Provisions) Regulations 1999 CITFA Construction Industry Training Fund Act 1993 DA Development Act 1993 DCMA Dog & Cat Management Act 1995 Det ANTS Division 81 Treasurer’s Determination 2002 EGCA Enfield General Cemetery Act 1944 EA Electricity Act 1996 HCCA Home & Community Care Act 1985 LB(SC)A Land & Business (Sale & Conveyancing) Act 1994 LGA Local Government Act 1999 LG(FOI) Regs Local Government (FOI Fees & Charges) Regulations 1991 PEHA Public & Environmental Health Act 1987 PPAA Private Parking Areas Act 1986 RDIRA Roxby Downs (Indenture Ratification) Act 1982 Res Ten Act Residential Tenancies Act 1995 RTA Road Traffic Act 1961 RVA Retirement Villages Act 1987 SAMFSA South Australian Metropolitan Fire Service Act 1936 SRFA Supported Residential Facilities Act 1992 WTCA West Terrace Cemetery Act 1976 42