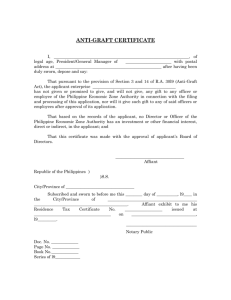

Specimen exemption certificate (Word 28KB)

advertisement

CERTIFICATE OF EXEMPTION UNDER PARAGRAPH 2 OF SECTION 77F OF THE TAXES MANAGEMENT ACT, 1970 CERTIFICATE NUMBER To the holder of Licence Number Petroleum Act 1998: granted under Part 1 of the WHEREAS an application has been made to the Commissioners of HM Revenue and Customs under paragraph 2 of Section 77F of the Taxes Management Act 1970 by [name of applicant] (Hereinafter called “the Applicant”); AND WHEREAS the Commissioners of HM Revenue and Customs are satisfied that the Applicant will comply with any obligations imposed on him by the Taxes Acts while this certificate is in force: IT IS HEREBY CERTIFIED that the holder of the above mentioned licence is exempt from the provisions of paragraph 1 of Section 77C of the said Act with respect to any tax payable by the Applicant while this Certificate is in force. This Certificate shall remain in force until such date as may be specified in a notice in writing from the Commissioners of HM Revenue and Customs to the holder of this Certificate cancelling it in accordance with paragraph 3 of Section 77F of the said Act. ......................................................................................... Signed on behalf of the Commissioners of HM Revenue and Customs Date...................................................................