Course_Outline_GCS_WS2012_Zafar

Muhammad Zafar Yaqub

Ph.D., MBA, M.A.(Economics),

M.A. (Political Science)

040426 SE IM: Internationale Unternehmensführung (Global Corporate Strategy)

WS 2012

Course Overview

With the advent of the business enterprises becoming more and more global in the 21stcentury, effective/successful managers will be those who would exhibit a profound understanding of the nature and dynamics of doing business successfully in the face of ever changing cross-national similarities and/or differences.

The primary goal of the seminar is to make the students work with academic literature, develop understanding of theoretical concepts and scholarly discourse and then apply them to the multinational firm(s) in the current global business environment. Students would have the opportunity to reflect their thoughts and ideas through their seminar papers and/or presentations. They are expected not only to know the subject matter of the literature but also to adequately reflect, critique and argue independently on the topic at large. The guidelines on searching the

(additional) literature and writing the Seminar Paper will be provided to the students during the introductory session.

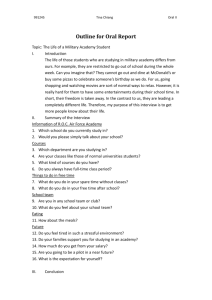

Topics

1.

Theory of competitive advantage

2.

The role of human capital as a source of competitive advantage

3.

Innovation as a source of competitive advantage

4.

Strategic groups

5.

Foreign market entry modes

6.

Strategic alliances

7.

Outsourcing

8.

Emerging markets and multinationals

9.

Determinants of superior performance in global business

10.

Off-shoring

11.

Doing business in China

12.

Impact of Culture on firms’ behaviour

13.

Impact of culture on the global business’s performance

14.

Diversity and the global business

Dates & Venues of the Course Meetings

DI 23.10.2012

FR 25.01.2013

MO 30.04.2012

14.00-15.00

DO 24.01.2013 09.00-15.00

09.00-13.00

13.00-15.00

SA 26.01.2013 09.00-15.00

MI 02.05.

DI 29.01.2013 13.00-15.00

Course Evaluation

The final scores shall be calculated as follows;

Seminar paper

Hörsaal 12 BWZ 2.OG (Bestätigt)

Hörsaal 8 BWZ 3.OG (Bestätigt)

Hörsaal 11 BWZ 3.OG (Bestätigt)

Hörsaal 8 BWZ 3.OG (Bestätigt)

Hörsaal 11 BWZ 3.OG (Bestätigt)

Hörsaal 11 BWZ 3.OG (Bestätigt)

60 %

Seminar Presentation

Participation in Public Lectures

Class participation

20%

10%

10 %

The Seminar Paper (Submission deadline: 21.01.2013)

The purpose of the project is to provide the students with an opportunity to examine the literature encompassing various issues relating to the global business and then to reflect their thoughts/findings in the form of a Seminar paper. The assignment has to be performed in the form of dyadic (2 persons) groups. The seminar papers are to be submitted at Muhammad.zafar.yaqub@univie.ac.at

, a copy also to be uploaded on the Moodle by 21 st of

January. The deadline for submission of Seminar Paper is final and cannot be negotiated.

Seminar manuscript guidelines

A scientific paper contains the following parts:

• Front page

• Table of contents

• List of figures (in case of three figures or more) (if applicable)

• List of tables (in case of three tables or more) (if applicable)

• List of abbreviations

• List of symbols (in papers with formal models) (if applicable)

• Text (introduction, main part, conclusion)

• Bibliography

• Appendix (if applicable)

Use for the margins:

• Top: 2.0 cm

• Bottom: 2.0 cm

• Left: 3.0 cm

• Right: 2.0 cm

The font for the text is "Times New Roman" in font size 12 pt with standard character spacing. Line spacing is 1.5 lines.

The first page of each contribution should include the following information: title of the paper, authors names, email-address of the authors. Each paper should be preceded by an abstract (10–15 lines long) that summarizes the content.

Please use the decimal system of headings with no more than three levels, e.g.:

1 Section

2 Section

2.1 Subsection

2.1.1 Sub-Subsection

Every figure/ table should be cited in the text. Please refer to the figure or table number (e.g. see Fig.

1.4).

Tables and figures should be directly added to the relevant part of the text.

References

The bibliography contains all sources the paper refers to. If several papers by one author are cited, they are sorted by publication year. Each item in the bibliography ends with a period.

EXAMPLES

Monographs:

Laux, H., Liermann, F. (1993) Grundlagen der Organisation, 3. Auflage, Springer, Berlin.

Contributions in journals:

Vetschera, R., Walterscheid H. (1996) The Evaluation of Managerial Support Systems in German

Corporations, European Journal of Information Systems, 5, 182-195.

Publications in collected editions:

Cave, M. (1996) Meeting Universal Service Obligations in Competitive Telecommunications Markets:

Lessons for the Postal Sector, in: Stumpf, U., Elsenbast, W. (Eds.) Cost of Universal Service, Bad

Honnef, pp. 95-114.

Websites:

Author/title, URL and the access date.

Sarabando, P., Dias, L., Vetschera, R.: Approaches to suggest potential agreements: Perspectives of

mediation with incomplete information. INESC Working paper 11/2009, http://www.inescc.pt/documentos/11_2009.PDF

, accessed March 29, 2011

MINIMUM LENGTH

If one student writes the paper, the length should be at least 15 pages (without references).

If two students write the paper, the length should be at least 25 pages (without references).

Dealing with the Plagiarism

All papers will be checked for plagiarism

Plagiarism: Use of prior work without proper references

Even with consent of original author

Or previous own work

Not necessarily 1:1 copy

For exact definitions, see e.g. http://www.plagiarism.org/plag_resources.html

Any incident of plagiarism/cheating will lead to failing the entire course (not just the exam or work where Plagiarism/cheating was detected)

Public Lectures

Public lectures are an integral part of this course. In these lectures, experts from the relevant field of study held discussion on the various topics/aspects relating to the global business. The participation/attendance during these lectures is mandatory for the completion of the course and constitutes 10% of the course evaluation. Students are advised to check, from time to time, the latest announcements on these lectures at http://im.univie.ac.at/windsperger/im-public-lectures/?no_cache=1

C contact Details

Should you have questions regarding understanding of the literature, scope and idea of the paper, possible contents and ideas regarding either paper or presentation, please contact:

Muhammad Zafar Yaqub, PhD

Room Nr. 3/149, Chair of Organization & Planning, University of Vienna, Brünner Straße 72, 1210, Vienna, Austria.

Phone: (Office) +43 1 4277 37932

(Handy): +43 650 9685364

Email: Muhammad..zafar.yaqub@univie.ac.at

Skype ID: mzyaqub

Contact Hours: only by appointment

Literature for Seminar Papers

Theory of Competitive Advantage – Key Factors

Decker/Mellewigt (2007), Thirty years after Michael E. Porter, Academy of Management

Perspectives 21: 41-55.

Cool et al. (1999), The relative impact of actual and potential rivalry on firm profitability in the

Pharmaceutical industry, Strategic Management Journal 20: 1-14.

Delmas/Tokat (2005), Deregulation, governance structures and efficiency, Strategic Management

Journal 26: 441-460.

Bensaou/Anderson (1999), Buyer-supplier relations in industrial markets, Organization Science

10_ 460-481.

Michael (2000), Investments to create bargaining power, Strategic Management Journal 21: 497-

514.

Dowell (2006), Product line strategies of new entrants in an established industry, Strategic

Management Journal 27: 959-979.

The Role of Human Capital as a Source of Competitive Advantage

Hatch/Dyer (2004), Human capital and learning as a source of competitive advantage, Strategic

Management Journal 25: 1155-1178.

Subramaniam/Youndt (2005), The influence of intellectual capital on the types of innovative capabilities, Academy of Management Journal 48: 450-463.

Skaggs/Youndt (2004), Strategic positioning, human capital, and performance in service organizations, Strategic Management Journal 25: 85-99.

Innovation as a Source of Competitive Advantage

Allred/Steensma (2005), The influence of industry and home country characteristics on firms’ pursuit of innovation, Management International Review 45: 383-412.

Cho/Pucik (2005), Relationship among innovativeness, quality, growth, profitability, and market value, Strategic Management Journal 26: 555-575.

Phene et al. (2006), Breakthrough innovations in the US biotechnology industry, Strategic

Management Journal 27: 369-388.

Subramaniam/Youndt (2005), The influence of intellectual capital on the types of innovative capabilities, Academy of Management Journal 48: 450-463.

Smith et al. (2005), Existing knowledge, knowledge creation capability, and the rate of new product introduction in high-technology firms, Academy of Management Journal 48: 346-357.

Strategic Groups

Dranove et al. (1998), Do strategic groups exist? Strategic Management Journal 19: 1029-1044.

Nair/Kotha (2001), Does group membership matter? Strategic Management Journal 22: 221-235.

Lee et al. (2002), An evolutionary perspective on group emergence, Strategic Management

Journal 23: 727-746.

Mas-Ruiz et al. (2005), Asymmetric rivalry between strategic groups, Strategic Management

Journal 26: 713-745.

Leask/Parker (2007), Strategic groups, competitive groups, and performance within the UK pharmaceutical industry, Strategic Management Journal 28: 723-745.

Foreign Market Entry Modes

Kaynak et al. (2007), Determinants of ownership-based entry mode choice of MNEs,

Management International Review 47: 505-530.

Mani et al. (2007), Entry mode and equity level, Strategic Management Journal 28: 857-866.

Barkema/Vermeulen (1998), International expansion through start-up or acquisition, Academy of

Management Journal 41: 7-26.

Harzing (2002), Acquisitions versus Greenfield investments, Strategic Management Journal 23:

211-227.

Chen/Hennart (2002), Japanese investors’ choice of joint venture versus wholly-owned subsidiary in the US, Journal of International Business Studies 33: 1-18.

Arora/Fosfuri (2000), Wholly owned subsidiary versus technology licensing in the worldwide chemical industry, Journal of International Business Studies 31: 555-572.

Strategic Alliances

Gnyaweli/Madhavan (2001), Cooperative networks and competitive dynamics, Academy of

Management Review 26: 431-445.

Dyer (1997), Effective interfirm collaboration, Strategic Management Review 18: 543-556.

Sampson (2007), R&D alliances and firm performance, Academy of Management Journal 50:

364-386.

Child/Yan (2003), Predicting the performance of IJVs, Journal of Management Studies 40: 284-

320.

Arino (2003), Measures of strategic alliance performance, Journal of International Business

Studies 34: 66-79.

Makino et al. (2007), Intended and unintended termination of international joint ventures,

Strategic Management Journal 28: 1113-1132.

Roehl/Zietlow (1999), “Trojan horse” or “workhorse”? Strategic Management Journal

20: 15-29.

Outsourcing

Barthelemy (2003), The seven deadly sins of outsourcing, Academy of Management Executive 17

(2): 87-98.

Leiblein et al. (2002), Do make-or-buy decisions matter? Strategic Management Journal 23: 817-

833.

Richardson (1993), Parallel sourcing and supplier performance in the Japanese automobile industry, Strategic Management Journal 14: 339-350.

Dyer (1997), Specialized supplier networks as a source of competitive advantage, Strategic

Management Journal 17: 271-292.

5

Parmigiani (2007), Why do firms both make and buy? Strategic Management Journal 28: 285-

311.

Rossetti/Choi (2005), On the dark side of strategic sourcing, Academy of Management Executive

19 (1): 46-60.

Emerging markets and emerging multinationals

Aulakh (2007), Emerging multinationals from developing economies, Journal of International

Management 13: 235-340.

Dawar/Chattopadhyay (2002), Rethinking marketing programs for emerging markets, Long

Range Planning 35: 457-474.

London/Hart (2004), Reinventing strategies for emerging markets, Journal of International

Business Studies 35: 350-370.

Matthews (2006), Dragon Multinationals as new features of globalization in the 21st century, Asia

Pacific Journal Journal of Management 23: 5-27.

Yamakawa et al. (2008), What drives new ventures to internationalize from emerging to developed economies, Entrepreneurship Theory and Practice 32: 59-82.

Determinants of superior performance in global business

Peterson et al. (2002), Long- versus short-term performance perspectives of Western European,

Japanese, and US companies, Journal of World Business 37: 245-255.

Hawawini et al. (2003), Is performance driven by industry- or firm-specific factors, Strategic

Management Journal 24: 1-16.

Kotha/Nair (1995), Strategy and environment as determinants of performance, Strategic

Management Journal 16: 497-518.

Carmeli/Tishler (2004), The relationship between intangible organizational elements and organizational performance, Strategic Management Journal 25: 1257-1278.

Morrow et al. (2007), Creating value in the face of declining performance, Strategic Management

Journal 28: 271-283.

Offshoring

Farrell (2005), Offshoring: Value creation through economic change, Journal of Management

Studies 42: 675-683.

Kedia/Mukherjee (2009), Understanding offshoring: A research framework based on disintegration, location and externalization advantages, Journal of World Business 44 (3): 250-

261.

Doh (2005), Offshore outsourcing, Journal of Management Studies 42: 695-704.

Levy (2005), Offshoring in the new global political economy, Journal of Management

Science 42: 685-693.

Doing business in China

Park/Luo (2001), Guanxi and organisational dynamics, Strategic Management Journal 22: 455-

477.

Tsang (1998), Can guanxi be a source of sustained competitive advantage for doing business in

China, Academy of Management Executive 12: 64-73.

Michailova/Worm (2003), Personal networking in Russia and China: Blat and guanxi, European

Management Journal 21: 509-519.

The impact of culture on firm behaviour

Bhardwaj et al. (2007), Host country cultural influences on foreign direct investment,

Management International Review 47: 29-50.

Hennart/Larimo (1998), The impact of culture on the strategy of MNEs, Journal of International

Business Studies 29: 515-538.

Lee et al. (2006), Tension and trust in international business negotiations, Journal of International

Business Studies 37: 623-641.

Makino/Neupert (2000), National culture, transaction costs, and the choice between joint venture and wholly owned subsidiary, Journal of International Business Studies 31: 705-713.

Salk/Brannen (2000), National culture, networks, and international influence in a multinational management team, Academy of Management Journal 43: 191-202.

Bailey/Spicer (2007), When does national identity matter? Academy of Management Journal 50:

1462-1480.

Impact of culture on the global business performance

Kogut/Singh (1988), The effect of national culture on the choice of entry mode, Journal of

International Business Studies 19: 411-432.

Hennart/Zeng (2002), Cross-cultural differences and joint venture longevity, Journal of

International Business Studies 33: 699-716.

Pothukuchi et al. (2002), National and organizational culture differences and international joint venture performance, Journal of International Business Studies 33: 243-265.

Diversity and the global business

Cox/Blake (1991), Managing cultural diversity: Implications for organizational competitiveness,

Academy of Management Executive 5: 45-56.

Dass/Parker (1999), Strategies for managing human resource diversity: From resistance to learning, Academy of Management Executive 13 (2): 68-80.

Milliken/Martins (1996), Searching for common threads: understanding the multiple effects of diversity in organizational groups, Academy of Management Review 21: 402-433.

Robinsin/Dechant (1997), Building a business case for diversity, Academy of Management

Review 11 (3): 21-31.

Van der Walt et al. (2006), Board configuration: are diverse boards better boards? Corporate

Governance 6 (2): 129-147.