Bagasse Based Cogeneration, India Marching Ahead

advertisement

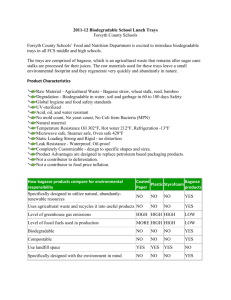

Bagasse Based Cogeneration, India Marching Ahead S. C. Natu, Sr. Vice President, Green Power Division, MITCON Consultancy Services Ltd., Pune, India 1. Introduction Indian sugar mills, both in the private and co-operative / joint sectors, have acknowledged importance of implementing high efficiency grid connected cogen power plants for generating exportable surplus. In fact, additional revenue stream by sale of exportable power to State Electricity Boards (or third party customers), has become the only way for achieving long term sustainability, given the fiercely competitive domestic and international sugar markets. 2. Potential The potential from about 575 operating sugar mills spread over 9 major States has been identified at 3,500 MW of surplus power by using bagasse as the renewable source of energy. The project involves employment of extra high-pressure boiler configurations of 67 kg/cm2 or 87 kg/cm2 or 105 kg/cm2 (against the conventional 32 kg/cm2 or 42 kg/cm2 pressure boilers used in the sugar mills). Sugar mills conventionally cogenerate their own requirements of steam and power during the season operation of 150-200 days by using bagasse, the residue of sugarcane generated after crushing. They, however, use a number of low-pressure inefficient boilers for the purpose and consume/waste the entire bagasse during their season operations. Over the years, due to the expansion and diversification of sugar mills, their energy needs, both during season and off-season, have multiplied. They often require high-cost grid power and additional fuels both during season and off-season. The high-efficiency cogeneration design not only uses the available bagasse efficiently, but also yields substantial quantities of power for exporting to the grid, over and above their enhanced energy needs. Improved energy efficiency of sugar mill operations to a maximum possible extent is a pre-requisite for building high-efficiency grid-connected cogeneration power plants. Reduced captive steam and power consumptions enhance bagasse availability for extra power generation and for extending their period of operation beyond the crushing season. The potential of 3,500 MW can be easily increased to over 5,000 MW by employing equipment and systems for reduction of steam and power in sugar processes (from present 50-52% steam on cane and 22 units of electricity per tonne of cane crushed to 42-45% steam on cane and 16 units of electricity per tonne of cane crushed), as well as for the manufacture of by-products. The following table gives the state-wise potential for existing conventional and energyefficient sugar mills in India: Sr. no. State 1. Maharashtra 2. Uttar Pradesh 3. Tamil Nadu Potential for Exportable Surplus, MW Conventional Energy-efficient Sugar Mills Sugar Mills 1,000 1,250 1,000 1,250 350 500 4. Karnataka 300 400 5. Andhra Pradesh 200 300 6. Bihar 200 250 7. Gujarat 200 400 8. Punjab 150 250 9. Haryana & others 100 400 3,500 5,000 Total Source : MNES Annual Report 2003 & Estimates from MITCON Cane trash and other agri / forest waste based biomass resources or even conventional fuels to some extent, help sugar mills operate their cogeneration plants for over 300 days, thereby improving their commercial viability. 3. Achievements Against this potential, the achievements as of December, 2004 cumulate to 432.53 MW from 56 projects. Additional capacity of about 322.97 MW from 36 projects in various stages of construction. Thus, a total of 92 projects, commissioned or under construction, have demonstrated techno-commercial viability. These projects vary in size from 5 MW to 40 MW and mainly use bagasse as fuel with biomass and conventional fuels like coal. On account of substantial efforts by MNES, bilateral agencies, financial institutions and others, the achievement of 8% of the potential has actually been realized, with another 7% under construction. The barriers for accelerated development of this sector include lack of a sustainable and conducive policy and regulatory framework, innovative financing mechanisms, high risks of fuel linkage, and inadequate capacity. 4. Promotion & Development The growth of this sector dates back to 1993-94, when the Ministry of Non Conventional Energy Sources (MNES), Govt. of India, New Delhi, launched National Program on Biomass Power / Bagasse based Cogeneration. This program focused on biomass as renewable energy source since 1992-93. Since then, the Ministry has launched key promotional programs including biomass resource assessment, bagasse- / biomassbased cogeneration, biomass-based power generation, R&D including advanced biomass gasification and industrial cogeneration. The bagasse cogeneration program focused on the generation of exportable surplus by deploying extra high pressure and temperature applications. This program included capital grant support for demonstration projects, interest subsidy schemes for different pressure/temperature configurations with higher levels of interest subsidy for higher configurations, a Program Partnership Initiative for promotion across the country, guidelines for States for purchase of exportable surplus, promotional efforts for conducive policy/regulatory framework development, capacity building and awareness, and fiscal support for SNAs, industry associations, consultants, etc. (Refer Appendix I for details). All the above initiatives were updated/revised every year, to suit the market requirements and status of commercialization. The Ministry is likely to announce a backended capital subsidy scheme for these projects for the new financial year 2005-06, with lower/reducing levels of capital grants. United States Agency for Industrial Development (USAID), through its innovative capital grant scheme for nine select bagasse cogeneration projects in the private sector during 1997-2002, as well as through specific technical assistance and capacity building programs in this sector, has also contributed significantly. United Nations Development Program (UNDP), along with the Government of India, has recently cleared an innovative project in this sector named ‘Removal of Barriers to Biomass Power Generation in India’. This project is expected to get operationalized in this year. Successful implementation of various activities under this project are expected to accelerate the growth. Under this project, one bagasse cogen project on IPP mode at co-operative sugar mill will be supported. State Nodal Agencies, particularly with predominant sugar mills and biomass resources, have also contributed to the development of this sector in their States, through specific programs and activities using available incentives from MNES. A host of other fiscal and promotional incentives from the Government of India and many States include accelerated depreciation, income tax holidays, concessions and exemption on customs/excise duties, direct/indirect taxes, sales tax, etc. The Electricity Bill 2003 duly enacted by the Indian Parliament and its conducive provisions for renewable energy thereof, will provide further impetus to harness maximum potential from this sector. 5. Financing The Indian Renewable Energy Development Agency Ltd. (IREDA), a Government of India enterprise and the lending arm of MNES, has provided promotional/development finance for harnessing biomass energy in India over the last 10-12 years. IREDA has made a major contribution in the development and commercialization of bagasse cogen projects at sugar mills and other biomass power plants in India (refer IREDA web site http://iredaltd.com for the prevailing lending norms for bagasse cogen and biomass power projects). Of late, a number of other financial institutions such as Housing & Urban Development Corporation Ltd. (HUDCO), Rural Electrification Corporation of India Ltd. (REC), Power Finance Corporation Ltd. (PFC), Industrial Credit & Investment Corporation of India Ltd. (ICICI) at the Central level, and nationalized banks at decentralized locations, have come forward to provide term loan finance to this sector, at attractive lending terms. 6. Key benefits to Indian Society & Rural Economy The key benefits of these projects have been highlighted below: Decentralized power from renewable sources, thereby reducing huge transmission and distribution losses Optimum resource utilization and reduction of oil imports Socio-economic benefits to rural populace Significant benefits with improved quality, reliability of power in rural areas Emission reduction and subsequent environmental benefits Low gestation period and capital cost (respectively 16-24 months from financial closure and Rs 30-40 million/MW of installed capacity) With the above key benefits, these projects provide truly win-win situation for all the stakeholders, the producers, utilities and consumers. Awareness amongst utilities and consumers regarding the benefits is still limited. 7. Key Barriers For accelerated growth of the bagasse cogen sector in India, the following key barriers have come to fore: Non-availability of a level-playing field and sustainable policy and regulatory framework regime across different sugar producing States. Inadequate capacity building of sugar mills, project promoters, financial institutions, SEBs, regulators and other stakeholders. Inadequate information dissemination Lack of business, commercial and institutional mechanisms at decentralized locations 8. Technology & Expertise Extra high-pressure and temperature configurations of 67 kg/cm2 and 495°C, 87 kg/cm2 and 515°C, and 105 kg/cm2 & 520°C have been successfully demonstrated in a number of sugar cogen plants. The technologies related to water treatment, Electro Static Precipitator (ESP) for emission control, fuel linkage and efficient grid interface have also been successfully demonstrated. The commissioned projects of 436 MW have exported over 2 billion MUs successfully to adjacent State Electricity Board (SEB) grids, with average 250 days of operation per year. A number of technology/equipment suppliers and service providers in India have been supplying know how, equipment and services to these projects. 9. Capacity Building Needs & Efforts Following capacity building needs of this sector have been identified: Conceiving, designing, implementing, operating and maintaining these plants by sugar mill engineers Fuel linkage for off season operation Assessment of techno-commercial viability Energy-efficiency improvement of sugar mills and cogeneration power plants Financing: MNES, financial institutions like IREDA/HUDCO/PFC/REC and others, State Nodal Agencies, service providers and consultants, bilateral agencies and other stakeholders, have been organizing awareness programs, business meets, workshops, in-plant training programs, site visits to successful plants, study tours, etc. 10. Policy & Regulatory Framework In the year 1993-94, the Ministry of Non Conventional Energy Sources (MNES) advised a single part tariff for purchase of power of Rs 2.25/kWh (5 US Cents/kWh), with a base year of 1993-94 and compounding annual escalation of 5%. This tariff was recommended by the Ministry based on the avoided cost of power at that time, capital cost/MW of installed capacity of Rs 25-30 million/MW, as well as for the promotion of this sector. On account of sustained efforts from MNES through 1994-98, most States in India, including Tamil Nadu, Maharashtra, Karnataka, Gujarat, Uttar Pradesh, Punjab, Haryana, Rajasthan, Andhra Pradesh, etc. adopted the MNES-advised tariff and policy. This led to significant development of this sector during this period. The available promotional incentives, as well as soft financing schemes and fiscal incentives, helped demonstration and commercialization of technologies involved. This created a supportive environment for the steady growth of this sector in the country. The Indian power sector reforms were initiated since 1997-98 onwards, with the bifurcation or trifurcation of State Electricity Boards (SEBs) in different States. This, however, was a major setback to this sector in the period 1999-2003. States went back on their declared policies and power purchase tariffs. The growth of this sector was seriously hampered. During this period, regulators at the Center and State levels came into force and the regulatory processes for deciding the tariffs and other conditions of the power purchase agreements were initiated. Due to reversal of policies and nonavailability of a level-playing field in this period, negative growth was registered. The Electricity Bill 2003 enacted subsequently by the Government of India has provided major impetus. The Bill has recommended that the States should generate a minimum 10% of energy from renewable sources. It also gave supreme powers to the State Electricity Regulatory Commissions for deliberating and deciding tariffs and other terms and conditions for all renewables, including bagasse cogeneration. For this purpose, the regulators adopted processes of technical validation and public hearings. This however, is still taking time and many States do not have conducive tariff orders providing longterm & sustainable policy/regulatory regimes. The Maharashtra Electricity Regulatory Commission (MERC) gave a landmark tariff order in the year 2002 for bagasse-based cogeneration power plants. This order announced a tariff of Rs 3.05/kWh and 2% compounding escalation, and included other conducive terms such as a 13-year PPA term, infirm power, 50% cost of evacuation to be borne by the SEB, etc. (refer www.mercindia.com for details). Industry associations like the Cogeneration Association of India, financial institutions and other stakeholders are pursuing the Central Electricity Regulatory Commission (CERC) to guide State Electricity Regulatory Commissions (SERCs) to adopt a uniform tariff order for bagasse cogeneration in the entire country. They are also putting efforts to secure conducive tariff orders at various States, better than, or in line with the MERC tariff order. The procedural delays of ERCs, lack of consumer awareness related to socio-economic environment-grid benefits, lack of a positive attitude by the SEBs (which are the monopoly suppliers of electricity in India), etc. have been responsible for India not having a level-playing field or conducive/sustainable policy and regulatory framework across the country. Appendix II provides the policy framework of various States as of March 2005, indicating major variations. It is hoped that policy makers and regulators will take a quick and fair view and come out with a long-term and conducive tariff regime for this sector. 11. Typical Case Studies Typical case studies of commissioned bagasse cogeneration projects are listed below. Case Study I Company name & address : Davangere Sugar Co. Ltd. 73/1, P. B. No. 312, Shamanur Road Davangere– 577 004, Karnataka State Ownership structure : Private limited company Project location : Kukkuwada village, Tehsil Davangere, Karnataka State Year of commissioning : March, 2004 Installed capacity, MW : 24.00 No. of days of operation per year, no. : 300 : 5.66 : 2.10 : 12.34 (48.87) : 21.20 (61.05) : 15.88 (109.92) : 103.50 : Mill bagasse, procured bagasse, cane trash, groundnut shells and imported coal Technology configuration : Rankine cycle, multi-fuel fired boiler with 87 kg/cm2 pressure & 515°C temperature and matching extraction-cum-condensing TG set Employment pattern : Total 60 (15 engineering and 45 skilled labourers) Capital cost, INR million : 768.00 & Dist. Captive consumption, MW Season Off-season Exportable capacity, MW kWh) surplus (million Season Off-season Total No. of units exported since commissioning, million kWh Types of biomass utilized Case Study II Company address : M/s. SCM Sugars Limited 3-5-821, Flat No. 104 1st Floor, Doshi Ford Building Hyderguda, Hyderabad – 560 029 Andhra Pradesh Ownership structure : Private limited company Project location : S C M Sugars Ltd. Koppa Village – 571 425 Tehsil Maddur, Dist. Mandya Karnataka State Year of commissioning : June, 2004 Installed capacity, MW : 26.00 No. of days of operation per year, no. : 330 (200 season days & 130 off-season days) : 6.25 : 2.30 : 14.40 (66.53) : 20.70 (64.58) : 16.88 (131.11) : 85.40 : Mill bagasse, procured bagasse, wood chips, cane trash and imported coal Technology configuration : Rankine cycle, multi-fuel fired boiler with 87 kg/cm2 pressure & 515°C temperature and matching extraction-cum-condensing TG set Employment pattern : Total 60 (15 engineering and 45 skilled labourers) Capital cost, INR million : 832.00 Captive MW name & consumption, Season Off-season Exportable capacity, MW Kwh) surplus (Million Season Off season Total No. of units exported since commissioning, million kWh Types of biomass utilized Case Study III Company name & address : Shree Doodhganga Krishna Sakkare Karkhane Niyamit Chikodi-591247 Dist Belgaum, Karnataka Sahakari Ownership structure : Co-operative society Project location : Same as above Year of commissioning : March, 2004 Installed capacity, MW : 20.00 No. of days of operation per year, no. : 320 (180 season days & 140 off-season days) : 5.60 : 2.00 : 10.40 (41.18) : 18.00 (60.48) : 13.73 (101.66) : 75.00 : Mill bagasse, procured bagasse and cane trash Technology configuration : Rankine cycle, multi-fuel fired boiler with 67 kg/cm2 pressure & 495°C temperature and matching extraction-cum-condensing TG set Employment pattern : Total 50 (10 engineering and 40 skilled labourers) Capital cost, INR million : 580.00 Captive consumption, MW Season Off season Exportable capacity, MW kWh) surplus (million Season Off-season Total No. of units exported since commissioning, million Kwh Types of biomass utilized 12. Environmental Benefits Use of biomass resource for generation of exportable surplus reduces carbon dioxide (CO2) emissions, as this power otherwise would have been generated mainly by coal. Reduction of about 0.8 to 1.2 Kg of CO2 per kWh have been estimated based on type of technology configuration employed in these projects and the local / national base line. Government of India signed the Kyoto Protocol in the year 2002 and recently it has come to force globally. Implementation of biomass based power projects in India not only will reduce environmental emissions but also will qualify for Certified Emission Reductions (CERs) under the Clean Development Mechanism (CDM). The Indian project promoters can sale the CERs internationally and ensure additional financial benefits every year. A number of bagasse cogen projects have been identified for approval by the Ministry of Environment & Forest (MoEF), the Nodal Agency. The validation process and approvals from CDM board will shortly follow. This will enable the sugar mills and project promoters to sign emission trade agreements with eligible partners from Annex 1 countries. 13. Conclusions Bagasse based cogeneration of power in India has come to a take-off stage. The lessons learned during the last decade have been extremely useful for achieving accelerated growth in the near future. The enactment of the Electricity Bill 2003 and its early adoption by different States will ensure a desired level-playing field and sustainable policy regime. The upcoming initiatives from the Government of India, and innovative financial mechanisms, including trade of emission reductions from these projects under the Clean Development Mechanism (CDM) of the Kyoto Protocol, are expected to remove the barriers for accelerated growth of this sector in India. Internationally, financing, technology transfer and project development opportunities, as well as trade of emission reductions will have immense business potential. Due to inadequacy of capital with the Indian promoters, particularly in the cooperative sugar mill sector, excellent potential for international independent power producers, investors and promoters exists for investing in these projects in India. Apart from setting up high efficiency cogen power plants adjacent to the sugar mills, the promoters can also invest in modernization of the sugar mills. The CERs from such projects can be sourced by international emission reduction buyers for meeting their targets under the Kyoto Protocol during 2008-12 period. 14. About the Author & Organization The author is Sr. Vice President of the Green Power Division of MITCON Consultancy Services Ltd., Pune, India. He has extensive experience in consultancy of over 20 years in the areas of energy efficiency, renewable energy, biomass/cogeneration power plants, captive power plants and emission reduction trade under CDM of the Kyoto Protocol. He is a mechanical engineer and cost accountant by profession, is 45 years of age, and has been working with MITCON since 1984. He also acts as Member Secretary, Cogeneration Association of India, and Vice Chairman, World Alliance for Decentralized Energy (WADE), UK. MITCON Consultancy Services Ltd. is an ISO 9001 and dividend paying company promoted by India’s major financial institutions, public commercial banks and State Corporations of Maharashtra. MITCON works in diverse areas of consultancy services in energy and environment or green power, agri business, market research, entrepreneurship development, IT education & training. Visit MITCON’s web site at www.mitconindia.com for details. The Green Power Division of MITCON headed by the author provides a diverse range of consultancy services both at the micro and macro levels, ranging from energy audits, renewable energy, biomass / cogeneration / captive power, to environment and climate change. The micro level consultancy services for biomass / bagasse cogeneration includes concept to commissioning services and MITCON has provided these services to various plants equivalent to 200 MW for commissioned projects and 1,000 MW equivalent projects under construction. The unit level services include pre-investment consultancy, pre-contract engineering consultancy and post-contract project management services. MITCON also works hand-in-hand with MNES as their Program Partner for promotion & development of these projects as well as with financial institutions like IREDA, HUDCO, REC, PFC and bilateral agencies like USAID and UNDP. MITCON bagged the Business Leadership Award for Cogeneration in 2004, awarded by the Solar Energy Society of India, and has been selected as the local implementing agency for the MNES-UNDP-GEF project “Removal of Barriers to Biomass Power Generation in India”. Appendix – I Bagasse/Biomass Based Cogeneration Program Sr. No. 1. 2. 3. Particulars Pressure configuration Interest subsidy Projects by cooperative/public/ joint 40 bar & above sector sugar mills 3% 60 bar & above 4% 80 bar & above 5% 100 bar & above 6% Projects in Independent Power 60 bar & above Producer (IPP) mode in cooperative/public/joint sector sugar mills 2% 80 bar & above 3% 100 bar & above 4% 60 bar & above 1% 80 bar & above 2% 100 bar & above 3% Projects by private sector sugar mills (for bagasse cogeneration by cooperative/public sector sugar mills, the floor rates of interest shall not be lower than 6%, otherwise 8% for general category of projects) Source : MNES, New Delhi Appendix - II Policy framework of various States as of March, 2005 State Participati on Wheeling Andhra Pradesh ** Private (Pvt.) 2% Chattisgarh Pvt. - Gujarat## Pvt. for cogen only ~~ 4% of energy Haryana** Pvt. 6-12% of energy Karnataka* * Pvt. 6-12% of energy Kerala Pvt. 5% of energy Allowed 4 months Banking Buy Back Third Party Sale Allowed at @ Rs 2.88 allowed 2% for 8- per unit up 12 months to 80% PLF escalated at 1% (04-05) (high court ordered interim rate of Rs 3.14 from June 04) Not @ Rs 2.25 Allowed per unit ~~ Allowed @ Rs 2.25 ~~ Allowed 12 months per unit, escalated at 5% (94-95) Allowed at Rs 2.80 per 2% charge unit, # on monthly escalated at basis @ 2% on base Allowed at 2% charge on monthly basis @ Other Incentives - As to other industry; electricity duty exempted for first five years - Subsidy @ Rs 25 lakh/ MW for cogen Rs 2.80 per unit, # escalated at 2% on base tariff - Subsidy @ Rs 25 lakh/ MW for cogen @ Rs 2.80 Not allowed per unit, escalated at 5% for five years (2000-01) 50% cost of power evacuation line to be borne by Karnataka Power Corporation Ltd. (KPTCL) Appendix – VI (contd.) Policy framework of various States as of March, 2005 State Participat ion Wheeling Banking of Allowed Buy Back Third Party Sale @ Rs 3.05 Allowed per unit, escalated at 2% from year of commissio ning Maharasht Pvt./ ra ** for Cooperativ cogen only e 7% energy MP Pvt. Punjab Pvt. Rajasthan Pvt. Tamil Nadu Pvt. UP** Pvt. 2% of @ Rs 2.25 energy Not per unit allowed 2% of Allowed 12 @ Rs 3.01 energy months per unit, escalated at 3% for 5 years (01-02) 2% of Allowed 12 @ Rs 2.25 energy months per unit, escalated at 5% (9495) 2% - 10% Allowed at @ Rs 2.73 2% charge per unit, *** escalated at 5% for 9 years (2000-01) 12.5%* 24 months 2.25 per Allowed @ Rs unit, escalated at 5% (9900) Allowed Other Incentives 50% cost of power evacuation line to be borne by Maharashtra State Electricity Board (MSEB) - Allowed As to other industry Allowed - Not allowed - Allowed - (*not allowed for cogen, ** SERC policy announced, *** Rs. 2.48 per unit at 5% escalation for 9 years (2000-01) for off season power generation using coal / lignite (subject to ceiling of 90% of HT tariff, # Govt. order dated June, 03 for biomass only, ## Govt. resolution no. REP102000-502-B dated Sept. 27, 01, ~~not allowed for cogen. For biomass only., ~notification dated Apr 8, 02) Source : MNES, New Delhi