View MS Word Version

advertisement

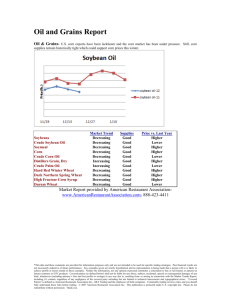

January 2, 2012 Weather No change in US Weather overnight. Argentina wheat areas will see continued favorable crop maturation and harvest weather into Saturday, although a few showers will be possible at the end of this week and during the weekend. No heavy rain is expected and fieldwork should advance favorably around the precipitation. A wetter biased pattern is advertised for Argentina late this weekend and next week and that may set back fieldwork again with some returning concern over crop quality. Argentina corn and soybeans are still rated in mostly good shape, despite much talk about excessive moisture this year. Weather conditions have recently improved and the trend will prevail for a few more days. Wetter weather is expected again later this week and into next week slowing fieldwork and maintaining or returning moisture abundance to many areas. Dryness in northwestern parts of the nation still needs to be more seriously relieved and some relief is expected Friday through the weekend with some follow up rain possible next week. No heavy soakings are expected in Santiago del Estero where it is driest. Brazil summer crop areas are still rated in very good shape with the exception of Bahia and immediate neighboring areas where it has become too dry. Relief to dryness in northeastern Brazil is not very likely for a while. The impact will be small on corn and soybeans since the region is not a huge production region. However, unirrigated coffee, sugarcane and rice in the region are being stress into producing poorly. The bottom line for South America remains fine for most of Brazil’s main crop region, but rain is needed in the northeast to stop the decline in crop and field conditions. Many other areas in Brazil will get sufficient rain to maintain or restore moist conditions. Argentina will see a better alternating pattern of rain and sunshine over the next two weeks with the heart of corn and soybean country seeing enough drying eventually to support additional planting. Santiago del Estero needs rainfall to ease persistent dryness and heat. Winter wheat in the southeastern Argentina will have a great opportunity to dry down for a few more days favoring better maturation and harvest conditions. Wet weather returning to Argentina later this week and into next week will slow fieldwork again and return some concern over unharvested grain quality. Announcements 1. 2. 3. Palm Springs Conference: February 11-13, 2013- see website for agenda/ speakers. Chicago Conference: March 28-29, 2013 Beaver Creek Conference: July 10-12, 2012 News The US House of Reps approves a bill to avoid fiscal cliff and President Obama signed it. US fiscal cliff legislation included 9 month extension to 2008 farm bill for dairy products, and temporarily fix the subsidy programs for corn, wheat, soy, cotton, rice out to Sept 30, 2013. India's state owned trading companies are expected to sell and ship abroad 2.5 mmt of Wheat recently released from gov't stockpiles. Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. Egypt’s GASC said this morning that they have enough wheat “to last 5 1/2 months”, including all the grain that’s been received and contracted for. Spain’s Ag Ministry reported the 2012 wheat crop at 5.09 mmt, down from 6.9 mmt a year ago; soft wheat output fell to 4.65 mmt, down from 5.96 mmt last year, though corn production rose from 4.15 to 4.4 mmt in 2012. Cordonnier left his estimates for Brail Corn and Soybean production unchanged this week. He noted yields in the early harvested areas of Mato Grosso were about the same as last year. He also left his Argentine Corn and Soybean production estimate unchanged but noted there was nearly 4 million hectares of Soybeans to plant yet and the nationwide Soybean yield could be negatively impacted by the late plantings. He also noted it was late for planting Corn in Argentina and he did not think all the intended acre s would be planted. Comments The weather is good in S America--- we bought a lot of days of holiday trading that was afraid to take a position one way or another especially ahead of the “cliff”. Congress kicked the can down the road, with any austerity other than the 2% FICA tax expiring (and that isn’t a tax anyway, it is an investment supposedly). Huge response in stocks, which apparently set a bear trap in commodities at least as it looks after 30 min of trading. Apparently grain and oilseed traders were waiting for a New Year gift to sell higher as that is exactly what they did—as grains and oilseed complex well off the highs and actually trading lower in wheat and beans and meal---Terrible action so far but not unexpected. I would think $6 CZ13 and $7 CH13 and $13 SX13 and $14 SN13 have some psychological significance, but if a bounce is not seen to close well off those levels, starting the year in this manner is not good--- odds are market will focus again on farmer selling after Jan 1 due to tax reasons???? We advised selling last year to push forward sales and it may not have backfired as markets have dropped in all grains/soybeans since we advised that. Even livestock gave up the higher openings this morning. Obviously no change in advice. Soy oil is exploding on news that the biodiesel credit is extended and in fact, the $1 credit was set for all of 2012 and going forward—this could have significant impact on soy oil! Traders got caught in the oil/meal spread. If you cannot log on to the web or don’t get phone message tomorrow, it will likely be due to a missing payment of past due invoices. Markets & Recommendations Yesterday’s Trades: No new trades. Overnights/ Outside Markets: Dow +196.00, Dollar -.27, Crude +$1.88, Nat Gas -.129, Hogs No Overnight Trade, Cattle No Overnight Trade, Cotton +1.17, Gold +$12.6 ADVICE: The weather is good in S America--- we bought a lot of days of holiday trading that was afraid to take a position one way or another especially ahead of the “cliff”. Congress kicked the can down the road, with any austerity other than the 2% FICA tax expiring (and that isn’t a tax anyway, it is an investment supposedly). Huge response in stocks, which apparently set a bear trap in commodities at least as it looks after 30 min of trading. Apparently grain and oilseed traders were waiting for a New Year gift to sell higher as that is exactly what they did—as grains and oilseed complex well off the highs and actually trading lower in wheat and beans and meal---Terrible action so far but not unexpected. I would think $6 CZ13 and $7 CH13 and $13 SX13 and $14 SN13 have some psychological significance, but if a bounce is not seen to close well off those levels, starting the year in this manner is not good--- odds are market will focus again on farmer selling after Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. Jan 1 due to tax reasons???? We advised selling last year to push forward sales and it may not have backfired as markets have dropped in all grains/oilseeds since we advised that. Even livestock gave up the higher openings this morning. Obviously no change in advice. If you cannot log on to the web or don’t get phone message tomorrow, it will likely be due to a missing payment of past due invoices. CORN: 2012: Hedged 85% (85% cash). 2013: 75% (10%, cash, 65% futures). END USERS: For 2013 Q1, Q2, and Q3, short 40% CH 770 puts and short CH 1x1. SOYBEANS: 2012: Hedged 100% (100% cash). 2013: Hedged 75% (25 % cash, 50% futures). End Users: For 2013: For Q3, hedged 65% in SMN. WHEAT: 2012: Hedged 100% (85% cash, 15% futures). 2013: Hedged 85% (10% cash, 75% futures). SPRING WHEAT: 2012: No hedges, BUT we assume clients are following the wheat advice in Chicago wheat. CANOLA: 2012: Hedged 40% (40% cash). 2013: Hedged 10% (10% cash) SPEC: No trades LIVESTOCK: Live Cattle: 2013: Short 40% in Q1 and 25% in Q2. Feeder Cattle: 2013: Producers – no hedges. End Users – no hedges. Lean Hogs: 2013: Short 25% in Q1 and Q2. Cotton: Big reversal in the overnight’s this morning---maybe a fiscal cliff rebound? Exit hedges on a move above 77 today. Rice: The down draft continued on Friday, we switched our profitable hedges to March. We’ll lift those hedges on a move above 15.40. Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information.