Improving Local Government Transparency, Accountability and

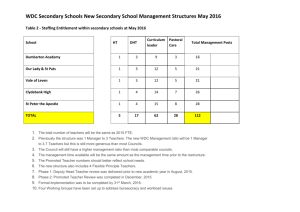

advertisement