Homework 7 on Engineering Economics

advertisement

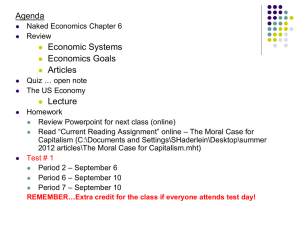

Steven A. Jones BIEN 402 Handout on Engineering Economics February 11, 2003 Engineering Economics The essential idea behind engineering economics is that money generates money. You cannot compare $10.00 today to $10.00 a year from now without adjusting for the investment potential. A simple example would be to take the $10.00 and put it in a savings account at 2% interests. After a year you have $10.20 instead of $10.00. You might be presented with three options for being paid. 1. A single payment right now. 2. A single payment at some time in the future. 3. A uniform annual payment over several years. For example, consider a lottery that is held in a fictional state (Rustiana). In this particular lottery, the winner is given three different payment options. The first is a lump sum payment immediately of $1,000,000. The second is a series of 21 annual payments of $50,000. The third is a whopping $2,000,000 to be paid ten years from now. How does the winner choose which option to take? Of course, that will depend on the winners personal needs, but beyond that, how does one compare the three options? The annual payment method provides $50,000 more than the immediate payment, and the deferred payment provides a cool million more. For argument sake, let’s say that the person who won the lottery knows that he can make 5% interest on the money in some safe investment. The notation is provided in Table 1. We will call the immediate payment the “Present Value” of the winnings. The $50,000 annual payments will be called “Annual Value,” and the $2,000,000 will be the “Final Value.” The interest that we presume we can get on the money in some investment is designated as “i”. Symbol P A F i n Meaning Amount (in example) Present Value (What the money is worth now) Annual Value (What the money is worth in annual payments) Final Value (What the money will be worth at some future date) Interest (an estimate of how fast the money can grow in some relatively safe investment). Number of years (Duration over which an investment is made). $1,000,000 $50,000 $2,000,000 5% 5 years Table 1: Notation used to describe engineering economics problems. These parameters are related to each other through standard engineering formulas, which are provided in Table 2. The purpose of this document is to explain where the equations came from and how they are used in engineering economics problems. 1 Steven A. Jones BIEN 402 Handout on Engineering Economics February 11, 2003 Find From Single Payment EqualPayment Series Discrete Payments, Discrete Compounding Discrete Payments, Continuous Compounding Continuous Payments, Continuous Compounding F Pe rn F Pe rn F P F P 1 i P F P F 1 i P F e rn P F e rn F A 1 i n 1 F A i e rn 1 F A r e 1 e rn 1 F A r A F i A F n 1 i 1 er 1 A F rn e 1 r A F rn e 1 P A 1 i n 1 P A n i 1 i 1 e rn P A r e 1 e rn 1 P A rn re P i 1 i n A P n 1 i 1 er 1 A P rn 1 e re rn A P rn 1e 1 A A G Gradient Series P Fi n n 1 n n 1 A G A G e r 1 e rn 1 n i 1 i 1 P Fi 1 g 1 g n 1 n g 1 g Not Applicable Not Applicable Not Applicable Table 2: Summary of relationships between the different amounts used in engineering economics problems (Adapted from Ertas and Jones). Table 2 tells us how to convert from one form of payment to another. A discrete payment is one that is made at specific designated times, such as 1 payment each year, 1 payment each month, or two payments each month. Continuous payment means that the money is deposited into your account continuously in time, and can logically be thought of as receiving x dollars per day. Discrete compounding means that interest is calculated at discrete times, such as once a year or once a month. The more frequently interest is calculated, the faster the money grows because one receives interest on the interest. For example, $100 invested at 5% interest and compounded after one year becomes $105, but if it is compounded after 6 months, it will be $100(1.025)=$102.5 after 6 months and will then become $102.5(1.025)=105.06 after 1 year because 6 months of interest is accrued on the $2.50 that was earned in interest during the first 6 months. Continuous compounding means that the interest is calculated continuously, meaning that the frequency of compounding goes to infinity. 2 Steven A. Jones BIEN 402 Handout on Engineering Economics February 11, 2003 Consider the column under “Discrete Payments, Discrete Compounding.” The equations are designed to answer the following questions: F P(1 i ) n “If I have P dollars today (present worth), how many dollars ( F is future worth) will I have in n years if it grows at an interest of i? In our example, if we want to know the value of the $1,000,000 in 10 years, it would be F 1,000,000(1 0.05)10 1,628,894 . Given this, the delayed payment option doesn’t appear too bad! P F /(1 i ) n “If I know what the value of the funds will be in n years, what are they worth now? In our example, if we want to know what $2,000,000 is worth in today’s dollars, it would be P 2,000,000 /(1 0.05)10 $1,227,826 . This just confirms what the previous calculation told us, i.e. that the value of the delayed payment is greater than that of the immediate payment. 1 i n 1 F A “If I know the annual payments, what is the money worth n years from i now?” In our case, after 21 years the $50,000 per year will come out to be 1 0.0521 1 F 50,000 $1,785,962 . This seems to be a lot of money, but remember that 0 . 05 this is in terms of the value of dollars 21 years from now. To compare that to the immediate $1,000,000 we have to convert the $1,000,000 to 21 year old dollars via F P(1 i ) n . Previously we used 10 for n, but now we need to use 21. The answer is: F 1,000,000(1 0.05) 21 $2,785,962 . This is about a million dollars more, which would argue for the immediate payment. i A F “If I know the future value of the money, what is that equivalent to in annual n 1 i 1 payments?” So let’s say that we would like to convert the $2,000,000 at ten years to annual 0.05 payments over 10 years. We then obtain: A 2,000,000 159,009 . 10 1 0.05 1 1 i n 1 P A “If I am paid in annual payments of A over n years (with the first payment n i 1 i starting at the end of the first year), what does that correspond to in current dollars?” In our case, 1 0.0521 1 $641,058 , which is 21 payments of $50,000 is equivalent to only P 50,000 21 0 . 05 1 0 . 05 kind of a rip-off. 3 Steven A. Jones BIEN 402 Handout on Engineering Economics February 11, 2003 i 1 i n A P “If I could be paid in a lump sum today, what must my annual payment be n 1 i 1 for me to recover the same amount of money over n years?” A logical question to ask in our case is, “How much money should I get if I am paid my winnings over 21 years?” The answer 0.051 0.0521 is: A 1,000,000 $77,996 . 21 1 0.05 1 Exercise 1: The above analysis does not take into account that the $1,000,000 will be taxed at a different rate from the $50,000 annual payments. Assume that the tax on $1,000,000 in one year is 50% and the tax on $50,000 per year is only 25%. This means that the present value of the $1,000,000 is only $500,000, and that the annual payment of the $50,000 is only $37,500. Calculate the equivalent annual payment for the $500,000 and compare it to the $37,500. Also calculate the present value of the $37,500 payment option. The next two columns in the table provide similar information, but for different ways of compounding the interest and making the payments. We all know that by compounding interest monthly we can earn greater return than if the interest is compounded annually. Notice that for the single payment rows the “Discrete Payment” and “Continuous Payment” colums are identical. This is because, by definition, a single payment is discrete. To see what happens to the Equal-payment series, consider the entry under “Discrete Payments, Discrete Compounding” 1 i n 1 and in the “Compound amount” row. This equation is: F A . What if we were to i compound monthly rather than annually? We would then have to replace “i” with “i/12” (interest rate per month), and we would have to replace “n” with “12n” (number of months). The amount of interest paid would then be greater, as a result of compounding. On the other hand, if we are paid monthly instead of annually, the value of our future worth is larger simply because we get the money earlier. To understand this completely, it is necessary to derive the equations in table 5.5. Exercise 2: Your engineering firm needs a rapid prototyping machine. The company gives you two options. In Option 1 you purchase the machine outright for $50,000, pay a maintenance contract of $1,000 per year, and expect to be able to resell the machine after 10 years at a salvage value of $10,000. In Option 2, you lease the machine at $7,000 per year and pay no maintenance, but receive no salvage. Assume that you will be able to take in $8,000 per year in income from this machine. Also assume that an additional option is not to buy the machine at all, but to put the money in the bank at 5% interest. Which option will be best for the firm? Origins of the Equations The engineering economics equations can be derived relatively simply. Consider first the case of simple interest. At the end of one year, the principal amount is worth its initial value, P, plus an 4 Steven A. Jones BIEN 402 Handout on Engineering Economics February 11, 2003 additional amount equal to Pi , so the value is P1 i dollars. At the end of two years it is worth what its value at the end of the first year times i 1 , or P i 1i 1 P i 1 each subsequent year the value increases by a factor of i 1 , so by year n, the value is simply 2 F P i 1 dollars. If the intrest is compounded monthly instead of annually, there are twelve times as many compoundings, so the exponent becomes 12n instead of n, but the interest at each compounding is 1/12th as much (i.e. i/12). If we compound continuously, we speak of a rate of interest, r, which is percent per year. At any given time t, we have that the rate of change of monetary value is that rate multiplied by the current value. In other words: n dV rV . dt Note that P is the value of V at time t 0 , and that F is the value of V at time t. Since r is a F dV t F r dt ln rt F Pe rt . To constant, this equation is easily integrated to P V 0 P obtain P in terms of F, it is sufficient to invert the relationships already derived. For example, n n from F P i 1 we obtain P F i 1 , and from F Pe rt we obtain P Fe rt . This takes care of the top section in the table from Ertas and Jones. The next question is, “what is the value of a “deal” where you are given a certain amount of money “A” each year. First, consider the present value (P) of the first year’s payment. From our n relationship for simple interest, P F i 1 . If we consider A to be the future value after one year, we find that P1 Ai 1 . Similarly, the present value of the second year’s payment is 1 P2 Ai 1 . Extending this to the nth year’s payment, Pn Ai 1 . Thus, the total present worth of the entire “deal” is the sum of all P’s up to Pn. That is: n 2 n n k 1 k 1 k P Pk Ai 1 k n A i 1 k 1 x x n1 , which is a formula you may 1 x k 1 have seen in BIEN 225 and/or BIEN 425 (in relation to z transforms). And just where did that Okay, now let’s have a little fun. Recall that n xk n come from, you may ask? It goes like this. Let’s define x k . Let’s now take the first k 1 n term (the k 1 term) out of this summation to get x x k . Now make the simple k 2 substitution j k 1 . This means that when k 2 , j 1 (in the lower limit), and when k n , j n 1 (in the upper limit), and we can substitute j 1 for k in the exponent of the n 1 summation. This gives us x x j 1 . Since x j 1 x x j , and since x is independent of j 1 5 Steven A. Jones BIEN 402 n 1 k, we can write x j 1 Handout on Engineering Economics February 11, 2003 j 1 n 1 x x j . We can now add in x x n x x n (i.e., add zero) to obtain j 1 n 1 j 1 x x x j x x n x x n and notice that the expression in square brackets is just equal to n n j 1 k 1 x x j , which is the same as x x k (because j and k are dummy variables), which is equal to x , according to our original definition. It follows that x x x x n . Thus, if we take n x to the left hand side, factor out , and then divide by 1 x , we get x k k 1 x x n1 , as 1 x x 1 x n 1 1 k x promised. If we substitute 1/x for x in this expression we get . 1 x 1 k 1 x k 1 n n k If we use this expression, we get P A i 1 k 1 A k n i 11 i 1 n 1 . 1 1 i 1 To obtain the relationship for F , given A , we can either use this same method or use the expression that converts P to F . Exercise 3: This last expression for “P given A” is not in the same form as the attached table. Rewrite the expression as: 1 1 i 1 i 1n 1 PA 1 1 i 1 and simplify to obtain the form in the table. Exercise 4: Use the expression that converts P to F , along with the expression for P given A to obtain an expression for F given A . Exercise 5: Obtain the expression for F given A directly, using the summation method above. The expression for P given A is for the case where the first payment starts at the end of year 1. While dividends will often be paid at the end of the year, other types of transactions will start at the beginning of the first year. For example, if you are paying for maintenance on a piece of equipment, the company will want to have their money up front. They will not be receptive if you wait until after your equipment breaks to tell them you would like to buy the maintenance contract. A simple way to determine P given A for this situation is to use P given A for n-1 years, instead of n years (to account for the payments at the beginning of years 2-10) and add the payment for the first year. The result is 6 Steven A. Jones BIEN 402 1 i n 1 1 P A A n 1 i 1 i Handout on Engineering Economics February 11, 2003 1 i n 1 1 i 1 i n 1 1 i n 1 1 i 11 i n 1 1 A1 n 1 n 1 n 1 i 1 i i 1 i i 1 i 1 i n 1 P A n 1 i 1 i Valid if A starts at the beginning of the year instead of the end of the year. Recap: Assume you want to know whether Option 1 or Option 2 is better. The approach is as follows: 1. Decide what common time frame to use. For example, you can convert everything to its value in current dollars (present worth), convert everything to its value in future dollars (future worth), or convert everything to an annual payment. For now we will assume that we are using the present worth method, so we want to convert everything to present worth. 2. Anything that is already expressed in your time frame does not need to be modified. For example, if you are using the present worth method, there is no need to convert the down payment or the initial investment to anything. 3. For the present worth method, convert annual payments to present dollars with 1 i n 1 P A . n i 1 i 4. For the present worth method, convert single payments for any given year to present dollars with P F /(1 i ) n . 5. Now that everything is in terms of the same time frame, you can just add and subtract dollars. 7 Steven A. Jones BIEN 402 Handout on Engineering Economics February 11, 2003 Solution to Exercise 2 using the Present Worth method: Exercise 2: Your engineering firm needs a rapid prototyping machine. The company gives you two options. In Option 1 you purchase the machine outright for $50,000, pay a maintenance contract of $1,000 per year, and expect to be able to resell the machine after 10 years at a salvage value of $10,000. In Option 2, you lease the machine at $7,000 per year and pay no maintenance, but receive no salvage. Assume that you will be able to take in $8,000 per year in income from this machine. Also assume that an additional option is not to buy the machine at all, but to put the money in the bank at 5% interest. Which option will be best for the firm? Option 1: The present worth of the initial 50,000 is just 50,000. The present worth of the maintenance contract (remembering that it must be paid at the beginning of the year) is: 1 i n 1 1.0510 1 P A 1000 0.05 1.059 $8,107 n 1 i 1 i The present worth of the income (8,000/year), remembering that income comes at the end of the year, is: 1 i n 1 1.0510 1 P A 8000 0.05 1.0510 $61,774 n i 1 i 10 The present worth of the salvage ($10,000) is: P F 1 i 10000 1.05 6,139 . n Thus, the profit is Income – Outlay = 61,774 + 6139 – (50,000 + 8,107) = $9,806. Because your profit is positive, you would be better off to choose Option 1 than to put the money in the bank. Option 2: The present worth of the 7,000/year lease is: 1 i n 1 1.0510 1 P A 7000 0.05 1.059 $56,754 n 1 i 1 i We already figured out that the present worth of the $8,000/year profit is $61,774, thus the total profit by this option would be $61,774 - $56,754, or $5,019. This may not sound like much, but it’s better than having the money just sit in the bank at 5% interest. Thus, the correct choice is Option 2. 8