17. Travelling Allowance and Daily Allowance Rules

advertisement

17

TRAVELLING ALLOWANCE AND

DAILY ALLOWANCE RULES

For the purpose of these rules, the officers

and employees of National Agricultural

Cooperative Marketing Federation of India Ltd.

shall be classified into the following categories:

1.

Classification*

(i)

(ii)

(iii)

(iv)

Those drawing monthly pay of Rs.

14150/- and above.

Those drawing monthly pay of Rs.

11050/- and above but less than Rs.

14150/Those drawing monthly pay of Rs.

6000/- and above but less than Rs.

11050/Those drawing monthly pay of Rs.

4250/- and above but less than Rs.

6000/-

(v)

2.

Those drawing monthly pay less

than Rs.4250/(The pay range has been modified as

per revised pay scales vide OO No.21

dated 7.12.2004)

Mileage Allowance

(a)

(b)

A mileage allowance is an

allowance

calculated

on

the

distance travelled and given to meet

the cost of a particular journey.

For the purpose of calculating

mileage allowance, the journey

between the two places should be

performed by the shortest and the

cheapest of the two or more

practicable routes.

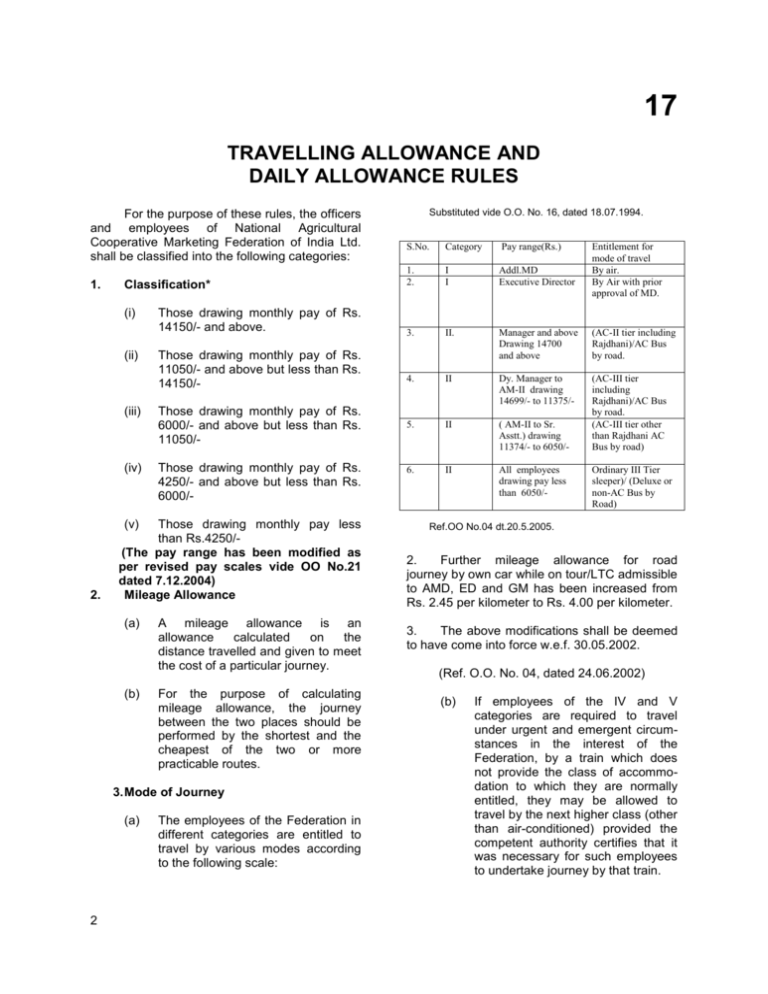

3. Mode of Journey

(a)

2

The employees of the Federation in

different categories are entitled to

travel by various modes according

to the following scale:

Substituted vide O.O. No. 16, dated 18.07.1994.

S.No.

Category

Pay range(Rs.)

Entitlement for

mode of travel

By air.

By Air with prior

approval of MD.

1.

2.

I

I

Addl.MD

Executive Director

3.

II.

Manager and above

Drawing 14700

and above

(AC-II tier including

Rajdhani)/AC Bus

by road.

4.

II

Dy. Manager to

AM-II drawing

14699/- to 11375/-

5.

II

( AM-II to Sr.

Asstt.) drawing

11374/- to 6050/-

(AC-III tier

including

Rajdhani)/AC Bus

by road.

(AC-III tier other

than Rajdhani AC

Bus by road)

6.

II

All employees

drawing pay less

than 6050/-

Ordinary III Tier

sleeper)/ (Deluxe or

non-AC Bus by

Road)

Ref.OO No.04 dt.20.5.2005.

2.

Further mileage allowance for road

journey by own car while on tour/LTC admissible

to AMD, ED and GM has been increased from

Rs. 2.45 per kilometer to Rs. 4.00 per kilometer.

3.

The above modifications shall be deemed

to have come into force w.e.f. 30.05.2002.

(Ref. O.O. No. 04, dated 24.06.2002)

(b)

If employees of the IV and V

categories are required to travel

under urgent and emergent circumstances in the interest of the

Federation, by a train which does

not provide the class of accommodation to which they are normally

entitled, they may be allowed to

travel by the next higher class (other

than air-conditioned) provided the

competent authority certifies that it

was necessary for such employees

to undertake journey by that train.

(c)

Notwithstanding anything contained

in any of the rules herein

incorporated, the Managing Director

shall have power to allow any

employee to travel by a class higher

than the one to which the said

employee is entitled, under special

circumstances.

*

Modified w.e.f. 27.03.1991, vide O.O. No. 13, dated

25.04.1991.

#

Modified vide O.O. No. 03, dated 18.05.1995 &

applicable w.e.f. 17.04.1995.

** Added w.e.f. 09.01.1984 vide HO/FA/20-52/83-84 dated

07.03.1984.

[]

4.

(d)

In all cases, an employee shall be

eligible for a single fare only.

(e)

Return journey tickets should

invariably be purchased where

available.

(f)

The TA bill should be submitted in

the form ‘A’ annexed hereto.

Ref. HO/FA/20-52/89-90 dated 11.05.1990.

@ Added vide O.O. No. 05, dated 12.06.95 and effective

from same date.

**Those officers and staff who are entitled

to travel by 1st class and above by rail may

travel by air-conditioned deluxe coach by

road and claim actual fare subject to the

conditions that:

(i)

the journey is undertaken by State

Road Transport Buses or coaches

of Public Under-takings;

(ii)

evidence in the form the bus ticket is

produced.

Journey by Sea

Officers and employees in

(a)

(b)

Category I & II

Category III, IV & V

Upper Class

Lower Class

5.

Mileage Allowance : Journey by Road

(A)

Mileage allowance for the employees of

the Federation is to be calculated on the

basis of the mode of transport used for

performing a journey by road.

(a)

In one’s own car:

or by hiring full

taxi with the prior

approval of the

Managing Director

Rs. 2.45*

per km.

(b)

By Scooter:

Rs. 0.80*

*(c)

The mileage allowance admissible to the

employees for performing journeys by

State Transport Buses etc., shall be paid

according to the actual fare, in addition to

an incidental allowance of 25# paise per

km. However, during the journey period no

daily allowance would be admissible.

Similarly, for journeys undertaken on tour

by rail, an employee will be entitled to

reimbursement of fare on actual basis as

per his entitlement, in addition to an

incidental allowance of 25# paise per km.

If the journey undertaken is by Rajdhani/

Shatabdi@ Express, the

incidental

charges admissible would be reduced to

50% of the above rates.

The above is applicable in case of Leave

Travel Concession and transfer cases also.

(d)

While on tour, from residence to

airport/railway station/bus stand to place

of stay/Branch or Regional Office.

[Actual fare by taxi or scooter as per

entitlement under the rules is admissible subject

to a ceiling of Rs. 250/-# in case of local journey

undertaken in metropolitan cities and Rs. 100/in all other cities/ towns. If local conveyance in

such cases exceeds the prescribed amount, it

will be entertained for reimbursement in case

same is supported by cash receipt.]

At place where auto-rickshow (three

wheelers) or cycle-rickshaws, are not available

employees who are not entitled, to travel by taxi

may be allowed reimbursement of the taxi

charges subject to the following conditions:

(i)

Local

train

services,

where

available, should be utilised to the

maximum possible extent and

distance which remains to be

covered to the working point from

residence may be covered by autorickshaw or taxi whichever is

available.

(ii)

Where such journeys are made by

taxi by the employees who are not

3

prescribed working hours

on a particular day.

entitled to use such mode of

transport under the normal rules, the

local conveyance claims should be

certified

by

the

concerned

Branch/Regional Managers.

Where a taxi is engaged by a touring

official in Branch/sub-offices/HO the following

procedure may be followed :

(i)

(ii)

(iii)

Note:

(B)

Where a vehicle made available by

the State Mktg. Fedn. or some other

agency is utilised, the cost of petrol

etc. consumed for the journey performed may be absorbed by the

sub-office/Branch/

Regional/Head

Office.

Where a full taxi is engaged to

perform the journey, the taxi

charges should be borne by the

touring official. The touring official

shall claim taxi charges in the TA bill

at the rate prescribed at para 5 of

the rules.

Officers of the rank of Assistant

Managers and above are entitled to

travel on tour by road by taking a

single seat in a taxi on payment of

prescribed fare to places like

Shilong, Nowgong, Kharupe-tia,

Managal, Tejpur etc. In this case

they will not be entitled to claim

mileage allowance at the rate

mentioned under Rule 5.

On return journey from the place of

visit the mileage shall be admissible

from the place of stay to the railway

station/airport.

When an employee who is supplied

means of conveyance without charge,

returns to his HQ on the same day or

thereafter, daily allowance will be

calculated as follows:

*(1)

If the absence from HQ is

less than 6 hours

But in the case of employees eligible to get OTA as

per OTA Rules, he/she

shall be entitled to overtime allowance subject to a

ceiling of ½ DA provided

the employee concerned

was on duty for more than

4

Nil

(2)

If the absence from HQ

exceeds six hours, but does

not exceed twelve hours.

Half Daily

Allowance

(3)

If the absence from HQ

exceed twelve hour

Full Daily

Allowance

*

Modified w.e.f. 19.10.1983 vide O.O. No. 22, dated

14.11.1983.

** Inserted vide O.O. No. 20, dated 22.02.1989.

(C)

When an employee is provided with free

conveyance for part of the journey only,

the DA may be calculated as follows:

(i)

(ii)

6.

If the absence from HQ does not

exceed twelve hour

Half DA.

If the absence from HQ exceeds

twelve hours

Full DA.

Journey by Air (w.e.f. 26.12.1982)

(a)

For the purpose of this rule ‘travel

by air’ means journey performed by

the plane of the public air transport

companies regularly flying but does

not include journeys performed by

private aeroplanes.

#(b)

Officers in the rank of AMD and

above will only be permitted to

travel by Air; and

(c)

Officers in the rank of GMs and

below shall undertake journeys by

Air only with prior permission of MD,

that too as a special case.

(d)

BMs/RMs and officers upto the level

of EDs shall not travel by Air/First

Class AC Rail without the express

prior approval of MD.

Competent Authority has desired that only

in exceptional cases request with sufficient

reasons or urgency be made by phone/fax

invariably before travelling by Air.

(e)

The touring officer will be entitled to

one air-fare plus one fifty thereon

subject to a maximum or Rs. 100/-##

on a single day irrespective of the

number of flights undertaken on that

day for onward journeys. The return

journey to HO though performed on

the same day shall be treated as a

separate journey for the purpose of

this rule. Return journey ticket

should invariably

where available.

be

purchased

5.

(Ref O.O. No. 09, dated 15.01.1999

and O.O. No. 21, dated 11.10.1999)

6.

(Text of orders issued by MD on 29.09.2004)

In recent months, I have found a lot of Officers are

7.

moving by Air without prior permission. In this connection

please refer to clause 3 of Office Order No.

8.

HO/AD/2/41/2002-03 dated 6th January’ 2003, which clearly

states that admissibility of air journey stands withdrawn for

9.

all Officers. As such, all Officers are requested to resort to

Between

11,375/- &

13,149/(Category-II)

Between

7975/- &

11,374/(Category-III)

Between

6050/- &

7974/(Category-III)

Between

4300/- &

6049/(Category-IV)

Less Than

4300/(Category-IV)

a)

b)

90.00

78.75

480

384

a) 82.50

b) 75.00

400

320

a)

b)

75.00

67.50

400

320

a)

b)

67.50

60.00

320

240

320

240

a)

b)

56.25

45.00

air travel only when no alternative is possible. Further, low

fare schemes are now available with most of the Airlines

and whenever air travel has to be resorted to these low

S.

N

o.

fare schemes should be taken advantage of.

7.

(Rs.)

Daily Allowance and Lodging Facilities

(a)

(b)

S.

N

o.

Pay Range

Daily allowance is an allowance granted to

an employee on tour for halt away from

Headquarters with a view to enable him to

cover the ordi-nary charges which he is

required to incur on such tour.

Rates for lodging facilities and daily

allowance admissible to various categories

of employees shall be as per the following

schedule: -

Pay Range

DA Rates

(if lodging

charges

claimed)

(Rs.)

AMDs/EDs

(Rs.)

a)

b)

64 a)

b)

1.

AMDs/EDs

2.

17,250/- & above

(excluding AMDs & EDs (Category-I)

Between 14700/- & 17249/-(CategoryII)

Between 13150/- & 14699/-(CategoryII)

Between 11,375/- &

13,149/- (Category-II)

Between 7975/- & 11,374/- (CategoryIII)

Between 6050/- & 7974/-(Category-III)

3.

4.

5.

6.

7.

Upper limits for lodging Facility

(including the 60%enhancement notified vide OO No.03

8.

Between 4300/- & 6049/-(Category-IV)

dt.18.5.95)

A class

Other

9.

Less Than 4300/- (Category-IV)

Cities

cities

(Rs.)

(Rs.)

DA Rates (if

requirement

of lodging at

the touring

station does

not occur)

(Rs.)

a) 150.00

b) 140.00

a) 150.00

b) 140.00

a) 140.00

b)125.00

a) 130.00

b) 115.00

a)120.00

b)105.00

a) 110.00

b) 100.00

a)100.00

b) 90.00

a) 90.00

b)80.00

a) 75.00

b) 60.00

Ref.OO No.04 dt.20.5.2005.& OO No.11 dated 27.7.2005.

1.

2.

3.

4.

17,250/400 &

above

(excluding

AMDs & EDs

(Category-I)

Between

14700/- &

17249/(Category-II)

Between

13150/- &

14699/(Category-II)

112.50

105.00

112.50

105.00

800

640

640

480

#

Modified vide O.O. No. 03, dated 18.05.1995 and

applicable w.e.f. 17.05.1995.

## Vide O.O. No. 09, dated 15.01.1999.

@ Vide O.O. No. 02, dated 18.05.1995.

a)

b)

105.00

93.75

640

480

a)

b)

97.50

86.25

480

384

The lodging charge for various categories of

employees indicated above have been raised by

60 % over and above the existing rates as

notified vide Office Order No. 12, dated

24.04.1991.

{(a) - means those station which have been

classified ‘A’ as per Government of India

Classification.

5

(b)

- means all other stations.}

2.

3.

4.

5.

**The classification of ‘A’ Class cities as

contained in Government of India, Ministry of

Finance Office Memorandum No. 2(2) 93-E.

II(B) dated 14.05.1993 is hereby notified for the

purpose of drawal of daily allowance by the

employees on tour as under: 1.

Hyderabad

2.

Delhi

3.

Ahmedabad

4.

Bangalore

5.

Navi Mumbai

(Andhra Pradesh))

(Delhi)

(Gujarat)

(Karnataka)

Pune

7.

Chennai

8.

Kanpur

(Uttar Pradesh)

9.

Kolkata

(West Bengal)

10.

Nagpur

(Maharashtra)

11.

Lucknow

#

Jaipur

Note:

An employee while on tour shall have

the following options in regard to

admissibility of daily allowance: (i)

7.

8.

9.

S.No.

(Maharashtra)

(Tamil Nadu)

1.

6

280

280

235

280

230

240

200

240

190

190

150

190

140

In this regard, it is clarified that the revised

rates of DA as at (ii) above are applicable only

where lodging requirements occur but are not

availed of by the touring employees.

(Ref. O.O. No. 07, dated 07.08.1996

and O.O. No. 04, dated 02.05.1997)

(iii)

Halt of less than 8 hours at the

place of stay will be treated as half

day and halt of 8 hours and more at

the place of stay will be treated as

one day.

(iv)

For journeys outside the Indian

Union the DA and such other actual

expenses as are likely to be

incurred on local business travels

etc. in the foreign country, shall be

paid at such rates as are fixed by

the Chairman from time to time

depending on the country of visit,

subject to allotment of foreign

exchange by the Reserve Bank for

the purpose.

(v)

No ‘Daily Allowance’ is admissible

to an employee who does not travel

on any day more than a redius of

eight

kilometers

or

beyond

municipal limits of the Headquarters

whichever is farther.

(vi)

Daily allowance is admissible for

halt on a ‘Holiday’ occurring during

a tour.

(vii)

An employee is not entitled to any

daily allowance during leave on

tour.

(Rajasthan)

Claim full daily allowance as per

rates given below in which case no

charges for lodging will be

admissible:

AMDs/EDs

375

* Vide O.O. No. 07, dated 07.08.1996 and O.O. No. 04,

dated 02.05.1997.

** Modified vide O.O. No. 40, dated 22.12.1993.

(Uttar Pradesh)

Claim lodging expenses as per

entitlement and 75% of the

admissible daily allowance, as per

rates mentioned above.

Pay Range(Rs.)

300

Ref OO No.04 dated 20.5.05.

OR

*(ii)

375

(Maharashtra)

6.

12.

6.

15450/- & above

(excluding AMDs &

EDs) (Category-I)

Between 13500/- &

15449/- (Category-II)

Between 12600/- &

13499/- (Category-II)

Between 10525/- &

12599/-(Category-III)

Between 7425/- &

10524/-(Category-III)

Between 5350/- &

7424/-(Category-III)

Between 3970/- &

5349/-(Category-IV)

Less Than 3969/(Category-IV)

Rate of Daily Allowance(Rs.)

A Class

Other

Cities

Cities

450

375

*(viii) An employee will normally be given

48 hours time to proceed on tour.

This will be subject to exigencies of

work. The decision of the Branch

Manager in this regard will be final.

*(ix) Full DA will be admissible to the

employees during the period of tour.

However, tour continuously for more

than 30 days should be avoided,

wherever possible.

8.

Local Journeys on Tour

Actual taxi, tonga or rickshaw fare paid by

touring officers while on official tour in a

particular town shall be admissible on

production of schedule of trips undertaken by

him in the city along with a certificate that the

amounts mentioned in the schedule were

actually paid by him and that he did not use the

car or vehicle of any institution for such trips

(Form ‘B’). Where an employee travels in a

mode to which he is not ordinarily entitled the

TA claim relating to local conveyance of each

day should be verified by the supervisory officer

regularly on the following day.

9.

TA on Transfer

The terms and conditions regarding grant

of TA on transfer of the Federation’s employees

shall be the same as are applicable to the

employees of the Central Government. The

Board of Directors in their meeting held on

28.08.1992 have approved the payment of

lump-sum transfer grant to the employees of the

Federation, in lieu of disturbance allowance, at

the following rates: -

.No.

Pay range (Rs.)

Lump-sum transfer

Grant admissible(Rs.)

1.

15,450/- & above.

4000/-

2.

11,375/- & above but less

than 15,450.

3000/-

3.

Less than Rs.11,375/-.

1500/-

Ref OO No.04 dt.20.5.2005.

A.

Personal Effects

Rule 10 of Travelling/Daily Allowance

Rules of the Federation stipulates that the terms

and conditions regarding grant of TA on transfer

of the Federation’s employees shall be the same

as are applicable to the employees of the

Central Government except in respect of

disturbance allowance admissible on transfer.

It is, therefore, clarified that in terms of rule 10 of

TA Rules, the maximum entitlements of

employees of different grades for transportation

of personal effects by goods train, on transfer

from old to new headquarters in the Federation

shall be the same as indicated in S.R. 116 of the

Government of India. The present maximum

limit in S.R. 116 is as under: #

Substituted vide O.O. No. 12, dated 22.12.1993.

*

Substituted w.e.f. 25.11.1986 vide O.O. No. 30.

** Substituted w.e.f. 28.08.1992 vide O.O. No. 14 dated

20.10.1992, and subsequently w.e.f. 11.07.1994 vide

O.O. No. 12 dated 11.07.1994.***Substituted vide O.O.

No. HO/FA/20-52/82-83 dated 15.04.1982; O.O. No. 10

dated 25.05.1989 and O.O. No. 1 dated 06.04.1992.

S.No.

Category

Revised Pay

range(Rs.)

Maximum limit of

personal effects

To be carried by

goods train

6000 Kg.

1.

I & II

11,375/– and above.

2.

III

Between 6,050/- &

11,374/-.

3000 Kg.

3.

IV

Between 4,300/- &

6,049/-

1599 Kg.

4.

V

Less than 4,300/-.

1000 Kg.

Ref.OO No.04 dt.20.5,.2005

(iii)

B.

Carriage of personal effects by modes of

conveyance other than goods train as also

from residence to railway stations/bus

stand at the old headquarters and from

railway stations/bus stand to the

residence at the new headquarters will

also be regulated in accordance with the

provisions of S.R. 116 ibid.

To & Fro single fare on transfer in

addition to transfer benefits

In accordance with the existing rules,

transfer TA is admissible to the employees and

his/her family only for the journey performed

from the old Headquarters to the new

Headquarters. It has been observed that an

employee on transfer initially goes to the new

place of posting alone. After fixing up his

residence there, he comes back to his old

7

station of posting to shift his family and personal

effects to the new place. With a view to mitigate

the difficulties and to make good the financial

loss being suffered by the employees in such

cases it has been decided to extend the facility

of to and fro single fare to the employees from

the new station to old place of posting, by the

entitled class of travel. This facility will be in

addition to the normal transfer benefits

admissible to an employee and will have to

availed within six months of the date of issue of

transfer orders.

the employees on transfer is payable only at the

time of transportation of household goods from

old station to new headquarters.

(Ref. O.O. No. 59, dated 27.04.1987)

In furtherance to office order No. 59,

dated 27.04.1987, it is hereby notified for

information that packing allowance is granted at

flat rates and is in the nature of lump sum

transfer grant. The grant of this allowance is not

related to the quantity of personal effects

transported.

This order shall be effective for transfers

ordered on or after 30.07.1986.

(Ref. O.O. No. 08, dated 25.08.1986)

C.

Pay Range(Rs.)

3.

4.

5.

6.

D.

Admissibility of Transfer benefits on

request transfer

Packing Allowance

Rules 10 of the travelling allowance

rules of NAFED provide that the terms and

conditions regarding payment of TA on transfer

to the employees of the Federation shall be the

same as applicable to the employees of the

Central Government except the disturbance

Allowance.

In terms of the Rule 10 of the TA Rules of the

Federation, the Executive Committee in their

meeting held on 25th November, 1986 has

decided to grant packing allowance to the

employees on transfer in accordance with the

provision of Office Memo. No. 19018/1/86/E/V

dated 03.01.1986 of the Department of

Expenditure, Ministry of Finance, Government of

India, as under: S.No.

1.

2.

(Ref. O.O. No. 15, dated 23.12.1988)

15450/- & above

10525/- & above but less than

15450/7975/- & above but less than

10525/5350/- & above but less than 7975/4,300/- & above but less than

5,350/-.

Below 4,300/-.

Rate of Packing

Allowance.

1500/1200/900/600/450/-

300/-

In accordance with the practice being

followed in the Federation, transfer benefits are

not admissible to the employees in cases of

request transfers. However, in such cases,

representations have often been received,

requesting for grant of transfer benefits, as

admissible in the case of normal transfers.

Keeping in view the financial difficulties being

faced by the employees owing to inadmissibility

of transfer benefits on request transfers, the

matter has been examined and it has been

decided that employees whose request transfers

are acceded to after three years of stay outside

Delhi/his Home state during the last 10 years,

shall be entitled to all transfer benefits.

(Ref. O.O. No. 57, dated 23.03.1994)

10. Casual/ad-hoc employees working on

daily wages/consolidated pay will be governed

by the following rates:

Travelling Allowance

(i)

(ii)

Actual bus fare if travelled bus.

IInd class railway fare by the shortest

route, if travelled by train.

Daily Allowance

Ref OO No.04 dated 20.5.05

(Ref. O.O. No. 31, dated 16.01.1987, O.O. No.

13, dated 20.06.1990 and O.O. No. dated

18.07.1994.)

In furtherance to office order No. 31,

dated 16.01.1987, it is thereby notified for

information that packing allowance admissible to

8

The Board of Directors in their meeting held on

26.8.2005 has decided to revise the rates of

Daily Allowance payable to the casual

employees of the Federation from existing level

to Rs.100/- per day while on tour irrespective of

category of employee or class of city. The

above rates would be applicable w.e.f.

26.8.2005 and the cases already settled shall

not be reopened. Ref.OO No.20 dt.30.9.2005

4.

#

The expenses on TA/DA for the representatives

under these rules would be paid on actual visits

against the approved visit programme, excluding

his local visits.

11. TA/DA Allowances to staff deployed in

Marketing of Fertilizer & Agricultural

Inputs.

The Executive Committee in its meeting

held on 21.12.2000 have approved TA/DA and

rental allowances to staff deputed to reside and

work from places other than Branch

Headquarters for marketing of fertilizer and

other agricultural inputs, viz; seeds and further

revised them on 25.05.2001. The revised rates

are as under: i)

DA Rs. 75/- per day

(Maximum Rs. 1050/- p.m.)

(Actual visits against approved

tour programme)

ii) Maintenance allowance for carrying Rs. 750/out official work at place of duty.

P.m.

iii) a) Travelling expenses of Rs. 1000/- p.m.

(max.) (Actual Bus fare against

approved tour programme) for covering

one or two districts.

b) Travelling expenses of Rs. 1200/- p.m.

(max.) (actual Bus fare against approved

tour programme) for covering three or

more districts.

iv) Night Halt:

As per existing TA/DA Rules of Nafed.

(Not exceeding 3 days in a month).

91 to 100%

100%

The above order is deemed to have come into

force w.e.f. 25.05.2001.

(Ref. O.O. No. 10, dated 28.06.2001)

12.

Competent Authority

(i)

The Managing Director shall act as

a self-controlling officer; and

(ii)

He shall also act as ‘Controlling

Officer’ in respect of other

employees of the Federation.

13. As regards matters not covered by these

rules, the Government of India rules and

instructions issued from time to time on the

subject shall apply.

14. In case of doubt regarding interpretation

of these rules the decision of the Managing

Director shall be final.

15. On receipt of journey particulars in Form

‘A’ from the touring officer, TA Bill shall be

prepared in the Accounts Branch in the

proforma prescribed.

# Ref. O.O. No. 10, dated 28.06.2001.

The above DA, which is linked with

performance of the Field representative

deployed at a designated location for the

fertilizer business is payable in accordance with

the following table, subject to the minimum

achievement of 70% of the total target fixed for

him particular area, failing which they would not

be entitled to receive the full DA: Sl.

No.

% of target

achieved

% of DA to

be paid

Recovery of

franchise

commission

1.

Below 70%

75%

100%

2.

70 to 80%

80%

3.

81 to 90%

90%

9

IMPORTANT DECISIONS

A.

Approval of Tour Programme

In continuation of this office order of even

number dated 05.05.1975, the following

guidelines are laid down with regards to

regularising the TA Bills in respect of officials

whose claim requires the approval of Managing

Director, for future compliance:

(i)

Whenever tour is proposed to be

undertaken

a

tentative

tour

programme should be sent to HO.

(ii)

After completion of the tour, the final

programme alongwith a brief visit

note should be sent to HO for the

approval

of

the

Competent

Authority.

(iii)

The TA claims when sent to

Accounts Division for settlement

should be accompanied by the

approved ‘Tour programme’.

(Ref. HO/AD/5/5/77-78 dated 01.11.1977)

B.

Travel by Higher Class

(i)

Vide Circular No. HO/FA/12/80-81 dated

25.11.1980,

it

was

advised

to

the

Branches/Divisional Heads in the HO that all

cases where an official proposes to perform or

have performed journeys by class higher than

the one to which he is entitled to, will be dealt

with by the Finance & Accounts Division and

accordingly such cases should be referred to

this Division in the HO with full justification to

process the same timely. It has been brought to

notice that the above procedure is not being

followed by few of the officers and they are

getting the tour programme approved directly

from the Competent Authority without giving

proper justification and getting the same

examined from this Division. Adoption of such a

practice in most of the cases delays settlement

of TA claims.

It is, therefore, advised that when an

officer proposes to perform or has performed

journeys by class higher than the one to which

he is entitled, final tour programme may not be

submitted to the Competent Authority directly

but the same should be forwarded to Finance &

Accounts Division alongwith the complete

justification who will process the case and put

10

up the same for approval of the Competent

Authority. In case the above procedure is not

followed. TA claims of the concerned officers will

be settled according to TA rules of the

Federation.

(Ref. HO/FA/12/81-82) dated 04.11.1981)

(ii) Reference is invited to office order No. 21

dated 11.10.1999 indicating that approval of the

Competent Authority is required to be obtained

in advance by an officer for travel by Air.

However, instances have come to notice where

officers have travelled by air without obtaining

prior approval/telephonic approval of the

Competent Authority, which has been viewed

seriously by the Competent Authority.

It is, therefore, once again reiterated that

air travel may be undertaken by the officers only

in very unavoidable circumstances after the

express/specific approval of Managing Director

before undertaking air journey.

Officers of the level of Executive Director

and above shall also obtain prior approval from

Managing Director before air journey for official

tour.

This order supersedes all earlier orders

issued in this regard.

(Ref. O.O. No. 09, dated 18.07.2000)

(C)

Economy on Local Conveyance while

on Tour

(a) It has been observed that officers while on

tour are incurring heavy expenditure on local

conveyance, under Rule 9 of the TA Rules of

the Federation. Normally daily allowance is

supposed to meet the expenditure incurred by

touring officers on local journeys. However, in

order to avoid hardship to officers, it has been

decided that hereafter, the expenditure on local

journeys undertaken at the station of tour by an

officer, will be admissible in the following

manner.

(i)

Conveyance charges for journey

between Railway Station/ Airport to

the place of stay/ first point of

business and vice versa.

(ii)

The touring officers should plan

their movement in such a manner

that the distance covered is reduced

to the minimum.

(iii)

The officers should proceed from

one point of business to a second

point from where they can proceed

to a third one and so on, without

returning to the place of stay, on a

particular day.

(iv)

(v)

(vi)

The journey between (i) place of

stay and the first point of business

and (ii) the last point of business

and place of stay on any day will not

be paid for as daily allowance is

supposed to take care of this part of

the journey.

A touring officer may undertake

local journeys in the interest of the

Federation at the station of his tour

accord-ing to his entitlement in the

local conveyance rules of the

Federation. In case he travels by a

mode of transport lower than his

entitlement,

he

should

claim

accordingly.

Expenditure incurred by a touring

officer on conveyance on official

local journeys from one place of

business to the other only may be

claimed by him in the annexed

revised

proforma

(From

B)

prescribed under Rule ‘9’ of the TA

rules of the Federation, giving brief

of the discussions held or business

transacted at each point.

(Ref. HO/AD/5/5/73-74 dated 25.04.1975)

(b) Instances have come to notice where

touring officers have been charging amounts in

their TA bills for making frequent visits from the

place of their stay (hotel etc.) at the halting

station to the places of business in that city on

the same day, under Rule 9 of the TA rules of

the Federation, which is not correct.

2.

Rule 9 of TA Rules provide undertaking of

local trips by touring officers to places of

business in the city of halt which means that

once the touring officer leaves his place, he is

expected to complete the official business of the

day and return to the place of his stay, and not

that he should leave the hotel or the place of

stay to one place of business and return, and

then go to another place and return, and so on.

3.

It is hereby ordered that only one trip from

the place of stay to the place of business and

back during one day, will hereafter be allowed to

the touring officers at the halting station.

This order

immediate effect.

comes

into

force

with

(Ref. F-5/7/68 Admn./22 dated 07.07.70)

D.

Claim for Local Conveyance while on

Tour

1.

According to rule 9 of TA Rules of the

Federation actual taxi/tonga/ rickshaw fare paid

by the touring officer while on official tour in a

particular town is admissible on production of

the schedule to trip undertaken by him in the city

along with a certificate that the amounts

mentioned in the schedule were actually paid by

him and that he did not use the car or vehicle of

any institution for such trips.

2.

It has been observed that in a number of

cases, the TA bills submitted by the employees

showed that reimbursement of large amounts

had been claimed on account of local

conveyance for journeys undertaken at

procurement centres etc. by taxi, scooter etc. by

which they were not entitled to travel. In

particular, it was noticed that several official had

visited docks, godowns and other places

engaging taxis though the places of visit are

connected with local trains.

3.

In future, when an employee is deputed to

attend to any urgent important work where he is

to claim by a mode of conveyance which he is

not entitled, the TA claim relating to local

conveyance of each day should be verified by

the supervisory officer concerned on the

following day. For this purpose a record should

be kept by each supervisory officer of the local

journeys made by the employee and also the

mode of transport allowed to be used. In the

absence of such verification certificates, the

local conveyance bills will not be entertained.

4.

Further, under rule 5 of the TA rules,

actual fare by taxi or scooter, as entitled under

the rules is admissible for road journeys

performed from residence to airport/station and

back, both at the headquarters and at the place

11

of visit. It has been reported that auto-rickshaw

are not available at certain cities like Mumbai,

Kolkata etc. and, therefore, officers and staff of

the Federation are visiting such places on

tour/transfer by taxi from airport/railway station

to residence and back. In such cases where the

employees are not entitled to travel by taxi, expost facto approval of the Managing Director is

being obtained at the time of settlement of TA

bills. For this purpose, it has been decided that

in future at all places where auto-rickshaws are

not available, employees who are not entitled to

travel by taxi may be allowed reimbursement of

the taxi fare subject to the following conditions:

(i)

(ii)

E.

(Ref. HO/FA/12(1)/79-80 dated 24.5.1980)

F.

TA Bill to be Sent by Registered Post

1.

Instance have come to notice where loss

of TA bills of officials are reported either in

transit or in office. To overcome this problem it

has been decided that TA bills and other

important documents sent by one office to

another office of the Federation should

invariably be sent under Registered Post.

Local

train

services,

where

available, should be utilised to the

maximum possible extent and

distance which remains to be

covered

to

the

working

point/residence may be covered by

auto-rickshaw or taxi, whichever is

available.

2.

On receipt of such TA bills and other

important documents, the concerned receipt

despatch clerk shall make an entry in the receipt

register, and pass on the same to the concerned

officers/staff and obtain his signature.

Where such journeys are made by

taxi by the employees who are not

entitled to use such mode of

transport under the normal rules,

the local conveyance claims should

be certified by the concerned

Branch Incharge.

(Ref. HO/AD/G-39(26)/79-80 dated 23.05.1980)

Production of Railway Money Receipt

for Rail Journey

1.

The Railway authorities have announced

the discontinuance of money receipt while

issuing rail tickets and notifications have been

issued by railway authorities in various

newspapers on 19th March 1980. For settlement

of the claims, railway authorities have advised

that touring officers may submit the details of rail

ticket, No., date of journey, train No., coach No.

and reservation No. etc. in the form of following

certificate:

I……….. certify that I have purchased Rail

Ticket No. ………… for sector ………. for Rs.

……….. , Coach No./Class …………..

Reservation No. …………. on …………

(Touring Officer)

2.

The railway authorities have indicated that

this notification is valid till the end of July 1980

and is likely to become permanent if found to

work well. As such, the above order will be

12

followed till receipt of further communication

from the railway authorities in this regard.

This order

immediate effect.

G.

comes

into

force

with

Economy in Travelling

It has been observed that some of the

officers of the Federation are proceeding

on tour without prior approval of the

Competent

Authority.

This

causes

dislocation of work of the Federation. It

has, therefore, been decided that in future

Branch Managers will proceed on tour

only after their tour programme is

approved by the Regional Managers. The

Regional Managers can undertake tour

with the prior approval of the Managing

Director. In regard to officers posted in HO

they should proceed on tour after having

their tour programmes approved by the

Competent

Authority.

The

powers

regarding approval of tour programmes

and passing of TA bills have already been

laid

down

in

HO

order

no.

HO/AD/8/275/79-80 dated 1st may, 1980.

The journey should be undertaken strictly

in accordance with the entitlement of the

officer concerned. If journeys are to be

undertaken by a higher class than the

entitlement in the exigencies of office

work, it has to be approved by the

Managing Director. These instructions

should be noted for strict compliance.

It has also been observed that tendency

amongst officers to go on tour by official car or

hired taxi is on the increase. The cost of petrol,

lubricants and maintenance of vehicle has

considerably gone up in the recent past. In

addition,

drivers

of

official

vehicles

accompanying the officers are to be paid TA/DA.

Therefore, the total cost of tour by car, in certain

cases, exceeds even cost of air journey. In view

of the above, it has been decided that officers

should avoid travelling by car/taxi. TA Bills shall

not be passed until and unless proper and

sufficient justification for so undertaking the

journey is given.

(ii)

Submission of TA Bills – Time Limit

and

Adjustment/Recovery of

TA

Advance

1.

It has been brought to the notice that

officers/employees are not submitting TA bills

for the tour being undertaken within the

stipulated period of one month for settlement of

TA bill and recovery of the advances. In this

context, the following officer orders had been

issued:

(i)

HO/AD/5/5/73-74 dated 05.06.1974.

(ii)

HO/AC/12919)/76-77 dated 28.08.1976

(iii)

HO/AC/129190/76-77 dated 04.04.1977.

(Ref. HO/AD/8/280/79-80 dated 27.06.1980)

(Text of orders issued by MD on 29.09.2004)

In recent months, I have found a lot of Officers are

moving by Air without prior permission.

In this

connection please refer to clause 3 of Office Order

No. HO/AD/2/41/2002-03 dated 6th January’ 2003,

which clearly states that admissibility of air journey

stands withdrawn for all Officers.

As such, all

Officers are requested to resort to air travel only

when no alternative is possible. Further, low fare

schemes are now available with most of the Airlines

and whenever air travel has to be resorted to these

low fare schemes should be taken advantage of.

H.

Submission of TA Bills – Time Limit

thereof

1.

Instance have come to notice where the

advance taken by the employees are not got

adjusted/settled within a reasonable period of

the date of taking of such advances. In a

number of cases TA bills are being submitted

after considerable lapse of time of the

completion of journeys by the employees.

It has been decided that, in future, if a TA

bill is not submitted within one month of the

completion of the tour, the same will not be

entertained. Advance, if any, taken for the tour

will be recovered in the manner stipulated in the

office order No. HO/AC/12/(19)/76-77 dated

04.04.1977.

(Ref. HO/AC/12(19)/76-77 dated 04.04.1977)

2.

In spite of the above orders and

subsequent reminders from time to time, no

improvement in submitting the TA bills as well

as adjustment of TA advances has been seen.

In number of cases, TA bills are being submitted

by the touring officers after considerable lapse

of time of the completion of the journey. This

result in non-adjustment of the advances and

the same has also been commented upon

adversely by the Statutory Auditors.

3.

It has, therefore, been decided that if the

TA bills are not submitted by the touring officer

within one month of the completion of the tour in

future, TA bill may not be entertained. Advances

taken by the touring officer/employees may be

recovered in the manner indicated in the Office

order

No.

HO/AC/12(19)/76-77

dated

28.08.1976. Further TA advances may not be

allowed in case the earlier TA advances are not

adjusted against the TA bill of the concerned

employee.

4.

It will be the responsibility of the AO/

AAO/Accountant/Incharge of the Branch Office

to ensure that no deviation of the above

instructions takes place in future.

(Ref. HO/AC/12(19)/78-79 dated 06.03.1979)

I.

Settlement of TA Bill of Legal Adviser

for his outstation Visits

1.

It has been brought to notice that

Divisional Heads/Officers are referring the cases

to Legal Adviser for visiting outstation in

connection with the legal case of the Federation

and no reference to this effect is being made to

13

F&A Division. Resultantly delay occurs in

settlement of bills of the Legal Adviser.

2.

The following procedure, for this purpose,

may be implemented:

(i)

Divisional Heads will submit the proposal

for visit of the Legal Adviser or his associates for

attending legal matters outside Delhi to the

competent authority in triplicate. One copy after

the proposal is approved, may be sent to FA

Division for releasing advance to Legal Advisor

as and when required.

(ii)

On receipt of the bills from the Legal

Advisor, the concerned Divisional Head should

examine and verify the bills and thereafter the

same may be forwarded along with a copy of the

approved proposal to FA Division for settlement

of the TA claims of legal Adviser. The 3rd copy of

the approved proposal may be retained by the

concerned Divisional Head for reference

purposes, in future.

(Ref. HO/FA/2/81-82 dated 05.12.1981)

J.

Tour Reports

It has been decided by the MD that in

future

all

tour

reports

by

Divisional

Heads/Section Chiefs/Regional Managers be

sent to Coordination Division in quadruplicate

immediately and in any case not later than one

week of the completion of the respective tours.

(Ref.HO/Coord/10/TR-Cir/81-82 dated 17.12.81)

K.

Payment

of

transfer

travelling

allowance to Departmental Candidates

appointed against Direct Quota.

According to the Recruitment & Promotion Rules, a number of posts are to be filled

up by direct recruitment. For such posts

normally an advertisement is issued and the

interested persons are asked to apply for the

same. Some of the departmental candidates

also send their applications. It is observed that a

few of such candidates are selected for

appointment. On selection they are posted to

different stations. A question has been raised by

a number of branch offices as to how TA/DA,

transfer benefits etc. should be paid to these

employees. The matter has been examined and

it has been decided that such employees shall

be eligible to draw all benefits on account of

transfer TA/DA etc. as is admissible to an

14

employee on routine transfer. In future,

therefore, such cases need not be referred to

head office and may be decided by the

concerned branches if the claims come under

their purview.

(Ref. O.O. No. 31, dated 12.02.1985)

L.

Admissibility of transfer Travelling

Allowance to Family member from

places other than old headquarters.

Under existing rules of the Federation,

TA/DA is not admissible to a person for initially

joining a post in the Federation. A case has

come to notice where an employee who initially

joined the Federation at a particular station had

* Reference O.O. No. 38, dated 04.02.1987.

not taken his family alongwith him to that station.

Later on when he was transferred to another

place, he requested that he may be permitted to

take his family from his native place to his new

headquarters directly and he be allowed to claim

transfer TA for the family also. So far as the

family is concerned, it amounts to grant of

transfer TA for the first time. The point whether

transfer TA should be allowed or not to the

family in such a case has been examined and

after careful consideration, it has been decided

that transfer TA in respect of family in such

cases may be granted from a station other than

the old headquarters to the new headquarters or

from the old head-quarters to the new

headquarter whichever is less.

This order

immediate effect.

comes

into

force

with

(Ref. O.O. No. 34, dated 20.03.1985)

M.

Service Charges for Railway Booking

Admissible

As per the existing rules of the Federation,

the Service charges on Railway booking

arranged through a travel agent are not

admissible to the employees.

The matter has been examined and in

order to avoid financial loss to the touring

employees, it has been decided that the service

charges payable to an authorised travel agency

for arranging railway booking shall, hereinafter,

be reimbursed to the employees on production

of cash memo from the travel agency. The

amount reimbursable, shall be as per actuals

but not exceeding Rs. 25/-* per ticket. This

facility shall be admissible only for official tours.

(Ref. O.O. No. 48, dated 25.06.1985)

N.

State Buses viz. Express, Deluxe, Ordinary,

what will be the class

of entitlement in case

of employees under

Category III and IV.

vel by Ordinary State

Buses/Private Buses.

But, incase such Buses are not available,

an employee may travel with the permission

of the Branch Manager/Regional Manager/

Divisional Head by Express/Deluxe Buses.

iii.

Whether

Incidental Allowance is

payable in case the

journeys are performed by office vehicle or

any other free vehicle.

This may be

regulated in terms of

office order No. 78,

dated 02.06.1996.

TA/DA Rules – clarification reg.

The TA/DA Rules of the Federation were

revised vide office order no. 47 and 49 both

dated 22.01.1986. According to the modified

rules, the rate of mileage allowance and daily

allowance of the employees were revised w.e.f.

16.12.1985. A number of doubts in regard to

interpretation of the above office orders were

raised by various branches. These have been

examined and the following clarifications are

issued to enable the branches to settle the TA

bills of the concerned employees :

Point of Doubt

1

1. Cochin Branch:

Whether half/full

DA

is

admissible

under the revised orders for tours where

due to frequent jouneys and short period of

stay at number of

places (excluding journey time), the total halt

comes to 5 ¼ hours.

Although the employee concerned was

away from his headquarter for mor than

12 hours.

2. Ahmedabad Branch

Clarification

2

Whether revised

rates of Daily/Alloawance are applicable to

casual/ad hoc employees working on daily

wages/consolidated

salary.

3. Kolkata Branch

No.

i. Whether Office

Order No. 47, dated

22.01.1986 is applicable only to travel by

State Transport Buses

or other modes like

Taxi, Ordinary Buses

other than State Transport.

The

rates

of

Mileage allowance for

the journeys performed by Taxi or Scooters

as laid down in Rule

5(A) (a) (b) of TA/DA

Rules have not been

revised. Therefore, the

rates of Mileage Allowance modified vide

Office Order No. 47

ibid are applicable

only to such journeys

performed by State

Road Transport or

other Buses.

ii. Since there are

different categories of

Since the total

stay at the touring stations comes to 5 ¼

hours, only half DA is

admissible as DA is

not payable during journey time for which

Incidental Allowance

at the rate of 6 paise

per km. is paid.

All Regional/Branch Managers are

requested to keep the above clarification in mind

while settling the TA/DA bills of the employees

working under them.

(Ref. O.O. No. 81, dated 26.06.1996)

O.

In partial modification of office order No.

81, dated 26.06.1986, it has been decided that it

will not longer be necessary to produce bus

tickets by the employees for the purpose of

reimbursement, in respect of the journeys

performed on tour by ordinary buses. Production

of bus ticket will, however, be compulsory when

the journey is undertaken by higher mode of

transportation like Express/Deluxe/Air-conditioned buses.

This order takes effect from 30.07.1986.

(Ref. O.O. No. 07, dated 25.08.1986)

P.

Payment of Local Conveyance to LCT

Candidates

It is notified for the information of all that

such of the outstation employees as are invited

to take up the Limited Competitive Test (LCT)

shall be entitled to local conveyance as per their

admissibility from the residence/office to the

Railway/Bus-station/Airport in their Head

Quarters and from Rly. Station/Bus Station/

Airport to the place of stay or venue of the Test

as the case may be, and vice-versa.

The admissibility of local conveyance to

employees who attended the LCT on

28.07.1991 from outstation may also be dealt

with in terms on this order.

(Ref. O.O. No. 50, dated 10.10.1991)

Q.

Entitlement of students/trainees on

summer placement with NAFED for

Travelling/Daily Allowance

Ordinarily,

employees should tra-

15

It has been decided that the students/

trainees from different training institutions who

are taken for summer placement by NAFED will

be entitled to TA/DA as per the entitlement of an

Assistant Manager of NAFED, if they are

required to undertake tours as part of the

projects assigned to them by the Federation.

duty and daily allowance will be admissible for

such halts at the rates prescribed for ordinary

localities. Accordingly, Rules 5 (c) of travelling

allowance & daily allowance rules of the

Federation shall stand modified to the above

extent w.e.f. 14.08.1993.

(Ref. O.O. No. 15, dated 02.09.1993)

(Ref. O.O. No. 06, dated 18.06.1993)

S.

TA/DA for Management Trainees

It has been decided that the Management

Trainees appointed in the Federation will

henceforth be entitled to the benefits of

travelling

allowance

daily

allowance,

remuneration for attending office on Holidays

and local conveyance at par with the Assistant

Managers of the Federation.

(Ref. O.O. No. 05, dated 10.05.1994)

S.

Stay arrangement for employees who

visit Mumbai on official tour

It has been observed that as and when

any official of the Federation goes on tour to

Mumbai, he has to face a lot of difficulty in

finding accommodation there. In order to solve

this problem, Mumbai Branch was asked to find

out a suitable accommodation on actual

occupancy basis. Mumbai Branch has now

made arrangements with some specified

Hotels/Guest Houses, at Mumbai.

The officials who visit on tour to Mumbai

may give their requisition to Branch Manager,

Mumbai for reservation of accommodation. The

employees utilising said accommodation during

tour at Mumbai shall be paid DA @ 50% of the

amount admissible to them under the TA/DA

Rules of the Federation.

(Ref. O.O. No. 15, dated 13.11.1984,

issued from file NO. HO/AD/G-14(f)/84-85)

T.

Payment of Daily allowance during

journey period for enforced halts

The Board of Directors in their meeting

held on 14.09.1993 have decided that in the

case of enforced halts occurring enroute on

journey on tour, transfer, temporary transfer and

in connection with training, necessitated by

breakdown of communication due to blockage of

roads/railway tracks on account of floods, rains,

heavy snowfall, landslide and accidents or

delayed sailing of ships or awaiting for air lift, the

period of such enforced halt will be treated as

16

U.

Some branches have raised certain

doubts about various provisions of the travelling

allowance & daily allowance rules of the

Federation. The same have been examined and

the position is clarified as under: Sl.No.

1.

2.

Point of Doubt

Whether an employee who is deputed on

tour to a place, which happens to be his

place of stay also, is entitled for travelling

allowance?

Whether taxes/levies charged in the hotel

bills are to be allowed if the billed amount

exceeds the entitlement of the employees

prescribed in the rules.

Clarification

Even if the place where the employee is

being deputed on tour, happens to be place of

his stay, he has to incur travelling expenses.

Since these expenses are being incurred for an

official purpose the employees will be entitled for

travelling allowance.

Taxes/levies etc. are not be included in

entitlement of room rent. As such to be allowed

extra.

These clarifications may kindly be kept in

view while settling the TA/DA claims of the

employees.

(Ref. O.O. No. 41, dated 01.01.1994)

V.

Grant of Transfer incidentals

According to Rule 9 of Travelling

Allowance and Daily Allowance Rules, the terms

and conditions regarding grant of TA on transfer

of the Federation’s employees shall be the same

as are applicable the employees of the Central

Government. However, it is observed that the

employees of the Federation are being paid

incidental allowance at the prescribed rates for

journeys undertaken in connection with both tour

as well as transfer. This position is not in

conformity with the Government Rules.

According to Supplementary Rule 116 (III)

relating to payment of transfer incidentals to the

employees of the Government of India, the

Government servant, in addition to the fare for

himself and members of the family, draw one

daily allowance for himself and each member of

family for every completed day occupied in the

journey from residence reckoned from midnight

to midnight. For the period less than 24 hours on

any day, the daily allowance is admissible as

follows: Up to 6 hours

Nil

Exceeding 6 hours

But not exceeding

12 hours

70%

Exceeding 12 hours

Full

The children below 12 years are allowed

daily allowance at half of the rates for adults.

Therefore, the above instructions may

kindly be kept in view while settling TA bills of

the employees for journeys on transfer.

However, past cases will not be reopened.

(Ref. O.O. No. 16, dated 22.11.1995)

17

(Annexure Form A)

NATIONAL AGRICULTURAL COOPERATIVE MARKETING FEDERATION OF INDIA LTD.

TRAVELLING ALLOWANCE BILL

Name ………………………………………

Headquarters ………………….

Month …………..

Designation ……………………………….

Pay …………………………….

Voucher No. …..

PARTICULARS OF JOURNEY 7 HALTS

ROAD MILEAGE

Departure

Arrival

Station Date Hour Station Date

1

2

3

4

5

Mode of

journey

i.e. by

road, air,

sea, rail

Means

of

conveyance

Actual

fare

paid

DAILY

ALLOWANCE

No. Rate

of

kms.

Amount

No.

Rate

of

Days

Amount

Total

of

each

line

15

Rs. P

16

Purpose

of

Journey

Hour

6

7

8

9

10

11

12

13

14

17

Grand Total

Signature of the Travelling Officer

18

REMARKS

AMOUNT

ABSTRACT OF CHARGES

Rs.

1.

Actual fare i.e. by Air/Rail/Road ,,,,,,,,,,,,,,,,,,,

2.

Mileage Allowance for …………….. kms.

P.

Certified that I have unUndertaken travel on tour

…………………………….

(name of the class) or the

class to which I am entitled and have incurred

the expenditure stated in

the TA bill.

at the rate of ……….. per km. …………...

3.

Incidental expenses for ……………….. km,

at the rate of ………. per km. ……………

4.

Daily Allowance for ………………. Days.

At the rate of …… per day for …. days …..

5.

Others ……………………………………………

Deduct

Advance

Received vide voucher No, ……. Dated …..

Other items as per details:

…………………………………………..

…………………………………Total deduction

Net Claim

Rupees …………………………………………..

Debitable to TA …………………………………

Cr. TA Advance …………………………………

Passed for payment of Rs. ………… P……….

(Rupees …………………………………………)

Accounts Asstt.

A.O.

Signature of the Travelling Officer

Designation

M(F&A)

Controlling Officer

19

Annexure (Form B)

SCHEDULE OF LOCAL JOURNEYS UNDERTAKING IN A CITY WHILE ON TOUR

Name of the Officer …………………………………………………………………………………………

Designation …………………………………………………………………………………………………

City

Date

From

To

Purpose of local

Journey

Mode of Conveyance

i.e. Taxi, Rickshaw,

Tonga, Bus, etc.

Fare

Paid

Certified that the amounts mentioned in the above schedule were actually paid by me and

that I did not use any conveyance of any institution for these trips.

Signature …………………

20