The British economy, 1870-1939: performance and

advertisement

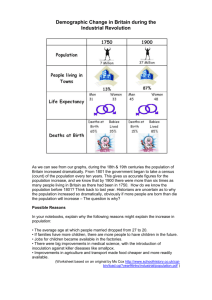

Contemporary Britain Lecture 2: The British economy, 1870-1939: performance and policy1 1. INTRODUCTION In a recent major revisionist account of modern British history (Clarke 1996, p. 3) the observation is made that as the century draws to a close all confidence has evaporated that in Britain’s twentieth-century history there might be anything to celebrate and instead it ‘threatens to become a history of decline, centred on the question: where did it go wrong?’ In this ‘history as tragedy’, fin de siècle concerns and post-modern angst are clearly detectable, but above all this pessimistic version of contemporary British history is dominated by the notion of long-term decline deriving from endemic and manifold economic weakness. If we assume for the present that those who profess to understand the causes of decline are engaged in a contest to acquire power to avert further decline it is a simple step to appreciate that the study of the British economy between 1870 and 1939 is often reduced to merely the search for salvation through identification of the appropriate agency/group – or, typically, scapegoat(s) - responsible for that decline. Our purpose in this introductory lecture will be broader but we must be mindful of this dominant strand of both contemporary historical debate about, and the historiography on, the British economy. 2. ORGANISATION OF THIS LECTURE AND RECOMMENDED INTRODUCTORY READING Organisation and content This lecture divides into three parts: the first surveys the principal questions that should be asked of British economic performance between 1870 and 1939 (in truth a rather artificial periodisation forced upon us by the dictates of modularisation); the second examines economic policy over this period, which inevitably raises bigger questions about the role of government; and the third suggests some interim conclusions and flags some points that you ought to bear in mind when examining topics which are considered to be political or social history but for which the economic background is vital for a full understanding. Reading All of the themes discussed today are explored in my textbook Government versus the market (Middleton 1996) but this may be a bit intimidating for those without some background in economics and economic history. Thus, on the economic performance side I would recommend as preliminary reading the economic chapters in Johnson’s Twentieth-century Britain (1994), while on the policy side Tomlinson’s two studies (1990; 1994) are accessible to non-specialists although both have little on the first 1 D:\TEACHING\Contemporary Britain 98\Contemporary Britain Lecture 98 03.doc\16/02/2016 01:44:00 Lecture 3: The British economy, 1870-1939: performance and policy, page 2 of 8 ___________________________________________________________________________________ thirty years of our period. Green and Whiting (1996) also provides a good introductory survey of the shifting boundaries of the British state. 3. ECONOMIC PERFORMANCE Judging economic performance: introduction It is axiomatic that today we judge national economic performance rather differently from the way in which contemporaries in 1870 or 1939 did. Nonetheless, it is not anachronistic to at least begin our exploration of the past using the reference points and devices of the present provided we are aware of how the historical debate has progressed. One further introductory warning is also appropriate here: the statistics we shall use are subject to varying margins of error, both over time and as between countries. We are, however, basing our discussion on the best and most comprehensive available: Maddison’s Monitoring the world economy 1870–1992 (1995), the fruits of a lifetimes work on comparative historical national income statistics. We start then with the three conventional measures of national economic performance: A. the headline growth rate (real GDP, that is money GDP adjusted for inflation); B. the standard of living (real GDP per capita); and C. an aggregate labour productivity measure (real GDP per worker-hour), the foundation upon which the headline growth rate and thus living standards must ultimately depend. These three indicators are shown in Table 2.1 panels A-C (NB because 1870-1939 is so artificial the data given brings the story up to date; note also that 1938 is used since this is the usual benchmark). Absolute versus relative change In interpreting these it is important to make clear that when examining an economy the observer must bear in mind that the historical forces underlying the growth of an economic variable such as GDP, and the absolute level it has attained by any particular year, may be an exceptional historical performance but nonetheless deficient relative to the rate of change and final level attained by comparable countries. With this distinction established it then becomes much easier to appreciate that to understand fully why living standards are now lower in Britain than the average for the OECD countries the question that needs to be asked is not so much why productivity is lower in Britain but why it grew more slowly, i.e. what constrained the growth rate and thus prevented the absolute level of productivity from converging on that of the leading economies. The league table approach Begin with panel A of Table 2.1 which gives estimates of the national incomes (expressed in constant 1990 US dollars) of the UK and comparator economies (EU, G-7 and OECD-17; all defined in the note to Table 2.1) for 1870 and subsequent benchmark dates. We stress that this is highly processed cross-country data obtained by adjusting each country’s GDP at current prices and exchange rates for the effects Lecture 3: The British economy, 1870-1939: performance and policy, page 3 of 8 ___________________________________________________________________________________ of inflation between 1870 and 1992, for the differing purchasing power of each country’s national currency and for any territorial changes (important in the case of Germany which was divided between the end of the Second World War and 1989). The derivation of these statistics pose a number of significant problems but we leave these to one side for the moment and instead focus on what these numbers might tell us about Britain in comparative perspective. Taking absolute magnitudes first, it is clear that in 1870 the UK economy if not the workshop of the world was still the second largest of the advanced capitalist economies (behind the US) but had slipped to sixth place by 1992 (now also behind France, Germany, Italy and Japan). It still, however, ranked second in 1938 and thus in terms of relative economic decline the greater part of developments lie with the Second World War and after. This is our first major conclusion: before the Second World relative economic decline, if we use the league table approach, is only really significant with respect to the US. The size of a country’s national income is, of course, partly a function of the size of its population, and when this is factored in (as in panel B where population is the denominator in the calculation) a somewhat different picture emerges with the UK slipping from second place in 1870 to fourth place in 1938 (sixth place by 1950 and fifteenth by 1992). Moreover, since this measure is the economists’ favoured indicator of the standard of living it is clear that the relative decline of the British economy was even more pronounced, although again the major slippage is after the Second World War. We can see, therefore, from panel B that whilst in absolute terms the British people by the eve of the Second World War were enjoying a standard of living which was over 80 per cent higher than in 1870, in relative terms over the preceding 68 years almost all other OECD economies had grown more affluent at a faster rate than had Britain and spectacularly so in relation to the US which had emerged as the world’s leading industrial power. To explain why the British economy was growing so slowly we begin by invoking the hypothesis of catch-up and convergence, one which is now used routinely to examine the economic growth of all economies, developed and less developed. The concept of catch-up and convergence is relatively new but derives from a longstanding observation by economic historians that latecomers to industrialisation grew faster than the early-starters and that the forces underlying that late industrialisation might be substantially different, in particular that the role of the state might be enhanced relative to the laissez-faire stance of the nineteenth-century British and American governments. Catch-up can be conceived as a process whereby latecomers use new technology and best organisational practices to move towards comparable absolute levels of productivity to those now enjoyed by the early-starters, with convergence the tendency for all countries, subject to differing natural resource endowments and certain other conditioning factors, to eventually attain more or less comparable absolute productivity levels. We envision the process of catch-up in Figure 2.1 where we chart on the Y axis the absolute level of aggregate labour productivity attained in 1870, the high point of British industrial hegemony, with the subsequent growth rate in aggregate labour productivity over the period 1870–1992. For catch-up to be present we would expect an inverse relationship between the two series, and we do indeed observe that from Lecture 3: The British economy, 1870-1939: performance and policy, page 4 of 8 ___________________________________________________________________________________ the fitted trend line. We should also notice the high value for the R 2 statistic, indicating a small difference between the Y values as represented on the trend line and the Y values existing as data points and, therefore, that we can at this stage have some confidence in the catch-up hypothesis. Clearly, however, the achievement of the potential catch-up bonus (the gap between a country’s actual absolute level of productivity and the level attained by the leading economies) is not automatic. Were it so there would be no less developed economies: no countries like Nepal with levels of GDP per capita (1995 figures) of US$200, only those like the Netherlands with US$24,000 or even Switzerland, the country with the world’s highest standard of living, with US$40,630 (World Bank 1997, pp. 214–15). Thus catch-up is neither automatic, nor is it necessarily complete. Indeed, econometric research suggests that the growth paths and characteristics of the leading economies are not consistent with the view that absolute productivity levels tend towards equalisation and that countries differ in their productivity levels by more than would be expected from their levels of investment in physical capital (i.e. machinery) and human capital (i.e. education and vocational training), the two principal vehicles whereby new technologies and production practices are translated into higher output. This leads to an important second conclusion: if differences in the scope for catchup are a conditioning rather than a determining factor in economic growth we have room once more to investigate why some economies succeed and some fail. This is obviously of some importance for the British case. We envision this process of conditional catch-up in Figure 2.2 which compares the aggregate productivity experience of Britain, the US, Germany and the OECD-16 averages for 1870, 1938 and 1992. Clearly, all economies have advanced absolutely since 1870, but as is also clear initially Britain’s relative decline was very much more marked with respect to the US and much less with respect to the principal European economy or indeed the OECD average. It is thus only since the Second World War that there emerges scope for a generalised failure of the British economy, and even this must be qualified by the finding that by 1992, by this measure, Britain was only 4 per cent behind the OECD average. Note also that on this league table approach Britain was a more highly developed economy than Germany on the eve of the Second World War. To complete this part of the discussion we need one further component of the catchup and convergence literature: that of social capability, here defined as a complex of economic, social, attitudinal and other factors which bear upon a country’s capacity to acquire and use advanced technology. From league tables we can thus come back to history and policy. Contemporary understanding of decline 1870-1939 The raw material for these league tables did not exist before the mid-1950s. How then did contemporaries understand national economic decline? The first point to note is that relative decline had long been anticipated by economists, and particularly with respect to the US which obviously had huge advantages in terms of natural resources and market size once – through massive immigration – it acquired a population. Indeed, The Economist magazine, in reporting on the great exhibition of 1851, had observed that the question about Britain’s economic future was less whether relative decline would occur and more when would it occur. Lecture 3: The British economy, 1870-1939: performance and policy, page 5 of 8 ___________________________________________________________________________________ Refining this further we identify the 1880s as the critical decade, as the beginnings of that ‘critical inquest into the state of the British economy which has been going on ever since’ with much contemporary debate ‘intimat[ing] the need for some form of government action or supervision’ (Greenleaf 1983, pp. 103–4). It is from the late 1880s that we locate a broadly based crisis of liberalism, from which we can then explore the growth of government and the contours of twentieth-century political competition. As that debate about relative economic decline developed from the 1880s it developed one further characteristic which has endured through to the present: the distinction between internal and external causes of decline. The former emphasised deficiencies internal to the fabric of British economy and society (class conflict, underinvestment in human and physical capital) while the latter sought to locate decline in external factors, particularly initially in the continued maintenance of free trade in the face of the growing competitive challenge of the US and Germany. Both internal and external diagnoses have policy implications, but rather different ones. By focusing on such debates one acquires much raw material to supplement the league table approach to national economic performance. It opens up a myriad of debates concerning entrepreneurial weaknesses, in particular the slow transfer of resources from the staple to new, high-technology industries; the various consequences of class for education and training and for industrial relations; and the implications of Britain’s highly inegalitarian distribution of income/wealth for the popular consent for markets and thus for the operation of the market itself. Underlying all of this, as I argue in Government versus the market (Middleton 1996), is a set of choices that have to be made between government and market in the allocation and distribution of resources, with the choice the central element of British political economy as government, organised capital and organised labour constantly seek to renegotiate that cardinal choice. We chart this as a triangular policy space in Figure 2.3 in terms of the diagnoses of relative decline. Beginning thus in the 1880s as contemporary concerns about threats to geo-political hegemony, in which economic capacity was more the focus of concern than modern concepts of growth, you can explore this literature through the recommended readings. What you will find is more evidence of economic failure at the industrial and microeconomic level than at the macroeconomic. You will observe the central role played by the two world wars in the erosion of Britain’s economic hegemony, and how the growing deterioration in Britain’s balance of payments (on both current and capital account) is both a cause and a consequence of that adjustment to industrialisation elsewhere. Before turning to policy we come to our third conclusion: the issue of timing in economic decline is of major significance. Until very recently, those who tended to implicate government as the root cause of economic failure concentrated on postwar economic policies and the growth of the public sector, while those who looked further back tended to identify forces more deeply rooted in Britain’s social and political structure (Warwick 1985). That has now changed somewhat as we have identified government having an impact much earlier in the process of decline, as much for what it did not do as for what it did (themes explored in Government versus the market). Lecture 3: The British economy, 1870-1939: performance and policy, page 6 of 8 ___________________________________________________________________________________ 4. ECONOMIC POLICY AND THE GROWTH OF GOVERNMENT Proxies for government In Figure 2.4 we chart government expenditure as a percentage of GDP from 1900, no reliable consolidated data being available for the earlier years although we can say that the trend was slightly upwards since 1870. As can be seen, from this proxy for government activity, it is war that is decisive for government growth. This is typically explained in terms of war having a displacement effect on society’s toleration of taxation, but in addition with the trend being upwards between the wars and after the Second World War we need to factor in political competition. We will explore this more in part II of the unit but here observe that Britain’s public sector was over twice as large in 1938 as 1870 with almost all of that growth due to transfer payments, of which the largest element was spending on welfare - national insurance for pensions, health and unemployment having begun in 1911 – and the cost of servicing the enlarged national debt forced by wars to defend Britain’s geo-political status. To complete the picture we also chart the tax side of the national accounts in Figure 2.5. Observe the rise to prominence of the income tax, a further manifestation of the growth of redistributive activities by the British state. What does government do and why? This leads to broader issues of what government does, why it does it and with what capability. The functions of the state are summarised in Table 2.2 with the focus being the economic rational for government intervention which economists model in terms of market failure and concerns for equity. Typically, this is couched in terms of economic systems having a trade-off between efficiency and equity but as you will see when you examine the social and economic policy debates from the 1870s onwards this is not necessarily a simple inverse function (as in panel A of Figure 2.6) but can also be portrayed by what we here call the New Liberal formulation (after the reformist Liberal Party ideology of the 1890s onwards) and which is represented in panel B. The shape of this function, whether realised by the protagonists or not, underlies all of the debates about the relationship between government and market. Using Table 2.2 we can characterise the growth of government from 1870 through 1938 as follows. Initially, government had only very minimal functions (defence, law and order, property rights) and a bare minimum of measures to protect the poor (notably the Poor Law). As we move towards the 1900s, and especially with the reforming Liberal governments of 1906-14, government acquires intermediate functions for addressing market failure and extending its instruments for protecting the poor. But progress is not linear, it varies immensely between functions and programmes. We can say that the growth of policy objectives and instruments was faster with respect to social than economic policy, but that by the 1930s, under pressure from unemployment and very different political competition forced by the advent of labour, government was becoming recognisably modern - what I have called in an earlier book Towards the managed economy (Middleton 1985). Differential ‘progress’ with respect to economic and social policies leads us to consider government policy-making capability. Our starting point is that political institutions shape the process through which policies are made and implemented and these in turn influence government capabilities; and that the principal determinants of this process are the extent to which decision-making is centralised, the degree to which decisions are subjected to multiple vetoes and the extent to which elites are stable and share common values and objectives (Weaver and Rockman 1993). Our argument here is that our starting point, the mid-nineteenth-century laissez-faire Lecture 3: The British economy, 1870-1939: performance and policy, page 7 of 8 ___________________________________________________________________________________ minimal state, had limited capacity to grow. It needed shocks and structural changes in the balance of power. The principal shock was war: initially the Boer War which demonstrated that after a century or more of industrialisation Britain’s working-class were insufficiently healthy to be able to serve in the army to defend perceived national interests, giving rise to social imperialism, national efficiency etc; and then the First World War which brought to the forefront many issues affecting both economic efficiency and social equity. The structural changes were what Lowe (1986) calls the adjustment to democracy, which can be decomposed as: the implications of the full franchise for party structure and competition, manifest of course eventually as the decline of the Liberal Party and the rise of the bi-polar Labour-Conservative contest which is fully established by the 1930s; and the coincident economic rise of labour, exercising power through trade unions with direct political links to the Labour Party. Alan Taylor (1965, p. 1) once observed that ‘Until 1914, a sensible, law-abiding Englishman could pass through life and hardly notice the existence of the state, beyond the post-office and the policeman’. This was not the case by 1938, as manifest by: 5. all (after 1928) now had the vote; conscription in the First World War had fundamentally changed the balance between the individual and state; there now existed a bargain of sorts that the state, employers and individuals would provide insurance against the most pressing of contingencies (ill-health, unemployment and old age) for men at least; government was no longer passive in face of the vagaries of the trade cycle; and in economic policy, as elsewhere, expertise was being incorporated by government to solve a myriad of problems (see Middleton 1998 on the role of the economists). CONCLUSIONS What can we draw from our very abbreviated account of these enormous themes and dominant questions: interrelationship between diminishing economic capability and growing competition to Britain’s geopolitical hegemony growing politicisation of economic issues, raising momentous problems for interpretation – objectivity, mass of data, interconnectedness. as ‘history’ becomes part of the battlefield of ‘Britishness’ it was inevitable that economic performance, and particularly the notion of some glorious historic economic past (industrial revolution), would be invoked. Be wary. insularity of the British historiography until very recently; typically working with idealised notions of some glorious industrial revolution or, if other countries are Lecture 3: The British economy, 1870-1939: performance and policy, page 8 of 8 ___________________________________________________________________________________ invoked, vibrancy and vitality elsewhere which the British failed to emulate. beneath the surface growing affluence but also insecurity, either unemployment or war. Where next: next term we pick up the story, in many ways the more interesting part of the story for both relative economic decline and economic policy. 6. REFERENCES AND SOURCES FOR FIGURES/TABLES Clarke, P.F. (1996) The Penguin history of Britain. Vol. 9: Hope and glory. Britain, 1900–1990. London: Allen Lane. Green, S.J.D. and Whiting, R.C. (eds) (1996) The boundaries of the state in modern Britain. Cambridge: Cambridge University Press. Greenleaf, W.H. (1983) The British political tradition. Vol. I: The rise of collectivism. London: Methuen. Johnson, P.A. (ed.) (1994) Twentieth-century Britain: economic, social and cultural change. London: Longman. Lowe, R. (1986) Adjusting to democracy: the role of the Ministry of Labour in British politics, 1916-1939. Oxford: Clarendon Press. Maddison, A. (1995) Monitoring the world economy, 1820–1992. Paris: OECD. Middleton, R. (1985) Towards the managed economy: Keynes, the Treasury and the fiscal policy debate of the 1930s. London: Methuen. Middleton, R. (1996) Government versus the market: the growth of the public sector, economic management and British economic performance, c.1890–1979. Cheltenham: Edward Elgar. Middleton, R. (1998) Charlatans or saviours?: economists and the British economy from Marshall to Meade. Cheltenham: Edward Elgar. Middleton, R. (1999) ‘Britain’s economic problem: too small a public sector?’, in S. James and V. Preston (eds) (1999) Old politics, new politics, British history, 1945-95. London: Macmillan, forthcoming. Taylor, A.J.P. (1965) English history, 1914-1945. Oxford: Clarendon Press. Tomlinson, J.D. (1990) Public policy and the economy since 1900. Oxford: Clarendon Press. Tomlinson, J.D. (1994) Government and the enterprise since 1900: the changing problem of efficiency. Oxford: Oxford University Press. Warwick, P. (1985) ‘Did Britain change?: an inquiry into the causes of national decline’, Journal of Contemporary History, 20 (1), pp. 99-133. Weaver, R.K. and Rockman, B.A. (1993) ‘Assessing the effects of institutions’, in R.K. Weaver and B.A. Rockman (eds) (1993) Do institutions matter?: government capabilities in the United States and abroad. Washington, DC: Brookings Institution, pp. 1–41. World Bank (1997) World development report, 1997: the state in a changing world. Oxford: Oxford University Press.