Problems and Solution

advertisement

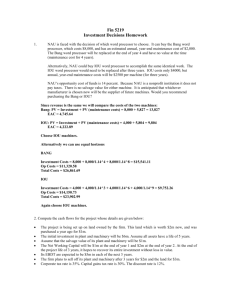

Workbook 6 Capital Budgeting/Making Capital Investment Decisions/ Estimation of Project Cash Flows 1. Ojus Enterprises is determining the cash flow for a project involving replacement of an old machine by a new machine. The old machine, bought a few years ago, has a book value of Rs 400,000 and it can be sold to realize a post-tax salvage value of Rs 500, 000. It has a remaining life of 5 years after which its net salvage value is expected to be Rs 160,000. It is being depreciated annually at a rate of 25 % under the WDV method. The working capital required for the old machine is Rs 400,000. The new machine costs Rs 1,600,000. It is expected to fetch a net salvage of Rs 800,000 after 5 years when it will no longer be required. The depreciation rate applicable to it is 25 % under the written down value method. The net working capital required for the new machine is Rs 500,000. the new machine is expected to bring a saving of Rs 300,000 annually in manufacturing costs (other than depreciation). The tax rate applicable to the firm is 40 %. Given the above information, the incremental after-tax cash flow associated with the project has been worked out below: replacement Solution: 0 I. Investment Outlay 1. Cost of New asset 2. SV of old asset 3. Increase in NWC 4. Total net investment (1-2+3) II. Operating Inflows 5. After-tax savings in manufacturing cost 6. Depreciation on new machine 7. Depreciation on old machine 8. Incremental depreciation (6-7) 9. Tax savings on Incremental Depreciation (0.4 x 8) 10. Net operating cash inflow (5 + 9) III. Terminal Cash Inflow 11. Net terminal value of new machine 12. Net terminal value of old machine 13. Recovery of incremental NWC 14. Total terminal cash inflow (11 - 12 + 13) IV. Net cash flow (4 + 10 + 14) 1 Rs in '000 2 3 4 5 180 168.8 42.2 126.6 50.6 230.6 180 126.6 31.6 95 38 218 230.6 800 160 100 740 958 (1600) 500 (100) (1200) 180 400 100 300 120 300 (1200) 300 180 300 75 225 90 270 270 180 225 56.3 168.7 67.5 247.5 247.5 1. The Farlow Company is considering the replacement of a riveting machine with a new one that will increase the earnings before depreciation from Rs 20,000 per year to Rs 51,000 per year. The new machine will cost Rs 100,000 and has an estimated life of 8 years with no salvage value. The applicable corporate tax rate is 40%, and the firm’s cost of capital is 12%. The old machine has been fully depreciated and has no salvage value. a) Evaluate the replacement decision using a MACRS 5 year class life b) Evaluate the replacement decision using the pre-MACRS sum of the years digit accelerated depreciation c) Comapre the results Solution: a) Calculation of Depreciation Year Depreciation rate Depreciation (Rs 100,000x rate) 1 2 3 4 5 6 7 8 20% 32% 19.20% 11.52% 11.52% 5.76 - 20,000 32,000 19,200 11,520 11,520 5,760 - - 1 S.B.Khatri – Financial Management - AIM Note: Calculating depreciation through MACRS , the estimated salvage value need not be deducted from the original investment outlay. Calculation of incremental cash flow Year Incremental EBDT Less: Dep EBT Less: Tax @ 40% EAT Add: Dep Cash Flow 1 31,000 2 31,000 20,000 32,000 19,200 11,520 11,520 5,760 (1,000) (400) 26,600 (600) 32,000 31,400 3 4 5 6 7 8 31,000 31,000 31,000 31,000 31,000 31,000 - - 26,280 23,208 23,208 20,904 18,600 18,600 Calculation of NPV Year Cash Flow 0 (100,000) 1 26,600 2 31,400 3 26,280 4 23,208 5 23,208 6 20,904 7 18,600 8 18,600 Net Present Value = ∑ of all PVs PVIF@ 12% PV = Rs 21,922 Since NPV is positive, replacement should be done b) Sum of the years = 1+2+3+4+5+6+7+8=36 Depreciation = (Cost – SV) x (Remaining useful life/sum of the years) Year 1 2 3 4 5 6 7 8 Depreciation Rs 100,000 x 8/36 = Rs 22,222 Rs 100,000 x 7/36 = Rs 19,444 Rs 100,000 x 6/36 = Rs 16,667 Rs 100,000 x 5/36 = Rs 13,889 Rs 100,000 x 4/36 = Rs 11,111 Rs 100,000 x 3/36 = Rs 8,333 Rs 100,000 x 2/36 = Rs 5,556 Rs 100,000 x 1/36 = Rs 2,778 Find the Cash Flow as in (a) Find NPV @ 12% disount rate as in (a) Ans: NPV = Rs 20,476 (accept the replacement) c) NPV in (a) is higher than in (b). It is because, higher depreciation is charged in the earlier year than in the sum-of-the-year-digit method. The higher the cash flow in the earlier years, the higher will be the NPV than the lesser cash flow 2. Natural Breverage is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of Rs 500,000 and a remaining useful life of 5 years. The firm does not expect to realize any return from scrapping the old machine in five years; but it can sell the 2 S.B.Khatri – Financial Management - AIM machine new to another firm in the industry for Rs 300,000. Pre-MACRS straight line depreciation was used for the old machine. The new machine has a purchase price of Rs 1.1 million, an estimated useful life of 5 years, and an estimated salvage value of Rs 200,000. It is expected to economize on electric power usage, labor and repair costs and reduce the number of defective bottles. In total, an annual savings of Rs 250,000 will be realized if the new machine is installed. The company is in the 40% tax bracket, has a 10% cost of capital, and will use MACRS 5 year class life depreciation on the new machine. a) What is the initial cash outlay required for the new machine ? b) Should Natural Breverages purchase the new machine ? Support your answer. Solution: a) Calcuation of initial cash outlay for the new machine: Cost of new machine Sale of old machine Tax savings on old (500,000-300,000)x0.40 Initial Cash Outlay Rs 1,100,000 (300,000) (80,000) Rs 720,000 b) Calcuation of Depreciation of Old machine: Depreciation of old machine = (Rs 500,000 – 0)/5 = Rs 100,000 Calcuation of Depreciation of New machine: Year Dep rate Dep (Rs 1,100,000 x rate) 1 2 3 4 5 Total 20% 32% 19.20% 11.52% 11.52% 94.24% 220,000 352,000 211,200 126,720 126,720 1,036,640 Book Salvage Value = Cost of machine – Total depreciation = Rs 1,100,000 – Rs 1,036,640 = Rs 63,360 Calculation of Incremental Cash Flow: Year a. Savings (EBDT) Differential depreciation: Depreciation, New Less: Depreciation, Old b. Differential Dep EBT (a-b) Less: Tax @ 40% EAT Add: Diff Dep Cash Flow 1 2 3 4 5 250,000 Rs 250,000 Rs 250,000 Rs 250,000 Rs 250,000 220,000 352,000 100,000 100,000 120,000 252,000 211,200 100,000 111,200 Calculation of final year cash flow: Operating Cash flow in year 5 Cash SV of new machine Tax on profit on sale (Rs 200,000 – 63,360) x x0.40 Cash Flow 126,720 100,000 26,720 126,720 100,000 26,720 Rs 160,000 200,000 (54,656) Rs 306,032 Calcuation of NPV Year Cash Flow PVIF@10% PV 0 (720,000) 1 1 198,000 2 250,800 3 194,480 4 160,688 5 306,032 Net present value = Rs 113,162 New machine should be purchased. S.B.Khatri – Financial Management - AIM 3 3. The Starbuck Compnay is considering the purchase of a new machine tool to replace an obsolete one. The machine being used for the operation has both a tax book value and a market value to zero, it is in good working order and will last, physically, for at least 5 years. The proposed machine will perform the operation so much more efficiently that Starbuck engineers estimate that labor, material, and other direct costs on the operation will be reduced Rs 6,500 a year if it is installed. The proposed machine costs Rs 30,000 delievered and installed, and its economic life is estimated to be 10 years, with zero salvage value. The company expects to earn 12% on its investment after taxes. The tax rate is 40% and the firm has been advised that the new equipment will qualify for a MACRS 7 year class life. a) Should Starbuck buy the new machine ? b) Assume that the tax book value of the old machine is Rs 6,000, that the annual depreciation charge is Rs 400, and that the machine has no market value. How do these assumptions affect your answer? c) Answer part (b) assuming that the old machine has a market value or Rs 4,000 d) Answer part (c) assuming that the annual savings will be Rs 8,000. Solution: Given, Cost of new machine = Rs 30,000 Annual savings on cost = Rs 6,500 Economic life = 10 years Cost of capital = 12% Tax rate = 40% Depreciation = MACRS 7 years class Calculation of depreciation: Year 1 2 3 4 5 6 7 8 9 10 Rate 14.29% 24.49 17.49 12.49 8.93 8.93 8.92 4.46 - Depreciation (Rs 30,000 x Rate) 5247 1338 - Calcualation of Cash Flows: Year 1 EBDT 6500 Less: Depreciation EBT Less: Tax@ 40% EAT Add: Depreciation Operating Cash Flow 2 6500 3 4 5 6 7 8 9 10 6500 6500 6500 6500 6500 6500 6500 6500 5247 1338 - (847) (339) (508) 7347 6839 4435 3900 a) Calcuation of NPV Year 0 1 2 3 4 5 6 7 8 9 10 Cash Flow PVIF @ 12% PV (30,000) 1 (30,000) 5615 0.8929 5452 4972 4972 0.5674 2248 3900 0.3220 NPV = 208 As the NPV is positive, the company should buy the new machine. b) Given, Book value of old machine = Rs 6,000 S.B.Khatri – Financial Management - AIM 4 Annual Depreciation = Rs 400 Now, Calculation of net cash outlay: Cost of New machine Rs 30,000 Sale of old machine 0 Tax adjustment: Cash Salvage value, old Less: Book salvage value, old 0 Loss Rs 6,000 Tax savings @ 40% Rs 6000 (2400) Net cash outlay Rs 27,600 Calculation of Differential Depreciation Year 1 2 3 4 5 6 7 Depreciation, new 5247 Depreciation, old 400 400 400 400 400 - Differential Depreciation 3887 3347 Calculation of Cash Flow Year Annual saving (EBDIT) Less: Differential Deprn EBT Less: Tax @ 40% EAT Add back: Depreciation Operating cash flows 1 2 3 4 5 6 7 6500 6500 6500 6500 6500 6500 6500 3887 3347 2613 (447) (179) (268) 6947 5239 8 1338 1338 9 - 10 - 8 9 10 6500 6500 6500 1338 - 4435 3900 Calculation of NPV Year 0 1 2 3 4 5 6 7 8 9 10 Cash Flow PVIF @ 12% PV (27,600) 1 0.8929 5839 0.5674 2519 4970 1406 0.3220 NPV =2031 The present value increases over the part (a), if the given condition exists. c) Given, Market value of old machine = Rs 4,000 Now, Calculation of net cash outlay: Cost of New machine Rs 30,000 Sale of old machine (4000) Tax adjustment: Cash Salvage value, old Less: Book salvage value, old 4,000 Loss Rs 6,000 Tax savings @ 40% Rs 2,000 (800) Net cash outlay Rs 25,200 S.B.Khatri – Financial Management - AIM 5 Calculation of NPV Present value of cash flows from part (b) = Rs 29,631 Less: Net cash outlay = Rs 25,200 NPV = Rs 4431 d) Given (related with b and c) Annual saving = Rs 8,000 Calculation of Cash Flow Year 1 Annual saving (EBDIT) 8000 Less: Differential Deprn 3887 EBT 4113 Less: Tax @ 40% EAT Add back: Depreciation Operating cash flows 2 3 4 5 6 7 8 8000 8000 8,000 8,000 8,000 8,000 8,000 3347 1338 1053 1892 9 10 8,000 8,000 8000 3997 6947 6139 5872 4800 Calculation of NPV Year 0 1 2 3 4 5 6 7 8 9 10 Cash Flow PVIF @ 12% PV (25,200) 1 0.8929 6739 3,901 0.5674 5870 2,155 0.3220 NPV =9,517 4. The Longdon Company has two alternative investment projects, E and F. As a result of a capital rationing policy, the management is contemplating which project they should accept. The following table provides the management with all related financial information: Project E Project F Cost Rs 15,000 Rs 15,000 Cash flow per year Rs 5,500 3,200 Life 4 years 8 years Cost of capital 12% 12% Calculate the NPV and IRR for each project and make your recommendation. Solution: Steps: Find out NPV of Project E = Rs 1705 Find out UAE (EAB) = NPV / PVIFA (4,12%) o UAE for E = Rs 561.48 o UAE for F = Rs 180.46 Based on UAE, (since NPV is positive), Project E should be accepted Find out IRR (since cash flow is annuity) o Find the factor = Initial Cost / Cash flow per year = 2.7273 o See PVIFA table, factor lies between the factors of 17% and 18% o Find out the right IRR by interpolation (Ans: 17.31% for Project E) Repeat same procedure for Project F (NPV = Rs 896, IRR = 13.70%) 6 S.B.Khatri – Financial Management - AIM Project E should be accepted. 5. The Grant Corporation is considering a project which has a five-year life and costs Rs 25,000. It would save Rs 4,100 per year in operating costs and increase reveue by Rs 5,000 per year. It would be financed with a five-year loan with the following payment schedule (annual rate of interest is 8%). No salvage value for the new purchased equipment is assumed at the end of the project. Payment Interest Payment of Principal Balance 626.14 2000 426.14 2073.86 626.14 165.91 460.23 1613.63 626.14 129.09 497.05 1116.58 626.14 89.33 536.81 579.77 626.14 46.37 579.77 0 630.70 2500 If the company has a 12% after tax cost of capital and a 40% tax rate, what is the NPV of the project if the company uses MACRS 3 years class life depreciation? Solution: Note: The financing cash flow has no bearing on the solution what-so-ever. Cash flow before tax = Rs 4,100 + Rs 5,000 = Rs 9,100 Calculation of depreciation: Year 1 2 3 4 5 Rate 33.33 44.45 14.81 7.41 Depreciation (Rs 25,000 x rate) 11,113 1,852 Calculation of Cash flow: Year 1 Cash flow before tax 9,100 Less: Depreciation EBT Less: Tax@ 40% EAT Add: Depreciation Operating Cash Flow 8793 2 3 4 5 9,100 9,100 9,100 9,100 11,113 1,852 (2012) (805) (1207) 11,113 6201 Calculation of NPV Year Cash Flow 0 (25,000) 1 2 3 6941 4 5 PVIF @ 12% PV 1 0.8929 3,941 0.5674 NPV =2,727 NPV of project is positive, so the project should be accepted. 6. Thoma Pharmaceutical Company may buy DNA testing equipment costing Rs 60,000. This equipment is expected to reduce clinical staff labor costs by Rs 20,000 annually. The equipment has a useful life of 5 years, but falls in the 3 year property class for cost recovery (depreciation) purpose. No salvage value is expected at the end. The corporate tax rate for Thoma is 38%, and its required rate of return is 15%. (If profits before taxes on the project are negative in any year, the firm will receive a tax credit of 38% of the loss in that year). On the basis of this information, what is the NPV of the project ? Is it acceptable ? Solution: Calculation of Depreciation: Calculation of depreciation: Year 1 2 3 4 5 Rate 33.33 44.45 14.81 7.41 Depreciation (Rs 60,000 x rate) 26,670 4,446 S.B.Khatri – Financial Management - AIM 7 Calculation of Cash flow: Year 1 Cash flow before tax 20,000 Less: Depreciation EBT Less: Tax@ 38% EAT Add: Depreciation Operating Cash Flow 2 20,000 26,670 (6670) (2535) (4135) 26,670 22,535 3 4 5 20,000 20,000 20,000 4,446 - 4,446 14,089 Calculation of NPV Year Cash Flow PVIF @ 15% PV 0 (60,000) 1 1 19,999 17,391 2 0.7561 3 10,373 4 5 12,400 0.4972 NPV =(975) As the NPV is negative, the project is not acceptable. 7. In problem 8, suppose 6% inflation in labor cost savings is expected over the last 4 years, so that savings in the first year are Rs 20,000, savings in the second year are Rs 21,200 and so forth. a. If the required rate of return is still 15%, what is the NPV of the project? Is it acceptable? b. If the working capital requirement of Rs 10,000 were required in addition to the cost of the equipment and this additional investment were needed over the life of the project, what would be the effect on NPV? (all other things are the same in part a) Solution: Given, Inflation, i = 6% Calculation of cash flow with a consideration of inflation Year 1 Cash flow before tax (in real terms) 20,000 Less: Depreciation EBT Less: Tax@ 38% EAT Add: Depreciation Nominal Cash Flow Real Cash Flow = Nominal Cash Flow / (1+i)n 2 21,200 26,670 (5470) (2079) (3391) 3 4 5 22,472 23,820 25,250 23,279 20,718 13,036 11,698 Calculation of NPV on the basis of Nominal and Real cash flow Year 0 1 2 3 4 5 PVIF @ 15% Nominal Cash Flow PV 1 (60,000) 0.8696 17,309 0.4972 NPV (nominal) = Real Cash Flow PV (60,000) 18867 15666 14,533 9411 7784 3,586 NPV (real)= 5816 (5,103) In nominal basis, though the project is acceptable, its not acceptable on the real basis b) Additional working capital requirement = Rs 10,000 Now, 8 S.B.Khatri – Financial Management - AIM Recalculating the initial investment Cost of the equipment = Rs 60,000 Add: additional working capital = Rs 10,000 Total initial investment = Rs 70,000 Recalculating terminal cash flow Operating cash flow of 5th year = Rs 15,655 Add: Working capital release = Rs 10,000 Nominal Cash Flow = Rs 25,655 Year 0 1 2 3 4 5 PVIF @ 15% Nominal Cash Flow PV 1 (70,000) 0.8696 19,999 Real Cash Flow PV (70,000) 18867 15,666 17,309 0.4972 NPV (nominal) = 9411 13,036 12,756 (1,461) NPV (real)= 9,532 (11,387) Project is not acceptable on both basis of cash flows. 9 S.B.Khatri – Financial Management - AIM