Mark Levy`s Economic Update – October 2, 2012 In last month`s

advertisement

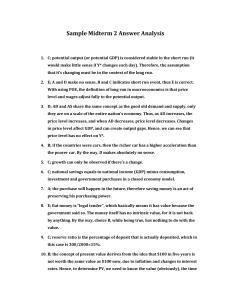

Mark Levy’s Economic Update – October 2, 2012 In last month’s letter we mentioned the possibility of the Federal Reserve extending its “Quantitative Easing” policy and that is exactly what has occurred. The definition of “Quantitative Easing” is as follows: A government monetary policy occasionally used to increase the money supply by flooding financial institutions with capital, in an effort to promote increased lending and liquidity. Central banks tend to use “Quantitative Easing” when interest rates have already been lowered to near zero percent and the desired effects still have not been achieved. The major risk of “Quantitative Easing” is that, although more money is floating around, there is still a fixed amount of goods for sale. This will eventually lead to higher prices or inflation. Hopefully the Federal Reserve is successful in its stimulative efforts and they have stated that interest rates will remain low for the foreseeable future. But, if all goes well, it is obvious that they will have to eventually deal with inflation pressure and the main tool for that occurrence is raising interest rates. This would help to curb inflation and cool down an inflating economy. It would also affect bond prices by deflating them as interest rates rise. Why am I telling you this? Because the general investing public may be unaware that in a rising interest rate environment bond prices decline and if interest rates on a 30 year government bond rise only 1 point, the 30 year bond will decline 17.77%. So, in an effort to defend against this outcome, we now invest in shorter bond maturities or Certificates of Deposit or high yield bonds that will not decline as significantly if rates rise. It is also important to note that hundreds of billions of dollars have been taken from equity markets in the last few years and placed in bonds in an effort to achieve some sort of “yield”. When most people do one thing en masse in the investing world, it tends to be the wrong thing to do. The benefactor of this scenario will probably be the equity markets. That is why we have held so steadfastly with our equity investments. With interest rates low and an accommodating Federal Reserve we expect the next few years to be very positive for equities. Yes, there are short term concerns that may increase volatility; China’s slowing economy, the fiscal cliff, renewed European economic concerns, etc. Longer term, we believe equity markets will climb and as bond prices decline, money will flow to what works best and drive the stock market even higher. The Presidential Election will take place next month and we are hopeful that some clarity will form before the end of the year regarding extending or not, the Bush Tax cuts, and to what extent the “Fiscal Cliff” will or will not occur. We will do our best to keep you informed, but do not hesitate to contact us if you have any questions or concerns. - Mark The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. * Stock investing involves risk including loss of principal. The Dow Jones Industrial Average is an unmanaged index and cannot be invested into directly. Past performance is no guarantee of future results. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise and bonds are subject to availability. LPL Financial Weekly Economic Commentary, LPL Financial Weekly Market Commentary and Don Hays Investment Newsletter, all dated 10/1/2012.