UB Senior Student Guide - Utah Valley University

advertisement

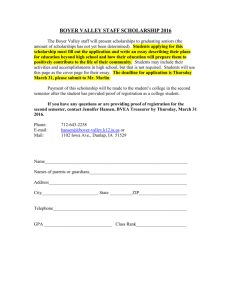

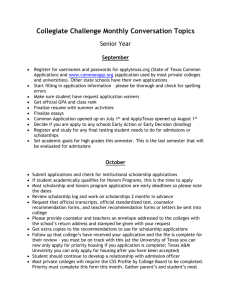

1 SENIOR STUDENT GUIDE 2014 - 2015 EDUCATIONAL TALENT SEARCH & UPWARD BOUND 2 TABLE OF CONTENTS Senior Year To Do List pg. 3 Senior Year Calendar pg. 4 College Admissions Checklist pg. 5 Choosing a College pg. 6 Local College Information pg. 9 Frequently Asked Questions pg. 12 Federal Financial Aid Programs pg. 14 Scholarship Information pg. 16 Financial Aid & Scholarship Resources pg. 17 Strategies for Succeeding in College pg. 18 Letters of Recommendation pg. 21 Personal Portfolio Contents pg. 22 Example of Introductory Page pg. 23 Worksheet for Introductory Page pg. 24 Example of Educational Resume pg. 25 Example of Job Resume pg. 26 Finishing the Personal Portfolio pg. 27 3 SENIOR YEAR TO DO LIST Fall Create a master calendar of deadlines. Include college applications, test registrations and test dates, scholarship applications, housing and financial aid deadlines. Make sure you are on track for graduation. Meet with your school counselor to review your credits and check that your transcript is up to date (especially if you are applying for the Regents’ Scholarship). Consider taking college classes if your school offers them. Look for scholarships. Use sources such as your high school’s counseling center website, utahfutures.org, fastweb.com and bigfuture.collegeboard.com. Take the ACT Test (or retake it if you aren’t satisfied with your score). See actstudent.org for a list of test dates and registration deadlines, test preparation and online registration. You are entitled to 2 ACT fee waivers as a UB/ETS participant! Attend college fairs and financial aid workshops. Most high schools will host a college day for seniors where you can visit with representatives and pick up information. Watch for information on college representatives visiting your school. Make college visits on your own. Ask for letters of recommendation from teachers, employers and coaches. Write essays for college applications and scholarships. Make sure to ask a teacher or your Trio Advisor to proofread your essays. Prepare your senior resume and eProfile. Create a professional email address if you don’t have one. Apply to colleges of your choice. Winter Keep looking for scholarships. Most college scholarships are due by February 1. Check with your high school counselor or scholarship advisor often. Keep working hard in school. Colleges do look at senior year transcripts! Ask your parents to file their taxes early this year so that you can begin your Free Application for Federal Student Aid (FAFSA). Gather tax information. Apply for Federal Student Aid as soon as possible after Jan. 1 at fafsa.gov. Apply for college housing if you have been accepted to the school of your choice. Spring Review financial aid packages offered by colleges. Make sure you have submitted all necessary paperwork. Decide on a college and notify the admissions office by May 1 of your decision. Notify schools that you will not attend of your decision. Accept financial aid and/or scholarship offers from the college of your choice. Make sure you stay on top of information from your college. Many schools will set up a college email address for you and communicate only through that address. Keep looking for scholarships. Many local scholarships become available in the spring, so do not miss out on these. Even a small award can help you pay for books or housing. Look into graduating with honors. See your high school counselor or UB/ETS advisor for information. Create a college budget to determine your needs for loans. Look for a summer job and start saving for college! 4 SENIOR YEAR CALENDAR AUGUST ____________________ JANUARY ____________________ ____________________ ____________________ ____________________ ____________________ SEPTEMBER ____________________ FEBRUARY ____________________ ____________________ ____________________ ____________________ ____________________ OCTOBER ____________________ MARCH ____________________ ____________________ ____________________ ____________________ ____________________ NOVEMBER ____________________ APRIL ____________________ ____________________ ____________________ ____________________ ____________________ DECEMBER ____________________ MAY ____________________ ____________________ ____________________ ____________________ ____________________ 5 COLLEGE ADMISSIONS CHECKLIST Make sure you are on track for graduation and that your transcript is in order before requesting one for a college application. Use the “Choosing a College” exercise in this booklet to explore what type of college is best suited to your personality and needs. The most important factor in choosing a college is finding a good fit! Choose which college(s) you will apply to and check the priority application deadlines. Some can be as early as December 1! Remember that you have to pay an application fee for each school you apply to, and you do not get it back if you decide not to go there. Some colleges will waive the application fee if you make a campus visit or if their representative visits your school. It never hurts to ask! Follow the directions on the college website to apply online. Make sure you follow all the steps and submit your transcript and application fee. Watch for email confirmation that the college(s) has received your application and that you have been accepted. If you did not have your ACT scores sent to the college(s) you are applying to, you will need to request that they be sent through actstudent.org. There is a fee to have them sent. If you need to take or retake the ACT, register online at actstudent.org. The latest you can take the test is in December if you wish to have your scores considered for admissions and scholarships. ACT test dates for the 2013 – 14 year are below. Test Date September 13, 2014 October 25, 2014 December 13, 2014 February 7, 2015 April 18, 2015 June 13, 2015 Registration Deadline August 8, 2014 September 19, 2014 November 7, 2014 January 9, 2015 March 13, 2015 May 8, 2015 Once you have been accepted, you can apply for scholarships. Some colleges automatically consider you for academic merit scholarships when you apply for admissions, but some will have a separate application. See the Scholarship Information pages in this booklet for more on applying for scholarships! Apply for housing if you plan to live on campus. Sign up for orientation and/or a meeting with an academic advisor before registering for classes. 6 CHOOSING A COLLEGE If you are like many college-bound students, you probably made the decision to continue your education fairly early, even before you started high school. Looking back, you may find your reasons for making that decision are no longer clear to you, or the reasons may have changed, just as you have changed in the past few years. Whether you have known you were going to college, or whether you are considering it now for the first time, take this opportunity to think about your reasons. If you can state your objectives clearly at the start, your college search will be much easier. Make a list of your reasons for going to college, putting your most important reason at the top of your list. 1) 2) 3) 4) 5) Discuss your reasons for going to college with your parents, counselors, friends and anyone else who can help you to focus on your long-term goals. Don't worry if your reasons are not the same as those of your friends or advisors: you are an individual and your reasons have to make sense to you. Ask yourself if the best way to achieve your objectives is by going to college. If you think it is, then you are off to a good start. What are you like? Knowing yourself-- your abilities, interests, attitudes and personality-- plays an important role in the college decision process. What you know about yourself will help you to define what you are looking for in a college. Try to get a clear picture of your strengths and weaknesses, your likes and dislikes. It is difficult to decide what's important to you in a college unless you have some guidelines. The following is a list of characteristics which make one college different from another. Some of these factors will be important to you-- others may not be as important. This list is designed to help you develop a better definition of the kind of college you would like to attend. Indicate in the first column which of these factors would be important if you were able to "design" your own ideal college. Then fill in the names of three colleges you are considering. Check the characteristics that fit that school. Compare your "ideal" school with each of the three, and count the number of matching factors. If the school which is the closest match doesn't really seem like your favorite school-perhaps there are some factors, besides these, that you haven't identified, but that really are important to you. 7 Ideal 4-year College 4-year University with Graduate School 2-year Junior College 2-year Community College Vocational/Technical College Business College Large size school Medium size school Small size school Small classes Large classes Personal attention Privacy/Anonymity Opportunity for athletic participation Opportunity for spectator sports Good intramural sports program Modern facilities Older, "traditional" facilities Close to home/family Away from home/family Go where my friends go Go where someone in my family went Chance to "break away" from high school crowd Be with students like myself Be with students different from me/my friends Good academic reputation Summer school available International reputation Study abroad programs Good library Research facilities Staff/faculty with strong academic credentials Staff/faculty who are friendly and helpful "Classy" image Good career counseling Tutorial services Good job placement rate Active student government Lots of student activities/clubs Particular student activities/clubs #1 #2 #3 8 Ideal Tuition cost per academic year Cost per academic year: $1500 - 3000 $3000 - 5000 $5000 - 8000 $8000 - 12000 $12000 & up Availability of financial aid Availability of scholarships Availability of on/off campus work Active social life on campus Active social life in community Location in large city Location in medium-size/small city Rural location Warm climate Cool climate Recreational opportunities Adequate on-campus housing Adequate off-campus housing Religious atmosphere Easy to be admitted (open-door policy) Hard to be admitted (selective enrollment) Remedial coursework available Personal counseling available Honors program available Good food in cafeteria Primarily residential campus Primarily commuter campus State owned school Private college Other: TOTAL #1 #2 #3 9 LOCAL COLLEGE AND UNIVERSITY INFORMATION Prices are approximate and subject to change. See college websites for exact information. Brigham Young University byu.edu LDS Business College ldsbc.edu Provo, Utah 84602 Admissions: (801) 422-2507 Financial Aid: (801) 422-4104 95 N 300 W Salt Lake City, Utah 84101 Approximate Enrollment Tests Required Priority Application Deadline Application Deadline Application Fee Scholarship Deadline Room and Board LDS Tuition/Fees Non-LDS Tuition/Fees 30,000 ACT or SAT Dec. 1 Feb. 1 $35 Feb. 1 $3665 per semester $2500 per semester $5000 per semester Brigham Young University-Idaho byui.edu 525 S Center St Rexburg, Idaho 83460 Admissions: (208) 496-1300 Financial Aid: (208) 496-1600 Approximate Enrollment Tests Required Priority Application Deadline Application Deadline Application Fee Scholarship Deadline Room and Board LDS Tuition/Fees Non-LDS Tuition/Fees 15,000 ACT or SAT Dec. 1 Feb. 1 $35 April 1 $2400 per semester $1975 per semester $3750 per semester Dixie College dixie.edu (801) 524-8100 (801) 524-8111 Approximate Enrollment 2,000 Tests Required (for scholarships only) ACT Application Deadline Ten days prior to semester Application Fee $35 Scholarship Deadline March 1 Room and Board Varies (no on-campus housing) LDS Tuition/Fees $1530 per semester Non-LDS Tuition/Fees $3060 per semester Salt Lake Community College slcc.edu 4600 South Redwood Road Salt Lake City, Utah 84123 Admissions: (801) 957-7522 Financial Aid: (801) 957-4410 Approximate Enrollment (13 campuses) 60,000 Tests Required ACT or SAT Application Deadline August 15 Application Fee $40 Scholarship Deadline March 1 Room and Board Varies (no on campus housing) Tuition/Fees $1734 per semester Student Support Services Gregory Roberts, Director (801) 957-4334 gregory.roberts@slcc.edu Snow College snow.edu 225 South 700 East St. George, Utah 84770 Admissions: (435) 652-7777 Financial Aid: (435) 652-7575 Approximate Enrollment Tests Required Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees Student Support Services Jonathan Morrell, Director (435) 652-7656 morrell@dixie.edu Admissions: Financial Aid: 150 College Avenue Ephraim, Utah 84627 Admissions: (435) 283-7144 Financial Aid: (435) 283-7131 10,000 ACT or SAT Aug. 15 $35 March 1 $2449 per semester $2145 per semester Approximate Enrollment Tests Required Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees Student Support Services Mike Anderson (435) 283-7393 mike.anderson@snow.edu 4,500 ACT or SAT Open $30 March 1 $1600 per semester $1543 per semester 10 Utah State University usu.edu Southern Utah University suu.edu Taggart Student Center Logan, Utah 84322 Admissions: (435) 797-1079 Financial Aid: (435) 797-0173 351 West University Blvd Cedar City, Utah 84720 Admissions: (435) 586-7740 Financial Aid: (435) 586-7735 Approximate Enrollment Tests Required Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees Student Support Services Lynne Brown (435) 586-7771 Brown_lj@suu.edu 8,000 ACT or SAT May 1 $50 December 1 $3215 per semester $3069 per semester 451 East 400 North Price, Utah 84501 Admissions: (435) 613-5226 Financial Aid: (435) 613-5323 201 Presidents Circle Salt Lake City, Utah 84112 Admissions: (801) 581-8761 Financial Aid: (801) 581-6211 32,000 ACT or SAT December 1 $45 December 1 $4440 per semester $3938 per semester Approximate Enrollment Tests Required Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees 2,500 ACT or SAT Open $40 March 1 $2099 per semester $1686 per semester Utah Valley University uvu.edu 800 West University Parkway Orem, Utah 84058 Admissions: (801) 863-8466 Financial Aid: (801) 863-8442 Utah College of Applied Technology ucat.edu 9 campuses statewide Admissions: (801) 955-2170 Approximate Enrollment Tests Required Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees 16,000 ACT or SAT April 1 $40 December 1 $3045 per semester $3192 per semester Utah State University Eastern eastern.usu.edu University of Utah utah.edu Approximate Enrollment Tests Required Priority Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees Student Support Services Donna Jordan-Allen (435) 581-7188 djallen@sa.utah.edu Approximate Enrollment Tests Required Application Deadline Application Fee Scholarship Deadline Room and Board In-State Tuition/Fees Student Support Services Dr. Nazih Al-Rashid, Director (435) 797-3371 nazih.alrashid@usu.edu 42,000 N/A Year Round $40 Year Round Varies $1.70 per hour Approximate Enrollment 33,000 Tests Required ACT or SAT Application Deadline August 1 Application Fee $35 Scholarship Deadline February 1 Room and Board Varies (no on campus housing) In-State Tuition/Fees $2635 per semester Student Support Services Keith Jensen (801) 863-8426 jensenke@uvu.edu 11 Weber State University weber.edu 1137 University Circle Ogden, Utah 84408-1137 Admissions: (801) 626-6743 Financial Aid: (801) 626-7569 Approximate Enrollment 25,000 Tests Required ACT or SAT (for scholarships & placement only) Application Deadline Open Application Fee $30 Scholarship Deadline Jan. 13 Room and Board $3200 per semester In-State Tuition/Fees $2590 per semester Student Support Services Donalyn Sessions-Education Advisor (801) 626-6867 dsessions@weber.edu Westminster College westminstercollege.edu 1840 South 1300 East Salt Lake City, Utah 84105 Admissions: (801) 832-2200 Approximate Enrollment 3,300 Tests Required ACT or SAT Application Deadline Rolling (suggest applying in Sept.) Application Fee $50 Scholarship Deadline March 1 Room and Board $3859 per semester In-State Tuition/Fees $15182 per semester FREQUENTLY ASKED QUESTIONS 12 Where do I get money for college? Parents and students will always be expected to contribute to the cost of a college education. Other sources of aid are scholarships, grants, loans, and college work-study. Scholarships: money given for education, based on merit, need and/or talent, no need for repayment. Grants: money given to those who qualify based upon financial need, no need for repayment. Loans: money loaned at a favorable rate, must be repaid. Work-Study: money paid to a qualified individual in exchange for work on campus. NOTE: Private scholarships make up less than 1% of available student aid. Most scholarship money comes directly from individual colleges-- this is why communication between students and college representatives is so important. Parents and students will need to complete financial aid forms to be eligible for funds from sources other than scholarships. What forms must I complete to qualify for financial aid? The FAFSA, or Free Application for Federal Student Aid, is the main source for qualifying for financial aid. It is used to determine eligibility for federal Pell grants, as well as federally subsidized loans, work-study and state and institutional aid. Many scholarships also require that you fill out the FAFSA, which must be filled out every year you attend college. Every student should fill out the FAFSA, even if you think your family will not qualify. It can be filled out online at fafsa.gov after January 1 of your senior year, and as soon as your parents (and you, if you work) fill out their income tax forms for the previous year. Much of the financial aid is given out on a first-come, first-serve basis, so it is to your advantage to get the FAFSA filed as soon as possible. See Federal Financial Aid Programs section for more information. How do my parents and I apply for a FAFSA PIN? Your FAFSA PIN, or Personal Identification Number, can be used each year to electronically apply for federal student aid and to access your federal student aid records online. Both you and your parents will need to apply for a PIN before you can submit your FAFSA. Apply for a PIN at pin.ed.gov. Where do I find scholarships? Start with the college you want to attend. Find the financial aid page on their website and look for scholarships you may qualify for (some schools publish a scholarship/admissions index, some don’t). Many colleges will consider you for academic scholarships when you apply for admissions, others may have a separate application. There may also be scholarships for those with special talents (music, sports, drama, etc.), leadership potential, financial need, ethnic or cultural diversity and other characteristics. Your high school’s counseling office is the next best source for scholarship information. If 13 they have a website, get familiar with it. Check back often for new scholarships and opportunities. Let the counselor know what school you want to go to, what your interests are, and that you are looking for scholarships. Personal relationships with your counselor, UB/ETS advisor, administrators and teachers can be a great benefit in finding scholarships. Online sources can be a great way to look for scholarships, but keep in mind that many of these are nationally advertised, and you will be competing with a huge pool of applicants. Check first with utahfutures.org, where you can build a scholarship profile and receive updates when scholarships that fit your profile become available. Other good sources are fastweb.com and bigfuture.collegeboard.com. Never pay to apply for a scholarship. See section on Scholarships for more information. If I want to apply for an institutional (from the college itself) scholarship, must I apply for admission at that school? YES! In order to have your scholarship application accepted for consideration, you must meet the admission requirements for that school. How do I apply for Admission? See page entitled College Admissions Checklist. May I apply for more than one scholarship? YES! You should apply for as many scholarships as you can. If the college has restrictions on receiving more than one scholarship, they will let you know. The more scholarships you apply for, the better chance you have of receiving one. Make sure to save a copy of your applications, so that you can re-use pertinent materials. What if I plan to serve a religious mission before attending college? Most colleges in Utah will defer your admission and scholarships for religious or humanitarian missions, illness or military service. It is imperative that you apply before you leave, just as if you were planning to attend college the upcoming fall. Deferring your admissions will allow you to hold any scholarships you may be awarded, get priority registration upon your return, designate someone to register for your classes prior to your return and access financial aid or veteran’s benefits. 14 FEDERAL FINANCIAL AID PROGRAMS Note: All of the following programs are accessed by filling out the FAFSA (Free Application for Federal Student Aid) at fafsa.gov. More detailed information can be found at studentaid.gov. Federal Pell Grants Largest of the grant programs, this federal entitlement program provides grants to those undergraduate students who meet the eligibility and need criteria established by the U.S. Congress. The exact amount of a Pell Grant depends on a student's need, cost of attendance and the money appropriated by Congress to fund the program in any given year. Unlike loans, grants do not have to be paid back. Federal Supplemental Educational Opportunity Grant (FSEOG) These grants are available to a limited number of undergraduate students who demonstrate exceptional financial need. Only students who receive Federal Pell Grants and have the most financial need will receive FSEOG’s. The FSEOG program is administered directly by the financial aid office at each participating school and is therefore called “campus-based” aid. Not all schools participate. Check with your school's financial aid office to find out if the school offers the FSEOG. Teacher Education Assistance for College and Higher Education (TEACH) Grant A TEACH Grant can help you pay for college if you plan to become a teacher in a high-need field in a lowincome area. You’ll be required to teach for a certain length of time, so make sure you understand your obligation. A Teacher Education Assistance for College and Higher Education (TEACH) Grant is different from other federal student grants because it requires you to take certain kinds of classes in order to get the grant, and then do a certain kind of job to keep the grant from turning into a loan. College Work-Study Program Students who need a job to help pay for their higher education may be eligible for employment by their institutions under the federally supported Work-Study Program. Eligible students must demonstrate financial need by filling out the FAFSA. Students may work part-time while enrolled in classes at least half-time; they may work full-time during the summer or other vacation periods when they do not have classes (if funds are available at their school). Loans Education loans are different from scholarships and grants. Loans are borrowed money that you have to pay back with interest. Interest is a fee you pay for borrowing the money. Interest can cost more than the amount of the loan by the time you pay it back! There are many different education loans, so it’s important to know as much as you can about each. Some loans let you wait until you are done with school to start paying them back. Others require payments soon after you receive the loan. Most student loans make you pay more for your education in the long run. So why even take out loans? Many students, and you might be one of them, can’t pay for school without borrowing money. The value of your education will last a lifetime, long after your loans are repaid in full. Perkins Loans This student loan program is by far the simplest of them all. Its requirements are similar to the Pell Grant, but you have to pay Perkins Loans back (which is a pretty big difference). To be eligible you must: Fill out the Free Application for Federal Student Aid (FAFSA) Show financial need 15 Enroll full time or part time Promise to start repaying the loan 9 months after graduation, and repay the loan within 10 years Although schools offer Perkins loans to students, the money actually comes from the federal government. Each school only receives a limited amount, so it is important to apply early! Maximum loan amounts and interest rates for new borrowers may change each year. Direct Loans (Stafford Loans) Direct Loans are the main loans offered to students by the U.S. Department of Education. The terms of your Direct Loan will depend on your financial need and whether your loan is subsidized or unsubsidized. Subsidized means that the government will pay your interest while you are in school and for 6 months after you graduate. If your loan is unsubsidized, the government does not pay any of your interest. You will owe interest as soon as you receive the loan, although you may not have to pay it until after you graduate. You may borrow with both subsidized and unsubsidized Direct Loans at the same time. Here are the terms: All Direct Loans: Apply using the Free Application for Federal Student Aid (FAFSA) You must be enrolled at least half time You cannot borrow more than the annual limits Repayment begins 6 months after you graduate or drop below half time There are fees in addition to your principal (that’s the amount loaned to you) Sign a repayment promissory note Direct Subsidized Loans: Demonstrate financial need Total amount of the loan cannot exceed your financial need U.S. Department of Education pays the interest while you are in school, for 6 months after you graduate, and while you are in deferment Interest rate is fixed at 3.86% Direct Unsubsidized Loans: Do not have to show financial need Amount you are eligible for is determined after all of your other financial aid is considered You must pay all of the interest yourself, but can wait to begin payments until after graduation Interest rate is fixed at 6.8% Plus Loans The Parent Loan for Undergraduate Students (PLUS) is offered to parents of students who need to borrow more money than the unsubsidized Direct Loan allows. For parents who want to help their students pay for school, the federal PLUS loan is usually the best option. You can borrow money with a PLUS loan if your student is your dependent (according to the FAFSA) and enrolled at least half time at an eligible school. The main difference to keep in mind is that you, the parent, are responsible for repaying it. 16 SCHOLARSHIP INFORMATION Scholarships are becoming increasingly difficult to obtain due to competition, but this should not discourage you from applying. You certainly won’t get any if you don’t apply! Eligibility for scholarships can be based on a variety of factors, including high school GPA, ACT scores, talent, leadership, ethnic background, financial need, service resume and the types of classes taken in high school (especially Advanced Placement and Concurrent Enrollment). Colleges offer many different kinds of scholarships: Honors at Entrance, Presidential and Dean’s Scholarships, Talent and Departmental Awards (often given after completing the freshman year), and Leadership Awards (based on leadership positions held in high school and willingness to serve in college). When to Apply for Institutional Scholarships Apply as soon as you are accepted at a college or university. Many colleges use the admissions application as the scholarship application for merit based awards, but there may be a separate application, especially for other types of scholarships. You will not be considered for a scholarship until you are accepted for admission. Scholarships are given on a first-come, first-serve basis. You must apply before the deadline, which is February 1 for many colleges. When Applying For Scholarships 1. Apply to colleges or institutions of your choice before the admissions deadline. You may be the most qualified applicant, but if you miss the deadline you will miss out on the money! Many admissions and scholarship applications are combined. You must be admitted to a school to be considered for a scholarship at that institution. 2. Be accurate, neat, and informative when filling out scholarship applications. 3. Complete your senior resume or eProfile and use it to fill out applications. Make sure to include activities and accomplishments from ninth grade on. Don't be modest-- remember you are competing against other qualified applicants. See your Trio Advisor for more information on how to complete the eProfile. 4. If you are applying for Departmental and Leadership Scholarships enclose not more than three letters of recommendation from people who could verify your ability or talent in the area for which you are applying. Make arrangements for an audition if necessary. 5. The earlier you apply for a specific scholarship, the better. Some schools award scholarships as eligible students apply-- until all the money is used. 6. Apply for several scholarships at the same time, and re-use materials that may be pertinent for more than one award. 7. Consider applying to more than one school, and consider the best offer. Remember, to be considered for scholarships, you must be accepted for admission. Keep in mind that most colleges require an admission fee. 8. To be considered for an Academic Scholarship, you will need to have a high GPA and ACT/SAT score. 9. Keep checking your high school website or scholarship bulletin board for new scholarships. 10. You may use both private and school scholarship offerings in the same school year. **For additional scholarship information contact your UB/ETS and high school counselors** 17 FINANCIAL AID & SCHOLARSHIP RESOURCES For updated information on scholarships, please contact your high school counseling/career centers, or use the Internet addresses provided below. Utah Futures Use the “Financial Aid Sort” tool found under “Education” on the Utah Futures website. You will build a scholarship profile and be given links to specific scholarships that you qualify for. utahfutures.org Regents’ Scholarship Information on the state scholarship awarded to those students who take the Utah Scholar’s Core Course of Study higheredutah.org/regentsscholarship/ New Century Scholarship Information on the state scholarship awarded to those students who complete an Associate’s Degree while in high school higheredutah.org/newcenturyscholarship/ Federal Department of Education Find detailed information on all forms of federal aid, including Pell Grants, work-study and loans. studentaid.gov Free Application for Federal Student Aid Get access to grants, loans and work-study fafsa.gov fastWEB Financial Aid Search Through the Web, one of the best-know scholarship search pages fastweb.com FinAid The Financial Aid Information Page, a comprehensive source of student financial aid information finaid.org College Board Check out their college search tool if you are still undecided, or use the scholarship search to find awards that you qualify for bigfuture.collegeboard.org Daniels Fund Scholarship Four-year scholarships awarded to students with financial need who demonstrate character, leadership and service danielsfund.org/scholarships The Gates Millennium Scholar Program Four-year scholarships for ethnic minorities who demonstrate leadership and community service gmsp.org Dell Scholars Program Scholarships for students enrolled in an approved college readiness program (such as Upward Bound) dellscholars.org 18 STRATEGIES FOR SUCCEEDING IN COLLEGE You’ve prepared, you’ve made the decision, you’ve been accepted into college. Now what? Your UB/ETS advisors don’t just want you to go to college, we want you to finish college. Unfortunately, the statistics are not in your favor. For every 100 students in Utah who enrolled in a public college in 2010, 71 chose a 2-year college, 45 enrolling full-time and 26 part-time; after four years, only 14 of the full-time students and one of the part-time students graduated. Of the 29 who started at a four-year college, only 13 got their degree within 8 years. So how can you beat the odds? Persistence! Learn how to navigate the system, use the resources that are available and don’t give up! Here are some realities to consider, and a few common-sense ways to help you handle them. College Work is Harder The material covered in college courses is more complex than that taught in high school classes, and it’s presented at a faster pace. Also, professors assign more reading, writing and problem sets than you may be used to. Your Strategy Give yourself an opportunity to adjust gradually to the new academic demands. Choose a course load that includes some challenging classes and others that are less intense. Remember this rule: For every credit hour you take, you should plan to study 3 hours outside of class (i.e., 3 credit class = 9 hours of outside study). You Make the Schedule Your Strategy You are responsible for managing your Use a calendar and note when and time in college. It’s your responsibility to where your classes meet, when get to your classes on time, do all your assignments are due, and when tests assignments and be prepared for exams. take place. Create reminders for deadlines and important dates. When you plan your schedule, give yourself plenty of time to study and write papers; that way, you can avoid pulling an allnighter at the last minute. More Independence – and Your Strategy Make smart decisions. For example, Responsibility It’s time for you to take control of your life. when it comes to your money, stick to a budget and use credit cards wisely. That means you have to handle your When it comes to your health, get finances, manage daily life, and keep yourself healthy and focused. Of course, enough sleep, eat well, and pay attention your college has support systems to help to what your body tells you. You need energy to enjoy all that college has to you with these things, but now they’re offer and succeed in getting a good your responsibility. education. A New Social Scene Your Strategy Social opportunities abound in college. Remember that new friendships can be You may have the chance to meet exhilarating, but true friendships are different people, join a new crowd and formed slowly. When participating in even remake your image if you want to. social events and activities, consider your choices carefully. Talk to parents, trusted friends from high school and college counselors about how to make good choices. 19 REACH OUT TO RESOURCES College is full of resources. Help and advice are available, but it’s up to you to seek them out. Look for campus services like these to help you succeed. Academic Assistance Take advantage of the academic resources your college offers to help you in your studies. Try these strategies: Meet with your professors during office hours to ask any questions you have about assignments and course topics. Get to know the TA (Teaching Assistant) assigned to your class to get help when the professor is unavailable. If you have a problem with a professor, speak with the chair of the department or with a dean. Get help with basic composition techniques in the writing center. Find out if tutors and guided study groups are available through the campus learning center or a particular department. Join or start study groups with other students in your courses for informal support. Seek out the Student Support Services or Trio office if your college has one. As an Upward Bound or ETS student in high school, you may be entitled to get academic support services from them. Academic Advising You’ll be assigned to an academic advisor who will help you choose your classes and your major. Your advisor provides information on the academic requirements for completing your degree. Residential Services Dorms and other campus housing options usually have resident advisors (RA’s) who can talk to you about issues not related to your classes. If necessary, your RA can direct you to other campus services that can provide more specialized assistance. Commuter Services Your college may have services for students who don’t live on campus. These can include student lounges, services to help commuting students find off-campus housing, commuter parking and transit passes and clubs for older students. Counseling Transitioning to a college environment is challenging for most students. If you’re having a tough time coping with stress, pressures from home, or problems in relationships, mental health counselors are a great resource. They can also help if you feel isolated or depressed, or have other personal issues that you want to work through. Counseling is usually free and confidential. Health Centers The doctors and nurses at college health centers provide confidential medical services and education. Services can include treatment of illness and injury, immunizations and diagnostic testing. Counseling and health centers work together with the goal of maintain students’ overall wellness. 20 Religious Centers Most colleges have clergy members with whom you can talk, as well as religious organizations that hold services and sponsor activities. Financial Aid Office The financial aid office can explain your college financing and loan options. Financial aid forms can be daunting, but college financial aid officers know all the options and can introduce you to strategies you may not have previously considered. Information Technology Support As a college student, you’ll rely heavily on computers, Wi-Fi and other educational technologies. There are staff members available to help you with your internet connection and network access to keep you online and on track. Career Centers The career center is a good spot to learn about the types of jobs available to graduates in your field. May colleges have offices dedicated to helping you find your first job once you graduate, or an internship while you’re still in school. The centers offer techniques for creating resumes and practicing interviews. They usually maintain a job board and other employment resources. 21 LETTERS OF RECOMMENDATION Many scholarship applications require letters of recommendation. The letters should come from a variety of sources that support different facets of yourself. Possible sources are: counselors, teachers, advisors of extracurricular activities, employers, supervisors of volunteer work, community leaders, church activity leaders, etc. According to representatives of colleges and scholarship selection committees, one of the most important and valuable recommendations is that of your school counselor. The recommendation should summarize your overall academic progress, extracurricular activities, and leadership skills. A letter should include 1) a general statement of the relationship of the student and the writer of the letter; 2) the writer's evaluation of the student's performance and participation; 3) the writer's perception of the student's attitude, motivation, commitment, and reliability; 4) a statement on the student's character strengths; and 5) the writer should make a summary statement about the uniqueness of the student. Students can help the writer of the letter of recommendation by following these steps: 1) Give the individual sufficient time to write the letter. Two weeks is a reasonable time. 2) Discuss with the writer the reason for the letter and what information it should cover. 3) Supply the writer with a list of details (or your senior resume), such as: activities you participated in at school and in the community, leadership position, grades, etc. 4) Request that the letter be typed on letterhead. 5) Set the date you will pick up the letter or that it should be mailed. Remind them a week before you want the letter. 6) Send the letter(s) with the application early. Do not wait until the last minute. 7) Write a thank you note to those who have written your letters of recommendation . 8) If the letter is to be submitted online, make sure you provide the writer with the correct website and instructions for submitting it. 22 PERSONAL PORTFOLIO CONTENTS The personal portfolio is an important activity to complete your senior year. When your portfolio is finished, it can be used for job interviews and for scholarship applications. It will also be a source of great personal pride in your high school achievements. The following suggestions will assist you in preparing your portfolio. You may also complete a College Bound eProfile your senior year, which will take you through all of the steps of creating a portfolio online, as well as enable you to connect directly with colleges. See your UB/ETS counselor for information on how to access the eProfile webpage. Suggested Contents 1. Introductory page 2. Educational Resume 3. Job Resume 4. Academic records: ·Grade transcript or a list of achievement classes ·ACT/SAT scores ·List of academic skills ·List of academic certificates/awards/recognitions ·Academic certificates (Four to six certificates should be sufficient.) 5. Letters of recommendation: ·Employers, school personnel, community acquaintances are good sources to ask. 6. Extra-curricular activities: ·List of activities ·List of certificates/awards/recognitions ·Certificates of achievement (Four to six certificates should be sufficient.) 7. Leadership positions: ·List of organizations/positions/responsibilities ·List of certificates/awards/recognitions ·Certificates of achievement (Four to six certificates should be sufficient.) 8. Newspaper clippings/photographs of school activities and projects As you work with the suggestions contained in this section of the book, you will probably add some of your ideas and make revisions in some of the worksheets. Wonderful! It's your portfolio, and you will want it to reflect your style. Keep in mind its purpose and your reader. Impressive and professional- these are excellent guidelines. 23 EXAMPLE OF INTRODUCTORY PAGE The introduction is a summary of your outstanding high school achievements and activities. It should demonstrate your writing skills: sentence structure, paragraphing, punctuation, and spelling. Introduction My career goal is to become involved in a business profession. I plan to continue my education at UNLV, pursuing a BA degree in accounting and business management. High school achievement classes consisted of accounting, data and word processing, office procedures, business law, Algebra I, II, Geometry, Trigonometry, AP English, AP History, computer, and Science. My ACT scores are: English- 24; Mathematics- 25; Reading- 23; and Science Reasoning- 31. I have maintained a GPA of 3.8. Some of my high school achievement activities have been Business Student of the Year Award; Certificates of High Achievement in accounting, mathematics, science; FBLA member for three years; International Science and Engineering Fair-Third Place Award in Environmental Science; Drug Free Council member; basketball and track team member. Leadership positions were FBLA Vice President, Freshmen Class Officer, Student Body Activity Director, Yearbook Photographer, Forensics Club Historian. In conclusion, these experiences have also taught me thinking skills, time management, communication skills, and job performance responsibilities. I have enjoyed my high school experiences and have tried to use the time in preparing for future education and responsibilities. 24 Worksheet for Introductory Page The following worksheet will help you get started on an introduction. Add your ideas; delete whatever you do not wish to use. Introduction My career goal is I plan to continue my education at after which I would like to My high school achievement classes consisted of ACT scores are: English _____, Mathematics _____, Reading _____, Science Reasoning _____. I have maintained a GPA of _____. Achievement activities have been Leadership positions were In conclusion, 25 EXAMPLE OF EDUCATIONAL RESUME The educational resume can be used for scholarship applications and interviews. Educational Resume for John Doe 3556 Lawnwood Drive Phoenix, AZ 90250 (602) 555-5789 jdoe@yahooz.com Career Objective: Accounting and Business Management Achievement Courses: Accounting Business Law Data and Word Processing Algebra I, II Computer A AA A A- Academic Job Skills: Accounting 10-key Calculator Word Processing - 65 wpm Mathematical skills Computer programming Geometry Trigonometry AP English AP History Science Office Procedures AB+ B+ B+ AB+ Persuasive Communication Excellent writing skills Research skills Photography Business Student of the Year Award Achievement and Awards: Certificates for Outstanding Achievement: ·Accounting ·Mathematics ·Computers ·Science International Science and Engineering Fair: ·Third Place Award in Environmental Science Most Improved Basketball Team Player Award Region Track Meet-Second Place Shot Put and Discus Leadership Positions: Drug Free Council Member Forensics Club Historian Ski Club Treasurer FBLA Vice President Freshmen Class Officer Yearbook Photographer Extra-curricular Activities: Lettermen Club Member Upward Bound Participant Ski Club Member March of Dimes Walkathon Participant Educational Talent Search Participant Vocational College Course: Auto Body 26 EXAMPLE OF JOB RESUME RESUME John Doe 3556 Lawnwood Drive Phoenix, AZ 90250 Telephone: (602) 555-5789 jdoe@yahooz.com EDUCATION 2003 to 2007 Emerson High School 1234 W. Emerson Avenue Phoenix, AZ 90250 · General education curriculum with business emphasis · High School Diploma WORK EXPERIENCE 2006 to 2007 Harvey Department Store 8574 Blanding Ave., Phoenix, AZ · Position: Sales-Men's Dept. · Responsibilities: Selling of men's clothing; maintaining accurate inventory records, assisting the buyer; designing window and in-store displays · Supervisor: Mr. Bill Jones 2003 to 2005 Cardy Quick Market 548 S. 18th St., Phoenix, AZ · Position: Cashier and shelf-stocker · Supervisor: Mrs. Jill Belford WORK SKILLS Accounting 10-key Calculator Word Processing-65 wpm Mathematical skills Organizational, on-task skills Persuasive Communication Excellent writing skills Research skills Photography Confidentiality ACHIEVEMENTS/EXTRA-CURRICULAR ACTIVITIES Business Student of the Year Award FBLA Vice President Certificates of Achievement: Freshmen Class Officer ·Accounting ·Mathematics Forensics Club Historian ·Computers ·Science Ski Club Treasurer International Science and Engineering Fair-Third Place Winner 27 FINISHING THE PERSONAL PORTFOLIO The final step: Everything has been typed and proofread. You have gathered the other items needed for your portfolio as listed on the "Suggested Contents" page. The final step will be to place the typed pages, certificates, letters of recommendation, photos, newspaper clippings, etc. inside plastic protective sheets. Use the style which allows you to slip your papers into the protective sheets without punching holes in the papers. Select a durable, attractive cover, and you now have a very professional bound portfolio--easy to use, attractive to view-- and very impressive! ## Your Personal Portfolio activities have come to an end. But, this is only the beginning. Use your personal portfolio to "open doors" for you. Use it at job interviews and college scholarship interviews. Before mailing your completed scholarship applications to colleges, copy sections of the portfolio and attach to your applications. Use it when you are having a "down" day in order to focus in on the achiever that you have become. As the years pass, you will want to keep your records and portfolio updated. Entrance into promising careers will come with preparation and proof of your accomplishments. Don't hesitate to revise your portfolio so that it will suit your particular career opportunity needs. Self-esteem is a wonderful feeling and a tremendous accomplishment! Use your personal portfolio to help you feel proud of your many achievements. The world is waiting for achievers! And because of you, it will be a better place. Best wishes for a wonderful, satisfying future.