Building SMEs Competitiveness

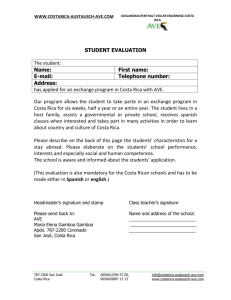

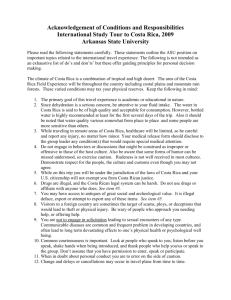

advertisement