A useful metaphor for understanding the increasingly

advertisement

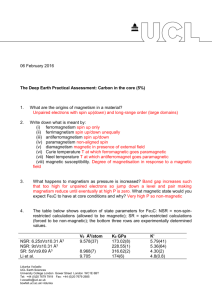

Title: If Prices Are Signals, Then Taxes Are Noise: How Raising Taxes Causes Increasing Damage to Economic Efficiency by Cyril Morong cyrilmorong@sbcglobal.net A useful metaphor for understanding the increasingly disproportionate damage to economic efficiency caused by rising taxes is the “noise-to-signal” ratio (NSR). As the NSR rises, what economists call the “deadweight loss” or DWL also rises at a steady rate. The DWL is a standard measure of the loss of social welfare that results from inefficiencies like taxes or imperfect competition. It rises faster than an actual tax does. For example, if a tax on a product doubles, the DWL quadruples. If the tax triples, the DWL rises by nine times. This is seen using supply and demand curves and calculating the geometric areas like rectangles and triangles. The economist Greg Mankiw issued “an expositional challenge” on his blog page in November, 2006 to explain the increasing damage done by taxes without having to use supply and demand (see references for the link). The NSR, as I explain below, does just that: it shows how every tax increase hurts economic efficiency more than the previous one. The NSR is the reverse of what is called the “signal-to-noise” ratio in electronics. Here are two definitions (again, see references): ratio of information to interference: the ratio of the strength of a signal carrying information to unwanted interference in an electronic circuit The ratio of the power or volume (amplitude) of a signal to the amount of unwanted interference (the noise) that has mixed in with it. Measured in decibels, signal-to-noise ratio (SNR or S/N) measures the clarity of the signal in a circuit or a wired or wireless transmission channel. In economics, prices are often seen as signals that reveal the value or scarcity of resources so that they can be used efficiently. But taxes can be seen as the noise that distorts that signal. The more the signal gets distorted, the less efficient prices become in allocating resources. If you are listening to the radio, if you start getting noise or static, the signal starts to lose its value. Eventually the noise overwhelms the signal and there is no longer a reason to listen since the NSR is so high. Below I will show, using supply and demand, that as the NSR rises, the DWL rises pretty steadily. This means that the NSR is a viable substitute or metaphor for how the DWL increases disproportionately with each tax increase. But first, a brief explanation of how taxes work as a NSR. Here is my April 30, 2007 letter to The Wall Street Journal on the subject: "Stephen Moore did a great job explaining how complicated our tax code is and how high taxes have gotten relative to what was originally promised in 1913 ("Those April Blues," page A12, April 13). One other way to see the insidiousness of taxes is to realize that they are just as much the "noise" in the economy as prices are the "signals." The income you get paid is the price for your services and therefore signals the value of those services. But taxes reduce the clarity of that signal (hence, they are noise) by reducing how much of your pay you actually get to keep. As taxes increase, the noise-to-signal ratio in the economy increases even more, meaning distortions, and the mis-allocation of resources they cause, increases disproportionately. For example, if the income tax rate is 10%, you keep 90% of your income. The noise-to-signal ratio is .111 (or .1/. 9). But if the tax rate goes up by .10 or to 20%, the noise-to-signal ratio goes up even more, by .15 to .25 since you keep 80% of your income. The .25 comes from .20/.80 equaling .25. Another .10 increase in the tax rate increases the noise-to-signal ratio by .179 from .25 to .429. Then going from a 30% tax rate to a 40% tax rate makes it go up by .238, from .429 to .667. Every tax increase causes increasing damage to the economy's ability to efficiently allocate resources." In the graph below, the equilibrium price is 5.5 and the quantity is 5.5. The value of what economists call “consumer surplus” or CS is 15.125. The CS is the area above the price and below the demand line.1 That area forms a triangle. Since the area of a triangle is (1/2) times the base times the height, the area in this case is (1/2)*5.5*5.5 = 15.125. For the “producer surplus” or PS, we need to find the area above the supply curve and below the price. The height of this triangle is 5.5 (or 5.5 – 0). The base is also 5.5 since that is the equilibrium quantity. That means the PS will also be 15.125. By adding the CS and PS together, we get the “social welfare” or SW. In this case it is 30.25 The SW can be seen as the total benefit society gets from consuming and producing a good. There is no DWL in this case since there is no tax on this product. Figure 1 P 11 10.5 10 9.5 9 8.5 8 7.5 7 6.5 6 5.5 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 S D 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 Q In Figure 2 below, the area for CS is illustrated. Figure 2 P 11 10.5 10 9.5 9 8.5 8 7.5 7 6.5 6 5.5 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 S D 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 Q In Figure 3, PS is highlighted Figure 3 P 11 10.5 10 9.5 9 8.5 8 7.5 7 6.5 6 5.5 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 S D 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 Q Now what if an excise tax of $1 per unit is enacted? It causes the supply line or supply curve to shift up by the amount of the tax since sellers now need $1 more to offer each and every quantity for sale. Figure 4 below shows this with the CS and PS shaded in. Figure 4 P 11 10.5 10 9.5 9 8.5 8 7.5 7 6.5 6 5.5 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 S D 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 Q The new price is 6 and the new quantity is 5. CS = (1/2)*(11 – 6)*5 = 12.5. PS is also 12.5. SW is not 25 because we have to add in the tax revenue (XR) of 5. Adding in the XR makes SW 30. But recall that SW was 30.25 before the tax. This difference of 0.25 is the DWL. 2 So society is worse off as a result of the tax. Now let’s double the tax to $2 per unit. The supply line will have to shift up by another $1. This is in Figure 5 below. Figure 5 P 11 10.5 10 9.5 9 8.5 8 7.5 7 6.5 6 5.5 5 4.5 4 3.5 3 2.5 2 1.5 1 0.5 0 S D 0 0.5 1 1.5 2 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 Q The new price is 6.5 and the new quantity is 4.5. CS = (1/2)*(11 – 6.5)*4.5 = 10.125. PS is also 10.125. The XR is 9. So the SW is 29.25. But recall that SW was 30.25 before the tax. This difference of 1.0 is the DWL. But this DWL is 4 times as much as it was before when it was 0.25. This is what happens when a tax is doubled, the DWL quadruples. In this case the tax went from $1 to $2 but the DWL went from 0.25 to 1. The table below summarizes what happens at all tax levels. Graphically, each $1 increase in the tax shifts the supply line up by $1 as in the graphs above. Table 1 Tax 0 1 2 3 4 5 6 P 5.5 6 6.5 7 7.5 8 8.5 Q 5.5 5 4.5 4 3.5 3 2.5 CS 15.125 12.5 10.125 8 6.125 4.5 3.125 PS 15.125 12.5 10.125 8 6.125 4.5 3.125 XR 0 5 9 12 14 15 15 SW 30.25 30 29.25 28 26.25 24 21.25 DWL 0 0.25 1 2.25 4 6.25 9 7 8 9 10 11 9 9.5 10 10.5 11 2 1.5 1 0.5 0 2 1.125 0.5 0.125 0 2 1.125 0.5 0.125 0 14 12 9 5 0 18 14.25 10 5.25 0 12.25 16 20.25 25 30.25 Notice that if the tax is 3, the DWL is 2.25, which nine times as much as what it is when the tax is 1. So triple the tax and the DWL increases by 9 times. Notice also that if the tax were 11, the quantity would be 0, meaning there no longer is no market and, of course, the SW is zero as well. But how does this relate to the NSR? First we have to see what price the seller actually gets at each tax level. When the tax is $1 per unit, the price is $6. But the seller does not get to keep all of that. They must turn $1 over to the government. That leaves the seller with $5. Call that the producer price (PP), what the seller has left after the tax is paid. Since the seller had gotten $5.5 before the tax and they are only keeping $5 now, it means that their share of the tax is $0.50. Call that the producer tax (PT). So the NSR is .5/5 or .10 (the tax divided by the PP). When the tax is 2 (as in Figure 5), the PT is 1 (the seller always pays half of the tax). The PP is 4.5. So the NSR is 1.0/4.5 or .222. Notice that the tax doubles but the NSR more than doubles. The table below shows how the NSR rises at each tax level. In this table, the NSR is also the Tax/PP column. Table 2 Tax 0 1 2 3 4 5 6 7 P 5.5 6 6.5 7 7.5 8 8.5 9 PP 5.5 5 4.5 4 3.5 3 2.5 2 PT 0 0.5 1 1.5 2 2.5 3 3.5 PT/PP 0.000 0.100 0.222 0.375 0.571 0.833 1.200 1.750 DWL 0 0.25 1 2.25 4 6.25 9 12.25 8 9 10 9.5 10 10.5 1.5 1 0.5 4 4.5 5 2.667 4.500 10.000 16 20.25 25 There is no row for a tax of 11 since at that point the PP is going to be zero and the NSR is undefined when we have 5.5/0 (the PT would be 5.5). Since the PT/PP column also represents the NSR, it can be graphed against the DWL column. Figure 6 below shows that the DWL, for the most part, rises steadily as NSR increases. Figure 6 DWL 30 25 20 15 10 5 0 0.000 2.000 4.000 6.000 8.000 10.000 Since the NSR and the DWL have such a close relationship, using the NSR to demonstrate the increasing damage done to economic efficiency from tax increases has a sound basis in economic theory. But the NSR is the result of simple arithmetic and requires no use of supply and demand or the calculation of triangles. So it is useful tool or metaphor in understanding the role of taxes in our society. NSR Figure 6 below shows how the NSR increases at an increasing rate as a function of the tax rate. Figure 7 NSR 2 1.8 1.6 1.4 1.2 1 0.8 0.6 0.4 0.2 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Tax Rate End Notes 1. Consumer surplus is usually defined as the difference between what a consumer is willing to pay and what the actual price is. So, for example, if the price is $5 and the consumer would have been willing to pay $10, they are said to get $5 in consumer surplus. In Figure 1, the price at a quantity of 1 is $10, meaning that the consumer is willing to pay $10 for the first unit consumed. Since in the price in that graph is $5.50 to begin with, the first Q brings $4.50 in CS. The next Q brings in $3.50 in CS since the consumer is willing to pay $9. This is done for each unit purchased and then the CS’s at each Q are summed. Since the demand line is a continuous function, the entire area under the demand line and above price is the CS. Similarly, the producer surplus is the price minus marginal cost (MC) for each unit. The supply line actually indicates the extra cost or MC required to produce each unit. In Figure 1, it costs $1 to produce the first unit. So the first unit generates $4.50 in PS (5.5 – 1) since 1 unit is offered for sale when the price is $1. The next unit generates $3.50 in PS since 2 units are offered for sale at a price of $2 (5.5 – 2). Just like with demand, supply is a continuous function, so the entire area under price and above supply is the PS. 2. If the government uses the tax revenue to generate more than 0.25 in SW, then the tax is a good idea. But in reality it is often hard to know if the benefit of the government services provided outweighs the cost of the DWL. Of course, the point here is that each additional tax is actually more costly than the previous one. So for any tax increase to be worth it, the value of the government services the tax pays for has to be on the rise. Again, this is hard to prove in the real world. References Mankiw’s blog entry on this issue is at http://gregmankiw.blogspot.com/2006/11/expositional-challenge.html The definitions of signal-to-noise ratio are at http://encarta.msn.com/dictionary_1861735061/signal-to-noise_ratio.html http://www.eeproductcenter.com/encyclopedia/defineterm.jhtml?term=signal-to-noise+ratio