Handout 2 (Word) - Virginia Municipal League

advertisement

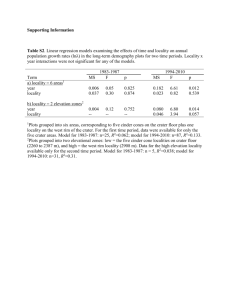

USING VIRGINIA CODE PROVISIONS TO COMBAT BLIGHT Cynthia B. Hall, Deputy City Attorney 900 City Hall Building, Norfolk, Virginia 23510 (757-664-4214/FAX 757-664-4201) e-mail address: cynthia.hall@norfolk.gov Statutory Reference Virginia Code Section 15.2-900 (Local Ordinance Not Required) Cost Recovery Key Points Practice Pointers Allows locality to - Code is very broad maintain an action to and elements easy to compel a responsible party prove. to abate a nuisance. - "Responsible party" is: - Code is used by many - owner, occupier or localities as basis possessor or of premises for Hazmat Response - owner or agent of Cost Recovery Program. material released - owner or agent - Negligence need not transporting material be shown by a locality whose negligence caused except under release transporting material - "Nuisance" is: category. 1)dangerous or unhealthy substances released Lien against real 2)unsafe, dangerous or property for unpaid unsanitary buildings, costs is authorized walls, or structures under 15.2-906(4). -Allows locality to undertake abatement if Code can be used immediate and imminent against derelict threat. structures. -Allows locality to recover emergency response costs. The chart is not intended to be exhaustive. Instead only the major provisions are mentioned. All the Virginia Code Sections referenced herein can be accessed at the Virginia Legislative Information Service website at leg1.state.va.us under the Code of Virginia link. (Amended 2013) 2 Statutory Reference Virginia Code Section 15.2-901 (Local Ordinance Required) General Nuisance Provision Key Points - Allows locality to require owner to remove trash, garbage, litter, refuse and to cut grass and weeds. Practice Pointers - Code gives locality broad authority to eradicate nuisances. - Allows locality to perform removal and cutting if not Enforcement done by owner after usually begins with reasonable notice. a notice of violation. - Permits issuance of one notice per growing season. Enforcement can be by criminal - Allows locality to charge summons or civil owner for costs of penalty (ticket). abatement. - Allows placement of a lien against real property for unpaid costs with same priority as unpaid local taxes. - Permits locality to waive lien to effectuate sale of property. - Allows imposition of a civil penalty in lieu of criminal sanctions. 3 Statutory Reference Virginia Code Section 15.2-906 (Local Ordinance Required) General Blight Provision Key Points - Allows locality to require owner of property to remove, repair or secure any building, wall, or other structure which "might" endanger public health or safety. - Allows locality to undertake abatement after 30 days written notice to owner via certified mail and publication in newspaper. Practice Pointers - Broad coverage of Code makes it a very useful tool. Actual imminent danger not be shown. and need Repair may include exterior maintenance of building to prevent deterioration so Code is useful for - Authorizes locality to situations not covered charge owner the costs for under the Uniform abatement if done by the Statewide Building locality. Code (USBC) provisions. - Authorizes placement of a lien against real property The notice with same priority as unpaid requirements differ local taxes. from those under the USBC so make sure the - Permits locality to waive notices to owner abatement lien to effectuate clearly identify sale of property. authority under which the locality is - Authorizes civil penalties proceeding. for violations. 4 Statutory Reference Virginia Code Section 15.2-907 (Local Ordinance Required) Drug Blight Provision Key Points - Allows locality to require owner of property to correct “drug blight” which constitutes present threat. - “Drug Blight” is: - a)regular presence on property of persons under the influence of drugs - b)regular use of property to sell, possess, manufacture or distribute drugs - Requires preparation of Affidavit. - Requires written notice to owner to abate. - Permits locality to abate if not done by owner (remove, repair, secure). - Permits locality to charge owner for costs to abate. - Authorizes placement of lien against real property with same priority as unpaid local taxes. Practice Pointers - Actual danger need not be alleged only a "present threat". Code requires notices only be sent regular mail but may also want to send by certified mail. Code can be used as basis to close business. 5 Statutory Reference Key Points Practice Pointers Virginia Code Section 15.2-907.1 (Local Ordinance Required) Derelict Building Provision - Allows locality to require owner to submit plan to rehabilitate a “derelict building.” “Derelict building” defined as a building or structure which might endanger public health, safety or welfare and for 6 months or more has been vacant, boarded up, and not connected to electric, water or sewer service. - Owner has 90 days to submit plan after written notice. If owner does not respond or if plan is not adequate, locality can repair or demolish. Provides incentives to owners to comply (reduction or waiver of permit fees, tax abatement and tax reassessments). This provision gets to long-term vacant structure issue. - Fills in gap left by building code for otherwise structurally sound vacant buildings. - Code addresses the concern that the mere fact that a structure is vacant is what causes blight. - Locality must have real estate tax abatement program to use this provision. Locality can petition to be appointed as receiver to repair derelict buildings under 15.2-907.2. 6 Statutory Reference Key Points Practice Pointers Virginia Code Section 15.2-908.1 (Local Ordinance Required) Prostitution Blight Provision - Allows locality to require owner to correct “bawdy place” which constitutes a "present threat". - “Bawdy Place” is: any place within or without any building which is used for lewdness or prostitution. Requires preparation of an affidavit. - Requires written notice to owner to abate. - Allows locality to abate if not done by owner (remove, repair, secure). - Permits City to charge owner for costs to abate. - Authorizes placement of lien against real property with same priority as unpaid local taxes. - Actual danger need not be alleged only a “present threat”. Code requires notices only be sent regular mail but may also want to send by certified mail. Code can be used as basis to close business. 7 Statutory Reference Virginia Code Section 15.2-909 (Local Ordinance Required) Abandoned Vessels and Derelict Piers Provision Key Points Permits locality to require owners of real property to remove, repair or secure any abandoned vessel or derelict wharf, pier, piling or bulkhead if a threat to public safety or a threat to navigation exists. Locality may remove, repair or secure if owner refuses to do so after reasonable notice and time period to do so, or if lawful owner cannot be determined, after notice in newspaper. - Locality may charge owner for abatement and locality may place a lien against owner's real property which can also be reduced to a personal judgement. Practice Pointers - This code can be used to require landowner to correct waterfront blight. Determining ownership of vessels is very complicated. 8 Statutory Reference Virginia Code Section 15.2-1115 (Local Ordinance Authorized) General Nuisance Provision Key Points - Broad nuisance authority for corporations. Practice Pointers abatement - This code can be municipal used as a tool to protect public health and safety. - Municipal corporation may regulate weeds, snow removal, filling, drainage, unsafe or dangerous buildings, and unhealthy substances. - Requires reasonable notice to owner or occupant. - Allows for abatement by municipal corporation. -Allows corporation to abatement and charges in the as unpaid taxes. municipal charge for to collect same manner (tax sale) Authorizes placement of lien against real property with same priority as unpaid taxes for amounts due over $200. 9 Statutory Reference Virginia Code Section 15.2-1127 (Local Ordinance Required) Vacant Building Registration Provision - Key Points Practice Pointers - Allows City to require - This code registration of a building provides a vacant for more than 12 mechanism to track months. vacant buildings in the community. - Allows City to assess registration fee up to $100.00. Provides penalty of $200.00 for failure to register or up to $400.00 if a conservation or blighted area. - Requires notice be sent 30 days prior to assessment of penalty. 10 Statutory Reference Key Points Practice Pointers Virginia Code Section 18.2-258 (Local Ordinance Not required) Drug Letter Procedure Provides that any structure, vehicle, aircraft or vessel that is frequented with the knowledge of the owner, operator, lessor, tenant, or manager by persons under the influence of drugs, or for possessing, manufacturing, or distributing drugs, is a "common nuisance". Person who knowingly permits, keeps or maintains a common nuisance is guilty of a class 1 misdemeanor. A second or subsequent offense is a class 6 felony. - Permits Court to close premises after hearing. - Allows owner to seek immediate termination of rental agreement for tenant violator. - Provides for forfeiture in certain instances. - Use of requires assistance police. code of - To help establish "knowledge" a notification letter of drug activity should be sent to person. The letter puts person on notice and serves as a tool for owner or lessor to seek immediate eviction of tenant. 11 Statutory Reference Virginia Code Section 36-49.1:1 (Local Ordinance Not Required) Spot Blight Provision Key Points - Gives locality authority, inside and/or outside of a conservation and redevelopment area, to acquire or repair "blighted" property. - "Blighted property” defined as “any individual, commercial, industrial or residential structure or improvement that endangers the public’s health, safety and welfare because the structure or improvement is dilapidated, deteriorated, or violates minimum health and safety standards.” - Requires notification to owner and preparation by owner of a plan to cure blight within 30 days. Allows declaration of “blight” by ordinance and allows locality to choose remediation option. - Allows placement of a lien against property for abatement costs with same priority as tax lien. - Prohibits acquisition by locality if premises occupied FOR “personal residential use” unless declared unfit for human habitation. - Alternatively, authorizes locality to declare by ordinance that blighted property is a nuisance. Practice Pointers - Broad coverage. - This code gives all localities power to go after "spot blight". - This code essentially makes eradication of spot blight a public purpose for purposes of eminent domain. - This code allows locality to take title to blighted property not just to repair or secure. - This code amended in 2009 to streamline process. 12 Statutory Reference Virginia Code Sections 48-1 to 48-6 (No Local Ordinance Required) Citizen Suit for Public Nuisance Provisions Key Points - Authorizes 5 or more Citizens to file complaint in Circuit Court about existence of public nuisance. Practice Pointers - Localities do not take an active role in these proceedings but some localities do send out notification letters - Requires Court to summon to persons causing a special grand jury to the nuisance. investigate complaint. - This can be a very powerful tool - Holds owner who allowed the nuisance to continue or for citizens to use. any person who caused or created the nuisance, responsible. - Provides a penalty of not more than $25,000.00 plus costs. - Requires removal abatement of nuisance. and 13 STATE LAWS RELATING TO TAX SALES USED TO COMBAT BLIGHT Statutory Reference Virginia Code Section 58.1-3965 (Local Ordinance Not Required) Key Points - Allows land to be sold at a tax sale if: (1) Taxes are delinquent for 2 years. (2) Taxes are delinquent which is situated a: (3) Virginia Code Section 58.1-3970.1 (Local Ordinance Not Required) for 1 year and upon Condemned building Any nuisance under 15.2-900 Any derelict building under 15.2-907.1 or Any blighted property under 36-49.1:1 Taxes are delinquent for 1 year on real estate assessed at less than $100,000, where there exists nuisance abatement liens older than 1 year. Property subject to sale at public auction - Allows for title transfer to locality where property is assessed at $50,000 or less, the parcel has delinquent taxes or nuisance abatement liens and the taxes, liens, and penalties exceed 50% percent of the assessed value of the property or the taxes alone exceed 25% percent of the assessed value. - Locality petitions Circuit Court for execution of deed to convey title to locality in lieu of sale at public auction. - Circuit Court conducts hearing. - If City later sells parcel, any surplusage must be paid to lienholders and owners. 14 Statutory Reference Key Points Virginia Code Section 58.1-3228 (Local Ordinance Not Required) Permits the governing body of any county, city or town to adopt an ordinance authorizing the locality to release all liens for delinquent real estate taxes (including penalty and interest) to facilitate conveyance of property if: 1. Purchaser is unrelated by blood or marriage to owner; 2. Purchaser has no business association with the owner; 3. Purchaser owes no delinquent real estate for any property, and 4. The property is valued at less than $50,000.00. All liens remain the personal obligation of the owner of property at the time the liens were imposed. Virginia Code Section 58.1-3965.1 A City may by ordinance institute proceedings to sell property after one year delinquency on real estate taxes (formerly the required time period before a City could sell for unpaid taxes was 1 year if property condemned by code official; 2 years if uncondemned property, and 3 years if abandoned property).