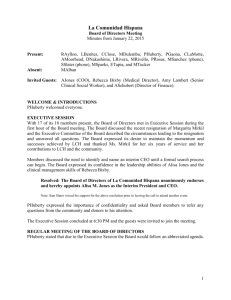

Corporate Events in CREST

advertisement

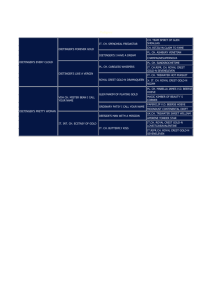

Central Counterparty for Equities Guidance Note January 2001 11/01 Corporate Events in CREST in the CCP 1 Introduction The purpose of this guidance note is to clarify the treatment of Corporate Events in CREST by the Central Counterparty for Equities service. The guidance provided is largely incorporated in LCH’s General Regulations, Default Rules and Procedures. The note covers the following areas: General information on notifications and the impact on margin calculation Distributions Reorganisations and should be read in association with the Blue Book issued by CREST entitled “The Central Counterparty: Corporate Actions – Market Norms”. Corporate Events should generally only impact CCP for Equities service transactions that have failed to settle on their ISD, or those that have been traded close to a record date. It is expected, given the existing high settlement results achieved, that the number impacted will be minimal. LCH’s role as Central Counterparty is designed to be as automated as possible and, therefore, neutral. For this reason, CCP for Equities participants should have little reason to contact LCH with regard to Corporate Events. Participants in the CCP for Equities service should also refer to the CREST publication “Corporate Actions – Central Counterparty” dated July 2000 which can be found on the CREST web-site. 2 General Notification of Events LCH will not pass on details of events to members with open transactions in an Eligible Security on which the event is taking place. Members should continue to use existing information sources such as Stock Situation Notice’s, CREST and third party vendors. Margin LCH will charge Initial Margin (at rates to be determined on a case-by-case basis) and Variation Margin where possible on all positions, stock or cash, created as a result of a Corporate Event, including claims. Cash positions created as a result of a Corporate Event will be charged initial margin at 100% effectively settling them on their ISD. 3 Distributions As all trades through the CCP for Equities service are for standard settlement, it is envisaged that only cum transactions that have not settled by record date will create claims. Therefore all claims will be against the seller. Claims settle in CREST In order to simplify the processing of claims raised on an open transaction in an Eligible Security in CREST on the CCP for Equities service, it must be settled in CREST. Claims deleted by a CREST participant will still settle, as only deletions matched by LCH will remove CCP for Equities claims (NB this is not a normal occurrence). LCH may agree with a member to delete a claim and settle outside CREST (but generally only when there were circumstances that prevented settlement in CREST). Claims Settlement All CCP claims will be raised in CREST with a priority of 50 to ensure settlement on their ISD. This priority should not be reduced or settlement frozen as this would be a breach of LCH’s General Regulations, Default Rules and Procedures. All claims should be settled on ISD as described in the CREST Market Norms (members should note that all cash claims will be margined at 100% and members will therefore effectively receive or pay the cash claim as margin when it is raised). Fractional Entitlements Fractional entitlements are dealt with in Guidance Note 10/01 – Guidance Note on Residuals in the Central Counterparty. Scrip Dividends Where an Issuing Company announces a Scrip Dividend on a CCP for Equities Eligible Security, buying members with open CCP for Equities transactions will only be permitted to receive the cash option (this will effect only a small number of “failed” transactions not on the register at Record Date). This is because the scrip ratio is usually announced after Record Date, once the claim has been raised. CREST, LCH and the London Stock Exchange will continue to seek ways in which participants will be able to elect for the stock option in later phases of the CCP for Equities service. 4 Reorganisations Transformations In the case of the CCP for Equities service, transformations will take place each night from transformation date (usually Record Date) to ten business days after the security’s end date (Ex-Date). This excludes voluntary events where transformations will take place on a rolling basis once ISD of the transaction has been reached. All matched open transactions will be transformed. Transformation Skip CREST participants will not be permitted to skip transformations against the CCP for Equities service. This is to prevent LCH from holding stock if either member fails to manually input their instructions on ISD. Any instruction to set this flag on a CCP for Equities transaction will be rejected by CREST. Transformation Deletions In the event that the security end date is reached and a transaction remains, CREST will break the link between the transactions. The unmatched transaction will only be transformed once it has been matched. If it remains unmatched ten days after the expiry date, CREST will delete the transaction and the participant in both the CCP for Equities service and CREST will be required to manually re-input the transaction with the new benefits received from the event. CCP Last Date & Time for Instruction CREST will be introducing new fields for “CCP Last Instruction Date & Time”. These will indicate the last point at which an ACON instruction will be accepted by CREST for CCP for Equities transactions. The last instruction dates for each event are detailed in the CREST Whitebook, Corporate Actions: The Central Counterparty July 2000 with the last instruction time being 11:00 am in all cases. The buyer’s instruction is 2 a binding and valid instruction. No instructions will be accepted on CCP transactions after this time, which therefore effectively ends the practice of reasonable endeavours. Passing Instructions For the CCP for Equities service, CREST functionality enhances London Stock Exchange buyer protection rules by allowing only the buying member to make elections through CREST. LCH will therefore only accept electronic instructions from buying members in CREST. Members should not contact LCH with verbal or written instructions. Selling members are not permitted to instruct LCH, and any electronic instruction entered by them against LCH in CREST will be rejected. Selling members are obliged to take up the appropriate election in accordance with the issuer’s terms and the London Stock Exchange rules for that corporate action. Failure to Instruct LCH Where a member fails to provide instructions with regard to any elective Corporate Event, LCH will use the Corporate Event to default to the default option determined by the issuer and the rules of the London Stock Exchange. Last Time for Delivery in a Voluntary Event Buyer protection rules will apply only when the instructions are accepted on or before the last date/time for a CCP for Equities instruction and the ISD of the transaction fell on or before the last date for a CCP for Equities instruction. Following an instruction from LCH in a voluntary event, the selling member is not entitled to deliver the original security after the last time for delivery. In the event that a selling member does deliver the original security, the buying member will be entitled to ask LCH to accept the delivered stock back. Upon such a request, LCH will contact the selling member and request that they match an LCH instruction to accept the stock back. Once the selling member has matched, LCH will match the buyers instruction, and the transactions should settle. The selling member is then obliged to deliver in accordance with the buyer’s instructions. Buyer Instructions on Voluntary Events Buyer instructions in voluntary events that are received for CCP for Equities transactions, where the ISD of the transaction is past the last date for acceptance, will be rejected by CREST. 5 Residuals Please refer to Guidance Note 10/01 – Guidance Note on Residuals in the Central Counterparty. List of guidance notes The project has published a number of guidance notes. The others published to date, or in production, are listed below, please contact the project for any later guidance notes. 01/00 Disclosure of shareholdings 07/00 Tripartite NCM-GCM-LCH Agreement 02/00 UK Stamp Duty Reserve Tax 08/00 Irish Stamp Duty 03/00 Agency and riskless principal trading 09/01 UK equity collateral in the CCP 04/00 Balance sheet reporting 10/01 05/00 Impact of late settlement Residual settlement of non-CREST outturns 06/00 Adjustment to LCH’s Default Fund to Cover Clearing of London Stock Exchange Business 11/01 Corporate events in CREST in the CCP 3 Contact points The CCP for Equities project can be contacted on 020 7849 0510 or via email at ccp@crestco.co.uk. Members of the Exchange, LCH or CRESTCo can also make use of their usual contacts in these organisations. Information about the service is also available on the following websites: www.crestco.co.uk www.lch.co.uk www.londonstockexchange.com This guidance note has been prepared by the London Stock Exchange, LCH and CRESTCo to assist participants in their planning for the CCP for Equities project. The London Stock Exchange, LCH and CRESTCo do not represent or warrant the completeness or accuracy of the information contained in this guidance note. Recipients should not rely on this guidance, which is not a substitute for specific legal advice, and should consult their own legal advisers. © January 2001 CRESTCo Limited, registered in England and Wales No 2878738, London Stock Exchange plc, registered in England and Wales No 2075721, and The London Clearing House Limited, registered in England and Wales No 25932. The CREST logo is a trademark of CRESTCo Limited. SETS, SEAQ, SEATS Plus and the London Stock Exchange crest and logo are trademarks of London Stock Exchange plc. The London Clearing House logo is a trademark of The London Clearing House Limited.