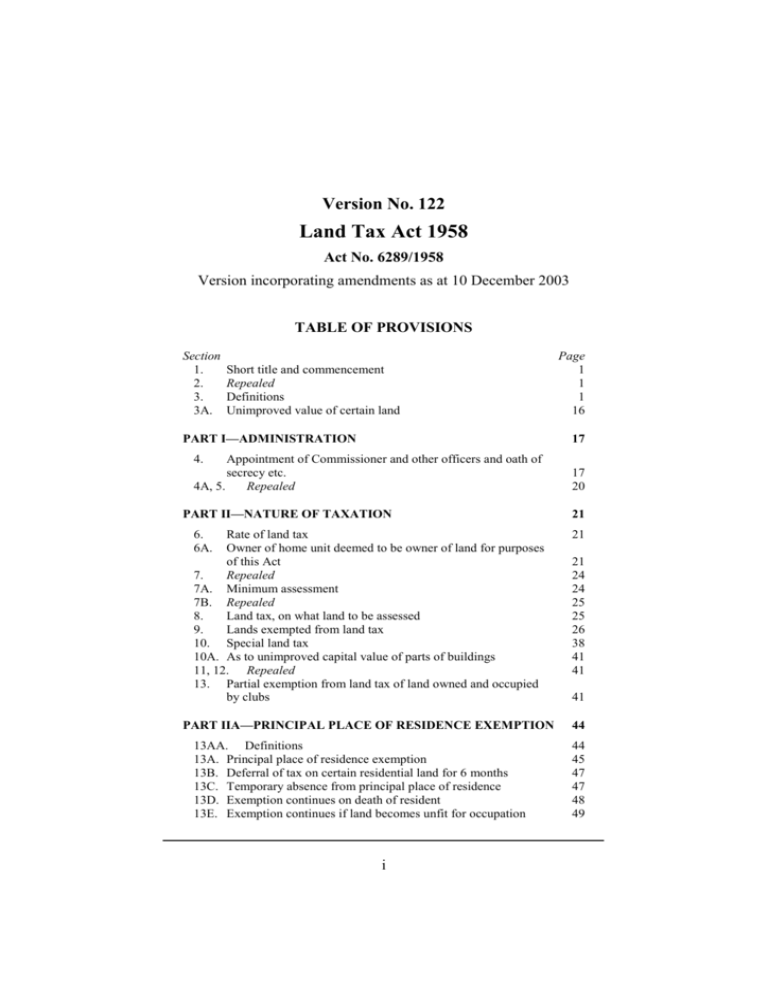

Land Tax Act 1958 - Victorian Legislation and Parliamentary

advertisement