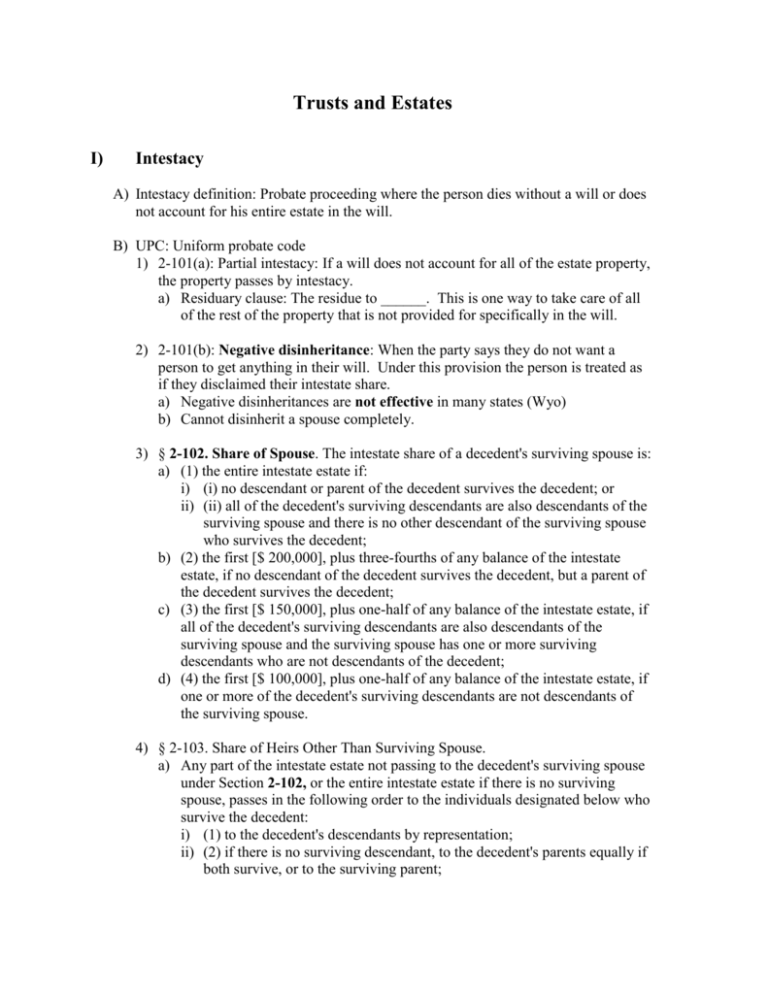

Chris Brown - wyolaw.org | intellectual property club

advertisement