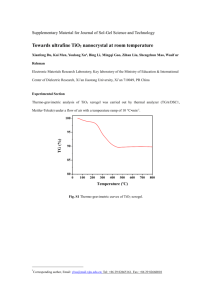

synthetic dioxide

advertisement

1. TITANIUM DIOXIDE 1. PRODUCT CHARACTERISTICS Appearance White pigment Grades Anatase and rutile grade Specifications Specification of Anatase TiO2 pigment Titanium dioxide Moisture max. Soluble salts Sb2O3 Iron Copper V2O5 Cr4O3 Silica Oil absorption Residue on 325 mesh Dispersion Relative tinting strength 97.5% max. 0.5% 0.5% 0.04% 0.01% 0.002% 0.001% 0.001% 0.75% 22.2% 0.05% Fairly dispersible in water 1400 max. Specifications of Rutile TiO2 pigment (surface coated) TiO2 content % Volatiles % Water soluble salts % P2O5 % Fe % Moisture (105 Deg C) % Rutile content % Specific resistance phm, cm-1 Tint-reducing power Oil absorption g/100 g pigment Whitness % Sieve residue-0.045 mm net % (ASTM 325 mesh) Zinc content % pH (water extract) Dispersity (red devil) 210 min. microns Chalk resistance 92.5 1 max. 1 max. 0.3 max. 0.01 max. 0.8 max. 98.0 9000 1850 24 96.5 0.02 0.1 6.0 12 Very good Surface treatment Bulk density Tamped density Refractive index 2. Al2O3, SiO2 710 1020 2.7 3 kg/m ,cca kg/m3,cca PRODUCT APPLICATIONS Pigment grade Anatase Pigment grade Rutile Paint industry Paint industry Printing ink industry Printing ink industry Paper industry Rubber industry Textile industry Polyester fibre industry Rayon industry Plastic industry Leather industry Detergent industry Electronic industry Refractories Pharmaceutical industry and others 3. IMPORTS Present import levels Anatase grade Rutile grade : : Around 3000 tonnes per annum Around 10000 tonnes per annum 4. EXPORTS 5. INDIAN MANUFACTURERS Nil S.No. Name of the Unit 1. 2. 3. 4. Travancore Titanium Products Ltd., Trivandrum Kolmak Chemicals Ltd., Calcutta Kilburn Chemicals Ltd.3000 Kerala Minerals & Metals Ltd.,Quilon 6. DEMAND SUPPLY TRENDS Demand Production level in tonnes per annum 15000 (anatase grade) 2000 (anatase grade) (anatase grade) 22000 (rutile grade) Pigment grade Anatase TiO2: 22000 tonnes per annum Pigment grade Rutile TiO2 : 30000 tonnes per annum The gap in supply is met by imports. Estimated growth rate in demand : 7. 8 to 9% per annum. MANUFACTURING PROCESS AND TECHNOLOGY DEVELOPMENT There are two routes for the production of TiO2 pigments namely, sulphate and chloride route. Sulphate Process : In the sulphate process, Ilmenite is directly reacted with sulphuric acid to produce titanium sulphate and iron sulphate. The Titanium sulphate is subjected to selective thermal hydrolysis to produce hydrated titanium dioxide. This is further washed and calcined to produce titanium dioxide pigment. In the sulphate process, both anatase and rutile grade TiO2 can be produced. Chloride Process : In the chloride process, Ilmenite is leached with hydrochloric acid or selectively chlorinated to produce synthetic rutile. Synthetic rutile would be chlorinated to produce titanium tetra chloride, which is oxidised to produce titanium dioxide pigment. By chloride process, only rutile grade TiO2 can be produced. Technology development Titanium dioxide is produced from either ilmenite, synthetic rutile or titanium slag. Titanium dioxide pigment is extracted by using either sulphuric acid (sulphate process) or chlorine (Chloride route). The sulphate route is perceived to be less environmentally friendly but acid recycling or neutralisation, combined with other byproduct developments, can make it as clean as the chloride route. The sulphate route generally has higher production costs, due to the need to build acid treatment facilities. It is more expensive to build than a chloride plant, but the latter may require the construction of a chlor-alkali unit to meet the requirement of Chlorine for the project. The chloride route produces a more pure product with a tighter range of particle size, but anatase pigments can only be produced by the sulphate process. Millennium estimates that 57% of world production uses the chloride route but among the seven top producers, the figure rises to 66%. 8. GLOBAL SCENARIO Global consumption pattern: (in '000 tonnes) By Region North America Western Europe Asia/Pacific Eastern Europe Latin America Africa & Mideast World Total 1487 1000 854 273 217 109 3940 By Market Paints & Coating Plastics Paper Other 2305 723 528 384 DuPont's ability to chlorinate relatively low-cost ilmenite gives it a cost advantage. Supply/demand Titanium dioxide is a $7 bn per year global industry. Worldwide demand in 1999 stood at 3.82 million tonne, according to consultancy organisation Artikol. Global capacity is estimated at 4.47 million tonnes per annum in 2000. The US and Western Europe account for a third of the market each with Asia consuming nearly 25%. Producers report very tight markets in Western Europe as a result of high demand and a number of ownership changes have occurred in recent years leading to some industry consolidation. By end 2000, five players account for close to 75% of global Titanium dioxide production. DuPont with 22% is the largest. In Europe HICI (Huntsman 70%, ICI 30%) is the largest producer. Huntsman bought Tioxide from ICI last year following FTC objections to the deal with DuPont. KerrMcGee has bought the remaining 20% of its 80% owned plant from Bayer and completed the purchase of Kemira's US and Dutch assets. Kemira retains Pori of Finland. Outlook Global demand has been picking up steadily since the second half of 1999, especially in Asia. In Europe, one producer talked of experiencing double digit growth in 2001. However, in the long term, consultants estimate the West European demand growth at 3 to 4% per annum. For the rest of 2001, global demand is set to grow at around 4.5%, according to Millennium. Prices are below reinvestment levels but a number of debottlenecks worldwide will add an extra 200,000 tonnes per annum of capacity by 2003. Of this, around 90,000 tonnes per annum is in Europe. This includes production at the chloride route unit at Greatham, UK, rising to its rated 100,000 tonnes per year Kemira hike at Pori, Finland, and the 15,000 tonne per year increase at Sachtleben's Duisberg, Germany, plant. Expansion at DuPont's plant at New Johnsonville, Tennessee, US, will add 65,000 tonnes per annum, bringing it to 395,000 tonnes per annum. Upgrades in China should add 20,000 to 30,000 tonnes per annum. Productwise consumption pattern Coatings Paper Plastics Other 9. 59% 13% 20% 8% RECOMMENDATIONS India has vast deposits of ilmenite which is the raw material for TiO2 production. Indian deposits is estimated to exceed 14% of the total world reserves. The project is extremely relevant to Indian conditions and additional capacities should be urgently created. Tamil Nadu has vast deposits of Ilmenite and Tamil Nadu is suitable location for setting up TiO2 project of global standards. Recommended Capacity & Estimated Project cost 1. Anatase Grade TiO2 : Process : Project Cost : 4500 tonnes per annum Sulphate Route. Rs.300 million 2. Rutile Grade TiO2 Process Project Cost : : : 15000 tonnes per annum Sulphate Route Rs. 1800 million 3. Rutile grade TiO2 Process : : 30000 tonnes per annum Chloride route. Project cost : Rs.3500 million