registration form and programme

advertisement

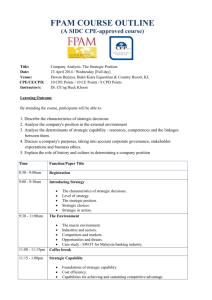

FPAM COURSE OUTLINE (A SIDC CPE-approved course) Title: Date: Venue: CPE / CE Points: Instructor/s: Family Wealth Planning – Leaving a Legacy 25 July 2012 / Wednesday [Full day] Dewan Berjaya, Bukit Kiara Equestrian & Country Resort, KL 10 CPE Points / 10 CE Points / 10 CPD Points Ms. Florence Koh Lee Kheng Learning Objectives The purpose of this course is to provide insights from a third generation on the above topics. It is designed to give practising professionals a better understanding of the needs, experiences and expectations over time of the subsequent generations from wealth planning, implementation and the actualisation of a legacy. With this, more emphasis will be given to consider real issues in the advisory process. Learning Outcome Participants will be able to: 1. Identify the importance of maintaining family heritage, its dynamics & culture 2. Recognise the importance of balancing individual and family interests 3. Identify the challenges for family wealth preservation from the perspective of a third generation family trust 4. Discuss the key aspects of advising multigenerational families – including selecting an adviser, considerations for creating a family office, selecting an investment vehicle structure and wealth transfer. Learning Outline Time Function/Paper Title 8.30 - 9.00 am Registration Family Wealth Planning – Leaving a Legacy A. Wealth Creation 9:00 - 10:00am 1. Understanding the family History & Heritage 2. What are the Family Dynamics & Culture B. Managing and Structuring Across Generations 1. What are the structures available for leaving a Legacy 2. How to manage multigenerational Succession C. Individual vs Family Interests 10.00 – 11.00am 1. Identify and prioritizing Family Objectives 2. What about Individual interest and Self Actualisation 11.00 - 11.15am Coffee break D. Preservation 11:15am - 1:00pm 1.00 - 2.00 pm 1. What are the Challenges for family wealth preservation 2. The role and responsibilities of a Family Office 3. The role and responsibilities of the Advisors of a family office Lunch break E. Synopsis 2:00 - 3:30pm 1. An overview Strategies required to understand, protect and grow family wealth across generations Principles to apply to ensure riches to riches across generation Sets out insights and information to help wealthy family on how to become, to grow, to protect, to transfer and remain wealthy across generations. 3.30 - 3.45 pm Coffee break 3.45 - 5.00 pm E. Synopsis 2. Going Beyond Strategy for the affluent family expands the scope of wealth planning and management by exploring beyond just financial concerns to consider essential human issues such as philanthropy and family leadership. To ensure the important individuality of all family members is fully reflected in every aspect of strategy for the family wealth management. Profile of Ms. Florence Koh In 1987 Ms. Florence Koh graduated with LLB (Hons) from National University of Singapore. She was admitted to the Singapore Bar in 1988. From 1988 until 2002 she was a legal counsel and practitioner primarily in insurance, reinsurance and risk management law, acting for domestic and international corporations including Royal & Sun Alliance, Allianz, Marsh, AON, Zurich Insurance Co Ltd, Swiss Re, AGF Insurance Co Ltd, Winterthur Re, Winterthur Insurance Co Ltd, American Re, AIG, Peoples' Insurance Co Ltd, ICS Insurance Co Ltd. She handled general corporate and real estate conveyancing matters for both private and institutional clients including OCBC, HSBC, DBS, UOB, OUB, UOF and many others. She has experience in handling many trust matters relating to trust administration, structuring, executor ship, probate and litigation. As from 2002 until to date: she is currently a private equity investor and real estate developer, and Group Advisor for Bekasi Tower 88 Group, Indonesia. She is the third generation of Koh Family Trust. CE COURSE REGISTRATION FORM / INVOICE Title of Course: Family Wealth Planning – Leaving a Legacy Speaker: Date: Venue: Ms. Florence Koh Lee Kheng 25 July 2012 / Wednesday [ full day ] Dewan Berjaya, Bukit Kiara Equestrian & Country Resort Jalan Bukit Kiara, Off Jalan Damansara, 60000 Kuala Lumpur 8.30 am – 9.00 am 9.00 am – 5.00 pm Early Bird Special; RM 280 (FPAM Member), RM 380 (Public) Payment by 1st July 2012. Normal – RM 320 ( FPAM Member), RM 430 (Public) Fee includes seminar materials, buffet lunch and refreshments. Ten ( 10 ) Ten ( 10 ) Ten ( 10 ) Please fill-up this form and fax to +603 7954 9400 or e-mail to aniza@fpam.org.my by 1st July 2012 for early bird discount. By cheque: Payable to ‘Financial Planning Association of Malaysia’. Address: Unit 1109, Block A, Pusat Perdagangan Phileo Damansara II, No 15, Jalan 16/11, off Jalan Damansara, 46350 Petaling Jaya, Selangor. By credit card: We will process and charge your credit card upon receipt of this form. This page serves as our official invoice. No further invoice will be issued. Send e-mail to aniza@fpam.org.my or call Cik Aniza at +603 7954 9500 Registration: Time: Fees: CE Points (FPAM): CPE Points (SIDC): CPD Points(FIMM): Instructions: Payment/Invoice: Enquiries: Terms: Registration is on a first-come-first-served basis. Confirmation is subject to payment before the course. Walk-in participant/s will be admitted on the basis of space availability. FPAM reserves the right to amend the program, speaker, date, venue, etc, without prior notice. YES, PLEASE REGISTER ME! Name: IC No.: Company& Address: E-mail: SC Licence / ERP No: FPAM No. : Telephone: Mobile: Mode of Payment By cash, please bank into Maybank A/C 5140-7512-8677 and email or fax in bank-in slip Cheque payable to Financial Planning Association of Malaysia. Cheque no.: Amount: RM Charge my credit card: ☐Visa ☐Mastercard ☐Amex ☐Diners Credit card no.: Expiry date: Amount : Early Bird Special – By 1st July 2012 EMAIL / FAX TO +603 7954 9400